Supplemental Insurance For Medicare

Medicare, the federal health insurance program for individuals aged 65 and above, and those with specific disabilities, offers a comprehensive coverage network. However, the out-of-pocket expenses associated with Medicare-covered services can be significant, leaving many beneficiaries seeking additional financial protection.

Supplemental insurance, often referred to as Medigap, steps in to fill these coverage gaps, providing a vital layer of financial security for those enrolled in Medicare. With a range of plans tailored to individual needs, supplemental insurance ensures that beneficiaries can access the medical care they require without incurring substantial financial burdens.

Understanding Medicare and Its Gaps

Medicare, established in 1965, is a cornerstone of the US healthcare system, providing healthcare coverage to millions of Americans. It consists of several parts, each covering different aspects of medical care.

Medicare Part A covers inpatient hospital stays, skilled nursing facility care, and some home healthcare services. Part B covers outpatient medical services, including doctor visits, lab tests, and durable medical equipment. Part D, on the other hand, covers prescription drugs, a critical component for many older adults.

Despite these comprehensive coverage options, Medicare has certain limitations. For instance, there are deductibles and coinsurance for Part A and Part B services, which can be costly. Additionally, Medicare does not cover long-term care, dental, vision, or hearing services, leaving many beneficiaries with significant financial gaps.

The Role of Supplemental Insurance

Supplemental insurance, or Medigap, is designed to cover the costs that original Medicare does not. It pays for a portion of the deductibles, copayments, and coinsurance associated with Medicare-covered services, reducing the financial strain on beneficiaries.

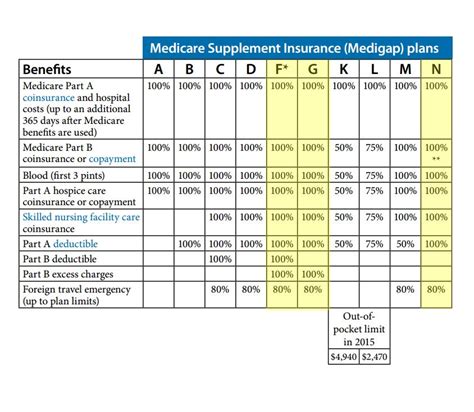

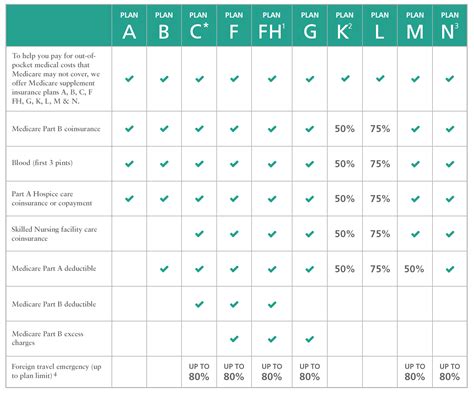

There are several Medigap plans, each offering different levels of coverage. For example, Plan A provides basic coverage, including the Part A deductible and Part B coinsurance. Plan F, on the other hand, offers the most comprehensive coverage, including foreign travel emergency coverage.

| Medigap Plan | Coverage |

|---|---|

| Plan A | Part A deductible, Part B coinsurance, blood deductible |

| Plan B | Plan A benefits plus Part B deductible |

| Plan C | Plan B benefits plus Part A deductible when hospitalized |

| Plan D | Plan C benefits plus skilled nursing facility care coinsurance |

| Plan F | All of the above, plus foreign travel emergency coverage |

It's important to note that Medigap plans do not cover services that are not covered by original Medicare, such as dental or vision care. Additionally, Medigap plans cannot be used in conjunction with Medicare Advantage plans (Part C), as these plans are already comprehensive health plans.

Enrolling in Supplemental Insurance

The enrollment process for Medigap plans is straightforward. Generally, individuals can enroll during their Initial Enrollment Period, which is the seven-month period that begins three months before the individual turns 65, includes the month they turn 65, and ends three months later.

It's important to note that during this period, individuals can enroll in a Medigap plan without undergoing medical underwriting. This means that insurance companies cannot deny coverage or charge higher premiums based on an individual's health status. This open enrollment period is a critical time for many beneficiaries to secure the supplemental coverage they need.

Outside of the Initial Enrollment Period, individuals may still be able to enroll in Medigap plans, but they may face medical underwriting, which could result in denial of coverage or higher premiums. However, there are special enrollment periods that may apply, such as when an individual loses their group health plan coverage or when they switch from a Medicare Advantage plan back to original Medicare.

The Benefits of Supplemental Insurance

Supplemental insurance provides several key benefits to Medicare beneficiaries. First and foremost, it reduces the financial burden of out-of-pocket expenses, ensuring that individuals can access the healthcare services they need without facing significant financial strain.

Additionally, Medigap plans offer stability and predictability in healthcare costs. With original Medicare, beneficiaries may face varying costs for the same service depending on the provider. However, with a Medigap plan, the costs are more consistent, as the plan covers a set percentage of these costs.

Furthermore, Medigap plans offer peace of mind, knowing that they have comprehensive coverage for their healthcare needs. This is particularly beneficial for individuals with chronic conditions or those who require frequent medical care.

Choosing the Right Supplemental Plan

Selecting the right Medigap plan involves careful consideration of individual needs and financial circumstances. While some plans offer more comprehensive coverage, they may also come with higher premiums.

It's important to assess personal healthcare needs and the likelihood of requiring certain services. For instance, if an individual frequently travels abroad, a plan that includes foreign travel emergency coverage may be beneficial. On the other hand, if an individual rarely requires skilled nursing facility care, a plan that covers this may be unnecessary.

Additionally, individuals should consider their financial situation and the potential impact of higher premiums. While more comprehensive plans may offer more coverage, they may not be feasible for those on a fixed income. It's essential to strike a balance between coverage and affordability.

Medigap and Prescription Drug Coverage

Medigap plans do not cover prescription drugs, as this is covered under Medicare Part D. However, individuals with Medigap plans can still enroll in Part D plans to cover their prescription drug needs.

It's important to note that some Medigap plans, like Plan F, offer limited prescription drug coverage for medications received while traveling outside the US. This coverage is not comprehensive and does not replace the need for a Part D plan for routine prescription drug coverage.

The Future of Supplemental Insurance

The landscape of supplemental insurance is constantly evolving, influenced by changes in healthcare policies and market dynamics. As healthcare costs continue to rise, the demand for supplemental insurance is likely to increase.

In response to this demand, insurance companies may develop new Medigap plans or modify existing ones to better meet the needs of beneficiaries. This could involve introducing plans with more affordable premiums or plans that offer additional benefits, such as coverage for dental or vision care.

Furthermore, the integration of technology in healthcare is likely to play a significant role in the future of supplemental insurance. With the rise of telemedicine and digital health platforms, insurance companies may explore ways to leverage these technologies to enhance the benefits and accessibility of Medigap plans.

Frequently Asked Questions

Can I have both a Medigap plan and a Medicare Advantage plan (Part C)?

+No, you cannot have both a Medigap plan and a Medicare Advantage plan simultaneously. Medigap plans are designed to supplement original Medicare (Part A and Part B), and Medicare Advantage plans are comprehensive health plans that replace original Medicare. Enrolling in both could lead to denial of claims or other issues.

<div class="faq-item">

<div class="faq-question">

<h3>What is the difference between Medigap and Medicare Advantage plans (Part C)?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Medigap plans supplement original Medicare (Part A and Part B) by covering deductibles, copayments, and coinsurance. Medicare Advantage plans, on the other hand, are comprehensive health plans that provide all the benefits of original Medicare, often including additional benefits like prescription drug coverage, dental, and vision. However, Medicare Advantage plans typically have networks of providers that beneficiaries must use.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Do Medigap plans cover prescription drugs?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>No, Medigap plans do not cover prescription drugs. However, you can enroll in a Medicare Part D plan to cover your prescription drug needs. Some Medigap plans, like Plan F, offer limited prescription drug coverage for medications received while traveling outside the US, but this is not a comprehensive drug coverage plan.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>When is the best time to enroll in a Medigap plan?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>The best time to enroll in a Medigap plan is during your Initial Enrollment Period, which is the seven-month period that begins three months before you turn 65, includes the month you turn 65, and ends three months later. During this period, you can enroll in a Medigap plan without undergoing medical underwriting, ensuring you get the coverage you need without being denied or facing higher premiums due to health issues.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I switch Medigap plans after my Initial Enrollment Period?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, you can switch Medigap plans after your Initial Enrollment Period, but it may be subject to medical underwriting. This means the insurance company can deny your application or charge you higher premiums based on your health status. However, there are special enrollment periods that may allow you to switch plans without underwriting, such as when you lose your group health plan coverage or when you switch from a Medicare Advantage plan back to original Medicare.</p>

</div>

</div>

</div>