Flight Insurance Australia

Introduction:

Flight insurance is an essential aspect of travel planning, offering peace of mind and financial protection to Australian travelers embarking on their journeys. In a country as vast and diverse as Australia, with its unique landscapes and remote destinations, having adequate insurance coverage is crucial. This comprehensive guide explores the world of flight insurance in Australia, delving into the various policies, benefits, and considerations to help you make informed decisions when it comes to safeguarding your travels.

Understanding Flight Insurance:

Flight insurance is a specialized type of travel insurance that focuses specifically on air travel. It provides coverage for a range of unforeseen events and circumstances that may arise during your flight or affect your travel plans. By investing in flight insurance, you ensure that you are protected against potential financial losses and can navigate unexpected challenges with confidence.

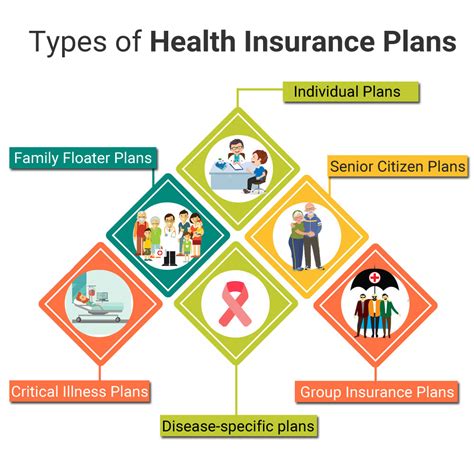

Types of Flight Insurance Policies:

Single Trip Flight Insurance: As the name suggests, this policy covers a single flight or a specific journey. It is ideal for travelers who make occasional trips and seek insurance coverage for a limited period.

Annual Multi-Trip Flight Insurance: This policy offers coverage for multiple flights taken within a 12-month period. It is beneficial for frequent flyers or individuals who plan to travel regularly throughout the year, providing convenience and cost-effectiveness.

Travel Insurance with Flight Coverage: Many comprehensive travel insurance policies include flight insurance as part of their package. These policies often offer broader coverage, including not only flight-related incidents but also other travel-related expenses and emergencies.

Key Benefits of Flight Insurance:

Trip Cancellation and Delay: Flight insurance policies often cover trip cancellation and delay expenses. If your flight is canceled or significantly delayed due to unforeseen circumstances, you may be reimbursed for non-refundable pre-paid expenses, such as accommodation and tours.

Medical and Emergency Assistance: In the event of a medical emergency during your flight or at your destination, flight insurance provides coverage for emergency medical treatment, evacuation, and repatriation. This benefit ensures that you receive the necessary care without incurring substantial financial burdens.

Lost or Delayed Luggage: Flight insurance policies commonly offer compensation for lost, damaged, or delayed luggage. This coverage can help alleviate the financial impact of replacing essential items and ensure a smoother travel experience.

Flight Disruption and Missed Connections: Some policies provide coverage for flight disruptions, such as missed connections or flight schedule changes. This benefit can assist with additional transportation costs and accommodation expenses arising from such disruptions.

Choosing the Right Flight Insurance Policy:

When selecting a flight insurance policy, it is crucial to consider your specific travel needs and the level of coverage required. Here are some key factors to keep in mind:

Policy Coverage:

Review the policy details to understand the scope of coverage. Ensure that the policy includes the benefits you prioritize, such as trip cancellation, medical expenses, and luggage protection.

Check for any exclusions or limitations within the policy. Some policies may have specific restrictions or conditions that could impact your coverage.

Provider Reputation:

Opt for reputable insurance providers with a strong track record in the Australian market. Look for companies that have positive customer reviews and a history of prompt claim settlements.

Consider providers that offer 24⁄7 customer support and emergency assistance, ensuring you have access to help whenever and wherever you need it.

Cost and Value:

Compare the prices and coverage limits of different policies. While cost is an important factor, ensure that you are not compromising on essential benefits for a lower premium.

Assess the value of the policy by considering the level of coverage relative to the premium. Policies with comprehensive benefits and reasonable prices offer the best value for your money.

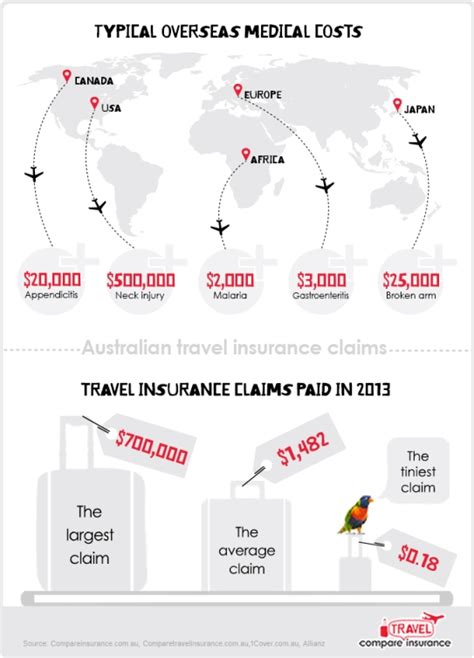

Real-World Examples and Case Studies:

To illustrate the importance of flight insurance, let’s explore a few real-life scenarios where having adequate coverage made a significant difference:

Scenario 1: Medical Emergency

A traveler, let’s call her Sarah, was on a flight from Sydney to Perth when she experienced severe chest pains. The flight crew quickly responded and provided initial medical assistance. Upon landing, Sarah was rushed to the nearest hospital, where she received emergency treatment. Her flight insurance policy covered all medical expenses, including the cost of her hospital stay and the emergency evacuation. Without insurance, Sarah would have faced significant financial stress during an already challenging situation.

Scenario 2: Trip Cancellation

John, an avid traveler, had planned a trip to the Australian Outback. Unfortunately, just a few days before his departure, a family emergency arose, forcing him to cancel his entire trip. Thanks to his single trip flight insurance policy, he was able to claim a refund for his non-refundable flight tickets and accommodation bookings. The insurance coverage allowed him to recoup a significant portion of his travel expenses and provided the flexibility to reschedule his trip.

Scenario 3: Luggage Delays

Emma, a business traveler, experienced a frustrating situation when her luggage was delayed by several days during a trip to Melbourne. Her flight insurance policy included coverage for delayed luggage, and she was promptly reimbursed for the essential items she had to purchase during the delay. This compensation helped ease the inconvenience and financial burden caused by the delayed luggage.

Performance Analysis and Industry Insights:

The Australian travel insurance market is highly competitive, with numerous providers offering flight insurance policies. To ensure you choose the right policy, consider the following insights:

Coverage Flexibility: Look for policies that offer customizable coverage options to suit your specific travel needs. This flexibility allows you to tailor your insurance to your journey, whether you require extensive medical coverage or focus on trip cancellation benefits.

Claims Process and Customer Support: Research the claims process and customer support offerings of different insurance providers. Efficient and responsive claim settlement processes are crucial to ensuring a smooth experience when you need it most.

Industry Reputation and Reviews: Pay attention to customer reviews and industry ratings. Positive feedback and a solid reputation indicate that the provider delivers on its promises and provides excellent customer service.

Future Implications and Industry Trends:

As the travel industry continues to evolve, flight insurance is likely to adapt to meet the changing needs of travelers. Here are some trends and developments to watch out for:

Digitalization and Instant Claims: The rise of digital technologies is expected to revolutionize the claims process, making it faster and more efficient. Insurers are investing in digital platforms and mobile apps to streamline claim submissions and provide real-time updates to policyholders.

Personalized Insurance: Insurers are increasingly offering personalized insurance policies that cater to individual traveler profiles. By leveraging data and analytics, insurers can provide tailored coverage options, ensuring that travelers receive the right level of protection for their unique journeys.

Enhanced Benefits: As competition intensifies, insurers are likely to enhance their flight insurance offerings. This may include expanding coverage for emerging risks, such as natural disasters or travel disruptions caused by geopolitical events.

FAQ:

What is the difference between flight insurance and travel insurance?

+Flight insurance specifically focuses on air travel, covering incidents and expenses related to flights. Travel insurance, on the other hand, is a broader policy that covers a wider range of travel-related expenses and emergencies, including flight-related incidents but also other aspects like accommodation, activities, and medical emergencies during the entire trip.

Can I purchase flight insurance after my departure date?

+Most flight insurance policies require you to purchase coverage before your departure date. It is essential to review the policy terms and conditions to understand the specific timeframes and requirements for purchasing insurance.

What should I consider when choosing a flight insurance provider?

+When selecting a flight insurance provider, consider factors such as the reputation of the company, the scope of coverage offered, the claims process, and customer support. It's beneficial to choose a provider with a strong track record, comprehensive coverage, and efficient claim settlement processes.

In conclusion, flight insurance is an invaluable tool for Australian travelers, providing financial protection and peace of mind throughout their journeys. By understanding the different policy options, benefits, and considerations, you can make informed choices to ensure a safe and enjoyable travel experience. Remember, the right flight insurance policy can make all the difference when unexpected situations arise, allowing you to focus on creating unforgettable memories during your travels.