How Is Sipc Insure Money In Brokerage

The Securities Investor Protection Corporation (SIPC) is a non-profit membership corporation created by an act of the U.S. Congress in 1970. It serves as a critical safeguard for investors, protecting their assets in the event of brokerage firm failures or financial irregularities. SIPC insurance provides a vital layer of security, ensuring that investors can recover their assets and continue their financial journey with confidence.

The Purpose and Function of SIPC

SIPC was established to restore investor confidence in the wake of numerous brokerage failures and securities frauds in the late 1960s. Its primary mission is to protect investors by insuring their brokerage accounts against losses due to the financial difficulties of their brokerage firm.

The key role of SIPC is to step in and safeguard investor assets when a brokerage firm cannot meet its financial obligations. This includes situations where the firm has declared bankruptcy, become insolvent, or is unable to produce customer assets due to fraud or other reasons. SIPC insurance ensures that investors receive their missing securities and cash up to certain limits.

SIPC Insurance Coverage Limits

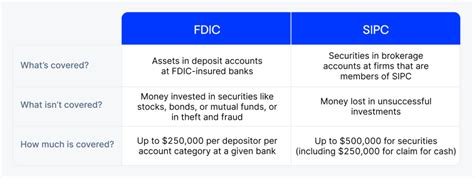

SIPC insurance coverage is comprehensive, providing protection for a wide range of securities, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). The insurance coverage limits are as follows:

| Asset Type | Coverage Limit |

|---|---|

| Cash and Securities (Combined) | $500,000 |

| Cash | $250,000 |

| Securities (Stocks, Bonds, ETFs) | $500,000 |

It's important to note that SIPC insurance does not cover losses due to the decline in value of investments. It is designed to protect investors against the financial failure of their brokerage firm, not market risks. Additionally, SIPC does not insure against theft of securities or cash by the customer, nor does it cover certain types of financial products like annuities, life insurance, or bank deposits.

The Process of SIPC Insurance

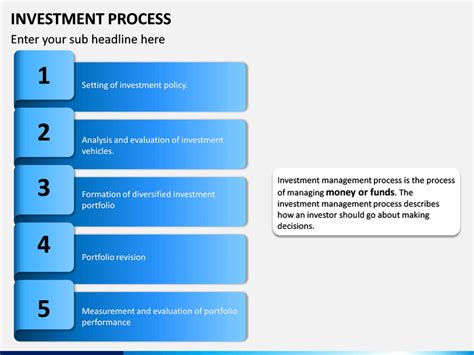

When a brokerage firm encounters financial distress or fails to meet its obligations, SIPC steps in to take control of the situation. The process typically involves the following steps:

-

Brokerage Firm Distress: SIPC becomes involved when a brokerage firm is unable to meet its financial obligations or when a court declares the firm insolvent. This could be due to bankruptcy, fraud, or other financial difficulties.

-

SIPC Appointment: SIPC appoints a trustee, who is an experienced professional in handling brokerage firm failures. The trustee's role is to oversee the distribution of customer assets and ensure a fair and efficient process.

-

Customer Claims: Investors who have accounts with the failed brokerage firm are required to file claims with the trustee. These claims provide details about the investor's assets held by the firm, including securities and cash balances.

-

Asset Recovery and Distribution: The trustee works to recover the assets held by the failed brokerage firm. This involves locating and liquidating securities, collecting cash balances, and ensuring that these assets are properly distributed to customers.

-

SIPC Insurance Payouts: In cases where the recovered assets are insufficient to fully reimburse customers, SIPC insurance steps in to make up the difference. Payouts are made according to the insurance coverage limits outlined above.

-

Customer Compensation: Once the trustee has completed the asset recovery and distribution process, customers receive compensation for their losses up to the SIPC insurance limits. This ensures that investors are protected and can continue their financial activities with minimal disruption.

The Importance of Brokerage Firm Membership

SIPC insurance is only applicable to brokerage firms that are members of the organization. This membership is mandatory for firms registered with the Securities and Exchange Commission (SEC) as broker-dealers. Therefore, when choosing a brokerage firm, it’s essential to verify their SIPC membership to ensure that your assets are protected.

Limitations and Considerations

While SIPC insurance provides a robust layer of protection, there are some important considerations and limitations to keep in mind:

-

Coverage Limits: As mentioned earlier, SIPC insurance coverage has limits. It's crucial to understand these limits and ensure that your assets are diversified and managed accordingly to avoid potential losses above the insurance coverage.

-

Non-Covered Assets: SIPC insurance does not cover all types of financial products. It specifically excludes annuities, life insurance, bank deposits, and certain types of investments. It's important to understand the scope of your brokerage account and the types of assets it holds.

-

Fraud and Theft: SIPC insurance does not cover losses due to theft or fraud by the customer. If your assets are misappropriated or stolen by the brokerage firm or its employees, SIPC may not provide coverage.

-

Timeframe for Claims: In the event of a brokerage firm failure, there is a specific timeframe within which customers must file their claims with the trustee. Failure to do so within this timeframe may result in forfeiture of their rights to compensation.

-

Investment Risks: SIPC insurance does not protect against market risks or the decline in value of investments. It is solely focused on safeguarding investor assets in the event of brokerage firm failures. It's important to manage investment risks through diversification and careful asset allocation.

Ensuring Maximum Protection

To maximize the protection offered by SIPC insurance, investors can take the following steps:

-

Choose a Reputable Brokerage Firm: Select a brokerage firm that is well-established, has a strong track record, and is a member of SIPC. This reduces the risk of financial distress and ensures that your assets are protected.

-

Diversify Your Investments: Diversification is a key strategy to manage investment risks. By spreading your investments across different asset classes, industries, and geographic regions, you can minimize the impact of any single investment failure.

-

Monitor Your Accounts: Regularly review your brokerage account statements and transactions. This helps you identify any unauthorized activities or discrepancies promptly, allowing for quicker action if needed.

-

Understand SIPC Coverage: Familiarize yourself with the details of SIPC insurance coverage, including the limits and exclusions. This knowledge will help you make informed decisions about your investments and asset allocation.

The Future of Investor Protection

As the financial landscape continues to evolve, SIPC remains a critical component of investor protection. The organization is committed to adapting its policies and procedures to address emerging risks and challenges. This includes staying abreast of technological advancements, regulatory changes, and market trends to ensure that investor assets are safeguarded effectively.

In recent years, SIPC has expanded its focus to include the growing realm of digital assets and cryptocurrencies. As these assets gain mainstream acceptance, SIPC is exploring ways to provide protection for investors who hold digital assets through brokerage accounts. This reflects the organization's commitment to staying at the forefront of investor protection, regardless of the asset class or investment vehicle.

Emerging Trends in Investor Protection

Looking ahead, several key trends are shaping the future of investor protection:

-

Digital Asset Protection: As digital assets become more prevalent, SIPC and other regulatory bodies are working to establish clear guidelines and protections for investors. This includes exploring the application of existing insurance frameworks to cover digital assets held through brokerages.

-

Enhanced Fraud Detection: With the increasing sophistication of financial fraud schemes, SIPC is investing in advanced technologies and analytical tools to enhance fraud detection and prevention. This helps identify potential risks and protect investor assets more effectively.

-

Collaborative Efforts: SIPC is actively collaborating with other financial regulatory bodies and industry associations to strengthen investor protection. By sharing knowledge and best practices, these collaborative efforts aim to create a more resilient and secure financial system for investors.

-

Educational Initiatives: SIPC recognizes the importance of investor education in promoting financial literacy and awareness. The organization is actively involved in educational initiatives to help investors understand their rights, responsibilities, and the protections available to them.

Conclusion

SIPC insurance is a cornerstone of investor protection in the United States, offering a vital safety net for investors in the event of brokerage firm failures. By understanding the purpose, coverage, and limitations of SIPC insurance, investors can make informed decisions to safeguard their assets and navigate the financial markets with confidence.

As the financial landscape continues to evolve, SIPC remains committed to adapting its practices to meet the changing needs of investors. By staying informed about emerging trends and collaborating with regulatory bodies, SIPC ensures that investor protection remains a priority, fostering a robust and secure financial ecosystem.

Frequently Asked Questions

What is the maximum amount of coverage provided by SIPC insurance for cash and securities combined?

+

SIPC insurance provides a maximum coverage of $500,000 for cash and securities combined. This limit applies to the total value of your account, including both cash balances and the market value of your securities.

Are all brokerage firms required to be members of SIPC?

+

Yes, all brokerage firms registered with the Securities and Exchange Commission (SEC) as broker-dealers are required by law to be members of SIPC. This ensures that investors are protected in the event of a brokerage firm failure.

Does SIPC insurance cover losses due to the decline in value of my investments?

+

No, SIPC insurance does not cover losses due to the decline in value of your investments. It is designed to protect investors against the financial failure of their brokerage firm, not market risks or investment performance.

How long does it typically take for SIPC to compensate investors after a brokerage firm failure?

+

The timeframe for SIPC compensation can vary depending on the complexity of the case and the number of affected investors. In general, SIPC aims to compensate investors as quickly as possible, often within a few months after the brokerage firm failure.

Can SIPC insurance be used to recover losses from theft or fraud by the brokerage firm or its employees?

+

SIPC insurance does not cover losses due to theft or fraud by the brokerage firm or its employees. It is designed to protect investors against the financial failure of the firm, not against fraudulent activities. In cases of theft or fraud, investors may need to pursue legal remedies separately.