Compare Motor Vehicle Insurance

Motor vehicle insurance, also known as auto insurance, is an essential aspect of vehicle ownership, providing financial protection against potential risks and liabilities. With numerous insurance providers offering a wide range of coverage options, it is crucial for vehicle owners to make informed decisions when selecting the right insurance policy. This comprehensive guide aims to explore the various facets of motor vehicle insurance, offering an in-depth comparison to assist readers in making well-informed choices tailored to their specific needs.

Understanding Motor Vehicle Insurance Policies

Motor vehicle insurance policies serve as a contractual agreement between the policyholder and the insurance company. This contract outlines the coverage, terms, and conditions, including the types of risks covered, the limits of coverage, and the associated premiums. Understanding the intricacies of these policies is vital for vehicle owners to ensure they obtain adequate protection.

Types of Motor Vehicle Insurance

Motor vehicle insurance policies can be categorized into three primary types, each offering different levels of coverage:

- Liability Insurance: This type of insurance provides coverage for damages caused by the policyholder to others in an accident. It covers bodily injury and property damage, offering protection against potential lawsuits and financial liabilities.

- Collision Insurance: Collision insurance covers damages to the policyholder’s vehicle in the event of a collision, regardless of fault. It typically includes repairs or replacements for the vehicle, ensuring financial protection for the policyholder.

- Comprehensive Insurance: Comprehensive insurance offers the broadest coverage, protecting against various risks beyond collisions. This includes damages caused by natural disasters, theft, vandalism, and other non-collision-related incidents. It provides a comprehensive layer of protection for the vehicle.

It is important to note that while liability insurance is often mandatory by law, collision and comprehensive insurance are optional. The choice between these options depends on individual needs, the value of the vehicle, and the level of protection desired.

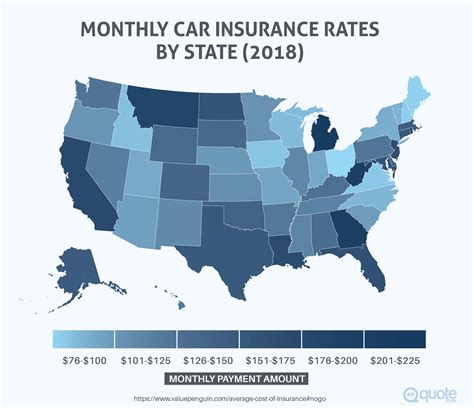

Factors Influencing Motor Vehicle Insurance Rates

Motor vehicle insurance rates are influenced by a multitude of factors, which insurance companies use to assess the risk associated with insuring a particular vehicle and its driver. Understanding these factors can help vehicle owners make informed decisions when selecting insurance coverage and managing their premiums.

Vehicle Factors

The type of vehicle being insured plays a significant role in determining insurance rates. Factors such as the make, model, year, and value of the vehicle are considered. For instance, luxury vehicles or those with high-performance engines may attract higher insurance premiums due to their increased risk of theft or higher repair costs.

Additionally, the safety features and anti-theft devices installed in the vehicle can impact insurance rates. Vehicles equipped with advanced safety technologies or anti-theft systems may qualify for discounts or lower premiums, as they are perceived as less risky to insure.

Driver Factors

The driving record and personal characteristics of the policyholder are crucial factors in insurance rate determination. Insurance companies consider factors such as age, gender, driving experience, and accident history. Younger drivers, especially those under 25, are often charged higher premiums due to their higher risk profile. Similarly, drivers with a history of accidents or traffic violations may face increased insurance costs.

Furthermore, the primary use of the vehicle, such as personal, business, or pleasure, can influence insurance rates. Business vehicles may attract higher premiums due to the increased mileage and potential for accidents associated with work-related driving.

Coverage Factors

The type and extent of coverage chosen by the policyholder directly impact insurance rates. Comprehensive coverage, which offers a wide range of protections, typically results in higher premiums compared to liability-only coverage. Additionally, the policy limits and deductibles selected by the policyholder can significantly affect the overall cost of the insurance policy.

Comparing Motor Vehicle Insurance Companies

When it comes to selecting a motor vehicle insurance provider, it is essential to conduct a thorough comparison to ensure you choose the right company for your needs. Each insurance company offers unique policies, coverage options, and customer service, so understanding these differences is crucial for an informed decision.

Policy Offerings

Different insurance companies provide a range of policy options, each with its own set of coverage limits, deductibles, and additional features. It is important to compare these policies side by side to identify the ones that align with your specific requirements. For instance, some companies may offer specialized coverage for classic cars or provide additional benefits such as roadside assistance or rental car coverage.

Customer Service and Claims Handling

The quality of customer service and claims handling can significantly impact your overall experience with an insurance company. Look for companies that have a solid reputation for prompt and efficient claims processing. Consider factors such as the availability of 24⁄7 customer support, the ease of filing claims online or over the phone, and the company’s track record for fair and timely settlements.

Additionally, reading customer reviews and testimonials can provide valuable insights into the company’s customer service and claims handling processes. Positive experiences shared by other policyholders can give you confidence in your choice.

Financial Stability and Ratings

The financial stability of an insurance company is crucial, as it ensures the company’s ability to pay out claims even in the face of significant losses. Research the financial ratings of the companies you are considering, such as those provided by independent rating agencies like A.M. Best or Standard & Poor’s. These ratings assess the company’s financial strength, indicating their ability to meet their obligations to policyholders.

Discounts and Savings

Insurance companies often offer a variety of discounts and savings opportunities to attract and retain customers. These discounts can significantly reduce your insurance premiums, so it is worth exploring the options available. Common discounts include multi-policy discounts (for bundling multiple insurance types with the same company), safe driver discounts, good student discounts, and loyalty discounts for long-term customers.

Some companies may also offer usage-based insurance programs, where your driving behavior and habits are monitored, and your premiums are adjusted accordingly. These programs can reward safe driving practices and result in lower insurance costs.

The Impact of Technological Advancements on Motor Vehicle Insurance

The insurance industry has undergone significant transformations with the advent of technology, and motor vehicle insurance is no exception. Technological advancements have not only improved the efficiency of insurance processes but have also opened up new avenues for personalized coverage and risk assessment.

Telematics and Usage-Based Insurance

Telematics, the use of technology to monitor and collect vehicle data, has revolutionized the way insurance companies assess risk and set premiums. Usage-based insurance programs leverage telematics to track driving behavior, such as miles driven, acceleration, braking, and time of day. This data is then used to calculate personalized insurance rates, rewarding safe drivers with lower premiums.

Additionally, telematics can provide real-time insights into vehicle diagnostics and maintenance needs, helping policyholders stay on top of their vehicle’s health and potentially preventing costly repairs.

Artificial Intelligence and Data Analytics

Artificial intelligence (AI) and data analytics have enabled insurance companies to process vast amounts of data more efficiently, leading to more accurate risk assessments and personalized coverage options. AI algorithms can analyze historical data, claim patterns, and customer behavior to identify trends and predict potential risks, allowing insurance companies to offer tailored policies and competitive rates.

Digitalization of Insurance Processes

The digitalization of insurance processes has brought about significant improvements in efficiency and convenience. Policyholders can now obtain quotes, purchase policies, and manage their insurance needs entirely online or through mobile apps. This digital transformation has streamlined the insurance journey, making it faster and more accessible for customers.

Additionally, the digitalization of claims processes has reduced the time and effort required for claim settlements. Policyholders can often submit claims online, upload necessary documents, and track the progress of their claims in real time.

Future Trends in Motor Vehicle Insurance

As technology continues to evolve and disrupt various industries, the motor vehicle insurance sector is poised for further transformation. Here are some key trends that are shaping the future of motor vehicle insurance:

Autonomous Vehicles and Insurance

The rise of autonomous vehicles is expected to have a significant impact on motor vehicle insurance. As self-driving cars become more prevalent, the traditional concept of driver fault and liability may need to be reevaluated. Insurance companies will need to adapt their policies and coverage to accommodate the unique risks associated with autonomous vehicles, such as software failures or cybersecurity breaches.

Personalized Insurance Policies

The trend towards personalized insurance policies is likely to continue, with insurance companies leveraging advanced data analytics and AI to offer highly tailored coverage options. By analyzing individual driving behaviors, vehicle usage patterns, and personal preferences, insurance providers can create customized policies that meet the unique needs of each policyholder.

This level of personalization not only enhances customer satisfaction but also allows insurance companies to price policies more accurately, leading to fairer premiums for policyholders.

Insurtech Partnerships and Innovations

The insurance industry is witnessing increased collaboration between traditional insurance companies and insurtech startups, which are known for their innovative use of technology. These partnerships are driving the development of new insurance products, streamlined processes, and enhanced customer experiences.

Insurtech companies bring expertise in areas such as telematics, AI, and data analytics, enabling insurance providers to stay ahead of the curve and offer cutting-edge solutions to their customers.

Environmental Considerations in Insurance

With growing concerns about environmental sustainability, insurance companies are starting to incorporate eco-friendly practices and initiatives into their operations. This trend is expected to extend to motor vehicle insurance, with providers offering incentives or discounts for environmentally conscious choices, such as electric or hybrid vehicles, carpooling, or reduced mileage.

Additionally, insurance companies may explore ways to offset their carbon footprint through partnerships with environmental organizations or by investing in sustainable initiatives.

Conclusion: Making an Informed Choice

Comparing motor vehicle insurance policies and providers is a critical step in ensuring you have the right coverage for your needs. By understanding the factors that influence insurance rates, exploring the policy offerings and customer service of different companies, and staying abreast of technological advancements and future trends, you can make an informed decision that provides both financial protection and peace of mind.

How do I choose the right motor vehicle insurance policy for my needs?

+When selecting a motor vehicle insurance policy, consider your specific needs and the value of your vehicle. Assess the types of coverage available, including liability, collision, and comprehensive insurance. Evaluate the policy limits, deductibles, and additional features offered by different providers. Additionally, research the company’s reputation for customer service and claims handling to ensure a positive experience.

What factors influence motor vehicle insurance rates?

+Motor vehicle insurance rates are influenced by various factors, including the type and value of your vehicle, your driving record and personal characteristics, and the coverage limits and deductibles you choose. Insurance companies assess these factors to determine the level of risk associated with insuring you and your vehicle, which in turn impacts your premiums.

How can I save on my motor vehicle insurance premiums?

+There are several ways to save on your motor vehicle insurance premiums. Explore the discounts offered by insurance companies, such as multi-policy discounts, safe driver discounts, and good student discounts. Consider usage-based insurance programs that reward safe driving practices with lower premiums. Additionally, maintaining a clean driving record and a good credit score can positively impact your insurance rates.