How Much Does The Fdic Insure

The Federal Deposit Insurance Corporation (FDIC) is a United States government corporation providing deposit insurance to depositors in American commercial banks and savings banks. FDIC insurance is backed by the full faith and credit of the U.S. government, ensuring that deposits are safe and secure.

If your bank fails, the FDIC will ensure that depositors receive their insured funds. If you have more than 250,000 in deposits, the FDIC will work to ensure that you receive your insured amount, which may involve transferring your account to another insured bank or paying you directly.">What happens if my bank fails, and I have more than 250,000 in deposits? +

Understanding FDIC Insurance Limits

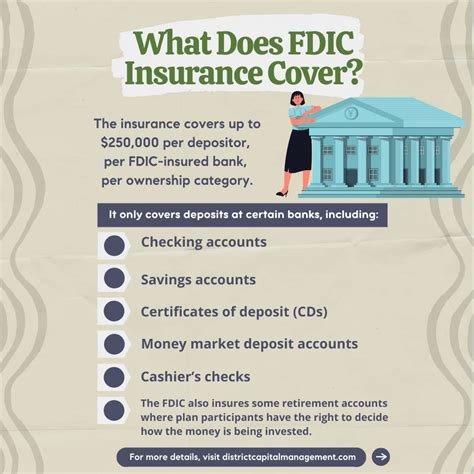

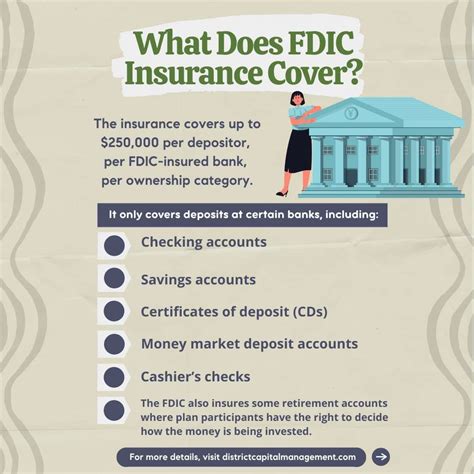

FDIC insurance protects depositors against the loss of their funds if an insured bank fails. The standard insurance amount is 250,000 per depositor, per insured bank, for each account ownership category. This means that if you have multiple accounts with the same bank, the total combined balance of these accounts is insured up to 250,000.

It's important to note that not all financial products are covered by FDIC insurance. While traditional checking and savings accounts are insured, some investment products like stocks, bonds, and mutual funds are not. Here's a breakdown of the types of accounts typically covered by FDIC insurance:

- Checking Accounts: Most standard checking accounts are FDIC-insured.

- Savings Accounts: Basic savings accounts are typically insured.

- Money Market Deposit Accounts (MMDAs): These accounts, often with higher interest rates, are also insured.

- Certificates of Deposit (CDs): FDIC insurance covers CDs, including those with terms as short as one day.

- Cashier's Checks, Money Orders, and Other Official Items: These instruments are insured if issued by an FDIC-insured bank.

- Interest on Deposits: The interest earned on insured deposits is also covered.

Special Coverage for Joint Accounts and Trust Accounts

The FDIC provides enhanced insurance coverage for certain types of accounts, including joint accounts and trust accounts. In these cases, the insurance coverage is calculated differently to offer more protection.

For joint accounts, each co-owner is considered a separate depositor, so the standard $250,000 insurance coverage applies to each co-owner. This means that a joint account held by two people would have a combined insurance coverage of $500,000.

Trust accounts, on the other hand, have a more complex insurance coverage structure. The insurance amount depends on the type of trust and the relationship of the beneficiary to the grantor. For example, revocable trusts are insured up to $250,000 for each unique beneficiary.

| Account Type | Insurance Coverage |

|---|---|

| Joint Accounts | $250,000 per co-owner |

| Revocable Trusts | $250,000 per unique beneficiary |

| Irrevocable Trusts | $250,000 for all beneficiaries combined |

Strategies to Maximize FDIC Insurance Coverage

While the standard insurance limit is $250,000, there are strategies to increase your FDIC insurance coverage, especially if you have substantial savings or investments.

Single Entity, Multiple Categories

FDIC insurance is calculated based on account ownership categories. By opening different types of accounts, you can increase your insurance coverage. For example, you can have a checking account, a savings account, and a CD, all with the same bank, and each account would be insured up to $250,000.

Different Ownership Categories

The FDIC recognizes different ownership categories, such as single accounts, joint accounts, trusts, and business accounts. By diversifying your accounts across these categories, you can maximize your insurance coverage. For instance, you could have a single account, a joint account with your spouse, and a business account, each insured up to $250,000.

Multiple Insured Banks

You can also increase your FDIC insurance coverage by spreading your deposits across multiple insured banks. Each bank is a separate insurer, so your deposits are insured up to $250,000 at each institution.

For example, if you have $500,000 in savings, you could split your deposits evenly between two FDIC-insured banks, ensuring that your entire savings are covered. This strategy is particularly useful for those with substantial savings who want to ensure full protection.

FDIC Insurance: A Safeguard for Depositors

FDIC insurance plays a critical role in maintaining confidence in the banking system. By providing deposit insurance, the FDIC ensures that depositors’ funds are protected, even in the event of a bank failure. This insurance coverage encourages individuals and businesses to keep their money in banks, contributing to the stability of the financial system.

While FDIC insurance provides a robust safety net, it's important for depositors to understand the limits and nuances of this coverage. By staying informed and employing strategies to maximize insurance coverage, depositors can ensure that their funds are secure and protected.

What happens if my bank fails, and I have more than 250,000 in deposits?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>If your bank fails, the FDIC will ensure that depositors receive their insured funds. If you have more than 250,000 in deposits, the FDIC will work to ensure that you receive your insured amount, which may involve transferring your account to another insured bank or paying you directly.

Are there any accounts that are not FDIC-insured?

+Yes, some financial products are not FDIC-insured, including stocks, bonds, mutual funds, life insurance policies, annuities, and municipal securities. It’s important to review the terms and conditions of your financial products to understand their insurance status.

How can I verify if my bank is FDIC-insured?

+You can verify your bank’s FDIC insurance status by checking for the official FDIC logo on their website or physical location. You can also use the FDIC’s BankFind tool, which provides a list of all FDIC-insured institutions and their insurance coverage details.