Commercial General Liability Insurance Costs

Commercial General Liability (CGL) insurance is a vital component of any business's risk management strategy, offering protection against a range of liability claims that could arise from everyday operations. Understanding the costs associated with this insurance is crucial for business owners and managers, as it directly impacts their financial planning and operational stability.

The price of CGL insurance can vary significantly depending on numerous factors. This article will delve into these variables, providing a comprehensive understanding of the costs and offering insights into how businesses can navigate this essential coverage.

Understanding Commercial General Liability Insurance

Commercial General Liability insurance is a type of business insurance that protects against a variety of claims, including bodily injury, property damage, personal and advertising injury, and medical payments. It is designed to cover the costs associated with legal defense, settlements, and judgments arising from these claims.

The importance of CGL insurance cannot be overstated, as it provides a financial safety net for businesses, safeguarding them from potentially devastating losses resulting from liability claims. It's an essential aspect of business insurance, covering a broad spectrum of risks that could arise from the normal course of operations.

Factors Influencing CGL Insurance Costs

The cost of CGL insurance is influenced by a multitude of factors, each playing a significant role in determining the final premium. These factors can be broadly categorized into the type of business, its location, and the nature of operations.

Type of Business

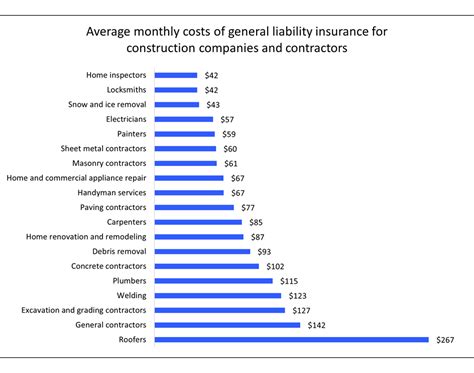

Different types of businesses face varying levels of risk, which directly impact the cost of their CGL insurance. For instance, a construction company will generally pay higher premiums due to the higher risk of bodily injury or property damage claims compared to a low-risk business like an accounting firm.

Additionally, the size of the business also matters. Larger businesses with more employees, higher revenues, or more extensive operations tend to pay higher premiums due to the increased exposure to potential claims.

Business Location

The location of a business is another critical factor in determining CGL insurance costs. Areas with higher crime rates, natural disaster risks, or dense populations may see higher insurance premiums. This is because the likelihood of certain types of claims, such as property damage or personal injury, is generally higher in such areas.

Furthermore, state-specific regulations and legal environments can also impact insurance costs. Some states have higher minimum coverage requirements or more favorable conditions for claimants, leading to higher insurance costs for businesses operating in those states.

Nature of Operations

The nature of a business’s operations, including the products or services it offers, can significantly influence CGL insurance costs. Businesses that deal with potentially hazardous materials or engage in activities with a higher risk of bodily injury or property damage will typically face higher insurance premiums.

For instance, a manufacturer dealing with toxic chemicals will face higher insurance costs compared to a business offering online services, as the former is at a higher risk of environmental liability claims. Similarly, a restaurant serving alcohol will face higher premiums due to the increased risk of liability claims related to intoxicated patrons.

Additional Factors Affecting CGL Insurance Costs

Beyond the type of business, location, and nature of operations, several other factors can influence CGL insurance costs. These include:

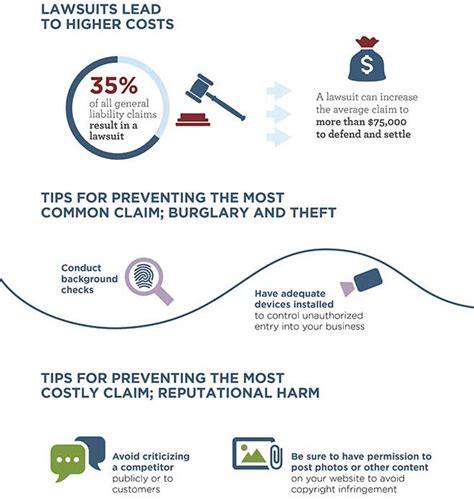

- Claim History: Businesses with a history of frequent or severe claims may face higher insurance premiums, as they are considered a higher risk by insurance providers.

- Credit Rating: A business's credit rating can impact its insurance costs. Businesses with lower credit ratings may be seen as higher risks, leading to higher premiums.

- Risk Management: Businesses that actively implement risk management strategies and safety measures may be rewarded with lower insurance premiums. Insurance providers often view these businesses as lower risks.

- Coverage Limits and Deductibles: The level of coverage and the deductible chosen by the business can significantly impact the cost of CGL insurance. Higher coverage limits and lower deductibles generally result in higher premiums.

CGL Insurance Costs: Real-World Examples

To provide a clearer understanding, let’s look at some real-world examples of CGL insurance costs for different types of businesses.

| Business Type | Average Annual Premium |

|---|---|

| Retail Store | $800 - $1,200 |

| Restaurant | $1,500 - $3,000 |

| Construction Company | $3,000 - $5,000 |

| Manufacturing Company | $5,000 - $10,000 |

These figures are average estimates and can vary significantly based on the factors discussed earlier. It's important to note that the actual cost of CGL insurance can be much higher or lower, depending on the specific circumstances of each business.

Strategies to Lower CGL Insurance Costs

While CGL insurance is a necessary expense for most businesses, there are strategies that can help lower the costs without compromising on coverage. Here are some tips to consider:

- Review Your Coverage: Regularly review your CGL insurance policy to ensure you're not over-insured or under-insured. Adjust your coverage limits and deductibles based on your business's changing needs and risk profile.

- Improve Risk Management: Implement robust risk management strategies to minimize the likelihood of liability claims. This could include employee training, safety protocols, and regular maintenance of equipment and facilities.

- Shop Around: Don't settle for the first insurance quote you receive. Shop around and compare quotes from different insurance providers. This can help you find the best value for your business's specific needs.

- Bundle Your Insurance: Consider bundling your CGL insurance with other types of business insurance, such as property insurance or business interruption insurance. Many insurance providers offer discounts for bundled policies.

- Maintain a Good Credit Rating: A strong credit rating can help you secure lower insurance premiums. Ensure you're managing your business finances effectively and maintaining a positive credit history.

Future Implications of CGL Insurance Costs

As the business landscape continues to evolve, the cost of CGL insurance is likely to be influenced by several emerging factors. These include changes in regulatory environments, shifts in the insurance market, and advancements in technology that could impact risk management strategies.

For instance, the increasing focus on environmental sustainability may lead to a rise in environmental liability claims, potentially impacting CGL insurance costs for businesses involved in activities with environmental risks. Similarly, advancements in technology, such as the use of AI and automation, could reduce certain types of risks, potentially leading to lower insurance premiums.

Staying informed about these emerging factors and adapting risk management strategies accordingly can help businesses navigate the changing landscape of CGL insurance costs effectively.

Conclusion

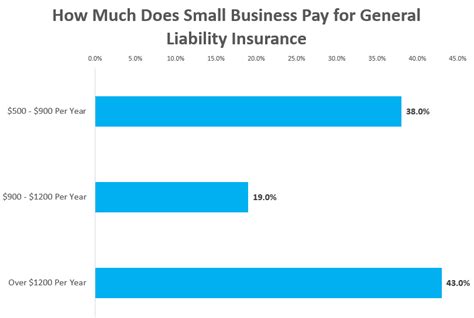

Understanding the costs associated with Commercial General Liability insurance is a critical aspect of effective business management. By considering the various factors that influence CGL insurance costs and implementing strategies to mitigate these costs, businesses can ensure they have adequate coverage without straining their financial resources.

Remember, while CGL insurance is an essential safeguard against liability claims, it's just one part of a comprehensive risk management strategy. Businesses should also consider other types of insurance coverage, such as property insurance, business interruption insurance, and professional liability insurance, to ensure they're fully protected against a wide range of risks.

What is the average cost of CGL insurance for a small business?

+The average cost of CGL insurance for a small business can range from a few hundred dollars to a few thousand dollars per year. However, this can vary significantly depending on the type of business, its location, and the nature of its operations.

Can I reduce my CGL insurance costs by increasing my deductible?

+Yes, increasing your deductible can lower your CGL insurance premiums. However, it’s important to ensure that you can afford the higher deductible in the event of a claim. It’s a balance between reducing your insurance costs and maintaining financial stability.

How often should I review my CGL insurance policy?

+It’s recommended to review your CGL insurance policy annually or whenever there are significant changes to your business, such as expansion, relocation, or changes in operations. Regular reviews ensure that your coverage remains adequate and aligned with your business’s evolving needs.