Capital One And Rental Car Insurance

When renting a car, many people often wonder if they need to purchase additional insurance coverage, especially when it comes to navigating the specific policies of different credit card companies. In this comprehensive guide, we'll delve into the rental car insurance offerings of Capital One, a prominent financial services company, and explore the ins and outs of their coverage.

Capital One is known for its innovative banking and credit card solutions, and their approach to rental car insurance is no exception. With a range of credit cards catering to various consumer needs, Capital One aims to provide valuable benefits, including rental car insurance coverage. Let's uncover the details and understand how Capital One's rental car insurance works.

Understanding Capital One’s Rental Car Insurance Coverage

Capital One offers an array of credit cards, each with its own set of perks and benefits. Among these advantages, many Capital One cards include rental car insurance as an added feature. This coverage can provide significant peace of mind when renting a vehicle, as it offers protection against various potential risks and expenses.

The rental car insurance provided by Capital One typically acts as a secondary coverage, meaning it supplements the primary insurance coverage you may already have. This secondary coverage kicks in when your primary insurance, such as your personal auto insurance or the rental company's collision damage waiver (CDW), has been exhausted. It's designed to fill in any gaps left by your primary coverage, ensuring you're adequately protected.

Capital One's rental car insurance coverage generally includes:

- Collision Damage Waiver (CDW): This waives your responsibility for damage to the rental car, providing protection against costly repairs or replacement costs.

- Loss Damage Waiver (LDW): Similar to CDW, LDW covers theft or vandalism of the rental vehicle, ensuring you're not financially liable for such incidents.

- Liability Coverage: This aspect of the insurance covers any damages you may cause to others' property or injuries you may inflict on others while operating the rental car.

- Personal Accident Insurance (PAI): PAI provides coverage for medical expenses and lost wages in the event of an accident, offering financial support during recovery.

It's important to note that the specific coverage and benefits may vary depending on the Capital One credit card you hold. Some cards offer more comprehensive rental car insurance, while others may have certain limitations or exclusions. Therefore, it's crucial to review the terms and conditions of your particular card to understand the exact coverage you're entitled to.

How to Utilize Capital One’s Rental Car Insurance

To maximize the benefits of Capital One’s rental car insurance, there are a few key steps you should follow:

Renting a Vehicle

When renting a car, ensure that you use the Capital One credit card associated with the rental car insurance benefit to pay for the entire rental. This is a critical step, as it activates the insurance coverage and makes you eligible for the benefits.

Decline Other Insurance Options

At the rental car counter, you may be offered additional insurance coverage by the rental company. However, if you have a Capital One credit card with rental car insurance, you can confidently decline these optional coverages. By doing so, you avoid unnecessary expenses and potential conflicts between multiple insurance policies.

Review the Rental Agreement

Take the time to carefully read and understand the rental agreement. This document outlines the terms and conditions of your rental, including any specific exclusions or limitations regarding insurance coverage. By familiarizing yourself with these details, you can ensure you’re fully aware of your rights and responsibilities.

Report Any Incidents Promptly

In the event of an accident, damage, or theft of the rental car, it’s crucial to report the incident to the rental company and Capital One as soon as possible. Prompt reporting ensures that the necessary steps can be taken to process your claim and provides a clear record of the incident.

Capital One’s Rental Car Insurance Benefits and Limitations

Capital One’s rental car insurance offers several advantages that can significantly reduce your out-of-pocket expenses in the event of an incident. However, it’s essential to be aware of certain limitations and exclusions that may apply.

Benefits

The benefits of Capital One’s rental car insurance include:

- Comprehensive Coverage: Capital One’s insurance covers a range of potential incidents, including collision, theft, and vandalism, providing you with a sense of security during your rental.

- Cost Savings: By utilizing Capital One’s rental car insurance, you can avoid the often costly insurance fees charged by rental car companies, resulting in significant savings.

- Ease of Use: Capital One’s insurance is automatically activated when you use your eligible credit card to pay for the rental, simplifying the process and eliminating the need for additional paperwork or applications.

Limitations and Exclusions

While Capital One’s rental car insurance offers valuable coverage, there are some limitations and exclusions to be aware of:

- Vehicle Type: Capital One’s insurance may have restrictions on the type of vehicles it covers. For instance, certain luxury or exotic cars may be excluded from coverage.

- Rental Duration: There may be limits on the length of time a rental car can be insured. Typically, Capital One’s insurance covers rentals for a maximum duration, after which additional insurance would be required.

- Primary Driver: The insurance coverage is often limited to the primary cardholder and authorized users. If someone else drives the rental car, they may not be covered, so it’s essential to review the terms carefully.

- Geographical Restrictions: Capital One’s rental car insurance may have geographical limitations, specifying the countries or regions where the coverage is valid. It’s crucial to check these restrictions before traveling.

Comparing Capital One’s Rental Car Insurance with Other Options

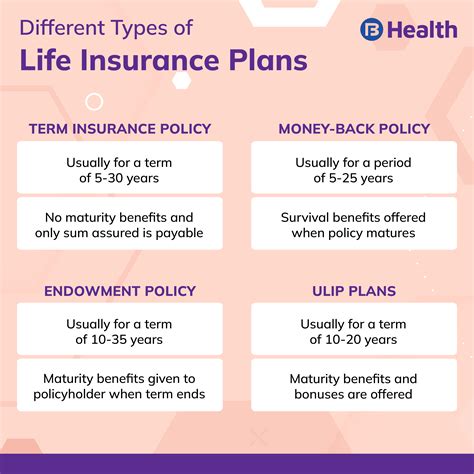

When considering rental car insurance, it’s beneficial to compare Capital One’s offering with other available options. Here’s a brief overview of how Capital One’s rental car insurance stacks up against other common alternatives:

Personal Auto Insurance

Many individuals already have personal auto insurance policies that may provide coverage for rental cars. However, it’s essential to review your policy to understand the specific terms and conditions. Capital One’s rental car insurance can act as a valuable supplement to your personal auto insurance, ensuring you’re covered in scenarios where your primary insurance may have limitations.

Rental Car Company Insurance

Rental car companies often offer their own insurance packages, such as collision damage waiver (CDW) or loss damage waiver (LDW). These options can be costly, and by utilizing Capital One’s rental car insurance, you can potentially save a significant amount of money. Additionally, Capital One’s insurance may provide more comprehensive coverage than what’s typically offered by rental car companies.

Travel Insurance

Travel insurance policies often include rental car insurance as part of their comprehensive coverage. While these policies can be beneficial, they may have specific requirements or limitations. Capital One’s rental car insurance, when used in conjunction with travel insurance, can provide an additional layer of protection, ensuring you’re covered from multiple angles during your travels.

Real-Life Examples and Case Studies

To better understand the impact and effectiveness of Capital One’s rental car insurance, let’s explore a few real-life scenarios:

Scenario 1: Collision Damage

Imagine you’re on a business trip and rent a car using your Capital One credit card. Unfortunately, an accident occurs, resulting in damage to the rental vehicle. With Capital One’s rental car insurance, you can file a claim, and the insurance will cover the costs of repairing the car, potentially saving you thousands of dollars.

Scenario 2: Theft and Vandalism

During a family vacation, you discover that your rental car has been vandalized and certain items have been stolen. In this situation, Capital One’s rental car insurance can step in, providing coverage for the repairs and replacements needed, alleviating the financial burden of such an unfortunate event.

Scenario 3: Medical Emergencies

While driving a rental car, you’re involved in an accident that results in injuries to yourself and your passengers. Capital One’s rental car insurance, with its personal accident insurance coverage, can provide financial support for medical expenses and lost wages, ensuring you and your loved ones receive the necessary care and compensation.

Expert Insights and Recommendations

As a financial expert, here are some key insights and recommendations regarding Capital One’s rental car insurance:

💡 Utilize Capital One's Rental Car Insurance Strategically: Capital One's rental car insurance is a valuable benefit, but it's essential to understand its limitations. By strategically using this coverage in conjunction with your personal auto insurance or travel insurance, you can maximize your protection and minimize potential gaps in coverage.

💡 Review Terms and Conditions: Take the time to carefully review the terms and conditions of Capital One's rental car insurance. Understanding the specific coverage, exclusions, and limitations will ensure you're fully aware of your rights and responsibilities, allowing you to make informed decisions.

💡 Consider Additional Coverage: Depending on your individual circumstances and travel plans, it may be beneficial to consider purchasing additional insurance coverage. This could include upgrading your personal auto insurance policy or opting for specialized travel insurance that caters to your specific needs.

Conclusion

Capital One’s rental car insurance offers a valuable layer of protection when renting a vehicle. By understanding the coverage, limitations, and strategic utilization of this benefit, you can make informed decisions to ensure your rental experiences are as smooth and worry-free as possible. Remember to always review the terms and conditions, and consider consulting with a financial expert or insurance professional to tailor your coverage to your unique needs.

Frequently Asked Questions

What types of rental cars are covered by Capital One’s rental car insurance?

+Capital One’s rental car insurance typically covers a wide range of vehicles, including standard passenger cars, SUVs, and even some luxury models. However, certain high-end or exotic vehicles may be excluded from coverage, so it’s essential to review the specific terms of your policy.

Can I use Capital One’s rental car insurance if I’m traveling internationally?

+Yes, Capital One’s rental car insurance often provides coverage for international rentals. However, it’s crucial to review the geographical limitations specified in your policy to ensure that your destination is covered. Some policies may have specific restrictions on certain countries or regions.

How do I file a claim with Capital One’s rental car insurance?

+To file a claim with Capital One’s rental car insurance, you’ll need to contact their customer service team and provide the necessary details and documentation related to the incident. This typically includes a police report, rental agreement, and any other relevant information. Capital One will guide you through the claims process, ensuring a smooth and efficient experience.

Are there any exclusions or limitations I should be aware of when using Capital One’s rental car insurance?

+Yes, while Capital One’s rental car insurance offers comprehensive coverage, there may be certain exclusions and limitations. These can include geographical restrictions, vehicle type limitations, and exclusions for certain activities or situations. It’s crucial to review the policy terms to understand these specifics and ensure you’re fully aware of any potential gaps in coverage.

Can I stack Capital One’s rental car insurance with other insurance policies I have?

+Yes, you can stack Capital One’s rental car insurance with other insurance policies you may have, such as your personal auto insurance or travel insurance. This allows you to maximize your coverage and ensure you’re protected from multiple angles. However, it’s essential to review the terms of each policy to understand how they interact and ensure there are no conflicts or duplicate coverages.