Texas House Insurance

Texas, known for its diverse landscapes and vibrant communities, is home to a wide range of homeowners and renters who require insurance coverage to protect their properties and assets. With its unique climate and natural hazards, understanding Texas house insurance is essential for residents to navigate the complex world of insurance policies and find the right coverage for their needs.

The Importance of Texas House Insurance

Texas house insurance, often referred to as homeowners insurance or renters insurance, is a crucial aspect of financial planning and risk management for property owners and renters alike. It provides a safety net against unexpected events, such as storms, fires, theft, or other covered perils, that could result in significant financial losses.

Given the state's vulnerability to natural disasters like hurricanes, tornadoes, and hail storms, having comprehensive insurance coverage is not just a smart financial decision but also a necessity. For instance, in 2020, Texas experienced a record-breaking hurricane season, with multiple storms causing widespread damage across the state. The impact of these events highlighted the importance of having adequate insurance to rebuild and recover.

Moreover, Texas house insurance offers liability protection, which can be a lifesaver in the event of an accident or injury on your property. It also often includes coverage for additional living expenses if your home becomes uninhabitable due to a covered event, ensuring you have the means to maintain your standard of living during the repair or rebuilding process.

Understanding Texas House Insurance Policies

Texas house insurance policies can vary significantly, offering different levels of coverage and benefits. It’s crucial to understand the key components and options available to tailor your policy to your specific needs and budget.

Coverage Options

When selecting a Texas house insurance policy, you’ll encounter various coverage options, each designed to address specific risks. These include:

- Dwelling Coverage: Protects the structure of your home, including the main house, detached garages, sheds, and other structures.

- Personal Property Coverage: Covers the cost of replacing or repairing your personal belongings, such as furniture, electronics, and clothing, in case of damage or theft.

- Liability Coverage: Provides financial protection if someone is injured on your property or if you're found legally responsible for causing property damage or bodily injury to others.

- Medical Payments Coverage: Pays for medical expenses for guests injured on your property, regardless of fault.

- Additional Living Expenses: Covers the cost of temporary housing and additional expenses if you need to evacuate your home due to a covered event.

It's essential to carefully review these coverage options and adjust them to align with your specific circumstances and needs. For instance, if you own high-value items like jewelry or fine art, you may want to consider additional endorsements or riders to ensure they are adequately covered.

Policy Types

Texas house insurance policies can be categorized into different types, each offering varying levels of coverage and cost. The most common types include:

- HO-3 Policy: This is the standard policy for homeowners, covering a wide range of perils, including fire, windstorms, hail, and vandalism. It also includes liability protection.

- HO-4 Policy (Renters Insurance): Designed for renters, this policy covers personal property and provides liability protection. It does not cover the structure of the building, as that is the landlord's responsibility.

- HO-6 Policy (Condo Insurance): Tailored for condo owners, this policy covers the interior of your unit, including upgrades and improvements you've made, as well as your personal belongings. It also includes liability protection.

- HO-8 Policy: This is a limited form of homeowners insurance, often used for older homes or homes in less desirable areas. It provides coverage for specific perils but may have lower limits and exclusions.

When choosing a policy type, it's crucial to consider your specific circumstances, the value of your home and belongings, and the potential risks you face. For instance, if you live in an area prone to hurricanes or flooding, you may need to supplement your policy with additional coverage to ensure you're fully protected.

Factors Influencing Texas House Insurance Rates

Texas house insurance rates can vary significantly depending on several factors. Understanding these factors can help you negotiate better rates and make informed decisions about your coverage.

Location

The location of your home is a significant factor in determining insurance rates. Areas prone to natural disasters, such as hurricanes or wildfires, typically have higher insurance costs due to the increased risk of damage. For instance, coastal regions of Texas often face higher insurance premiums due to the risk of hurricanes and storm surges.

Home Value and Construction

The value of your home and its construction materials can also impact insurance rates. Homes built with high-quality, durable materials may be eligible for discounts, as they are less likely to suffer extensive damage in a storm or fire. Similarly, homes with modern safety features, such as fire sprinklers or reinforced roofs, may also qualify for lower rates.

Coverage Limits and Deductibles

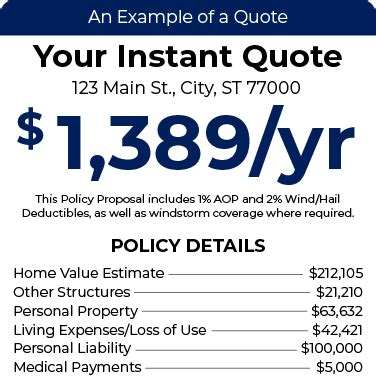

The coverage limits you choose can significantly affect your insurance premiums. Higher coverage limits typically result in higher premiums, as the insurance company is taking on more financial risk. Similarly, selecting a higher deductible can lower your premiums, as you’ll be responsible for a larger portion of the cost in the event of a claim.

Claims History

Your insurance claims history is a critical factor in determining rates. Insurance companies use your claims history to assess your risk profile. If you’ve had multiple claims in the past, you may be considered a higher risk, which could lead to higher premiums or even policy cancellations.

Discounts and Bundling

Insurance companies often offer discounts to policyholders who take proactive steps to reduce their risk of loss. These discounts can include:

- Multi-Policy Discounts: Bundling your homeowners insurance with other policies, such as auto insurance, can result in significant savings.

- Safety Features Discounts: Homes equipped with security systems, fire alarms, or storm shutters may be eligible for discounts.

- Loyalty Discounts: Staying with the same insurance company for an extended period may result in loyalty discounts.

- Retirement or Senior Discounts: Many insurance companies offer discounts to retirees or seniors, as they tend to spend more time at home and are less likely to engage in risky activities.

The Claims Process: What to Expect

Understanding the claims process is essential for Texas house insurance policyholders. Being prepared can help streamline the process and ensure you receive the coverage you’re entitled to in a timely manner.

Reporting a Claim

When you experience a covered loss, the first step is to report it to your insurance company as soon as possible. Most insurance companies offer 24⁄7 claims reporting, either online or over the phone. It’s important to provide as much detail as you can about the loss, including photos or videos of the damage.

Adjusting the Claim

After reporting your claim, an insurance adjuster will be assigned to assess the damage. The adjuster will visit your property, review the damage, and document the extent of the loss. They will then provide an estimate of the cost to repair or replace the damaged items.

It's crucial to cooperate with the adjuster and provide any requested information or documentation. However, if you disagree with the adjuster's assessment, you have the right to seek a second opinion or engage a public adjuster to advocate for your interests.

Payment and Recovery

Once the adjuster has completed their assessment and you’ve agreed on the cost of repairs or replacements, your insurance company will issue payment. The payment method and timeline can vary depending on the type of claim and the severity of the damage.

For smaller claims, you may receive a check or direct deposit to cover the cost of repairs. For more significant losses, such as a total loss due to a fire or hurricane, the insurance company may provide temporary living expenses or advance payments to help you start the recovery process.

It's important to keep detailed records of all expenses related to the claim, as you may need to provide receipts or invoices to the insurance company for reimbursement.

Common Pitfalls and How to Avoid Them

While Texas house insurance can provide invaluable protection, there are common pitfalls that policyholders should be aware of to ensure they receive the coverage they need and deserve.

Underinsurance

One of the most common mistakes is underinsuring your home. This occurs when the coverage limits on your policy are not sufficient to rebuild your home and replace your belongings in the event of a total loss. To avoid this, it’s crucial to regularly review and update your policy limits to reflect the current value of your home and its contents.

Exclusions and Limitations

Insurance policies often contain exclusions and limitations that can impact your coverage. For instance, many standard policies do not cover flood damage, which is a significant risk in certain parts of Texas. It’s essential to carefully review your policy to understand what is and isn’t covered, and consider purchasing additional coverage if necessary.

Misunderstanding Policy Terms

Insurance policies can be complex, and it’s easy to misunderstand certain terms or conditions. For instance, some policies may require you to take certain actions, such as maintaining a working fire alarm or keeping your home properly secured, to maintain coverage. Failure to comply with these requirements could void your policy in the event of a claim.

Delaying or Neglecting Regular Maintenance

Regular maintenance of your home is crucial not only for its overall condition but also for your insurance coverage. Insurance companies may deny claims if they believe the damage could have been prevented with proper maintenance. For example, failing to clean your gutters could lead to water damage or roof issues, which may not be covered if the insurance company deems it preventable.

Tips for Choosing the Right Texas House Insurance Provider

Selecting the right Texas house insurance provider is a critical decision that can impact your financial security and peace of mind. Here are some tips to help you make an informed choice.

Research and Compare Providers

Take the time to research and compare different insurance providers. Look for companies that have a strong financial rating, as this indicates their ability to pay out claims. Also, consider the company’s reputation for customer service and claims handling. Online reviews and ratings can provide valuable insights into the experiences of other policyholders.

Understand the Policy Details

Before committing to a policy, ensure you understand all the terms and conditions. Read the policy document carefully, paying close attention to the coverage limits, deductibles, exclusions, and any special conditions. If you have any questions or concerns, don’t hesitate to contact the insurance provider for clarification.

Consider Bundling Policies

Bundling your homeowners insurance with other policies, such as auto or umbrella insurance, can often result in significant savings. Many insurance companies offer multi-policy discounts, so it’s worth exploring this option to reduce your overall insurance costs.

Shop Around for the Best Rates

Insurance rates can vary significantly between providers, so it’s crucial to shop around for the best deal. Get quotes from multiple insurance companies and compare the coverage and premiums they offer. Keep in mind that the cheapest policy may not always be the best, as it may have higher deductibles or fewer coverage options.

Consider an Independent Insurance Agent

Working with an independent insurance agent can be beneficial, as they can provide unbiased advice and help you find the best policy for your needs. Independent agents work with multiple insurance companies, allowing them to shop around on your behalf and find the most suitable coverage at the best price.

Texas House Insurance: A Comprehensive Guide

Understanding Texas house insurance is crucial for homeowners and renters alike. By familiarizing yourself with the different coverage options, policy types, and factors influencing rates, you can make informed decisions to protect your home and belongings. Additionally, being aware of common pitfalls and knowing how to choose the right insurance provider can further enhance your financial security and peace of mind.

Frequently Asked Questions

What is the average cost of Texas house insurance?

+The average cost of Texas house insurance varies depending on several factors, including the location, size, and value of your home, as well as your chosen coverage limits and deductibles. According to data from the National Association of Insurance Commissioners (NAIC), the average annual premium for homeowners insurance in Texas was $1,985 in 2020. However, this is just an average, and your specific rate may be higher or lower based on your individual circumstances.

How often should I review and update my Texas house insurance policy?

+It’s a good practice to review your Texas house insurance policy annually or whenever there are significant changes to your home, such as renovations or additions. This ensures that your coverage limits are adequate to cover the current value of your home and belongings. Additionally, reviewing your policy regularly allows you to stay informed about any changes in coverage, deductibles, or premiums, and make adjustments as needed.

What should I do if my Texas house insurance claim is denied?

+If your Texas house insurance claim is denied, it’s important to understand the reasons for the denial. Your insurance company should provide a written explanation detailing why the claim was denied. If you believe the denial was unjustified or if there is a disagreement about the value of the loss, you have the right to appeal the decision. You can request a second review or engage a public adjuster or attorney to advocate for your rights.

Are there any discounts available for Texas house insurance policies?

+Yes, there are several discounts available for Texas house insurance policies. These may include multi-policy discounts (when you bundle your homeowners insurance with other policies like auto or umbrella insurance), safety features discounts (for homes with security systems or fire alarms), retirement or senior discounts, and loyalty discounts for long-term policyholders. It’s worth discussing these options with your insurance provider to see if you qualify for any discounts.