Motor Insurance Company List

The world of motor insurance is vast and diverse, with numerous companies offering a range of policies to cater to the needs of vehicle owners. In this comprehensive guide, we delve into the intricacies of the motor insurance industry, exploring the top players, their unique offerings, and the key factors that influence policy choices.

The Top Motor Insurance Companies: An Overview

When it comes to protecting your vehicle and securing your financial interests, choosing the right motor insurance company is paramount. Here, we present a curated list of some of the leading insurance providers, highlighting their specialties and the benefits they bring to the table.

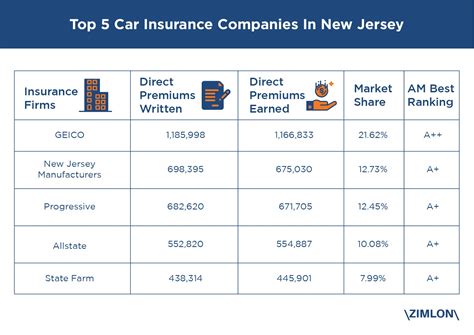

State Farm: The Trusted Giant

State Farm has solidified its position as one of the most trusted names in the industry. With a rich history spanning over a century, they have built a reputation for reliable coverage and exceptional customer service. Their policies offer comprehensive protection, including collision, liability, and comprehensive coverage, tailored to meet the unique needs of their diverse clientele.

One of State Farm’s standout features is their Claim Satisfaction Guarantee, ensuring a swift and seamless claims process. Additionally, their Drive Safe & Save program rewards safe driving habits with potential discounts, encouraging responsible behavior on the road.

| Key Features | State Farm |

|---|---|

| Coverage Options | Comprehensive, collision, liability, and specialized coverage for classic cars. |

| Discounts | Multi-policy, safe driver, and loyalty discounts. |

| Customer Satisfaction | Top-rated for customer service and claim handling. |

Geico: Innovation in Action

Geico has revolutionized the insurance landscape with its focus on digital innovation. Their online platform offers a seamless experience, allowing customers to easily compare policies, obtain quotes, and manage their insurance needs with just a few clicks. Geico’s policies are designed to provide comprehensive protection, with added perks like roadside assistance and rental car coverage.

What sets Geico apart is its Digital Discount, offering savings for customers who manage their policies online. Additionally, their Accident Forgiveness program ensures that one minor accident won’t impact future premiums, providing peace of mind for cautious drivers.

| Geico’s Key Offerings | |

|---|---|

| Digital Experience | Seamless online management and quotes. |

| Discounts | Digital discount, accident forgiveness, and multi-policy savings. |

| Specialty Coverage | Customizable options for rideshare drivers and motorcycles. |

Progressive: Customized Solutions

Progressive Insurance takes a personalized approach, understanding that every driver’s needs are unique. Their policies offer a range of coverage options, allowing customers to tailor their insurance to their specific requirements. From basic liability to comprehensive protection, Progressive ensures a customized experience.

Progressive’s Name Your Price tool is a standout feature, empowering customers to choose their desired level of coverage and premium. Additionally, their Snapshot program utilizes telematics to track driving behavior, potentially offering discounts for safe drivers.

| Progressive’s Highlights | |

|---|---|

| Customized Coverage | Tailored policies based on individual needs. |

| Discounts | Multi-policy, safe driver, and snapshot discounts. |

| Additional Benefits | Pet injury coverage and gap insurance for new car buyers. |

Allstate: A Comprehensive Approach

Allstate Insurance prides itself on providing a comprehensive range of coverage options. Their policies offer extensive protection, including liability, collision, and comprehensive coverage, as well as unique add-ons like sound system coverage and rental reimbursement.

Allstate’s Accident Forgiveness policy is a notable feature, ensuring that a single accident won’t affect future premiums. Additionally, their Safe Driving Bonus Check program rewards safe drivers with a yearly bonus, promoting responsible driving habits.

| Allstate’s Key Features | |

|---|---|

| Comprehensive Coverage | Wide range of coverage options and add-ons. |

| Discounts | Safe driving bonus, multi-policy, and loyalty discounts. |

| Unique Add-ons | Sound system coverage, rental reimbursement, and roadside assistance. |

Liberty Mutual: Community Focused

Liberty Mutual stands out for its community-centric approach. Their policies offer a balanced blend of comprehensive coverage and specialized options, catering to the diverse needs of their customers. Additionally, Liberty Mutual actively engages in community initiatives, promoting road safety and responsible driving.

Liberty Mutual’s RightTrack program utilizes telematics to reward safe driving, offering potential discounts based on individual driving behavior. Their Liberty Community Benefits program also provides discounts for customers who are active in their local communities.

| Liberty Mutual’s Unique Features | |

|---|---|

| Community Engagement | Involvement in local initiatives and community safety programs. |

| Discounts | RightTrack telematics discount and community benefits program. |

| Specialty Coverage | Options for classic car enthusiasts and rideshare drivers. |

Factors to Consider When Choosing Motor Insurance

Selecting the right motor insurance company involves careful consideration of various factors. Here, we explore the key aspects to keep in mind when making this important decision.

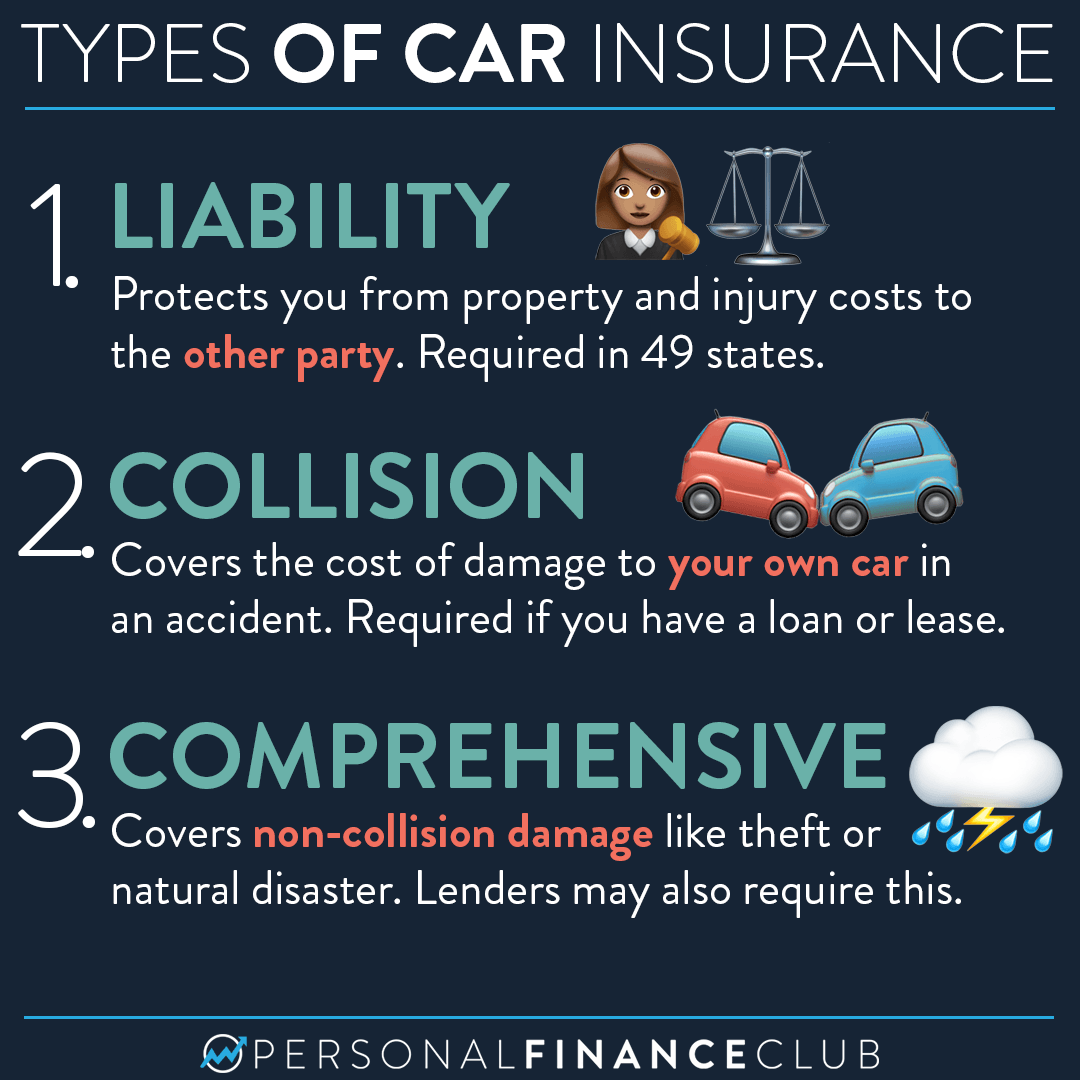

Coverage Options

The breadth and depth of coverage options offered by an insurance provider are crucial. Consider your specific needs, whether it’s comprehensive coverage for peace of mind or specialized add-ons for unique situations. Ensure the company provides the flexibility to tailor your policy to your requirements.

Discounts and Savings

Insurance companies often provide a range of discounts to attract and retain customers. From multi-policy discounts to safe driving rewards, these savings can significantly reduce your premium. Research and compare the discount offerings to find the most cost-effective option for your circumstances.

Customer Service and Claim Handling

In the event of an accident or claim, efficient and responsive customer service is invaluable. Look for insurance providers with a strong track record of prompt claim handling and exceptional customer support. Positive reviews and industry recognition for customer satisfaction are key indicators of a reliable insurer.

Reputation and Financial Stability

Choosing a reputable and financially stable insurance company is essential. Research their track record, financial ratings, and customer feedback to ensure they have the resources and reliability to provide long-term coverage. A stable insurer can offer peace of mind and continuity in your insurance journey.

Digital Experience and Convenience

In today’s digital age, a seamless online experience is a significant advantage. Look for insurance providers with user-friendly platforms, allowing you to easily manage your policy, obtain quotes, and access support. Digital convenience can save time and effort, making your insurance journey more efficient.

Conclusion: Navigating the Motor Insurance Landscape

The motor insurance industry offers a plethora of options, each with its own unique advantages. By understanding your specific needs, researching coverage options, and considering the key factors outlined above, you can make an informed decision when choosing a motor insurance provider. Remember, the right policy not only protects your vehicle but also provides peace of mind and financial security on the road.

How do I choose the right motor insurance company for my needs?

+Selecting the right motor insurance company involves assessing your specific needs and preferences. Consider factors such as coverage options, discounts, customer service, and financial stability. Research and compare multiple providers to find the one that aligns with your requirements and offers the best value.

What are some common discounts offered by motor insurance companies?

+Common discounts include multi-policy discounts for bundling multiple insurance types, safe driver discounts for maintaining a clean driving record, and loyalty discounts for long-term customers. Some companies also offer telematics-based discounts, rewarding safe driving habits.

How can I ensure a smooth claims process with my motor insurance provider?

+To ensure a smooth claims process, choose an insurance provider with a reputation for efficient and responsive claim handling. Look for positive reviews and industry recognition for customer satisfaction. Additionally, familiarize yourself with your policy’s claim process and keep important documents readily accessible.