Automobile Auto Insurance

Automobile insurance, commonly known as car insurance, is an essential financial safeguard for vehicle owners. It provides protection against potential financial losses resulting from vehicle-related incidents, ensuring peace of mind for drivers and their passengers. This comprehensive guide will delve into the intricacies of auto insurance, exploring its various aspects, benefits, and considerations.

Understanding Auto Insurance: A Comprehensive Overview

Auto insurance is a contractual agreement between an individual (the policyholder) and an insurance company. It is designed to offer financial protection in the event of accidents, theft, natural disasters, or other unforeseen circumstances that may damage a vehicle or cause bodily injury to the occupants. The specific coverage and benefits of an auto insurance policy can vary widely, depending on the policyholder’s needs, the laws of their jurisdiction, and the chosen insurance provider.

The primary goal of auto insurance is to mitigate the financial risks associated with vehicle ownership. It achieves this by providing coverage for a range of scenarios, including liability for bodily injury and property damage to others, medical expenses for the policyholder and their passengers, and repair or replacement costs for the insured vehicle. Additionally, some policies may offer protection against theft, vandalism, and other non-accident-related incidents.

Key Components of Auto Insurance Policies

Auto insurance policies typically consist of several core components, each offering specific types of coverage. These components include:

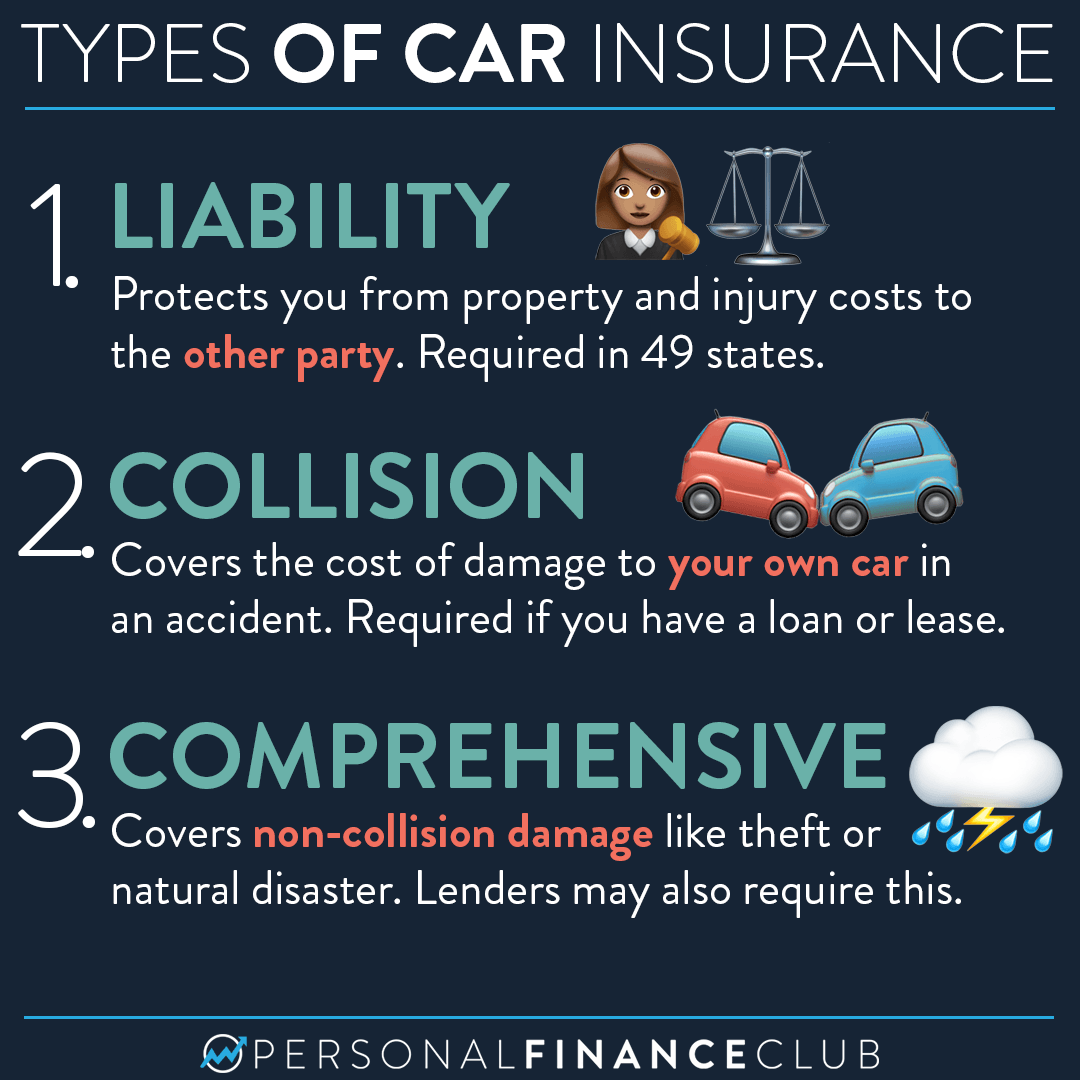

- Liability Coverage: This is the most fundamental aspect of any auto insurance policy. It covers the policyholder’s legal responsibility for bodily injury or property damage to others as a result of an accident for which they are at fault. Liability coverage is usually divided into two parts: bodily injury liability and property damage liability.

- Collision Coverage: This type of coverage pays for the repair or replacement of the insured vehicle after an accident, regardless of fault. It provides protection against the high costs of repairing or replacing a vehicle after a collision, ensuring that the policyholder is not left with significant out-of-pocket expenses.

- Comprehensive Coverage: Comprehensive insurance covers damages to the insured vehicle that are not caused by a collision. This includes incidents like theft, vandalism, natural disasters, and damage caused by animals. It provides a broader range of protection than collision coverage, ensuring that the policyholder is covered for a wide array of non-accident-related incidents.

- Medical Payments Coverage: Also known as Personal Injury Protection (PIP) or No-Fault Insurance, this coverage pays for the medical expenses of the policyholder and their passengers, regardless of who is at fault in an accident. It provides quick and efficient access to medical care, ensuring that injured individuals receive the necessary treatment without delay.

- Uninsured/Underinsured Motorist Coverage: This coverage steps in when the at-fault driver in an accident does not have insurance or does not have enough insurance to cover the costs of the accident. It protects the policyholder from being left with unpaid medical bills or other financial burdens in such situations.

| Component | Description |

|---|---|

| Liability Coverage | Covers legal responsibility for bodily injury and property damage to others. |

| Collision Coverage | Pays for repair or replacement of the insured vehicle after an accident. |

| Comprehensive Coverage | Provides protection against non-collision incidents like theft and natural disasters. |

| Medical Payments Coverage | Covers medical expenses for the policyholder and their passengers after an accident. |

| Uninsured/Underinsured Motorist Coverage | Protects the policyholder when the at-fault driver has insufficient insurance. |

The Process of Acquiring Auto Insurance

Obtaining auto insurance involves several key steps, from researching providers and understanding your coverage needs to selecting a policy and making informed decisions about optional add-ons.

Researching Insurance Providers

The first step in acquiring auto insurance is to research and compare various insurance providers. This involves understanding the reputation, financial stability, and customer service ratings of each provider. Online resources, consumer reviews, and industry ratings can provide valuable insights into the quality and reliability of different insurance companies.

It's important to note that insurance rates can vary significantly between providers, even for the same level of coverage. Factors such as the insurer's claims handling process, customer satisfaction ratings, and financial strength can all impact the overall value of an insurance policy. Therefore, it's essential to shop around and compare quotes from multiple providers to ensure you're getting the best possible coverage at a competitive price.

Understanding Coverage Needs

Before selecting an auto insurance policy, it’s crucial to understand your specific coverage needs. This involves assessing your vehicle’s value, your driving habits and mileage, and the risks associated with your location and personal circumstances. For example, if you live in an area with high crime rates or frequent natural disasters, you may require more comprehensive coverage to protect against theft or damage from these events.

Additionally, consider your personal financial situation and the potential impact of an accident or other vehicle-related incident. If you have significant assets or high income, you may want to opt for higher liability limits to protect your financial well-being in the event of a serious accident. On the other hand, if you're on a tight budget, you may need to carefully balance the cost of insurance with the level of coverage you can afford.

Selecting a Policy

Once you have a clear understanding of your coverage needs and have researched potential insurance providers, the next step is to select an appropriate auto insurance policy. This involves reviewing the terms and conditions of the policy, including the specific coverage limits, deductibles, and any exclusions or limitations. It’s essential to carefully read and understand the policy documents to ensure that the coverage meets your expectations and provides the protection you require.

When selecting a policy, consider the overall value it offers. This includes not only the cost of the premium but also the quality of coverage, the insurer's reputation for claims handling, and any additional benefits or perks that may be included. For example, some insurers offer roadside assistance or rental car coverage as part of their standard policies, which can provide added convenience and peace of mind in the event of a breakdown or accident.

Optional Add-Ons and Customization

Auto insurance policies can often be customized to meet your specific needs and circumstances. This involves adding optional coverages or endorsements to the base policy to enhance protection or address unique risks. For instance, if you frequently drive in snowy or icy conditions, you may want to consider adding roadside assistance or towing coverage to your policy. This can provide valuable support in the event of a breakdown or accident, ensuring that you have access to prompt assistance and minimizing the inconvenience and potential hazards of being stranded.

Other common optional coverages include rental car reimbursement, which can provide financial support for the cost of a rental vehicle while your own car is being repaired or replaced after an accident. Additionally, if you own a classic or antique car, you may want to consider specialized coverage that takes into account the unique value and preservation needs of such vehicles. By customizing your auto insurance policy with these optional add-ons, you can ensure that your coverage is tailored to your specific driving habits, vehicle type, and personal circumstances, providing the most comprehensive protection possible.

The Impact of Auto Insurance on Driving Behavior

Auto insurance not only provides financial protection but also plays a significant role in shaping driving behavior and promoting road safety. The presence of insurance coverage can influence drivers to adopt safer habits and make more informed decisions while on the road.

Encouraging Safe Driving Practices

One of the key ways auto insurance impacts driving behavior is by incentivizing safe driving practices. Insurance companies often offer discounts or lower premiums to policyholders who maintain a clean driving record, free from accidents and violations. This encourages drivers to prioritize safe driving habits, such as obeying traffic laws, avoiding aggressive or reckless behavior, and practicing defensive driving techniques.

Furthermore, the threat of increased insurance premiums or policy cancellations due to accidents or violations serves as a powerful motivator for drivers to exercise caution and responsibility behind the wheel. By recognizing the financial consequences of poor driving behavior, individuals are more likely to adopt safer practices, reducing the risk of accidents and injuries on the road.

Promoting Road Safety Awareness

Auto insurance companies play a crucial role in promoting road safety awareness through various initiatives and educational campaigns. Many insurers provide resources and information to policyholders, offering tips and guidance on safe driving practices, vehicle maintenance, and accident prevention. These efforts contribute to a broader culture of road safety, empowering drivers to make informed decisions and take proactive measures to reduce their risk of accidents.

Additionally, insurance companies often partner with law enforcement agencies and other safety organizations to support initiatives aimed at reducing traffic accidents and fatalities. This collaboration helps to raise public awareness about the importance of safe driving, the consequences of risky behavior, and the role that insurance plays in protecting individuals and communities from the financial and emotional burdens of accidents.

Addressing Risky Driving Behaviors

Auto insurance providers are actively involved in identifying and addressing risky driving behaviors. Through the use of advanced technology and data analytics, insurers can monitor driving patterns and identify potential risks, such as frequent hard braking, rapid acceleration, or excessive speeding. This information is then used to tailor insurance rates and coverage, encouraging drivers to modify their behavior and adopt safer practices.

Insurers may also offer incentives or discounts to policyholders who agree to install telematics devices in their vehicles. These devices collect real-time data on driving behavior, providing insurers with detailed information about factors such as miles driven, time of day, and driving habits. By leveraging this data, insurers can offer personalized insurance rates and coverage options, further incentivizing drivers to adopt safer and more responsible driving behaviors.

The Future of Auto Insurance: Technological Advancements and Emerging Trends

The auto insurance industry is undergoing significant transformation driven by technological advancements and evolving consumer expectations. These changes are shaping the future of auto insurance, offering new opportunities for insurers and policyholders alike.

Telematics and Usage-Based Insurance

Telematics technology, which involves the use of sensors and GPS devices to track driving behavior, is revolutionizing the auto insurance industry. By collecting real-time data on driving habits, insurers can offer usage-based insurance (UBI) policies that tailor coverage and rates to individual driving behavior. This shift towards UBI is expected to continue gaining traction, providing policyholders with more personalized and affordable insurance options.

UBI policies reward safe driving behavior by offering discounts or lower premiums to policyholders who exhibit responsible driving habits. Conversely, individuals with higher-risk driving patterns may face higher insurance rates, incentivizing them to improve their driving behavior. This pay-as-you-drive model not only encourages safer driving but also provides a more accurate assessment of an individual's risk profile, leading to more fair and equitable insurance pricing.

Artificial Intelligence and Data Analytics

Artificial Intelligence (AI) and data analytics are playing an increasingly crucial role in the auto insurance industry. Insurers are leveraging these technologies to process vast amounts of data, identify patterns, and make more informed decisions about risk assessment and pricing. By analyzing data from various sources, including telematics devices, social media, and weather patterns, insurers can more accurately predict and manage risks, leading to more efficient and effective insurance offerings.

AI-powered systems can also automate various aspects of the insurance process, from policy underwriting and claims handling to customer service and fraud detection. This not only improves operational efficiency but also enhances the overall customer experience, providing policyholders with faster and more accurate service. Additionally, AI-driven analytics can identify emerging trends and patterns in driving behavior, enabling insurers to develop targeted initiatives and educational campaigns to promote safer driving practices and reduce accidents.

Connected Car Technologies

The integration of connected car technologies is transforming the way vehicles interact with their surroundings and with insurance providers. Connected cars, equipped with advanced sensors and communication systems, can transmit real-time data on vehicle performance, driving behavior, and accident events. This data can be used by insurers to gain a more comprehensive understanding of an individual’s risk profile, enabling more accurate and personalized insurance offerings.

Furthermore, connected car technologies can facilitate the collection of data on vehicle maintenance and repair, providing insurers with valuable insights into the overall condition and reliability of a vehicle. This information can be used to develop predictive maintenance programs, helping policyholders identify potential issues before they become major problems. By leveraging connected car technologies, insurers can offer proactive services and support, further enhancing the overall customer experience and promoting safer and more efficient driving practices.

Conclusion: Navigating the Complex World of Auto Insurance

Auto insurance is a complex and dynamic field, shaped by a multitude of factors including legal requirements, economic conditions, and technological advancements. Understanding the various components of auto insurance policies, the process of acquiring coverage, and the impact of insurance on driving behavior is essential for making informed decisions as a vehicle owner.

As the auto insurance industry continues to evolve, policyholders can expect to see increasing personalization and customization of insurance offerings. From usage-based insurance policies that reward safe driving to the integration of advanced technologies like telematics and AI, the future of auto insurance is focused on providing more tailored and efficient coverage. By staying informed about the latest trends and advancements, vehicle owners can make more confident choices when selecting and managing their auto insurance policies, ensuring they have the protection they need while also benefiting from innovative features and services.

What factors influence auto insurance rates?

+Auto insurance rates are influenced by a variety of factors, including the policyholder’s age, gender, driving record, and the type and value of their vehicle. Other factors such as the location and frequency of driving, as well as the policyholder’s credit score, can also impact insurance rates.

How can I lower my auto insurance premiums?

+There are several strategies to reduce auto insurance premiums. These include maintaining a clean driving record, shopping around for quotes from multiple insurers, and considering usage-based insurance policies that reward safe driving behavior. Additionally, some insurers offer discounts for bundling multiple policies or for taking defensive driving courses.

What should I do if I’m involved in an accident?

+If you’re involved in an accident, the first step is to ensure the safety of yourself and others involved. Exchange information with the other driver(s), including insurance details and contact information. Take photos of the accident scene and any damage to the vehicles. Notify your insurance company as soon as possible and provide them with all relevant details. Follow their instructions for filing a claim and obtaining necessary repairs or replacements.

How do I choose the right auto insurance coverage for my needs?

+Choosing the right auto insurance coverage involves assessing your specific needs and circumstances. Consider factors such as the value of your vehicle, your driving habits and mileage, and the risks associated with your location and personal situation. Research different coverage options and compare quotes from multiple insurers to find a policy that provides adequate protection at a competitive price.