Auto Insurance Application

Simplifying the Auto Insurance Application Process: A Comprehensive Guide

Navigating the world of auto insurance can be a complex journey, especially when it comes to applying for coverage. The application process often involves a maze of paperwork, technical terms, and confusing requirements. However, with the right guidance and understanding, it can be streamlined and made more accessible. This comprehensive guide aims to demystify the auto insurance application, providing you with the knowledge and tools to make informed decisions and simplify the entire process.

Understanding the Basics: Auto Insurance Coverage and Its Importance

Auto insurance is a contract between you and an insurance provider, designed to protect you financially in the event of an accident or other vehicle-related incidents. It's a legal requirement in most states and an essential aspect of responsible vehicle ownership. The coverage you choose can significantly impact your financial well-being and peace of mind on the road.

The basic types of auto insurance include:

- Liability Coverage: This covers the costs of injuries or damages you cause to others in an accident. It's essential to have this to protect your finances and meet legal requirements.

- Comprehensive Coverage: This covers damages to your vehicle caused by incidents other than collisions, such as theft, vandalism, weather events, or hitting an animal.

- Collision Coverage: As the name suggests, this covers damages to your vehicle caused by collisions, regardless of who's at fault. It's often paired with comprehensive coverage.

- Medical Payments Coverage: Also known as Personal Injury Protection (PIP), this covers medical expenses for you and your passengers, regardless of fault, in the event of an accident.

- Uninsured/Underinsured Motorist Coverage: This provides protection if you're involved in an accident with a driver who has no insurance or insufficient coverage to pay for the damages.

Each type of coverage has its own set of benefits and limitations, and understanding these is crucial when deciding on the right policy for your needs.

Assessing Your Insurance Needs: Factors to Consider

Before diving into the application process, it's important to assess your specific insurance needs. Several factors come into play when determining the type and extent of coverage you require.

Vehicle Type and Usage

The type of vehicle you own and how you use it can significantly influence your insurance needs. For instance, if you own a classic car that's primarily used for shows and events, you may require a specialized policy that caters to its unique needs and limited usage. On the other hand, if you have a fleet of commercial vehicles, you'll need a policy that covers multiple vehicles and provides adequate liability protection for your business operations.

Personal Circumstances

Your personal circumstances, such as your age, marital status, and credit history, can also impact your insurance needs and rates. Younger drivers, for example, are often considered higher risk and may require additional coverage to protect themselves and their vehicles. Similarly, individuals with a history of traffic violations or accidents may need to take extra precautions to ensure adequate coverage.

Financial Considerations

Your financial situation is another crucial factor. While it's important to have adequate coverage, you also need to ensure that the policy is affordable and fits within your budget. Consider the potential costs of different coverage options and choose a policy that provides the best balance between protection and cost.

Gathering the Necessary Information: A Step-by-Step Guide

Once you've assessed your insurance needs, it's time to gather the necessary information for your application. This process can be made easier by breaking it down into manageable steps.

Vehicle Information

Start by gathering detailed information about your vehicle(s). This includes the make, model, year, VIN (Vehicle Identification Number), and any unique features or modifications. If you have multiple vehicles, ensure you have this information for each one. Additionally, note down the primary use of each vehicle, such as commuting, business, or pleasure, as this can impact your coverage options.

Driver Information

Compile a comprehensive list of all the drivers who will be using the insured vehicle(s). For each driver, you'll need their full name, date of birth, driver's license number, and driving record (including any traffic violations or accidents). If any of the drivers are under 25 years old, you may need to provide additional information, as younger drivers are often considered higher risk.

Insurance History

Gather details about your insurance history, including the names and contact information of your previous insurance providers. If you've had any claims or accidents in the past, note down the dates, details, and outcomes. This information is crucial for insurers to assess your risk profile and provide accurate quotes.

Financial Details

Have your financial information ready, including your bank account details for setting up payments. Consider whether you'd prefer to pay your insurance premiums annually, semi-annually, or monthly, and factor in any potential discounts or promotions that could reduce your overall costs.

Choosing the Right Insurance Provider: A Comparative Analysis

With a wealth of insurance providers in the market, choosing the right one can be daunting. However, by conducting a thorough comparative analysis, you can make an informed decision that aligns with your specific needs and budget.

Coverage Options and Customization

Start by evaluating the coverage options offered by different providers. Look for policies that offer the specific types of coverage you require, such as liability, comprehensive, collision, and medical payments. Additionally, assess the level of customization available. Some providers offer a wide range of optional coverages and add-ons, allowing you to tailor your policy to your exact needs.

| Provider | Coverage Options | Customization |

|---|---|---|

| Provider A | Liability, Comprehensive, Collision, Medical Payments, Uninsured Motorist | Wide range of optional coverages and add-ons, including rental car coverage and gap insurance |

| Provider B | Liability, Comprehensive, Collision, Medical Payments | Limited customization options, but includes roadside assistance as standard |

| Provider C | Liability, Comprehensive, Collision, Uninsured Motorist | Customizable deductibles and coverage limits, with an option for enhanced rental car coverage |

In the table above, we've provided a comparative analysis of three hypothetical insurance providers, showcasing their coverage options and customization capabilities.

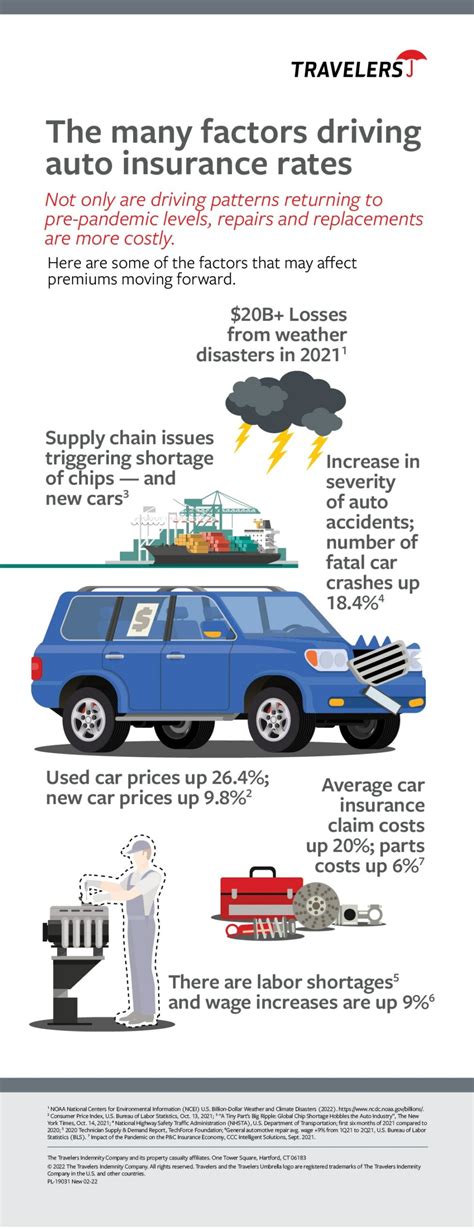

Pricing and Discounts

Pricing is a critical factor when choosing an insurance provider. Request quotes from multiple providers to compare rates. Consider not only the initial premium but also any potential discounts you may be eligible for, such as multi-policy discounts (if you bundle your auto insurance with other types of insurance), safe driver discounts, or loyalty discounts for long-term customers.

Reputation and Customer Service

The reputation and customer service of an insurance provider can significantly impact your overall experience. Research online reviews and ratings to gauge customer satisfaction. Consider factors such as response time to claims, ease of communication, and the provider's track record in resolving disputes. A reputable provider with excellent customer service can provide peace of mind and make the claims process less stressful.

The Application Process: A Seamless Step-by-Step Guide

Now that you've gathered the necessary information and chosen the right insurance provider, it's time to dive into the application process. This process can vary slightly depending on the provider, but the following steps provide a general overview.

Step 1: Start Your Application

Begin by visiting the website or contacting the customer service department of your chosen insurance provider. Most providers offer online applications, which can be convenient and efficient. However, if you prefer, you can also apply over the phone or in person at one of their branches.

Step 2: Provide Vehicle and Driver Information

Enter the details of your vehicle(s) and all the drivers who will be insured under the policy. This information should include the vehicle's make, model, year, and VIN, as well as the full names, dates of birth, and driver's license numbers of each driver. Ensure that all information is accurate and up-to-date.

Step 3: Select Your Coverage and Add-ons

Choose the types of coverage you require, such as liability, comprehensive, and collision. Consider any optional coverages or add-ons that may be beneficial, such as rental car coverage, roadside assistance, or gap insurance. Review the coverage limits and deductibles to ensure they align with your needs and budget.

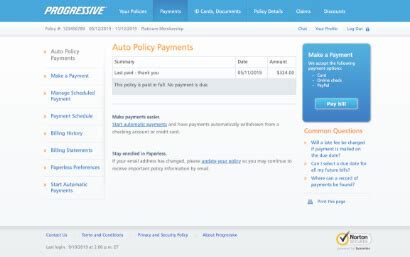

Step 4: Provide Payment Details

Enter your preferred payment method and schedule. Most providers offer flexible payment options, including monthly, quarterly, or annual payments. Ensure that you understand any potential fees or discounts associated with your chosen payment method.

Step 5: Review and Finalize Your Application

Carefully review all the information you've entered to ensure its accuracy. Check the coverage details, limits, deductibles, and total premium. If everything is correct, finalize your application and submit it to the insurance provider. You may receive an immediate quote, or the provider may need a few days to process your application and provide a formal quote.

Understanding Your Policy: Key Terms and Conditions

Once you've received your policy, it's crucial to take the time to understand its terms and conditions. This document outlines your rights and responsibilities as an insured individual, as well as the specifics of your coverage.

Policy Limits and Deductibles

Your policy will specify the limits of your coverage, which represent the maximum amount your insurer will pay for a covered claim. It's important to understand these limits and ensure they are adequate for your needs. Additionally, your policy will detail any deductibles, which are the amounts you must pay out-of-pocket before your insurance coverage kicks in.

Covered Perils and Exclusions

Every policy has a list of covered perils, which are the specific events or incidents that trigger coverage. These can include accidents, theft, vandalism, and natural disasters, among others. Conversely, your policy will also outline exclusions, which are events or situations that are not covered by your insurance. Understanding these perils and exclusions is crucial to ensure you have the protection you need.

Claims Process and Responsibilities

Familiarize yourself with the claims process outlined in your policy. This includes the steps you need to take in the event of an accident or other covered incident, as well as any time limits for filing a claim. Understand your responsibilities, such as providing accurate and complete information, cooperating with the insurer's investigations, and complying with any applicable laws or regulations.

FAQs

What documents do I need to apply for auto insurance?

+When applying for auto insurance, you'll typically need your driver's license, vehicle registration, proof of vehicle ownership (such as a title or lease agreement), and a valid Social Security number. Some providers may also request additional documents, such as a copy of your current insurance policy or recent pay stubs. It's best to gather all the necessary documents before starting your application to ensure a smooth process.

Can I get a quote without providing my Social Security number?

+While some insurance providers may allow you to get a preliminary quote without providing your Social Security number, most will require it at some point during the application process. Your Social Security number is used to verify your identity and check your credit history, which can impact your insurance rates. It's important to provide accurate and complete information to ensure an accurate quote.

How long does the auto insurance application process usually take?

+The application process can vary in duration depending on several factors, including the complexity of your insurance needs, the provider's processing time, and the accuracy of the information you provide. In general, it can take anywhere from a few hours to several days to complete the application and receive a formal quote. Once you've submitted your application, you can typically expect a response within a few business days.

Remember, while the auto insurance application process can be detailed and time-consuming, it’s an essential step towards ensuring your financial protection and peace of mind on the road. By understanding the basics, assessing your needs, gathering the necessary information, and choosing the right provider, you can navigate this process with confidence and ease.