How Much For Medical Insurance

In today's world, healthcare and medical insurance are essential aspects of our lives. With rising healthcare costs and the need for accessible and affordable medical care, understanding the costs and coverage of medical insurance is crucial. This comprehensive guide aims to provide an in-depth analysis of medical insurance, its various components, and the factors influencing its pricing.

Understanding Medical Insurance

Medical insurance, often referred to as health insurance, is a contract between an individual and an insurance provider. It is designed to protect individuals and families from the financial burden of unexpected medical expenses. By paying a premium, policyholders gain access to a range of healthcare services, treatments, and medications covered by their insurance plan.

The primary goal of medical insurance is to ensure that individuals can receive necessary medical care without facing significant financial hardships. It provides peace of mind, knowing that one's health and well-being are protected, and financial stability is maintained during challenging times.

Factors Influencing Medical Insurance Costs

The cost of medical insurance varies significantly depending on several key factors. Understanding these factors can help individuals make informed decisions when choosing an insurance plan.

Age and Gender

One of the primary factors affecting insurance premiums is the age and gender of the policyholder. Generally, younger individuals pay lower premiums as they are considered less risky and are less likely to require extensive medical care. As individuals age, their health risks increase, leading to higher insurance costs. Additionally, gender can also impact premiums, with some insurance companies charging different rates based on statistical differences in healthcare needs between men and women.

| Age Group | Average Premium (Monthly) |

|---|---|

| 18-25 years | $180 |

| 26-35 years | $220 |

| 36-45 years | $280 |

| 46-55 years | $350 |

| 56+ years | $420 |

It's important to note that these figures are approximate and can vary based on the insurance provider and the specific plan chosen. Age-based premiums are subject to change and may be influenced by other factors as well.

Medical History and Pre-Existing Conditions

An individual's medical history and the presence of pre-existing conditions can significantly impact insurance costs. Insurance companies carefully evaluate an applicant's medical records to assess their risk level. Those with a history of chronic illnesses, serious medical conditions, or frequent hospitalizations may face higher premiums or even be denied coverage.

Some insurance plans offer specific coverage for pre-existing conditions, but these plans often come with higher premiums to account for the increased risk. It's essential for individuals with pre-existing conditions to carefully review their options and understand the implications of their medical history on insurance costs.

Coverage Options and Plan Type

The type of coverage and plan chosen by an individual also plays a vital role in determining the cost of medical insurance. Insurance plans can vary widely in terms of coverage, deductibles, copays, and out-of-pocket maximums. Generally, plans with more comprehensive coverage and lower out-of-pocket costs tend to have higher premiums.

There are various types of insurance plans available, including:

- HMO (Health Maintenance Organization): HMOs typically have lower premiums but require policyholders to choose a primary care physician and obtain referrals for specialist visits.

- PPO (Preferred Provider Organization): PPOs offer more flexibility, allowing policyholders to visit any healthcare provider within the network without referrals. However, they often come with higher premiums.

- EPO (Exclusive Provider Organization): EPOs are similar to PPOs but limit policyholders to in-network providers only, excluding out-of-network coverage.

- POS (Point of Service): POS plans combine elements of HMOs and PPOs, offering flexibility but requiring referrals for out-of-network care.

The choice of plan and coverage options should be based on an individual's specific healthcare needs, budget, and preference for flexibility versus cost.

Geographic Location

The cost of medical insurance can also vary based on the geographic location of the policyholder. Healthcare costs, including the price of medical procedures and services, can differ significantly from one region to another. Urban areas with higher living costs and advanced medical facilities may have higher insurance premiums compared to rural areas.

Additionally, the availability of healthcare providers and specialists in a particular area can influence insurance rates. Regions with a limited number of healthcare professionals may experience higher demand and, consequently, higher insurance costs.

Lifestyle Factors

Insurance companies may consider lifestyle factors when determining insurance premiums. Individuals with unhealthy habits, such as smoking, excessive alcohol consumption, or a sedentary lifestyle, may face higher premiums. These lifestyle choices are associated with increased health risks and potential long-term health complications.

On the other hand, individuals who lead healthy lifestyles, engage in regular exercise, maintain a balanced diet, and avoid risky behaviors may be eligible for lower premiums or insurance discounts. Some insurance providers offer wellness programs or incentives to encourage policyholders to adopt healthier lifestyles.

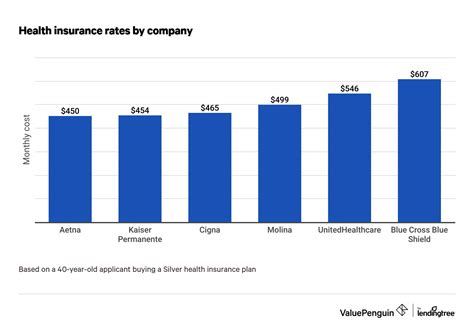

Comparing Insurance Providers and Plans

When shopping for medical insurance, it's crucial to compare different providers and plans to find the best coverage at an affordable price. Here are some key considerations when comparing insurance options:

Network of Healthcare Providers

Review the network of healthcare providers associated with each insurance plan. Ensure that your preferred doctors, hospitals, and specialists are included in the network to avoid unexpected out-of-network charges.

Coverage Details and Limitations

Carefully examine the coverage details of each plan. Pay attention to the specific services, treatments, and medications covered, as well as any exclusions or limitations. Understand the plan's deductibles, copays, and out-of-pocket maximums to estimate your potential out-of-pocket expenses.

Customer Reviews and Reputation

Research the reputation and customer satisfaction ratings of insurance providers. Online reviews and ratings can provide valuable insights into the overall experience of policyholders. Look for providers with a strong track record of prompt claim processing, fair coverage, and excellent customer service.

Additional Benefits and Services

Some insurance plans offer additional benefits and services beyond standard medical coverage. These may include wellness programs, telemedicine services, vision and dental coverage, or access to discounted prescription medications. Consider whether these added benefits align with your personal healthcare needs and preferences.

Maximizing Value and Saving on Medical Insurance

While medical insurance is an essential investment, there are strategies to maximize the value of your insurance plan and potentially save on costs.

Understanding Your Healthcare Needs

Assess your current and future healthcare needs to choose a plan that aligns with your requirements. Consider your age, medical history, and the likelihood of requiring specific treatments or medications. By selecting a plan that covers your essential needs, you can avoid unnecessary costs associated with unnecessary coverage.

Shop Around and Negotiate

Don't settle for the first insurance plan you come across. Compare multiple providers and plans to find the best value. Insurance brokers or online marketplaces can be valuable resources for comparing options. Additionally, don't hesitate to negotiate with insurance providers, especially if you have a good medical history and are a low-risk applicant.

Consider High-Deductible Plans with an HSA

High-deductible health plans (HDHPs) often come with lower premiums compared to traditional plans. Pairing an HDHP with a Health Savings Account (HSA) can provide significant tax advantages and the flexibility to save for future medical expenses. HSAs allow you to contribute pre-tax dollars, which can be used to pay for qualified medical expenses.

Take Advantage of Employer-Sponsored Plans

If you are employed, consider the medical insurance plans offered by your employer. Employer-sponsored plans often provide more affordable options with reduced premiums, as employers may contribute to the cost of coverage. Additionally, these plans may offer additional benefits or discounts exclusive to employees.

Utilize Preventive Care Services

Many insurance plans cover preventive care services, such as annual check-ups, vaccinations, and screenings, at little to no cost. Taking advantage of these services can help identify potential health issues early on, allowing for timely treatment and potentially reducing long-term healthcare costs.

The Future of Medical Insurance

The healthcare industry is continuously evolving, and so is the landscape of medical insurance. Here are some key trends and developments shaping the future of medical insurance:

Digital Transformation

The digital revolution is transforming the way medical insurance operates. Insurance providers are increasingly adopting digital technologies to enhance customer experiences, streamline claim processes, and improve overall efficiency. Online portals, mobile apps, and digital tools for managing policies and submitting claims are becoming more prevalent.

Personalized Medicine and Precision Health

Advancements in genomics and precision medicine are paving the way for more personalized healthcare approaches. Insurance providers are exploring ways to incorporate genetic testing and personalized treatment plans into their coverage. This shift towards precision health could lead to more targeted and effective treatment options, potentially reducing overall healthcare costs.

Value-Based Care and Outcomes-Focused Models

The healthcare industry is moving away from traditional fee-for-service models towards value-based care. This shift focuses on improving patient outcomes and overall health rather than simply providing services. Insurance providers are incentivizing healthcare providers to deliver high-quality care and achieve positive health outcomes, which could lead to more cost-effective and efficient healthcare delivery.

Expanded Telemedicine Services

Telemedicine, or the remote delivery of healthcare services, has gained significant traction during the COVID-19 pandemic. Insurance providers are increasingly covering telemedicine services, allowing policyholders to access medical care remotely. This trend is expected to continue, offering convenience, accessibility, and cost savings for both patients and providers.

Addressing Social Determinants of Health

Insurance providers are recognizing the impact of social and environmental factors on an individual's health. Efforts are being made to address social determinants of health, such as access to healthy food, safe housing, and social support systems. By incorporating these factors into insurance coverage, providers aim to improve overall health outcomes and reduce healthcare disparities.

Frequently Asked Questions

Can I switch insurance providers if I’m not satisfied with my current plan?

+

Absolutely! You have the freedom to explore and switch insurance providers at any time. However, it’s important to carefully review the terms and conditions of your current plan, including any cancellation fees or penalties. Additionally, ensure that your new provider offers coverage that aligns with your healthcare needs and budget.

What is the difference between in-network and out-of-network providers?

+

In-network providers are healthcare professionals and facilities that have a contractual agreement with your insurance provider. Visiting in-network providers typically results in lower out-of-pocket costs as they have negotiated rates with the insurance company. Out-of-network providers, on the other hand, do not have such an agreement, and visiting them may incur higher costs or require prior authorization.

Are there any government programs that provide medical insurance assistance?

+

Yes, there are several government programs designed to assist individuals and families with medical insurance coverage. Programs like Medicaid, Medicare, and the Children’s Health Insurance Program (CHIP) provide affordable or free healthcare coverage to eligible individuals. These programs have specific eligibility criteria based on factors like income, age, and disability status.

How can I reduce my out-of-pocket expenses when using medical insurance?

+

There are several strategies to minimize out-of-pocket expenses when using medical insurance. First, choose an insurance plan with a lower deductible and reasonable copays. Additionally, take advantage of preventive care services, as many plans cover these at no additional cost. Lastly, consider utilizing generic medications, which are often significantly cheaper than brand-name drugs.

Can I purchase medical insurance outside of the annual open enrollment period?

+

In most cases, you can only purchase medical insurance during the annual open enrollment period, which typically occurs once a year. However, certain life events, such as losing your job, getting married, or having a baby, may qualify you for a special enrollment period, allowing you to purchase insurance outside of the regular open enrollment timeframe.