Car Insurance For Nj

Car insurance is an essential aspect of vehicle ownership, providing financial protection and peace of mind to drivers across the United States. In the state of New Jersey, known as the Garden State, car insurance requirements and regulations are specifically tailored to meet the needs of its residents and road users. With a unique blend of urban and suburban landscapes, New Jersey presents a diverse range of driving conditions and risks, making comprehensive insurance coverage a necessity.

Understanding New Jersey’s Car Insurance Requirements

New Jersey is renowned for its strict car insurance laws, which aim to protect drivers and ensure financial responsibility on the road. The state mandates that all registered vehicles carry a minimum level of liability insurance coverage. This requirement is designed to safeguard drivers against the financial burdens that may arise from accidents, ensuring that victims of car crashes can receive compensation for their injuries and property damage.

The specific car insurance requirements in New Jersey are as follows:

- Bodily Injury Liability Coverage: New Jersey law requires drivers to carry a minimum of $15,000 per person and $30,000 per accident for bodily injury liability. This coverage ensures that medical expenses and compensation for pain and suffering are covered in the event of an accident where the insured driver is at fault.

- Property Damage Liability Coverage: The state mandates a minimum of $5,000 in property damage liability coverage. This covers repairs or replacements for any property damaged in an accident, including other vehicles, fences, buildings, or personal property.

- Uninsured/Underinsured Motorist Coverage: New Jersey drivers are also required to carry uninsured and underinsured motorist coverage with the same limits as bodily injury liability coverage. This ensures protection against drivers who are either uninsured or have insufficient insurance coverage to compensate for damages caused by them.

While these are the mandatory minimums, it's important to note that many drivers opt for additional coverage to enhance their protection. These may include comprehensive and collision coverage, which provide compensation for damage to the insured vehicle in events other than accidents, such as theft, vandalism, or natural disasters.

Factors Influencing Car Insurance Rates in New Jersey

Like in many other states, car insurance rates in New Jersey are influenced by a variety of factors, each playing a role in determining the overall cost of insurance premiums. These factors include:

- Age and Gender: Younger drivers, particularly those under 25, often face higher insurance rates due to their perceived higher risk on the road. Similarly, gender can also impact rates, with some insurance companies charging different premiums based on historical risk data associated with male and female drivers.

- Driving History: A driver’s history is a significant factor in determining insurance rates. Those with a clean driving record, free of accidents and traffic violations, are generally offered more favorable rates compared to those with a history of accidents or moving violations.

- Vehicle Type: The make, model, and year of a vehicle can impact insurance rates. Certain types of vehicles, especially those with higher repair costs or that are prone to theft, may result in higher premiums.

- Coverage and Deductibles: The level of coverage chosen by a driver, including additional coverage beyond the state-mandated minimums, can influence rates. Additionally, selecting a higher deductible can result in lower premiums, as it reduces the insurer’s financial exposure in the event of a claim.

- Location: The specific location where a vehicle is garaged can impact insurance rates. Urban areas, where the risk of accidents and theft is higher, often result in higher premiums compared to more rural or suburban areas.

| Factor | Influence on Rates |

|---|---|

| Age and Gender | Younger drivers and certain genders may face higher rates. |

| Driving History | Clean records lead to lower rates; violations increase costs. |

| Vehicle Type | High-risk vehicles or those with expensive repairs may increase premiums. |

| Coverage and Deductibles | More coverage and higher deductibles can affect rates differently. |

| Location | Urban areas may result in higher premiums due to increased risk. |

The Cost of Car Insurance in New Jersey

New Jersey is often associated with higher car insurance rates compared to many other states. This is due to a combination of factors, including the state’s dense population, high traffic volume, and historical accident rates. The average annual premium for car insurance in New Jersey is approximately $2,000, although this can vary significantly based on the factors mentioned earlier.

Here's a breakdown of average car insurance rates in New Jersey, based on data from various sources:

- Statewide Average: $2,000 per year

- Minimum Liability Coverage: $500 - $800 per year

- Full Coverage (Comprehensive and Collision): $2,500 - $3,500 per year

It's important to note that these averages can vary greatly depending on the specific insurance provider, the driver's profile, and the coverage chosen. Some drivers may find insurance rates significantly higher or lower than these averages based on their individual circumstances.

Tips for Reducing Car Insurance Costs in New Jersey

While New Jersey is known for its relatively high insurance rates, there are strategies that drivers can employ to reduce their insurance costs. Here are some tips to consider:

- Shop Around: Don’t settle for the first insurance quote you receive. Compare rates from multiple insurance providers to find the best deal for your specific circumstances. Online comparison tools can be a great starting point.

- Increase Your Deductible: Opting for a higher deductible can result in lower premiums. However, ensure that you can afford the higher deductible in the event of an accident.

- Maintain a Clean Driving Record: A clean driving record is crucial for obtaining lower insurance rates. Avoid traffic violations and accidents to keep your record clean and your premiums down.

- Take Advantage of Discounts: Many insurance providers offer discounts for a variety of reasons, such as good student discounts, safe driver discounts, and loyalty discounts. Ask your insurer about any applicable discounts and consider bundling your policies (e.g., home and auto insurance) to potentially save more.

- Consider Usage-Based Insurance: Some insurance providers offer usage-based insurance programs, where your driving behavior and habits are tracked to determine your insurance rates. This can be a great option for safe, low-mileage drivers, as it rewards responsible driving with lower premiums.

Remember, while it's important to save on insurance costs, it's equally crucial to ensure that you have adequate coverage to protect yourself and your assets in the event of an accident or other unforeseen circumstances.

Choosing the Right Car Insurance Provider in New Jersey

With a multitude of insurance providers operating in New Jersey, choosing the right one can be a daunting task. Here are some key considerations to help you make an informed decision:

- Reputation and Financial Stability: Opt for an insurance provider with a strong reputation and a solid financial standing. This ensures that the company will be able to pay out claims when needed and provides peace of mind regarding the long-term viability of the insurer.

- Coverage Options: Evaluate the range of coverage options offered by the insurer. Ensure that they provide the mandatory coverage required by New Jersey law, as well as any additional coverage you may require, such as comprehensive and collision coverage.

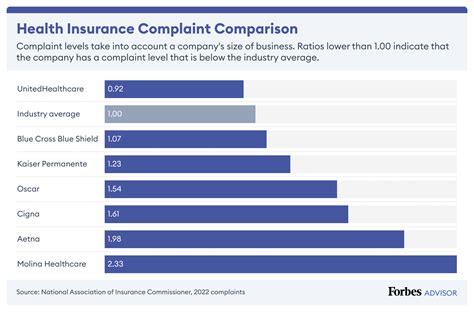

- Customer Service and Claims Handling: Consider the insurer’s reputation for customer service and claims handling. Efficient and responsive customer service can make a significant difference in the event of an accident or other insurance-related issues.

- Price and Value: While cost is an important factor, it’s essential to balance it with the value offered by the insurer. Look for a provider that offers competitive rates while providing comprehensive coverage and excellent customer service.

- Reviews and Ratings: Research online reviews and ratings from independent sources and current or past customers. This can provide valuable insights into the insurer’s performance, customer satisfaction, and areas of improvement.

By carefully evaluating these factors and comparing multiple insurance providers, you can make an informed decision and choose a car insurance provider that best suits your needs and budget in New Jersey.

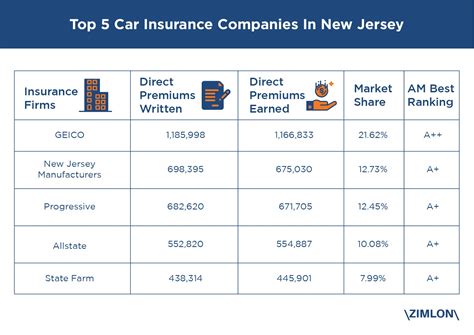

Popular Car Insurance Providers in New Jersey

Here’s a list of some of the most popular car insurance providers in New Jersey, along with a brief overview of their offerings:

- State Farm: State Farm is a leading insurance provider in New Jersey, offering a range of car insurance policies with customizable coverage options. They are known for their excellent customer service and provide various discounts to help lower premiums.

- Geico: Geico is a popular choice for many New Jersey drivers, offering competitive rates and a user-friendly online platform for managing policies and claims. They provide a range of coverage options and discounts, making them a popular and affordable choice.

- Progressive: Progressive is renowned for its innovative insurance solutions and flexible policies. They offer a range of coverage options, including usage-based insurance, which can be beneficial for safe drivers looking to save on premiums.

- Allstate: Allstate provides comprehensive car insurance coverage with a focus on customer satisfaction. They offer a variety of coverage options and discounts, and their “Name Your Price” tool allows customers to set their budget and find a policy that fits their needs.

- Esurance: Esurance is an online insurance provider known for its convenience and affordability. They offer a simple and straightforward process for obtaining quotes and managing policies, making it an attractive option for tech-savvy drivers.

These are just a few examples of the many reputable car insurance providers operating in New Jersey. It's always advisable to research and compare multiple providers to find the best fit for your specific needs and budget.

Car Insurance and New Jersey’s Unique Challenges

New Jersey presents some unique challenges when it comes to car insurance, primarily due to its dense population, high traffic volume, and diverse range of driving conditions. Here’s a closer look at some of these challenges and how they impact car insurance in the state.

Traffic Congestion and Accident Rates

New Jersey’s dense population and extensive road network contribute to high traffic congestion, particularly in urban areas like Newark, Jersey City, and along major highways. This congestion often leads to increased accident rates, as drivers face more potential hazards and distractions on the road.

The higher accident rates in New Jersey directly impact car insurance premiums. Insurers take into account the historical accident data when determining rates, and areas with higher accident rates often result in higher premiums for drivers in those regions. As a result, drivers in congested urban areas may face higher insurance costs compared to those in more rural or suburban areas.

Diverse Driving Conditions

New Jersey’s diverse landscape, ranging from urban centers to suburban neighborhoods and rural areas, presents a variety of driving conditions. Drivers may encounter busy city streets, congested highways, winding rural roads, and even coastal areas with unique weather conditions.

This diversity in driving conditions can influence insurance rates. For instance, drivers in coastal areas may face higher premiums due to the increased risk of natural disasters like hurricanes or coastal storms, which can result in vehicle damage. Similarly, drivers in urban areas may face higher premiums due to the increased risk of theft or vandalism.

New Jersey’s No-Fault Insurance System

New Jersey operates under a no-fault insurance system, which means that regardless of who is at fault in an accident, each driver’s insurance company is responsible for covering their own medical expenses and other damages up to the policy limits. This system aims to streamline the claims process and provide quicker compensation for accident victims.

While the no-fault system can offer benefits in terms of faster claims processing, it also has implications for car insurance rates. Since insurers are responsible for covering their policyholders' expenses regardless of fault, this can result in higher premiums to ensure that insurers have sufficient funds to cover these costs. As a result, drivers in New Jersey may face higher insurance rates compared to states with traditional liability systems.

Future Outlook and Emerging Trends in New Jersey Car Insurance

The car insurance landscape in New Jersey is continually evolving, driven by technological advancements, changing consumer preferences, and regulatory developments. Here’s a glimpse into the future of car insurance in the Garden State and some emerging trends to watch out for.

Telematics and Usage-Based Insurance

Telematics, the technology that allows insurance providers to track driving behavior and habits, is expected to play an increasingly significant role in car insurance in New Jersey. Usage-based insurance programs, which use telematics data to set insurance rates based on an individual’s driving behavior, are gaining popularity.

These programs reward safe drivers with lower premiums, as they can accurately assess an individual's risk based on their actual driving habits. For New Jersey drivers, this means that those who drive safely and responsibly may be able to significantly reduce their insurance costs through usage-based insurance.

Digitalization and Online Platforms

The rise of digital technologies and online platforms is transforming the way car insurance is purchased and managed. New Jersey drivers are increasingly turning to online platforms and mobile apps to obtain quotes, purchase policies, and manage their insurance needs.

Insurance providers are investing in digital transformation to enhance the customer experience and streamline processes. This includes offering online quote tools, digital policy management, and mobile apps for filing claims and accessing policy information. As a result, New Jersey drivers can expect a more convenient and efficient car insurance experience in the future.

Autonomous Vehicles and Emerging Technologies

The advent of autonomous vehicles and emerging technologies is set to revolutionize the car insurance industry, including in New Jersey. As self-driving cars become more prevalent, the risk landscape will shift, potentially leading to reduced accident rates and changing liability considerations.

Insurance providers are already beginning to adapt to this emerging trend, with some offering discounts for vehicles equipped with advanced driver-assistance systems (ADAS) or other safety features. As autonomous vehicles become more common, insurance providers may need to reassess their risk models and develop new coverage options to accommodate these technological advancements.

Regulatory Changes and Consumer Protection

Regulatory changes and consumer protection measures are always a consideration in the car insurance industry. In New Jersey, ongoing efforts to enhance consumer protection and ensure fair practices are expected to continue.

This may include initiatives to improve transparency in insurance pricing, expand coverage options, and address issues related to affordability and accessibility. As the state works to strike a balance between consumer protection and industry viability, New Jersey drivers can expect ongoing developments in car insurance regulations and practices.

Conclusion

Car insurance is an essential aspect of vehicle ownership in New Jersey, where strict regulations and diverse driving conditions necessitate comprehensive coverage. By understanding the state’s car insurance requirements, factors influencing rates, and the unique challenges presented by New Jersey’s road network, drivers can make informed decisions about their insurance coverage.

The cost of car insurance in New Jersey is influenced by a range of factors, including driving history, vehicle type, and location. While rates can be relatively high compared to other states, there are strategies to reduce costs, such as shopping around, increasing deductibles, and taking advantage of discounts. Choosing the right car insurance provider involves evaluating reputation, coverage options, customer service, and value.

New Jersey's unique challenges, including high traffic congestion and diverse driving conditions, impact car insurance rates and coverage. The state's no-fault insurance system also has implications for insurance costs. However, emerging trends like telematics, digitalization, and autonomous vehicles are expected to shape the future of car insurance in the Garden State, offering new opportunities for cost-effective and innovative coverage.

As the car insurance landscape continues to evolve, staying informed and adapting to these changes will be crucial for New Jersey drivers. By staying abreast of developments, drivers can ensure they have the right coverage to protect themselves and their assets on the road.