How Much Is Full Coverage Insurance A Month

Full coverage insurance is a comprehensive insurance policy that offers extensive protection for vehicle owners. It typically includes collision coverage, which covers damages to your vehicle in the event of an accident, and comprehensive coverage, which provides protection against non-collision incidents such as theft, vandalism, weather-related damage, and collisions with animals.

The cost of full coverage insurance can vary significantly based on numerous factors, including the type of vehicle, the driver's age and driving record, the location, and the insurance provider. While it is challenging to provide an exact monthly cost without specific details, we can delve into the various elements that influence the price and offer a comprehensive understanding of the expenses associated with full coverage insurance.

Factors Influencing Full Coverage Insurance Costs

Vehicle Type and Value

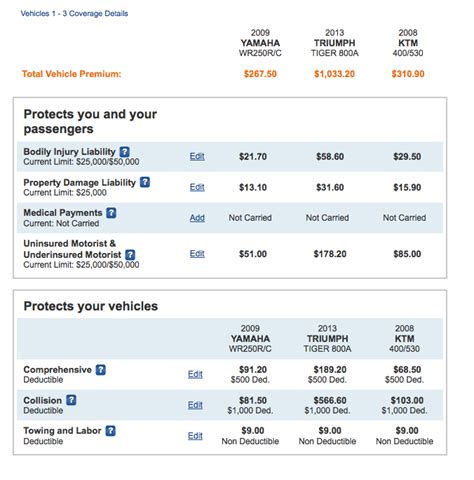

One of the primary factors that insurance companies consider when calculating full coverage premiums is the type and value of the vehicle. Generally, newer and more expensive vehicles will have higher insurance costs due to the potential for more significant financial losses in the event of an accident or theft. Additionally, certain vehicle models may have higher repair costs or be more prone to specific types of damage, which can also impact insurance rates.

| Vehicle Category | Average Monthly Premium |

|---|---|

| Economy Cars | $100 - $150 |

| Mid-Size Sedans | $120 - $180 |

| Luxury Vehicles | $180 - $300 |

| Sports Cars | $250 - $400 |

These figures are approximate and can vary based on other factors. For instance, a luxury sedan with advanced safety features may have lower premiums than a standard sports car due to its superior safety ratings.

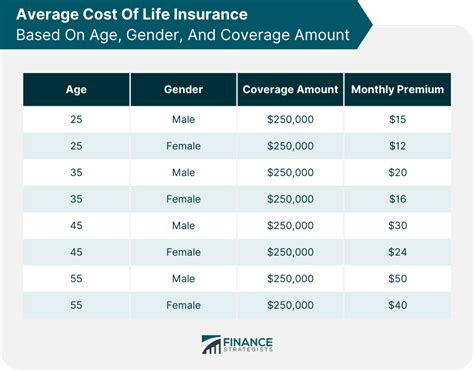

Driver’s Profile and Record

The driver’s age, gender, and driving record are crucial factors in determining full coverage insurance costs. Younger drivers, particularly those under 25 years old, are often considered high-risk due to their lack of experience and higher propensity for accidents. As a result, they typically pay significantly higher insurance premiums. Gender can also play a role, with male drivers often facing slightly higher premiums, especially in their younger years.

Additionally, a driver's history of accidents, violations, and claims can greatly impact insurance rates. Drivers with a clean record will generally enjoy lower premiums, while those with multiple accidents or traffic violations may see their rates increase substantially. Insurance companies use statistical data to assess the risk associated with each driver and adjust premiums accordingly.

Location and Usage

The geographical location where the vehicle is registered and primarily driven can significantly affect insurance costs. Areas with higher populations, more congested roads, and a higher incidence of accidents or theft tend to have higher insurance rates. Similarly, the vehicle’s primary usage, such as commuting, leisure, or business, can impact premiums. Business usage, for instance, may lead to higher rates due to the increased mileage and potential for accidents.

| Location Category | Average Monthly Premium |

|---|---|

| Rural Areas | $100 - $150 |

| Suburban Areas | $120 - $200 |

| Urban Areas | $150 - $250 |

Insurance Provider and Coverage Options

The insurance provider you choose can also impact the cost of full coverage insurance. Different companies offer varying rates and coverage options, so it’s essential to shop around and compare quotes from multiple providers. Additionally, the specific coverage options you select will influence your premiums. Higher coverage limits and additional coverage types, such as rental car reimbursement or roadside assistance, will typically result in higher monthly costs.

Tips for Reducing Full Coverage Insurance Costs

While full coverage insurance can be expensive, there are several strategies that drivers can employ to potentially reduce their monthly premiums. These include:

- Shopping around and comparing quotes from multiple insurance providers.

- Maintaining a clean driving record and avoiding accidents and violations.

- Increasing the deductible, which can lower premiums but increases the out-of-pocket cost in the event of a claim.

- Taking advantage of discounts, such as those for safe driving, multiple policies, or advanced safety features in the vehicle.

- Bundling insurance policies (e.g., auto and home insurance) can often result in significant savings.

- Regularly reviewing insurance coverage and adjusting it as needed to ensure you're not overpaying for unnecessary coverage.

It's important to note that while reducing insurance costs is desirable, it's crucial to maintain adequate coverage to protect yourself financially in the event of an accident or other covered incident. Skimping on insurance coverage can lead to significant financial burdens if an accident occurs.

Future Trends in Full Coverage Insurance

The insurance industry is constantly evolving, and several emerging trends are likely to impact the cost and availability of full coverage insurance in the future. These include:

Telematics and Usage-Based Insurance

Telematics refers to the use of technology to track and analyze a vehicle’s usage and driving behavior. This data can then be used to offer more personalized insurance rates based on actual driving habits. Usage-based insurance, also known as pay-as-you-drive or pay-how-you-drive insurance, allows drivers to pay premiums based on their individual driving habits, which can lead to significant savings for safe drivers.

Advanced Vehicle Safety Features

Many modern vehicles are equipped with advanced safety features such as lane departure warning systems, automatic emergency braking, and adaptive cruise control. These features can significantly reduce the risk of accidents, and as a result, insurance companies may offer lower premiums for vehicles with these safety enhancements. Over time, as these features become more common and their effectiveness is proven, they could lead to overall decreases in insurance costs.

Electric and Autonomous Vehicles

The growing popularity of electric vehicles (EVs) and the imminent arrival of autonomous vehicles are likely to have a significant impact on insurance costs. EVs often have lower maintenance costs and are generally considered safer, which could lead to lower insurance premiums. Autonomous vehicles, while still in their early stages, have the potential to drastically reduce accident rates, which could revolutionize the insurance industry and lead to substantial cost savings for drivers.

Insurance Technology and Digitalization

The insurance industry is increasingly adopting digital technologies and artificial intelligence to streamline processes, improve efficiency, and offer more personalized insurance products. This digitalization can lead to more accurate risk assessment, faster claims processing, and potentially lower administrative costs, which could be passed on to consumers in the form of reduced insurance premiums.

Conclusion

Full coverage insurance is a vital aspect of vehicle ownership, providing financial protection in the event of accidents, theft, or other covered incidents. While the cost of full coverage insurance can vary significantly based on a multitude of factors, understanding these factors and exploring various strategies can help drivers balance the need for adequate coverage with their budget constraints. The evolving trends in the insurance industry, particularly in the areas of technology and vehicle safety, are likely to bring about further changes and potentially make insurance more affordable and accessible in the future.

How often should I review my insurance coverage and premiums?

+It’s a good practice to review your insurance coverage and premiums at least once a year, or whenever your personal circumstances change significantly (e.g., marriage, buying a new home, or changing jobs). Regular reviews can help ensure you’re getting the best value and the right coverage for your needs.

What is the difference between liability-only insurance and full coverage insurance?

+Liability-only insurance, also known as liability coverage, provides protection against bodily injury or property damage claims made against you in the event of an accident. Full coverage insurance, on the other hand, includes liability coverage but also provides protection for your own vehicle, covering damages resulting from accidents, theft, vandalism, and other covered incidents.

Can I get full coverage insurance for an older vehicle?

+Yes, full coverage insurance is available for older vehicles. However, the cost of insurance may be higher for older vehicles due to their potentially higher repair costs and decreased value. It’s important to carefully consider the cost of insurance relative to the vehicle’s value to ensure it’s a financially sound decision.