What Is Life Insurance Policy

Life insurance is a vital financial tool that offers protection and peace of mind to individuals and their loved ones. In today's complex world, understanding the nuances of life insurance policies is crucial for making informed decisions about your future. This comprehensive guide aims to delve into the world of life insurance, exploring its various aspects, benefits, and implications to help you navigate this essential aspect of personal finance.

Understanding the Basics of Life Insurance

At its core, life insurance is a contract between an individual (the policyholder) and an insurance company. The policyholder pays a premium, typically on a regular basis, and in return, the insurance company agrees to pay a sum of money (the death benefit) to the designated beneficiaries upon the policyholder’s death.

The primary purpose of life insurance is to provide financial security and stability to the policyholder's family or dependents in the event of their untimely demise. It serves as a safety net, ensuring that their loved ones can maintain their standard of living, cover funeral expenses, pay off debts, and continue their financial goals without immediate financial strain.

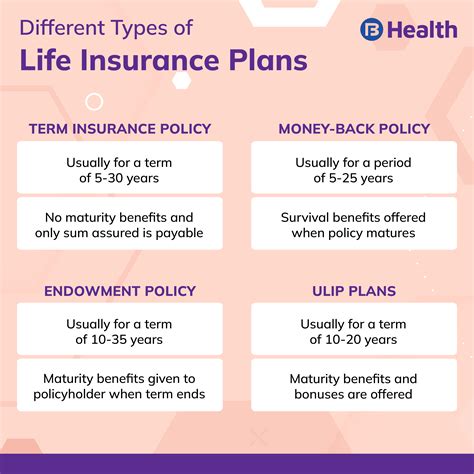

Types of Life Insurance Policies

Life insurance policies come in various forms, each designed to meet different needs and financial situations. Here’s an overview of the main types:

Term Life Insurance

Term life insurance is a straightforward and cost-effective option. It provides coverage for a specific period, known as the term, which can range from 10 to 30 years. During this term, the policyholder pays regular premiums, and if they pass away within the term, their beneficiaries receive the death benefit. However, if the policyholder outlives the term, the coverage expires, and no benefit is paid. Term life insurance is ideal for individuals seeking temporary coverage, such as covering financial obligations during their working years.

Whole Life Insurance

Whole life insurance, also known as permanent life insurance, offers coverage for the policyholder’s entire life. This type of policy accumulates cash value over time, which can be borrowed against or used to pay premiums if needed. Whole life insurance provides a guaranteed death benefit, and the premiums remain level throughout the policy’s duration. It’s a popular choice for those seeking long-term financial protection and stability.

Universal Life Insurance

Universal life insurance offers flexibility in premium payments and death benefits. Policyholders can adjust their premiums and death benefits within certain limits, allowing them to customize their coverage according to their changing needs. The policy also accumulates cash value, similar to whole life insurance, which can be accessed through loans or withdrawals. Universal life insurance provides a balance between the stability of permanent coverage and the flexibility of term life insurance.

Variable Life Insurance

Variable life insurance is a type of permanent life insurance that allows policyholders to invest a portion of their premiums in separate accounts. These accounts can be invested in stocks, bonds, or mutual funds, offering the potential for higher returns. However, it also comes with higher risk, as the policy’s cash value and death benefit can fluctuate based on the performance of the chosen investments. Variable life insurance is suitable for individuals seeking investment opportunities within their life insurance policy.

Key Components of a Life Insurance Policy

To fully comprehend life insurance, it’s essential to understand the key components that make up a policy.

Premiums

Premiums are the regular payments made by the policyholder to the insurance company. The cost of premiums depends on various factors, including the type of policy, the policyholder’s age, health status, lifestyle, and the amount of coverage desired. Generally, premiums are higher for younger policyholders and those with healthier lifestyles, as they are expected to live longer and pose a lower risk to the insurance company.

Death Benefit

The death benefit is the sum of money that the insurance company pays to the policyholder’s beneficiaries upon their death. It is the primary reason individuals purchase life insurance and is intended to provide financial support to their loved ones. The death benefit can be used to cover a wide range of expenses, from funeral costs to paying off mortgages or providing income for dependents.

Policy Duration and Renewal

The duration of a life insurance policy depends on the type of policy chosen. Term life insurance policies have a set term, after which the coverage expires. Whole life and universal life insurance policies, on the other hand, provide coverage for the policyholder’s entire life, ensuring long-term financial protection. Renewal options may vary, with some policies offering the opportunity to renew at specific intervals or upon reaching a certain age.

Benefits and Considerations of Life Insurance

Life insurance offers numerous advantages and should be considered as an integral part of a comprehensive financial plan. Here are some key benefits and considerations:

Financial Security for Loved Ones

The primary benefit of life insurance is providing financial security to the policyholder’s family or dependents. In the event of the policyholder’s death, the death benefit can help cover immediate expenses, such as funeral costs, and provide long-term financial support to ensure their loved ones’ well-being.

Debt Repayment

Life insurance can be used to repay outstanding debts, such as mortgages, car loans, or credit card balances. This ensures that the policyholder’s loved ones are not burdened with these financial obligations, allowing them to focus on their own financial stability.

Income Replacement

For families that rely on the policyholder’s income, life insurance can provide a replacement source of income. The death benefit can be used to cover living expenses, education costs for children, or even fund retirement plans for the surviving spouse.

Estate Planning

Life insurance can play a crucial role in estate planning. The death benefit can be used to pay estate taxes, ensuring that the policyholder’s assets are passed on to their beneficiaries without significant financial burden. It can also help fund trust funds or charitable donations, allowing individuals to leave a lasting legacy.

Flexibility and Customization

Many life insurance policies offer flexibility in terms of coverage and premium payments. Policyholders can choose the amount of coverage they need, adjust premiums to fit their budget, and even add optional riders to tailor their policy to their specific needs. This customization ensures that life insurance can adapt to changing life circumstances.

How to Choose the Right Life Insurance Policy

Selecting the right life insurance policy involves careful consideration of your unique financial situation and goals. Here are some steps to guide you through the process:

Assess Your Needs

Begin by evaluating your financial obligations and the needs of your loved ones. Consider factors such as outstanding debts, mortgage payments, children’s education expenses, and future financial goals. This assessment will help you determine the amount of coverage you require.

Understand Your Options

Familiarize yourself with the different types of life insurance policies and their features. Term life insurance is ideal for temporary coverage, while whole life and universal life insurance offer permanent protection and additional benefits. Variable life insurance provides investment opportunities, but with higher risk.

Consider Your Budget

Evaluate your financial capabilities and determine how much you can comfortably afford to pay in premiums. Remember that life insurance is a long-term commitment, so choose a policy with premiums that fit within your budget and financial plan.

Seek Professional Advice

Consulting with a qualified financial advisor or insurance agent can provide valuable insights and guidance. They can help you navigate the complexities of life insurance, compare policies, and ensure you make an informed decision based on your specific needs and circumstances.

Review and Compare Policies

Research and compare multiple life insurance policies from different providers. Look for policies that offer the coverage and benefits you require at a competitive premium. Consider factors such as the insurance company’s financial stability, customer service, and reputation when making your choice.

The Future of Life Insurance

The life insurance industry is continuously evolving to meet the changing needs and expectations of policyholders. Here’s a glimpse into the future of life insurance:

Digital Transformation

The digital age has brought about significant changes in the way insurance is purchased and managed. Online platforms and mobile apps are making it easier for individuals to compare policies, apply for coverage, and manage their policies digitally. This trend is expected to continue, with more insurance companies embracing technology to enhance the customer experience.

Personalized Coverage

Life insurance policies are becoming increasingly personalized to meet the unique needs of individuals. Insurance companies are utilizing advanced analytics and data-driven approaches to offer customized coverage options. This allows policyholders to choose benefits and riders that align with their specific financial goals and circumstances.

Focus on Health and Wellness

There is a growing emphasis on health and wellness within the life insurance industry. Some insurance companies are offering incentives and discounts to policyholders who maintain a healthy lifestyle. This trend is likely to continue, with more companies recognizing the importance of healthy habits and offering rewards for proactive health management.

Innovative Products and Services

The life insurance industry is constantly innovating to meet the evolving needs of consumers. We can expect to see the development of new products and services, such as simplified issue policies, which offer faster approval processes, and policies tailored to specific professions or lifestyles. These innovations aim to make life insurance more accessible and relevant to a broader range of individuals.

Conclusion

Life insurance is an essential tool for financial planning and protection. By understanding the different types of policies, their benefits, and how to choose the right coverage, individuals can ensure they have the financial security they need for their loved ones. As the life insurance industry continues to evolve, embracing technology and offering personalized coverage, it remains a vital component of a well-rounded financial strategy.

What is the difference between term and whole life insurance?

+Term life insurance provides coverage for a specific period, known as the term, and typically offers lower premiums. On the other hand, whole life insurance offers permanent coverage with level premiums and accumulates cash value over time. Whole life insurance is more expensive but provides guaranteed coverage for life.

Can I change my life insurance policy once it’s in place?

+Yes, most life insurance policies allow for certain changes to be made, such as adjusting the death benefit or adding optional riders. However, changes may be subject to underwriting and may require additional fees or adjustments to premiums. It’s best to consult with your insurance provider to understand the specific options available to you.

How often should I review my life insurance policy?

+It’s recommended to review your life insurance policy regularly, ideally every few years or whenever your financial situation or family circumstances change significantly. This ensures that your coverage remains adequate and aligned with your needs. Regular reviews allow you to make adjustments as necessary to maintain the right level of protection.