Best Cheap Insurance For Car

When it comes to finding the best cheap insurance for your car, there are several factors to consider. The definition of "cheap" insurance can vary based on individual circumstances, and it's important to strike a balance between affordability and adequate coverage. In this comprehensive guide, we will explore the key aspects of obtaining the most cost-effective car insurance while ensuring you are adequately protected on the road.

Understanding Car Insurance Basics

Car insurance is a legal requirement in most regions and provides financial protection in case of accidents, theft, or other vehicle-related incidents. It helps cover the costs of repairs, medical expenses, and potential liabilities. Understanding the different types of car insurance coverage is essential to make informed decisions.

Liability Coverage

Liability coverage is a fundamental aspect of car insurance. It protects you financially if you are found at fault for an accident that causes injuries or property damage to others. This coverage is mandatory in most states and typically includes:

- Bodily Injury Liability: Covers medical expenses and compensation for injuries sustained by others involved in an accident you caused.

- Property Damage Liability: Pays for repairs or replacements of others’ property, such as vehicles or structures, damaged in an accident you caused.

Comprehensive and Collision Coverage

While liability coverage is essential, it only covers damages to others. Comprehensive and collision coverage, on the other hand, provides protection for your own vehicle. These coverages include:

- Comprehensive Coverage: Covers non-collision-related incidents like theft, vandalism, natural disasters, or damage caused by animals.

- Collision Coverage: Pays for repairs or replacements if your vehicle is damaged in a collision, regardless of fault.

Additional Coverage Options

Depending on your needs and location, you may also consider additional coverages such as:

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re involved in an accident with a driver who has insufficient or no insurance.

- Medical Payments Coverage: Covers medical expenses for you and your passengers, regardless of fault.

- Rental Car Reimbursement: Provides coverage for rental car expenses while your vehicle is being repaired after an insured incident.

Factors Affecting Car Insurance Rates

The cost of car insurance can vary significantly based on several factors. Understanding these factors can help you make informed decisions to obtain the best value for your insurance coverage.

Driver Profile

Your personal driving record and history play a significant role in determining your insurance rates. Insurers consider factors such as:

- Age: Younger and less experienced drivers often face higher premiums due to a higher risk of accidents.

- Driving Record: A clean driving record with no accidents or traffic violations can lead to lower premiums.

- Credit Score: In many states, insurers use credit-based insurance scores to assess risk and set rates.

- Marital Status: Married individuals may enjoy lower rates, as insurers view them as more responsible and stable.

Vehicle Factors

The type of vehicle you drive and its usage can impact your insurance rates. Consider the following:

- Vehicle Make and Model: Certain vehicles may be more expensive to insure due to higher repair costs or theft risks.

- Vehicle Age and Condition: Older vehicles with higher mileage may require less comprehensive coverage, resulting in lower premiums.

- Vehicle Usage: If you use your car primarily for commuting or occasional pleasure driving, you may qualify for lower rates compared to frequent business travelers.

Location and Usage

Your geographical location and the purpose of your vehicle usage can also affect your insurance rates. Factors to consider include:

- State Laws: Each state has its own regulations and minimum coverage requirements, which can impact insurance rates.

- Crime Rate and Traffic Density: Areas with higher crime rates or heavy traffic may have higher insurance premiums.

- Commute Distance: Longer daily commutes can lead to increased insurance costs.

Tips for Finding Cheap Car Insurance

Now that we’ve covered the basics, here are some practical tips to help you find the best cheap insurance for your car.

Compare Quotes

Obtain quotes from multiple insurance providers to compare rates and coverage options. Online quote comparison tools can be a convenient way to quickly assess different options.

Understand Coverage Limits

Review the coverage limits and deductibles offered by different insurers. While lower limits and higher deductibles may result in cheaper premiums, ensure you have adequate protection for your specific needs.

Bundle Policies

Consider bundling your car insurance with other policies, such as homeowners or renters insurance. Many insurers offer discounts when you combine multiple policies with them.

Explore Discounts

Insurers often provide discounts for various reasons. Common discounts include:

- Safe Driver Discounts: Rewards for maintaining a clean driving record.

- Good Student Discounts: Offered to young drivers with good academic performance.

- Loyalty Discounts: Provided for long-term customers who renew their policies.

- Multi-Car Discounts: Available when insuring multiple vehicles with the same insurer.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, uses telematics technology to monitor your driving habits. Insurers may offer discounts based on safe driving practices, making it an attractive option for cautious drivers.

Maintain a Good Driving Record

A clean driving record is crucial for obtaining affordable insurance. Avoid traffic violations and accidents to keep your premiums low.

Choose the Right Coverage

Assess your needs and choose the appropriate coverage. Overinsuring yourself can be costly, while underinsuring may leave you vulnerable to financial risks. Strike a balance that provides adequate protection without unnecessary expenses.

The Future of Car Insurance

The car insurance industry is evolving, and several trends are shaping the future of affordable coverage. Here’s a glimpse into what lies ahead:

Telematics and Personalized Insurance

Telematics technology is becoming increasingly popular, allowing insurers to offer personalized insurance plans based on individual driving behavior. This shift towards data-driven insurance may lead to more accurate risk assessments and potentially lower premiums for safe drivers.

Automated Claims Processing

The use of artificial intelligence and machine learning in claims processing is streamlining the process. Automated systems can quickly assess and approve valid claims, reducing administrative costs and potentially leading to lower insurance premiums.

Electric and Autonomous Vehicles

The rise of electric and autonomous vehicles is expected to bring about significant changes in the car insurance industry. With fewer accidents and lower maintenance costs associated with these vehicles, insurance premiums may decrease over time.

Blockchain Technology

Blockchain technology has the potential to revolutionize the insurance industry by enhancing data security and transparency. Smart contracts and decentralized record-keeping could streamline insurance processes, reduce fraud, and ultimately lower costs for insurers and policyholders.

Conclusion

Finding the best cheap insurance for your car involves a careful balance between affordability and adequate coverage. By understanding the basics of car insurance, considering the factors that affect rates, and implementing strategic tips, you can navigate the insurance market with confidence. Remember, the key is to strike a harmonious balance between cost and coverage to ensure you’re fully protected on the road.

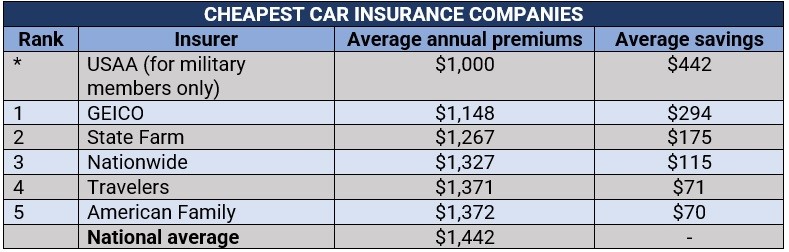

What is the average cost of car insurance in the United States?

+The average cost of car insurance in the U.S. varies based on factors such as location, driving record, and vehicle type. As of 2022, the national average annual premium was approximately 1,674, but rates can range from 500 to over $3,000 depending on individual circumstances.

How can I lower my car insurance premiums if I have a poor driving record?

+If you have a poor driving record, you can still take steps to lower your insurance premiums. Consider taking a defensive driving course, which may result in a discount. Additionally, maintain a clean driving record going forward to demonstrate improved driving behavior. Some insurers offer forgiveness programs for past violations, so it’s worth inquiring about these options.

Are there any government programs or subsidies available to help with car insurance costs?

+Some states and municipalities offer financial assistance programs or subsidies to help low-income individuals or specific demographic groups with car insurance costs. These programs may have eligibility criteria and vary by location. It’s advisable to research and contact your local government or insurance department to explore available options.