Open Market Health Insurance

In the United States, the healthcare landscape is complex, with a diverse range of insurance options available to individuals and families. Among these, open market health insurance stands out as a vital component of the healthcare system, offering flexibility and choice to those seeking coverage outside of traditional employer-based plans. This comprehensive guide aims to delve into the intricacies of open market health insurance, providing an expert analysis of its benefits, challenges, and future prospects.

Understanding Open Market Health Insurance

Open market health insurance, often referred to as individual health insurance or private health insurance, is a type of medical coverage that individuals can purchase directly from insurance companies or through authorized brokers and agents. Unlike group health plans offered by employers, these plans are available to anyone regardless of their employment status. This market provides a crucial safety net for those who are self-employed, unemployed, or otherwise not eligible for employer-sponsored coverage.

Key Characteristics of Open Market Plans

Open market health insurance plans offer a range of features and benefits that cater to the diverse needs of individuals and families. Here are some key characteristics:

- Individualized Coverage: These plans can be tailored to meet the specific needs of each policyholder, allowing for flexibility in choosing deductibles, copayments, and other plan features.

- Variety of Networks: Open market plans often provide options for Preferred Provider Organizations (PPOs), Health Maintenance Organizations (HMOs), or Point-of-Service (POS) plans, giving consumers a choice of networks and providers.

- Premium Costs: Premiums can vary significantly based on factors like age, location, tobacco use, and the chosen level of coverage. While these plans may offer more flexibility, they often come with higher premiums compared to group plans.

- Underwriting: Insurance companies may use underwriting practices to assess an individual’s health status and set rates accordingly. This process can result in higher premiums or even denial of coverage for those with pre-existing conditions.

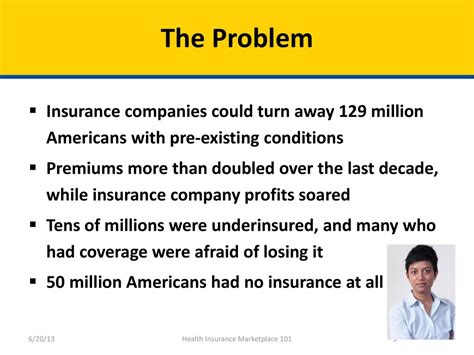

The Role of the Affordable Care Act (ACA)

The Affordable Care Act, also known as Obamacare, has significantly influenced the open market health insurance landscape. The ACA introduced several key provisions:

- Individual Mandate: Prior to the ACA’s repeal of the individual mandate penalty, individuals were required to have health insurance or face a tax penalty. This mandate aimed to encourage a broader pool of insured individuals.

- Essential Health Benefits: The ACA mandated that all health plans, including open market plans, cover a set of essential health benefits, ensuring comprehensive coverage for a range of services.

- Pre-Existing Condition Protection: The ACA prohibited insurance companies from denying coverage or charging higher premiums based solely on pre-existing conditions.

- Subsidies and Tax Credits: The ACA offered financial assistance in the form of subsidies and tax credits to help individuals and families afford their health insurance premiums.

Benefits and Challenges of Open Market Insurance

Open market health insurance presents a unique set of advantages and challenges for consumers. Understanding these aspects is crucial for making informed decisions about healthcare coverage.

Benefits of Open Market Plans

These plans offer several key benefits:

- Flexibility: Open market plans provide the freedom to choose coverage that aligns with individual needs and preferences. This flexibility is particularly beneficial for those with unique healthcare requirements.

- Portability: Unlike employer-based plans, open market insurance is not tied to a specific job. This portability allows individuals to maintain coverage even if their employment status changes.

- Choice of Providers: Many open market plans offer a wide range of provider networks, giving consumers the ability to select doctors and hospitals that best suit their needs.

- Tax Benefits: In certain circumstances, premiums for open market plans may be tax-deductible, providing a financial advantage to policyholders.

Challenges and Considerations

While open market health insurance offers flexibility, it also comes with several challenges and considerations:

- Cost: Premiums for open market plans can be significantly higher than employer-sponsored plans, particularly for those with pre-existing conditions or specific healthcare needs.

- Underwriting: The underwriting process can be complex and may result in higher premiums or denial of coverage for individuals with health issues. This practice has been restricted by the ACA but still poses challenges.

- Network Restrictions: While open market plans offer a choice of networks, some plans may have limited provider options, particularly in rural areas or for specialized medical services.

- Out-of-Pocket Costs: Deductibles, copayments, and other out-of-pocket expenses can be substantial, especially for those with high-deductible plans.

Performance Analysis and Future Prospects

Open market health insurance has played a crucial role in expanding access to healthcare coverage, particularly for those who do not have access to employer-based plans. However, the future of this market is subject to ongoing policy changes and market dynamics.

Market Trends and Growth

The open market health insurance sector has experienced significant growth in recent years, driven by factors such as:

- Changing Workforce Dynamics: The gig economy and the rise of self-employment have led to an increasing number of individuals seeking coverage outside of traditional employer-based plans.

- Healthcare Reform: The ACA’s implementation and subsequent policy changes have influenced the market, impacting premium costs, enrollment trends, and provider networks.

- Advancements in Technology: The rise of digital health platforms and telemedicine has expanded access to healthcare services, making open market plans more attractive to consumers.

Future Implications and Innovations

Looking ahead, several factors are likely to shape the future of open market health insurance:

- Policy Changes: Ongoing policy debates and potential reforms to the ACA or other healthcare regulations could significantly impact the market, affecting enrollment, premiums, and coverage options.

- Advances in Healthcare Technology: Continued advancements in telemedicine and digital health solutions may enhance the efficiency and accessibility of open market plans, particularly for rural or underserved populations.

- Focus on Value-Based Care: There is a growing trend towards value-based care models, which aim to improve patient outcomes while reducing costs. Open market plans may increasingly adopt these models to enhance quality and affordability.

- Integration of Social Determinants of Health: Recognizing the impact of social and environmental factors on health, open market plans may integrate these considerations into their coverage and benefits, addressing broader health disparities.

| Market Trend | Impact |

|---|---|

| Growing Self-Employment | Increases demand for open market plans |

| Healthcare Reform | Influences enrollment and premium trends |

| Telemedicine Advances | Expands access and enhances plan appeal |

Frequently Asked Questions (FAQ)

Can I qualify for open market health insurance if I have a pre-existing condition?

+Yes, the Affordable Care Act (ACA) prohibits insurance companies from denying coverage based solely on pre-existing conditions. However, premiums may be higher, and some plans may have limitations or exclusions for specific conditions.

How do I choose the right open market health insurance plan for my needs?

+Consider factors such as your healthcare needs, budget, and preferred provider networks. Compare plans based on coverage, premiums, deductibles, and out-of-pocket costs. Seek guidance from insurance brokers or agents to find the best fit.

Are open market plans more expensive than employer-based plans?

+Open market plans often have higher premiums compared to employer-based plans. This is because employer plans are typically subsidized by the employer and may have a larger pool of insured individuals. However, the cost can vary based on individual circumstances and the chosen plan features.