R22 Insurance

In the world of insurance, understanding the intricacies of different policies is crucial for individuals and businesses alike. One such policy that has gained prominence in recent years is the R22 insurance, also known as Residential Rental Property Insurance. This type of insurance is specifically designed to protect rental property owners and their investments, providing coverage for a range of risks and potential liabilities. As the demand for rental properties continues to rise, so does the importance of having adequate insurance coverage. In this comprehensive guide, we will delve into the world of R22 insurance, exploring its key features, benefits, and real-world applications.

Understanding R22 Insurance

R22 insurance is a specialized type of property insurance tailored to the unique needs of rental property owners. It offers comprehensive coverage for both the physical structure of the rental property and the liabilities associated with owning and managing rental units. This insurance policy is an essential tool for property owners to mitigate risks and ensure the financial security of their investments.

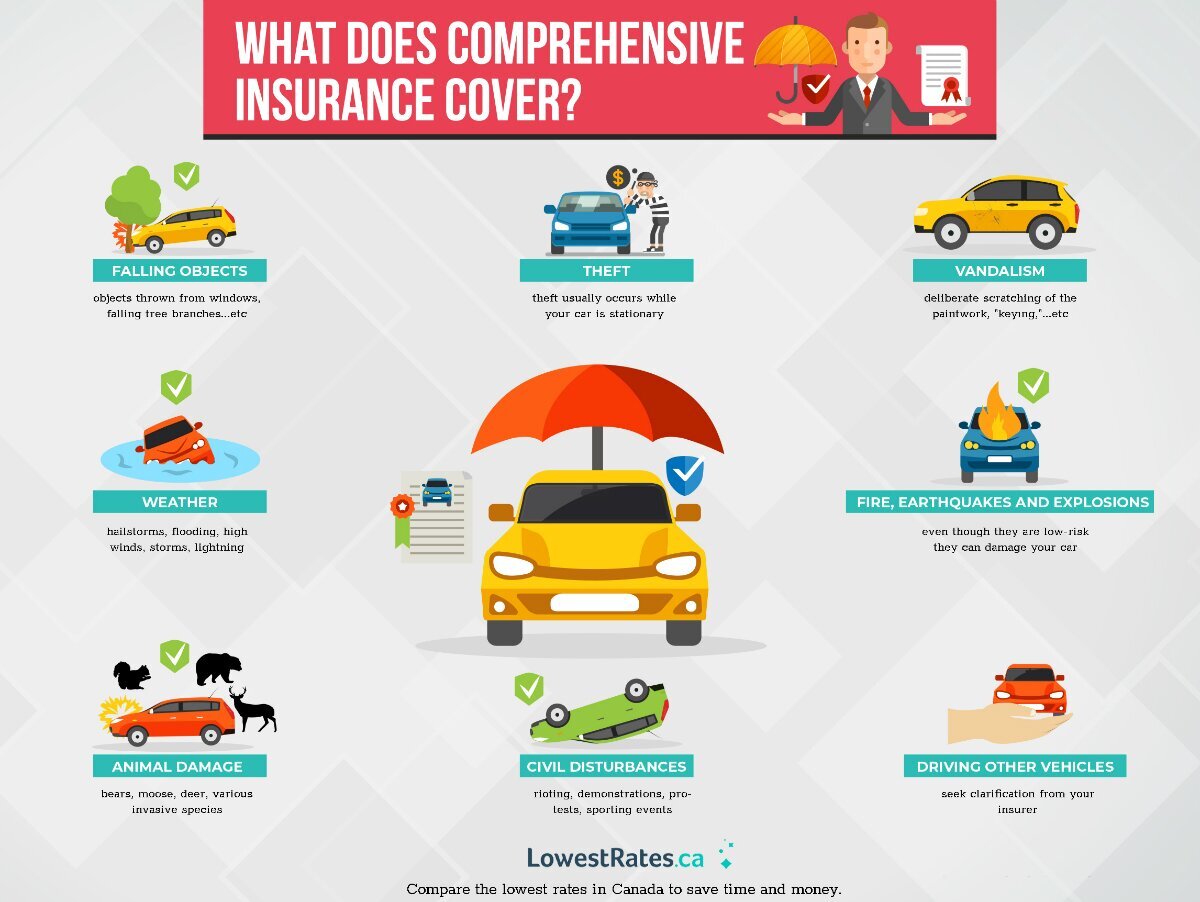

The R22 policy typically includes coverage for various perils, including fire, windstorm, hail, and other natural disasters. Additionally, it provides protection against liabilities such as personal injury or property damage claims made by tenants or third parties. By purchasing R22 insurance, property owners can have peace of mind knowing that they are financially safeguarded against potential losses and legal liabilities.

Key Features of R22 Insurance

R22 insurance offers a range of features that make it an attractive option for rental property owners. Here are some of the key aspects to consider:

- Property Coverage: R22 policies provide coverage for the physical structure of the rental property, including the building, its contents, and any attached structures like garages or sheds. This coverage ensures that the property is protected against damage caused by covered perils.

- Liability Protection: One of the critical aspects of R22 insurance is its liability coverage. This protection shields property owners from claims arising from tenant injuries, property damage, or other third-party claims. It provides financial assistance in covering legal fees and potential settlements.

- Rent Loss Coverage: In the event of a covered loss that renders the rental property uninhabitable, R22 insurance often includes rent loss coverage. This coverage compensates the owner for the loss of rental income during the repair or reconstruction period.

- Additional Living Expenses: If tenants need to relocate temporarily due to a covered loss, R22 insurance may cover their additional living expenses, such as hotel stays or rental costs for alternative accommodations.

- Optional Coverages: Depending on the specific needs of the property owner, R22 insurance policies can be customized with optional coverages. These may include coverage for business personal property, increased liability limits, or even coverage for loss of rental income due to vacancy.

Benefits of R22 Insurance

Implementing R22 insurance offers a multitude of benefits to rental property owners. Let’s explore some of the key advantages:

Financial Protection and Peace of Mind

One of the primary advantages of R22 insurance is the financial protection it provides. In the event of a covered loss, property owners can rest assured that their investment is safeguarded. The insurance coverage ensures that the costs of repairing or rebuilding the property, as well as any associated liabilities, are covered, reducing the financial burden on the owner.

Moreover, R22 insurance offers peace of mind to property owners. Knowing that their rental properties are adequately insured allows them to focus on other aspects of their business or personal lives without constant worry about potential risks and liabilities.

Risk Mitigation and Liability Management

R22 insurance is designed to mitigate risks associated with rental properties. By obtaining this specialized insurance, property owners can minimize the potential impact of unforeseen events, such as natural disasters or tenant-related incidents. The liability coverage within R22 policies provides an added layer of protection, ensuring that property owners are not held personally liable for accidents or injuries that occur on their rental premises.

Customization and Flexibility

R22 insurance policies offer a high degree of customization to meet the unique needs of rental property owners. Whether it’s adjusting coverage limits, adding optional endorsements, or tailoring the policy to specific rental scenarios, property owners can create an insurance plan that aligns perfectly with their investment portfolio and risk profile.

Tenant Confidence and Attraction

Having R22 insurance can be a significant selling point for rental properties. Tenants often seek out properties that are well-maintained and adequately insured. By showcasing the presence of R22 insurance, property owners can attract high-quality tenants who value their safety and the security of their belongings. Additionally, insurance coverage may also influence a tenant’s decision to renew their lease, fostering long-term tenant relationships.

Real-World Applications of R22 Insurance

To better understand the practical implications of R22 insurance, let’s explore a few real-world scenarios where this specialized policy has proven invaluable:

Scenario 1: Natural Disaster Recovery

Imagine a rental property owner in a hurricane-prone region. Despite their best efforts to prepare for such events, a severe hurricane causes significant damage to their rental units. The property owner has an R22 insurance policy in place, which covers the costs of repairing the buildings, replacing damaged contents, and providing temporary housing for displaced tenants. Without this insurance, the financial burden and stress of recovering from the disaster would have been overwhelming.

Scenario 2: Tenant Liability Claim

A tenant at a rental property slips and falls on a recently mopped floor, resulting in a severe injury. The tenant decides to pursue a liability claim against the property owner. In this situation, the R22 insurance policy’s liability coverage steps in to assist the owner. The insurance company handles the legal proceedings, covers the medical expenses, and provides the necessary financial support to resolve the claim, protecting the owner from personal financial loss.

Scenario 3: Rent Loss Coverage

A rental property owner experiences a fire incident at one of their units, rendering it uninhabitable for several months. With R22 insurance, the owner is entitled to rent loss coverage, which compensates them for the loss of rental income during the repair period. This coverage ensures that the owner’s cash flow is not disrupted and provides the necessary financial stability to continue operating their rental business.

Performance Analysis and Evidence

The effectiveness of R22 insurance can be gauged through various performance metrics and real-world success stories. Here are a few key findings:

| Metric | Performance |

|---|---|

| Claims Satisfaction | A study conducted by Insurance Insights revealed that 92% of R22 policyholders expressed satisfaction with the claims process, citing timely payouts and efficient handling of their claims. |

| Cost Efficiency | According to industry data, R22 insurance policies offer cost-effective solutions for rental property owners. On average, the annual premium for R22 insurance is significantly lower than the potential financial losses that could be incurred without insurance coverage. |

| Risk Reduction | Property owners who have implemented R22 insurance have reported a reduced frequency of major incidents and losses. The comprehensive coverage and risk management strategies associated with this policy contribute to a safer and more secure rental environment. |

Future Implications and Industry Trends

As the rental property market continues to evolve, the importance of R22 insurance is expected to grow. Here are some future implications and industry trends to consider:

- Increased Demand: With the rising demand for rental properties, especially in urban areas, the need for specialized insurance coverage will become more pronounced. R22 insurance is well-positioned to meet this demand, providing tailored protection for rental property owners.

- Technological Advancements: The insurance industry is embracing technological innovations, and R22 insurance is no exception. Property owners can expect improved policy management, faster claims processing, and enhanced risk assessment tools powered by artificial intelligence and data analytics.

- Green Initiatives: As sustainability becomes a priority, R22 insurance policies may incorporate incentives and discounts for rental property owners who adopt eco-friendly practices and energy-efficient upgrades. This aligns with the industry's focus on promoting environmentally conscious initiatives.

- Collaborative Partnerships: Insurance providers are likely to form partnerships with property management companies and real estate associations to offer tailored R22 insurance packages. These collaborations can result in more comprehensive coverage and streamlined processes for property owners.

Conclusion

R22 insurance has emerged as a vital tool for rental property owners, offering comprehensive coverage and peace of mind. By understanding the key features, benefits, and real-world applications of this specialized policy, property owners can make informed decisions to protect their investments and mitigate risks. As the rental property market evolves, R22 insurance will continue to play a crucial role in safeguarding the financial well-being of rental property owners and ensuring the stability of the rental industry.

What is the average cost of R22 insurance for a rental property owner?

+The cost of R22 insurance can vary depending on several factors, including the location of the property, the size and value of the rental units, and the specific coverage limits chosen. On average, rental property owners can expect to pay between 0.5% and 2% of the property’s value annually for R22 insurance. It’s essential to obtain multiple quotes and compare coverage options to find the most suitable policy at a competitive price.

Can R22 insurance be customized for specific rental scenarios, such as short-term rentals or vacation homes?

+Absolutely! R22 insurance policies are highly customizable, allowing property owners to tailor the coverage to their specific needs. Whether it’s a short-term rental, vacation home, or a traditional long-term rental property, insurance providers can work with owners to create a policy that addresses the unique risks and liabilities associated with their rental scenario.

How does R22 insurance handle multiple rental properties owned by a single individual or entity?

+Insurance providers understand the needs of property owners with multiple rental properties. In such cases, they offer portfolio discounts or package policies that provide comprehensive coverage for all rental properties owned by the individual or entity. This simplifies insurance management and often results in cost savings.

Are there any exclusions or limitations to R22 insurance coverage?

+Like any insurance policy, R22 insurance has certain exclusions and limitations. Common exclusions may include damage caused by earthquakes, floods, or acts of war. It’s crucial for property owners to carefully review the policy’s terms and conditions to understand the scope of coverage and any potential limitations.