Auto Liability Insurance For Rental Cars

Navigating the world of auto insurance can be a complex task, especially when it comes to understanding coverage for rental cars. With the rise in travel and the increasing popularity of rental services, it's crucial to have a comprehensive understanding of auto liability insurance for rental vehicles. This article aims to delve into the intricacies of this topic, providing you with expert insights and practical information to ensure you're well-prepared for your next rental car journey.

The Importance of Auto Liability Insurance for Rental Cars

When you rent a car, you’re not just borrowing a vehicle; you’re also taking on a significant financial responsibility. Auto liability insurance plays a vital role in mitigating the risks associated with operating a rental car. It provides coverage for damages and injuries that may occur during your rental period, offering protection for both yourself and the rental company.

In the event of an accident, auto liability insurance acts as a financial safeguard. It covers the costs of bodily injury and property damage that you may be held responsible for. This includes medical expenses, vehicle repairs, and even legal fees in certain situations. By having adequate liability coverage, you can avoid costly out-of-pocket expenses and potential legal complications.

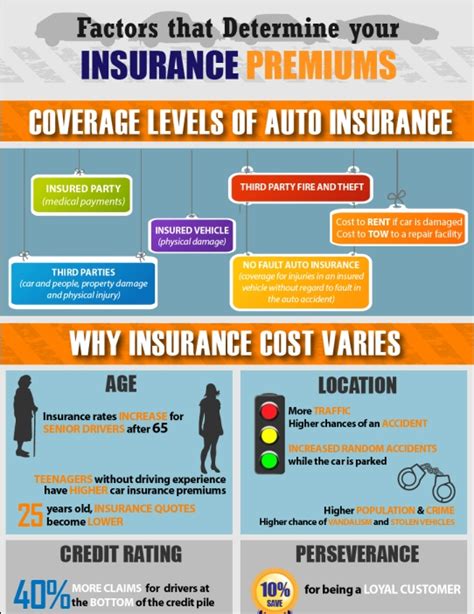

Understanding the Different Types of Liability Coverage

Auto liability insurance for rental cars typically comes in two main forms: third-party liability and collision damage waiver (CDW) or loss damage waiver (LDW). Understanding the differences between these coverage options is essential to making informed decisions when renting a car.

Third-Party Liability Coverage

Third-party liability insurance, often referred to as liability coverage, is a fundamental type of insurance that rental companies provide. It covers you for any damages or injuries you cause to other parties involved in an accident. This includes both bodily injury liability and property damage liability coverage.

Bodily injury liability provides financial protection if you or your passengers cause injuries to others. It covers medical expenses, pain and suffering, and even potential legal costs. Property damage liability, on the other hand, covers the cost of repairing or replacing the other party's vehicle or any other property damaged in the accident.

Collision Damage Waiver (CDW) or Loss Damage Waiver (LDW)

A CDW or LDW is an optional insurance coverage that rental companies offer. It provides protection for damage to the rental car itself, waiving your responsibility for the cost of repairs in the event of an accident. This coverage is particularly beneficial as it minimizes your financial liability, ensuring that you won’t have to pay out of pocket for any repairs needed.

CDW/LDW coverage is typically offered at an additional cost, but it can provide significant peace of mind during your rental period. It's important to note that this coverage may have exclusions and limitations, so it's essential to review the terms and conditions carefully before purchasing.

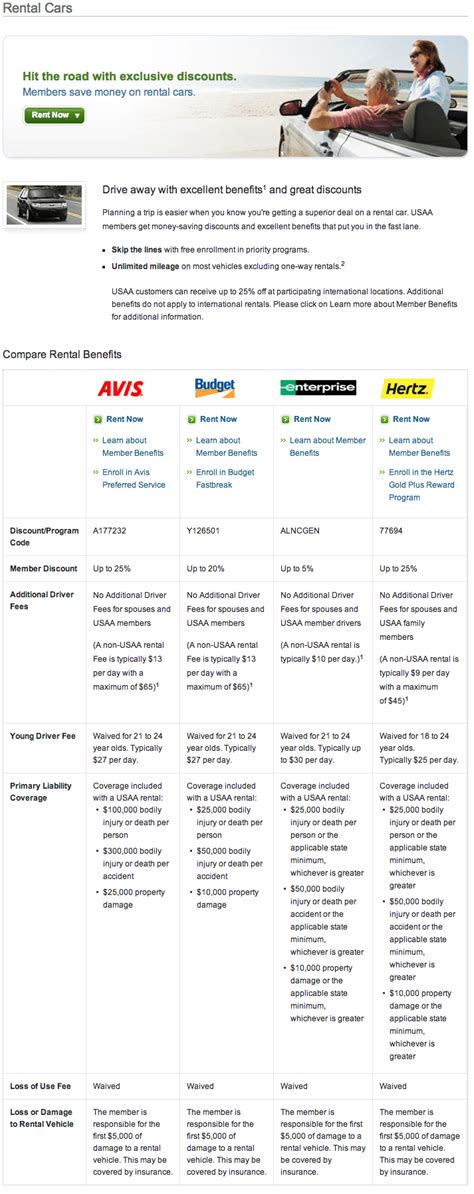

Comparing Rental Car Insurance Options

When renting a car, you have several insurance options to consider. These include:

- Rental Company's Insurance: Most rental companies offer their own insurance plans, which typically include third-party liability coverage and may also include CDW/LDW. These plans can vary in terms of coverage limits and exclusions, so it's crucial to review the details.

- Personal Auto Insurance: Your existing auto insurance policy may extend to rental cars. However, the level of coverage and any exclusions should be carefully examined. It's essential to understand if your personal policy covers rental cars and if there are any limitations on rental duration or location.

- Credit Card Insurance: Some credit card providers offer rental car insurance as a benefit when you use their card to pay for the rental. This insurance may provide liability coverage and sometimes collision coverage as well. However, the coverage limits and exclusions can vary, and it's important to understand the terms before relying on this option.

Choosing the Right Insurance Option

The choice of insurance option depends on various factors, including your personal circumstances, the terms of your existing insurance policies, and the specific rental company’s policies. Here are some considerations to help you make an informed decision:

- Review Your Existing Insurance: Check your personal auto insurance policy to understand the extent of coverage it provides for rental cars. Consider adding optional coverage if needed to ensure adequate protection.

- Compare Rental Company Policies: Research and compare the insurance options offered by different rental companies. Look for policies that provide comprehensive coverage with reasonable deductibles and minimal exclusions.

- Explore Credit Card Benefits: If you have a credit card that offers rental car insurance, review the terms and conditions. Ensure that the coverage limits are sufficient and that the rental duration and location are covered.

- Consider Third-Party Insurance: In some cases, purchasing third-party insurance from specialized providers can offer more flexibility and comprehensive coverage. These policies can be purchased directly from the rental company or through independent insurance brokers.

| Insurance Option | Pros | Cons |

|---|---|---|

| Rental Company's Insurance | Convenient, often includes CDW/LDW | May be more expensive, exclusions may apply |

| Personal Auto Insurance | Potential for cost savings, familiar coverage | Coverage may be limited, additional costs for excess liability |

| Credit Card Insurance | No additional cost, covers a wide range of rentals | Coverage limits may be low, specific conditions may apply |

| Third-Party Insurance | Customizable, often more comprehensive | Additional cost, may have restrictions |

The Impact of Your Driving Record

Your driving record plays a significant role in determining your auto liability insurance rates and coverage options for rental cars. A clean driving record with no recent accidents or violations can result in lower insurance premiums and potentially broader coverage options.

On the other hand, if you have a history of accidents or traffic violations, you may face higher insurance costs and limited coverage options. Some rental companies may even refuse to rent a car to individuals with severe driving records. It's essential to be upfront about your driving history when obtaining insurance for a rental car, as misrepresentation can lead to policy cancellation and financial penalties.

Tips for Improving Your Driving Record

- Avoid Distracted Driving: Distracted driving is a leading cause of accidents. Focus on the road, avoid using your phone while driving, and minimize any distractions that may impair your driving ability.

- Obey Traffic Laws: Follow speed limits, use turn signals, and yield to pedestrians and other vehicles. Obeying traffic laws reduces the likelihood of accidents and traffic violations.

- Attend Defensive Driving Courses: Consider enrolling in a defensive driving course. These courses can improve your driving skills, reduce the risk of accidents, and may even qualify you for insurance discounts.

- Review Your Driving Record: Regularly check your driving record for accuracy. If you find any errors or discrepancies, dispute them with the appropriate authorities. A clean and accurate driving record can improve your insurance options.

Future Trends in Auto Liability Insurance for Rental Cars

The auto insurance industry is continuously evolving, and several trends are shaping the future of liability insurance for rental cars. These include:

- Telematics and Usage-Based Insurance (UBI): Telematics devices and UBI programs are gaining popularity in the insurance industry. These technologies track driving behavior and offer personalized insurance rates based on actual driving habits. UBI programs could revolutionize rental car insurance, providing more accurate and fair pricing.

- Digital Insurance Platforms: The rise of digital insurance platforms and apps is streamlining the rental car insurance process. These platforms offer convenient access to insurance quotes, policy management, and claims processing, making it easier for renters to obtain the coverage they need.

- Enhanced Rental Car Safety Features: Rental car companies are investing in advanced safety features such as collision avoidance systems, lane departure warnings, and adaptive cruise control. These features can reduce the risk of accidents and lower insurance premiums.

- Sharing Economy and Peer-to-Peer Rentals: The sharing economy has introduced new rental models, such as peer-to-peer car rentals. As this trend continues, specialized insurance options may emerge to cater to these unique rental scenarios.

Conclusion: Stay Informed, Stay Protected

Understanding auto liability insurance for rental cars is essential for any traveler or individual considering a rental car. By familiarizing yourself with the different coverage options, comparing policies, and staying informed about industry trends, you can make confident decisions to ensure your protection on the road.

Remember, being proactive about your insurance choices can save you from financial headaches and provide peace of mind during your rental car adventures. Stay safe, and happy travels!

Can I rely solely on my personal auto insurance when renting a car?

+While your personal auto insurance may extend to rental cars, it’s essential to review the terms of your policy carefully. Some policies have limitations on rental duration or geographical coverage, and you may need to purchase additional coverage to ensure comprehensive protection.

What happens if I decline the rental company’s insurance offer?

+Declining the rental company’s insurance offer means you’re responsible for any damages or liabilities that occur during your rental period. It’s crucial to have alternative insurance coverage in place, such as your personal auto insurance or credit card insurance, to avoid financial risks.

Are there any situations where rental car insurance is not necessary?

+In certain cases, such as when you’re renting a car for a very short duration or when your personal auto insurance provides sufficient coverage, rental car insurance may not be necessary. However, it’s always recommended to assess your specific situation and consider the potential risks involved.