What Is A Car Insurance Premium

Car insurance is a fundamental aspect of vehicle ownership, providing financial protection and peace of mind for drivers around the world. At its core, car insurance is a contract between an individual and an insurance company, where the insurance provider agrees to cover the costs associated with specific incidents in exchange for regular payments known as premiums.

The car insurance premium is the price an individual pays for the insurance coverage. It is a vital component of the insurance policy, representing the financial commitment of the policyholder to maintain the protection offered by the insurer. Understanding car insurance premiums is crucial for any driver, as it directly impacts their budget and the level of coverage they can obtain.

The Importance of Car Insurance Premiums

Car insurance premiums are not just a cost; they are an investment in financial security and risk management. By paying a premium, policyholders transfer the financial risk of potential accidents, theft, or other vehicle-related incidents to the insurance company. This ensures that drivers are not left solely responsible for the often substantial costs of repairing or replacing their vehicles, or covering liability claims.

The premium also plays a pivotal role in determining the coverage limits and additional benefits of an insurance policy. Policyholders with higher premiums often have access to more comprehensive coverage, including higher liability limits, roadside assistance, rental car reimbursement, and other valuable perks. In this sense, the premium acts as a gateway to a range of essential protections and services.

How Are Car Insurance Premiums Calculated?

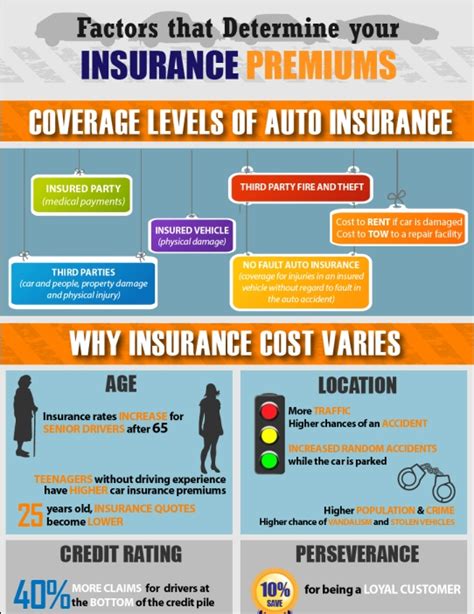

The calculation of car insurance premiums is a complex process that takes into account numerous factors. Insurance companies employ actuarial science to assess the potential risks associated with each policyholder and determine an appropriate premium. These factors can vary depending on the insurer and the type of coverage, but generally include:

- Driver's Age and Gender: Younger drivers, especially males, are often considered higher-risk due to their propensity for more frequent and severe accidents. As a result, their premiums tend to be higher.

- Driving Record: A clean driving record with no accidents or violations is generally rewarded with lower premiums. Conversely, a history of accidents or traffic violations can significantly increase insurance costs.

- Vehicle Type and Usage: The make, model, and year of the vehicle, as well as how it is used (e.g., commuting, pleasure, business), can influence premiums. Higher-value vehicles or those used for business purposes may incur higher premiums.

- Location: The area where the vehicle is primarily driven and garaged can impact premiums. Urban areas with higher population densities and more traffic tend to have higher premiums due to increased accident risks.

- Credit Score: In many states, insurance companies are allowed to use credit scores as a factor in premium calculations. Individuals with higher credit scores are often considered lower-risk and may receive more favorable premiums.

- Coverage Options and Limits: The level of coverage and the limits chosen by the policyholder directly affect the premium. Comprehensive and collision coverage, higher liability limits, and additional perks all contribute to a higher premium.

Example: Calculating Premiums Based on Risk Factors

Let’s consider an example to illustrate how these factors might influence premium calculations. Meet John, a 25-year-old male living in a busy urban area. He drives a 2018 Toyota Corolla primarily for commuting to work and has a clean driving record. His credit score is average, and he opts for basic liability coverage with a $500 deductible.

| Risk Factor | Impact on Premium |

|---|---|

| Age and Gender | Younger males are often considered higher-risk, so John's premium will likely be higher than that of an older female driver. |

| Driving Record | John's clean driving record is a positive factor, helping to offset his age and gender. |

| Vehicle Type and Usage | The Toyota Corolla is a relatively safe and affordable car, and John's usage for commuting is considered lower-risk compared to business or pleasure driving. |

| Location | Living in an urban area with high traffic density, John's premium will likely be higher due to increased accident risks. |

| Credit Score | With an average credit score, John may not receive any significant discounts or surcharges based on this factor. |

| Coverage Options | Choosing basic liability coverage with a $500 deductible keeps John's premium relatively low compared to more comprehensive coverage options. |

Factors Affecting Car Insurance Premiums

Beyond the standard risk factors, several other variables can influence car insurance premiums. These include:

- Marital Status: Married individuals are often considered lower-risk and may receive premium discounts.

- Education Level: Some insurers offer discounts for policyholders with higher education levels.

- Occupation: Certain occupations, such as those in the military or certain professions, may be eligible for discounts.

- Bundling Policies: Insurers often offer discounts when policyholders bundle multiple policies (e.g., auto and home insurance) with the same company.

- Discounts and Incentives: Many insurers provide discounts for safe driving, vehicle safety features, and other factors.

Real-World Example: Premium Variations

To provide a real-world perspective, let’s compare the premiums for two individuals with similar profiles but different risk factors. Meet Sarah, a 30-year-old female living in a suburban area, and Mike, a 30-year-old male living in the same area. Both drive a 2015 Honda Civic and have clean driving records.

| Individual | Premium (Annual) |

|---|---|

| Sarah (Female) | $800 |

| Mike (Male) | $1,000 |

In this example, Mike's premium is higher due to his gender, despite his identical driving record and vehicle to Sarah's. This illustrates the real-world impact of risk factors on insurance premiums.

Tips for Managing Car Insurance Premiums

While car insurance premiums are primarily determined by risk factors, there are several strategies policyholders can employ to manage their costs:

- Shop Around: Compare quotes from multiple insurers to find the best rates for your specific situation.

- Maintain a Clean Driving Record: Avoid accidents and violations to keep your premiums as low as possible.

- Choose a Higher Deductible: Opting for a higher deductible can reduce your premium, but be sure you can afford the higher out-of-pocket cost if an accident occurs.

- Bundle Policies: If you have multiple insurance needs, consider bundling them with the same insurer to take advantage of multi-policy discounts.

- Explore Discounts: Many insurers offer discounts for safe driving, vehicle safety features, good grades (for young drivers), and more. Ask your insurer about potential discounts.

Expert Insight: Balancing Coverage and Cost

The Future of Car Insurance Premiums

As technology continues to advance, the landscape of car insurance premiums is likely to evolve. Telematics, which uses in-vehicle devices or smartphone apps to track driving behavior, is already influencing premiums in some regions. Insurers are also exploring the use of artificial intelligence and machine learning to more accurately assess risks and price policies.

Additionally, the rise of electric and autonomous vehicles, as well as the sharing economy, is expected to bring new challenges and opportunities for insurers and policyholders alike. These developments may lead to new pricing models and coverage options, further shaping the future of car insurance premiums.

FAQs

How often do car insurance premiums change?

+Premiums can change annually or even more frequently, depending on the insurer and the policy terms. Factors such as changes in risk profile, claims history, or policy updates can trigger premium adjustments.

Can I negotiate my car insurance premium?

+While you cannot directly negotiate your premium, you can shop around for better rates and explore discounts to potentially lower your costs. Speaking with an insurance agent can also help you understand your options and make informed decisions.

What is the average car insurance premium in the United States?

+The average annual car insurance premium in the U.S. varies by state and can range from a few hundred dollars to over $2,000. Factors such as state regulations, competition among insurers, and the cost of living can influence these averages.