Definition Of Insurance

Unraveling the Complexity: A Comprehensive Definition of Insurance

In a world filled with uncertainties, insurance stands as a pivotal financial tool, offering individuals and businesses a crucial layer of protection and risk management. This article delves deep into the essence of insurance, shedding light on its definition, purpose, and the intricate mechanisms that underpin this essential industry.

At its core, insurance is a contractual agreement between an individual or entity (the policyholder) and an insurance company (the insurer). This agreement, known as an insurance policy, serves as a safeguard against potential financial losses resulting from various events, ranging from accidents and illnesses to natural disasters and even everyday mishaps.

The primary objective of insurance is to transfer the risk of financial loss from the policyholder to the insurer. By doing so, it provides a safety net that ensures individuals and businesses can manage unforeseen circumstances without facing devastating financial consequences.

The concept of insurance is rooted in the principle of shared risk. When a large group of people or entities pool their resources together to cover potential losses, the burden of any single event becomes more manageable. This collective risk-sharing is the foundation upon which the insurance industry is built.

The Mechanics of Insurance

Insurance operates on a straightforward yet effective premise. The policyholder pays a premium, which is a regular monetary contribution, to the insurer. In return, the insurer agrees to compensate the policyholder for specific losses or damages as outlined in the insurance policy.

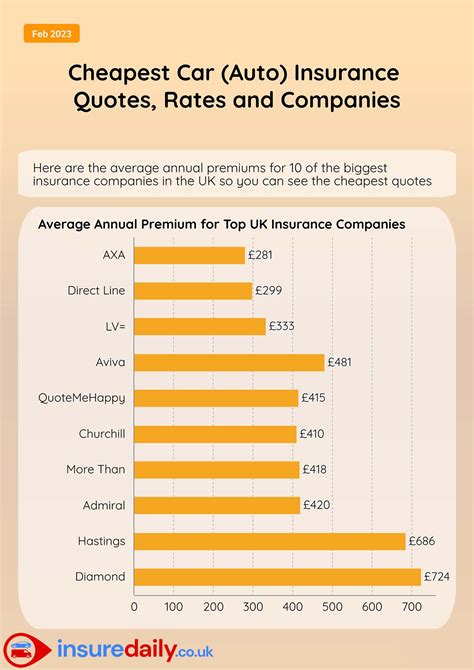

The premium is calculated based on a variety of factors, including the type of coverage, the level of risk associated with the insured activity or asset, and the policyholder's personal circumstances. These factors determine the likelihood and potential cost of a claim, which, in turn, influences the premium amount.

When a policyholder experiences a covered loss or damage, they file a claim with the insurer. The insurer then assesses the claim, verifies the validity and extent of the loss, and pays out the agreed-upon amount, known as the benefit or indemnity.

Insurance policies are tailored to specific needs, offering coverage for a wide range of scenarios. From health insurance to auto insurance, homeowners' insurance, and business insurance, each type serves a unique purpose, providing protection against the specific risks associated with different aspects of life and business.

The Impact and Benefits of Insurance

The impact of insurance extends far beyond the financial realm. It plays a crucial role in promoting social and economic stability by mitigating the financial impact of unexpected events. For individuals, insurance provides peace of mind, knowing that they are prepared for the unexpected, whether it's a sudden illness, an accident, or a natural disaster.

For businesses, insurance is an essential risk management tool. It protects assets, ensures continuity, and safeguards against potential liabilities, allowing businesses to focus on growth and innovation without the constant worry of financial ruin.

Furthermore, insurance fosters a sense of community and shared responsibility. By pooling resources, individuals and businesses contribute to a collective fund that provides support when needed, creating a resilient and supportive society.

Types of Insurance

The insurance industry offers a vast array of coverage options, each designed to address specific risks. Here's an overview of some common types of insurance:

- Health Insurance: This covers medical expenses, including hospitalization, surgeries, and prescription drugs. It provides financial protection against the high costs of healthcare.

- Life Insurance: Designed to provide a financial safety net for loved ones in the event of the policyholder's death. It can offer peace of mind and ensure financial stability for beneficiaries.

- Auto Insurance: Essential for vehicle owners, this coverage protects against financial losses resulting from accidents, theft, and other vehicle-related incidents.

- Homeowners' Insurance: Provides protection for homeowners against damages to their property, including natural disasters, theft, and liability claims.

- Business Insurance: A broad category that includes various types of coverage tailored to the specific needs of businesses, such as property damage, liability, and business interruption insurance.

The Future of Insurance

The insurance industry is undergoing significant transformations driven by technological advancements and changing consumer expectations. Here's a glimpse into the future of insurance:

- Digitalization: The rise of digital technologies has led to more efficient and accessible insurance services. Online platforms and mobile apps offer convenient policy management and streamlined claim processes.

- Data Analytics: Advanced analytics and artificial intelligence are revolutionizing risk assessment and underwriting. Insurers can now make more accurate predictions and tailor policies to individual needs, improving overall efficiency.

- Personalized Insurance: With data-driven insights, insurers can offer highly customized policies that cater to the unique risks and preferences of each policyholder.

- Blockchain Technology: Blockchain has the potential to revolutionize insurance contracts, making them more secure and transparent, and even enabling the creation of decentralized insurance models.

- Parametric Insurance: This innovative approach pays out based on pre-defined parameters, such as weather conditions or natural disasters, streamlining the claim process and providing faster payouts.

Conclusion

Insurance is more than just a financial product; it's a cornerstone of modern life and business. By understanding the definition and mechanics of insurance, individuals and businesses can make informed decisions to protect their financial well-being and navigate the complexities of an uncertain world with confidence.

What is the main purpose of insurance?

+The primary purpose of insurance is to transfer the risk of financial loss from the policyholder to the insurer, providing a safety net to manage unforeseen circumstances without devastating financial consequences.

How does insurance work in practice?

+Insurance operates on a simple principle: policyholders pay premiums to insurers, and in return, insurers agree to compensate policyholders for specific losses or damages outlined in the insurance policy. When a policyholder experiences a covered loss, they file a claim, and the insurer assesses and pays out the agreed-upon amount.

What are the benefits of having insurance coverage?

+Insurance provides peace of mind, financial protection, and stability. It helps individuals and businesses manage unexpected events, ensures continuity, and fosters a sense of community through shared risk-pooling.