Insurance And Liabilities

Welcome to a comprehensive exploration of the intricate world of insurance and liabilities. This article aims to delve deep into the complex relationship between these two fundamental aspects of risk management, offering an in-depth analysis and expert insights to enhance your understanding of this critical topic.

Understanding the Fundamentals: Insurance and Liabilities

Insurance and liabilities are integral components of the modern business and personal landscape, providing a safety net against unforeseen events and potential risks. While often discussed together, these concepts have distinct yet interconnected roles in managing risk and ensuring financial stability.

The Role of Insurance

Insurance is a financial tool designed to protect individuals, businesses, and assets from the financial burdens of unforeseen events, such as accidents, natural disasters, or lawsuits. It operates on the principle of risk pooling, where a group of individuals or entities contributes premiums to a central fund. In the event of a covered loss, the insurer compensates the policyholder, thereby mitigating the financial impact of the event.

For instance, imagine a small business owner who takes out a property insurance policy. In the event of a fire that damages their premises, the insurance company would assess the damage and provide financial compensation to help cover the costs of repairs or replacements. This ensures the business can continue operating without incurring catastrophic financial losses.

Liabilities: A Legal and Financial Obligation

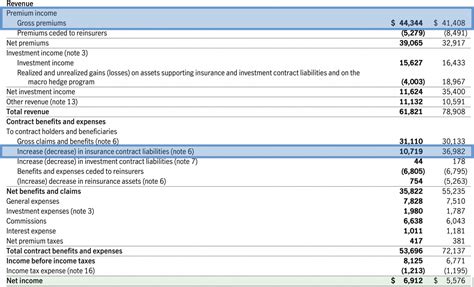

Liabilities, on the other hand, represent a legal and financial obligation. They are debts or obligations that an individual or entity is responsible for. In the context of business, liabilities can arise from various sources, including contractual agreements, legal disputes, or operational activities. Liabilities can be either current (due within one year) or long-term (due beyond one year), and they are an essential component of a company’s financial health.

Consider a manufacturing company that produces a faulty product resulting in injuries to consumers. The company would be liable for the injuries caused, and they would likely face lawsuits and legal obligations to compensate the affected individuals. This is where insurance plays a crucial role in mitigating the financial impact of such liabilities.

The Interplay Between Insurance and Liabilities

The relationship between insurance and liabilities is complex and multifaceted. Insurance policies are designed to cover specific liabilities, providing a financial safety net for policyholders. However, the coverage provided by insurance is not unlimited, and it is essential to understand the nuances of insurance policies to ensure adequate protection.

Types of Insurance and Their Liabilities

Various types of insurance policies exist to cover different types of liabilities. Here are some common types and their associated liabilities:

- Property Insurance: Covers physical damage or loss to assets such as buildings, equipment, and inventory. Liabilities include fire, theft, natural disasters, and vandalism.

- Liability Insurance: Protects individuals and businesses from legal claims and lawsuits. Liabilities may include bodily injury, property damage, or professional negligence.

- Health Insurance: Provides coverage for medical expenses. Liabilities include medical treatments, hospital stays, and prescription medications.

- Auto Insurance: Offers protection against financial loss from vehicle-related accidents. Liabilities include bodily injury to others, property damage, and vehicle repairs.

- Business Insurance: A range of policies tailored to specific business needs, covering liabilities such as product defects, employee injuries, or cyber attacks.

The Insurance Policy: A Detailed Analysis

An insurance policy is a legal contract between the insurer and the policyholder, outlining the rights and obligations of both parties. It specifies the coverage, exclusions, and limits of the policy, as well as the premium payments required. Understanding the intricacies of an insurance policy is crucial to ensure adequate protection against liabilities.

Key components of an insurance policy include:

- Declarations Page: Provides an overview of the policy, including the policyholder's name, policy period, and premium.

- Insuring Agreements: Outlines the coverage provided by the policy, including any specific conditions or limitations.

- Exclusions: Details the events or circumstances not covered by the policy, such as intentional acts or specific types of damage.

- Limitations and Conditions: Specifies the restrictions on coverage, such as maximum payout amounts or time limits for filing claims.

- Definitions: Defines key terms used in the policy to ensure a clear understanding of the coverage.

It is essential to carefully review the policy documents and seek professional advice to ensure that the insurance coverage aligns with the potential liabilities an individual or business faces.

The Impact of Liabilities on Insurance

Liabilities can significantly impact insurance coverage and premiums. When a policyholder faces increased liabilities, their insurance provider may adjust the policy terms, including raising premiums or introducing additional exclusions. This is especially true in cases where the policyholder has a history of claims or is engaged in high-risk activities.

For instance, a business that has experienced multiple liability claims in the past may find it challenging to obtain insurance coverage or may face significantly higher premiums. This is because insurance companies assess the risk profile of policyholders and adjust their premiums accordingly. High-risk activities or a history of claims can lead to higher premiums or even non-renewal of policies.

Managing Liabilities and Insurance Costs

Effective risk management strategies are crucial for individuals and businesses to mitigate liabilities and control insurance costs. Here are some strategies to consider:

- Risk Assessment: Conduct a thorough assessment of potential risks and liabilities. Identify areas where losses are most likely to occur and implement measures to reduce these risks.

- Loss Control Measures: Implement safety protocols, employee training, and regular maintenance to minimize the likelihood of accidents or losses.

- Insurance Shopping: Compare insurance policies and providers to find the best coverage at a competitive price. Consider bundling policies to potentially save on premiums.

- Risk Retention: Assess the financial capacity to retain a certain level of risk. For small risks, it may be more cost-effective to self-insure rather than purchase insurance.

- Risk Transfer: For larger risks, consider transferring the risk to an insurance company through a comprehensive insurance policy. This ensures financial protection against significant losses.

Future Trends and Considerations

The insurance and liability landscape is constantly evolving, influenced by technological advancements, changing regulations, and shifting societal expectations. Here are some key trends and considerations for the future:

Technology and Digital Transformation

The insurance industry is embracing digital technologies to enhance efficiency, improve customer experience, and streamline processes. From online policy management to real-time risk assessment, technology is revolutionizing the way insurance is delivered and consumed.

For example, the use of telematics in auto insurance allows insurers to monitor driving behavior and offer personalized premiums based on actual driving habits. This technology not only improves risk assessment but also encourages safer driving practices.

Regulatory Changes and Compliance

Changing regulations can significantly impact the insurance industry. From data privacy laws to new liability requirements, insurers must stay abreast of legal developments to ensure compliance and maintain competitive advantage.

For instance, the introduction of GDPR (General Data Protection Regulation) in the European Union has had a profound impact on the insurance industry, requiring insurers to implement robust data protection measures and transparency in handling personal information.

Environmental and Social Considerations

With growing awareness of environmental and social issues, insurers are increasingly focusing on sustainability and ethical practices. This includes offering insurance products that support sustainable initiatives and promoting responsible business practices among policyholders.

For example, some insurers are now offering coverage for green technologies and renewable energy projects, incentivizing the adoption of sustainable practices.

The Rise of Insurtech

Insurtech, the fusion of insurance and technology, is disrupting traditional insurance models. Startups and innovative companies are leveraging technology to offer more efficient and personalized insurance solutions, challenging established insurers.

Insurtech companies are often more agile and customer-centric, using data analytics and machine learning to offer tailored insurance products and improved risk assessment.

Conclusion: A Comprehensive Risk Management Approach

Insurance and liabilities are inseparable aspects of modern life and business. Understanding the complex relationship between these concepts is essential for effective risk management. By carefully assessing potential liabilities, choosing the right insurance coverage, and implementing risk mitigation strategies, individuals and businesses can navigate the complex world of insurance and liabilities with confidence.

As the insurance industry continues to evolve, staying informed about emerging trends and technological advancements will be crucial for policyholders and insurers alike. The future of insurance promises greater personalization, enhanced risk assessment, and a more sustainable approach to risk management.

How do I choose the right insurance coverage for my business?

+When selecting insurance coverage for your business, consider your specific industry, the types of risks you face, and the potential liabilities that could arise. Conduct a comprehensive risk assessment and consult with insurance professionals to determine the most suitable coverage. Remember to review and update your insurance policies regularly to ensure they align with your business’s evolving needs.

What happens if my insurance claim is denied?

+If your insurance claim is denied, it’s important to understand the reasons for the denial. Insurance companies may deny claims due to policy exclusions, late reporting, or insufficient evidence. Review the denial notice carefully and consider appealing the decision if you believe it was made in error. Seek legal advice if necessary to protect your rights.

How can I reduce my insurance premiums as a business owner?

+To reduce insurance premiums as a business owner, focus on implementing robust risk management strategies. This includes maintaining a safe work environment, conducting regular safety audits, and ensuring compliance with relevant regulations. By demonstrating a low-risk profile, you may be able to negotiate more favorable insurance rates with your provider.