Cheapest Home Insurance In Florida

Finding the cheapest home insurance in Florida can be a daunting task, especially with the state's unique set of challenges and considerations. From hurricane risks to sinkholes, Florida homeowners face a myriad of potential hazards that can significantly impact their insurance costs. In this comprehensive guide, we delve into the factors influencing home insurance rates in Florida, explore the best practices for securing affordable coverage, and provide an in-depth analysis of the most cost-effective insurance providers in the state. By understanding the intricacies of the Florida home insurance market, homeowners can make informed decisions to protect their homes and wallets.

Understanding the Cost Factors in Florida’s Home Insurance Market

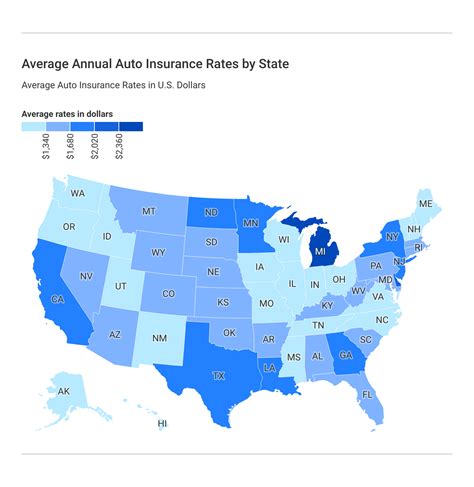

The cost of home insurance in Florida is influenced by a multitude of factors, many of which are unique to the Sunshine State. Here’s a breakdown of the key considerations:

Natural Disasters and Risk Assessment

Florida’s susceptibility to hurricanes, tropical storms, and other natural disasters is a primary driver of insurance costs. Insurance companies carefully assess the risk associated with each property’s location, taking into account factors such as proximity to the coast, historical hurricane paths, and flood zones. Properties in high-risk areas often incur higher premiums to account for the increased likelihood of claims.

| Risk Factor | Impact on Premiums |

|---|---|

| Hurricane Risk | Higher premiums for coastal properties |

| Flood Zones | Increased rates in flood-prone areas |

| Wildfire Risk | Surcharges in wildfire-prone regions |

Construction and Building Codes

The construction materials and methods used in a home’s construction play a significant role in determining insurance rates. Homes built with hurricane-resistant materials or designed to withstand high winds may qualify for discounts. Additionally, adherence to Florida’s stringent building codes, which are regularly updated to enhance disaster resistance, can impact insurance costs.

Claim History and Credit Score

Insurance companies assess a property’s claim history when determining rates. Homes with a history of frequent or costly claims may face higher premiums or even non-renewal. Similarly, an individual’s credit score can impact their insurance rates, with higher scores often correlating to lower premiums.

Coverage and Deductibles

The level of coverage and deductibles chosen by a homeowner also influence the cost of their insurance policy. Opting for higher deductibles can result in lower premiums, but it’s essential to strike a balance between affordability and adequate protection.

Strategies for Securing Affordable Home Insurance in Florida

Given the unique challenges of the Florida home insurance market, homeowners can employ several strategies to reduce their insurance costs without compromising on coverage. Here are some effective approaches:

Bundle Policies

Bundling multiple insurance policies, such as home and auto insurance, with the same provider can often lead to significant savings. Many insurance companies offer multi-policy discounts, so it’s worth exploring this option to maximize cost-effectiveness.

Choose the Right Coverage

Carefully evaluate your insurance needs and opt for coverage that aligns with your specific requirements. Overinsuring your home can lead to unnecessary expenses, while underinsuring may leave you vulnerable in the event of a claim. Work with an insurance agent to tailor a policy that provides adequate protection without being excessive.

Explore Discounts

Insurance companies offer a range of discounts that can help reduce your premiums. These may include:

- Home Safety Discounts: For homes equipped with security systems, smoke detectors, or fire sprinklers.

- Loyalty Discounts: Rewards for long-term customers who have maintained their policies without claims.

- Retirement Discounts: Many insurers offer reduced rates for homeowners aged 55 and older.

- Green Home Discounts: Incentives for eco-friendly homes that use sustainable materials or energy-efficient systems.

Shop Around and Compare

Don’t settle for the first insurance quote you receive. Take the time to compare rates from multiple providers. Online quote comparison tools can be a valuable resource, but it’s also beneficial to speak with insurance agents to understand the nuances of each policy and ensure you’re getting the best value.

Top Affordable Home Insurance Providers in Florida

Now that we’ve explored the cost factors and strategies for reducing insurance costs, let’s delve into the providers that consistently offer some of the most affordable home insurance rates in Florida.

State Farm

State Farm is a leading provider of home insurance in Florida, known for its competitive rates and comprehensive coverage options. They offer a range of discounts, including multi-policy discounts and loyalty rewards. State Farm’s policies can be customized to meet individual needs, making them a flexible choice for homeowners seeking affordable coverage.

Progressive

Progressive is a well-established insurance company that provides home insurance policies tailored to Florida’s unique challenges. Their policies include coverage for hurricane and wind damage, as well as options for additional protection against specific risks. Progressive offers competitive rates and a user-friendly online platform for managing policies and submitting claims.

Allstate

Allstate is another prominent insurance provider in Florida, offering a range of home insurance policies with customizable coverage limits and deductibles. They provide specialized endorsements for unique risks, such as sinkhole coverage, which is essential for many Florida homeowners. Allstate’s policies often include discounts for bundling with other insurance types.

USAA

USAA is a highly regarded insurance provider exclusively serving military members, veterans, and their families. They offer comprehensive home insurance policies with competitive rates and excellent customer service. USAA’s policies include coverage for a range of risks, including hurricanes and other natural disasters common in Florida. Eligibility for USAA’s services is restricted to those with military affiliations.

Amica

Amica is a highly recommended provider for homeowners seeking affordable and reliable insurance coverage. They offer a range of discounts, including multi-policy savings, loyalty rewards, and discounts for safe homes. Amica’s policies can be tailored to individual needs, ensuring homeowners receive the coverage they require without paying for unnecessary add-ons.

CSG

CSG, or Citizens Property Insurance Corporation, is a state-run insurance provider that serves as a last resort for homeowners who are unable to secure coverage from private insurers. While CSG’s rates are often higher than private insurers, they provide a vital safety net for those with high-risk properties or who face challenges obtaining coverage elsewhere. CSG’s policies cover a range of risks, including hurricanes and other natural disasters.

Performance Analysis and Customer Satisfaction

When selecting a home insurance provider, it’s crucial to consider not only the cost of the policy but also the provider’s performance and customer satisfaction ratings. Here’s an overview of the performance and customer satisfaction metrics for the aforementioned insurance providers:

State Farm

State Farm consistently ranks highly in customer satisfaction surveys, with a strong reputation for prompt claim processing and excellent customer service. They offer a range of resources to help homeowners understand their policies and navigate the claims process.

Progressive

Progressive is known for its innovative approach to insurance, with a user-friendly online platform and mobile app that simplify policy management and claim submission. They offer 24⁄7 customer support and have a strong track record of timely claim settlements.

Allstate

Allstate provides a comprehensive suite of insurance products and services, including home insurance tailored to Florida’s unique risks. They offer a dedicated claims team and a range of resources to help homeowners navigate the claims process. Allstate’s customer service is highly regarded, with a focus on providing personalized assistance.

USAA

USAA consistently ranks at the top of customer satisfaction surveys, with an exceptional reputation for customer service and claim handling. They offer a range of digital tools to simplify policy management and claim submission, and their customer support is widely praised for its efficiency and effectiveness.

Amica

Amica is renowned for its outstanding customer service and has consistently received top ratings in customer satisfaction surveys. They offer a personalized approach to insurance, with dedicated agents who work closely with customers to ensure their policies meet their specific needs. Amica’s claim handling process is highly efficient, with a focus on prompt and fair settlements.

CSG

CSG, as a state-run insurer, aims to provide a safety net for homeowners who face challenges obtaining coverage elsewhere. While their customer service and claim handling processes may not match the level of personalization offered by private insurers, they strive to provide efficient and effective support to policyholders.

Future Implications and Industry Trends

The home insurance landscape in Florida is constantly evolving, influenced by natural disasters, regulatory changes, and advancements in technology. Here are some key trends and future implications to consider:

Advancements in Risk Assessment

Insurance companies are increasingly utilizing advanced technologies, such as satellite imagery and artificial intelligence, to assess risk more accurately. This allows for more precise underwriting, which can lead to better-tailored policies and potentially lower premiums for homeowners.

Climate Change and Natural Disaster Preparedness

As climate change continues to impact Florida’s weather patterns, the frequency and severity of natural disasters are likely to increase. Insurance companies are adapting their policies and risk assessment methods to account for these changing conditions. Homeowners can expect more emphasis on disaster preparedness and mitigation measures to reduce the impact of natural disasters.

Regulatory Changes and Consumer Protection

The Florida Office of Insurance Regulation plays a vital role in overseeing the insurance market and protecting consumers. Ongoing regulatory changes aim to enhance consumer protection and ensure fair practices within the industry. Homeowners can expect continued oversight and advocacy to maintain a competitive and transparent insurance market.

Digital Transformation and Customer Experience

The insurance industry is undergoing a digital transformation, with insurers investing in technology to enhance the customer experience. From online policy management to digital claim submission, insurers are making it easier and more efficient for homeowners to access and manage their insurance policies. This trend is likely to continue, with insurers leveraging technology to improve customer satisfaction and streamline processes.

Conclusion

Securing affordable home insurance in Florida requires a thoughtful approach that considers the unique challenges and risks faced by homeowners in the Sunshine State. By understanding the cost factors, employing effective strategies, and choosing the right insurance provider, homeowners can protect their homes and finances. As the insurance landscape continues to evolve, staying informed about industry trends and advancements will be key to making informed decisions and securing the best value for your home insurance needs.

What is the average cost of home insurance in Florida?

+The average cost of home insurance in Florida varies based on several factors, including the location, size, and construction of the home, as well as the level of coverage and deductibles chosen. On average, homeowners in Florida can expect to pay between 1,500 and 3,000 annually for home insurance.

Are there any ways to reduce my home insurance premiums in Florida?

+Yes, there are several strategies to reduce your home insurance premiums in Florida. These include bundling policies, choosing the right coverage, exploring discounts, and shopping around for the best rates. Additionally, maintaining a good credit score and keeping your home well-maintained can also impact your premiums.

What should I look for when choosing a home insurance provider in Florida?

+When choosing a home insurance provider in Florida, consider factors such as the provider’s financial stability, their coverage options and limits, the availability of discounts, and their customer service and claim handling reputation. It’s also important to ensure the provider offers coverage for the specific risks relevant to your area, such as hurricanes or sinkholes.

How often should I review my home insurance policy in Florida?

+It’s recommended to review your home insurance policy annually or whenever your circumstances change, such as renovations or additions to your home. Regular reviews ensure that your coverage remains adequate and that you’re not paying for unnecessary add-ons. Additionally, reviewing your policy allows you to explore potential discounts or changes in the market that could benefit you.