Best Insurance Life

When it comes to safeguarding your financial future and the well-being of your loved ones, choosing the best life insurance policy is a critical decision. With countless options available in the market, it can be daunting to navigate the complex world of life insurance. In this comprehensive guide, we will delve into the key factors to consider, provide expert insights, and help you make an informed choice to ensure you select the best insurance life coverage tailored to your unique needs.

Understanding Life Insurance

Life insurance is a financial safety net designed to provide peace of mind and support to your beneficiaries in the event of your untimely passing. It offers a lump-sum payment, known as a death benefit, to your designated recipients, ensuring they can maintain their standard of living and cover expenses such as funeral costs, outstanding debts, and ongoing living expenses.

The primary purpose of life insurance is to mitigate financial risks and ensure that your loved ones are not left burdened with financial difficulties during an already challenging time. It is an essential component of any comprehensive financial plan, offering protection and stability to your family or chosen beneficiaries.

Types of Life Insurance

The life insurance market offers a wide range of policies, each designed to cater to different needs and life stages. Understanding the key types of life insurance is crucial in selecting the best coverage for your specific circumstances.

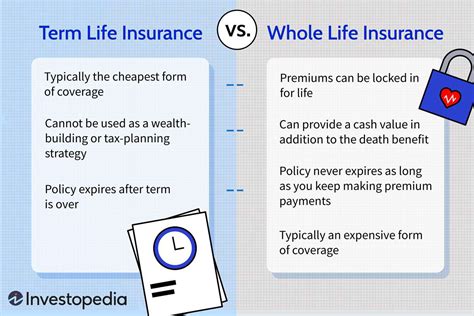

Term Life Insurance

Term life insurance is a popular choice for those seeking affordable and flexible coverage. This type of policy provides death benefit protection for a specified term, typically ranging from 10 to 30 years. It is ideal for individuals who have temporary financial obligations such as young children, a mortgage, or outstanding debts that they wish to cover in the event of their passing.

Term life insurance offers high coverage amounts at a relatively low cost, making it an attractive option for those with budget constraints. However, it is important to note that the policy does not accumulate cash value and the premiums may increase as the insured individual ages.

Permanent Life Insurance

Permanent life insurance, including whole life and universal life policies, provides lifetime coverage and offers additional benefits beyond a simple death benefit. These policies accumulate cash value over time, which can be accessed through loans or withdrawals during the insured’s lifetime.

Whole life insurance offers a fixed premium and a guaranteed death benefit, making it a stable and predictable option. Universal life insurance, on the other hand, provides more flexibility in terms of premium payments and death benefit amounts, allowing policyholders to adjust their coverage as their needs change.

Other Types of Life Insurance

In addition to term and permanent life insurance, there are other specialized types of policies available, including:

- Final Expense Insurance: A small, affordable policy designed to cover funeral and burial costs.

- Mortgage Life Insurance: A policy that pays off the remaining balance of a mortgage upon the insured's death.

- Group Life Insurance: Coverage offered through an employer or association, often at a discounted rate.

- Guaranteed Issue Life Insurance: A policy that does not require a medical exam, ideal for those with pre-existing health conditions.

Key Factors to Consider

When selecting the best life insurance policy, several critical factors should be taken into account to ensure the coverage aligns with your unique circumstances and goals.

Coverage Amount

Determining the appropriate coverage amount is essential to ensure your beneficiaries receive sufficient financial support. Consider your current and future financial obligations, such as:

- Outstanding debts (mortgage, loans, credit cards)

- Children's education expenses

- Spouse or partner's living expenses

- Funeral and burial costs

- Any other specific financial goals or needs

Working with a financial advisor or using online calculators can help you estimate the ideal coverage amount to ensure your loved ones' financial well-being.

Policy Duration

The duration of your policy should be aligned with your life stage and financial goals. Term life insurance is ideal for those with temporary financial obligations, while permanent life insurance provides lifetime coverage and additional benefits.

Consider the following when deciding on policy duration:

- When do you anticipate your financial obligations will decrease or be fulfilled (e.g., mortgage paid off, children become independent)?

- Do you have long-term financial goals that require coverage beyond a standard term policy (e.g., estate planning, business succession)?

Premiums and Affordability

Life insurance premiums can vary significantly based on the type of policy, coverage amount, and the insured’s age, health, and lifestyle. It is crucial to find a policy that offers adequate coverage while remaining affordable within your budget.

Shop around and compare quotes from multiple insurers to find the best combination of coverage and cost. Consider the long-term financial commitment and ensure the premiums are sustainable for the duration of the policy.

Health and Lifestyle Factors

Your health and lifestyle play a significant role in determining your life insurance eligibility and premium rates. Insurers will typically require a medical exam and review your medical history to assess your risk profile.

If you have a pre-existing health condition, consider guaranteed issue life insurance or simplified issue life insurance, which may have more flexible eligibility criteria but often come with higher premiums and lower coverage limits.

Expert Tips for Choosing the Best Insurance Life

To ensure you make the best decision when selecting life insurance, consider the following expert advice and strategies:

Seek Professional Guidance

Working with a licensed and experienced insurance agent or financial advisor can provide valuable insights and tailored recommendations based on your unique circumstances. They can help you navigate the complex world of life insurance and ensure you make an informed choice.

Compare Multiple Policies

Don’t settle for the first policy you come across. Compare multiple options from different insurers to find the best coverage and premium combination. Online comparison tools and quotes can be a great starting point to assess your options.

Consider Riders and Add-Ons

Life insurance policies often offer additional riders or add-ons that can enhance your coverage. Some common options include:

- Waiver of Premium: This rider waives your premium payments if you become disabled.

- Accelerated Death Benefit: Allows you to access a portion of your death benefit if you are diagnosed with a terminal illness.

- Child Rider: Provides a small amount of coverage for your children in the event of your passing.

Review and Update Regularly

Your life insurance policy should evolve with your changing circumstances and needs. Review your coverage regularly, especially after significant life events such as marriage, birth of a child, purchasing a home, or retirement. Ensure your policy remains adequate and aligned with your financial goals.

Performance Analysis and Reputation

When selecting the best life insurance company, it is crucial to assess their financial stability and reputation. Look for insurers with a strong financial rating from reputable agencies such as A.M. Best, Standard & Poor’s, or Moody’s. This ensures the company has the financial strength to honor their policy obligations.

Additionally, consider the customer service and claim settlement reputation of the insurer. Online reviews and industry ratings can provide valuable insights into the insurer's reliability and customer satisfaction. A company with a positive track record and a history of prompt claim settlements is a safer bet for long-term policyholders.

Future Implications and Peace of Mind

Choosing the best life insurance policy provides long-term financial security and peace of mind for both you and your loved ones. It ensures that, in the event of your passing, your beneficiaries will have the necessary resources to maintain their standard of living and fulfill their financial obligations.

By carefully considering your unique needs, comparing policies, and seeking expert guidance, you can make an informed decision and select the best insurance life coverage to protect your family's future.

Frequently Asked Questions

How much life insurance coverage do I need?

+

The amount of life insurance coverage you need depends on your individual circumstances and financial obligations. As a general rule, aim for a coverage amount that can replace your income for at least 10 years and cover any outstanding debts and expenses. Consider using online calculators or consulting a financial advisor to determine the ideal coverage amount for your situation.

What is the difference between term and permanent life insurance?

+

Term life insurance provides coverage for a specified period, typically ranging from 10 to 30 years, and offers high coverage amounts at a relatively low cost. It is ideal for temporary financial obligations. Permanent life insurance, such as whole life or universal life, provides lifetime coverage and accumulates cash value, offering more comprehensive benefits and flexibility.

Do I need to undergo a medical exam to get life insurance?

+

Most life insurance policies require a medical exam to assess your health and determine your risk profile. However, there are options such as guaranteed issue life insurance or simplified issue life insurance that may not require a medical exam but often come with higher premiums and lower coverage limits.

Can I add riders or additional benefits to my life insurance policy?

+

Yes, many life insurance policies offer riders or additional benefits that can enhance your coverage. Common riders include waiver of premium, accelerated death benefit, and child rider. These add-ons can provide extra protection and flexibility to your policy, tailored to your specific needs.

How often should I review and update my life insurance policy?

+

It is recommended to review your life insurance policy regularly, especially after significant life events such as marriage, birth of a child, purchasing a home, or retirement. These changes may impact your financial obligations and coverage needs. Regular reviews ensure your policy remains adequate and aligned with your evolving circumstances.