Local Insurance Brokers Near Me

In today's world, navigating the complex landscape of insurance policies can be a daunting task. Whether you're seeking comprehensive coverage for your home, auto, or health, finding a trusted advisor who understands your unique needs is crucial. This is where local insurance brokers step in, offering personalized guidance and expertise to help you make informed decisions. In this comprehensive guide, we will explore the world of local insurance brokers, their services, and how they can benefit you. By the end, you'll have a clear understanding of why seeking professional assistance from a nearby insurance broker is an essential step in securing your financial future.

The Role of Local Insurance Brokers

Local insurance brokers serve as your trusted advisors in the often-confusing world of insurance. These professionals possess extensive knowledge of the insurance market and have access to a wide range of policies from multiple carriers. Unlike direct insurance providers, brokers act as intermediaries, working on your behalf to find the most suitable coverage options. They take the time to understand your specific requirements, whether it’s for your home, vehicle, business, or health, and tailor their recommendations accordingly.

One of the key advantages of working with a local insurance broker is their ability to offer unbiased advice. Brokers are not affiliated with any particular insurance company, allowing them to provide impartial recommendations based solely on your best interests. They can help you compare policies, explain coverage options, and negotiate the best terms and premiums on your behalf. This ensures that you receive the coverage you need at a competitive price, without the hassle of navigating the insurance market alone.

Services Offered by Local Insurance Brokers

Local insurance brokers provide a comprehensive range of services to meet your insurance needs. Here’s an overview of some of the key services they offer:

Risk Assessment and Coverage Analysis

Brokers begin by conducting a thorough assessment of your risks and insurance needs. They’ll review your current coverage, if any, and identify potential gaps or areas where you may be overinsured. By understanding your unique situation, they can recommend appropriate coverage options to protect your assets, business, or family.

Policy Comparison and Selection

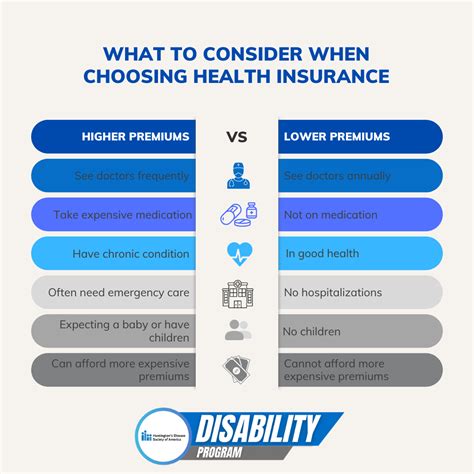

With access to multiple insurance carriers, brokers can present you with a variety of policy options. They’ll explain the differences in coverage, deductibles, and premiums, ensuring you understand the implications of each choice. This comprehensive comparison allows you to make an informed decision, selecting the policy that best aligns with your needs and budget.

Claims Support and Advocacy

When the unexpected occurs, having an advocate by your side can make a significant difference. Local insurance brokers provide invaluable support during the claims process. They can assist with filing claims, ensuring all necessary documentation is submitted, and advocating on your behalf to maximize your settlement. Their expertise in navigating insurance claims can help streamline the process and provide you with the support you need during challenging times.

Policy Reviews and Updates

Life is dynamic, and your insurance needs may evolve over time. Local insurance brokers offer ongoing support by reviewing your policies periodically. They’ll assess whether your current coverage remains adequate or if any adjustments are necessary to reflect changes in your life or business. By staying proactive, they can help you maintain the right level of protection as your circumstances change.

Risk Management and Loss Prevention

Beyond traditional insurance coverage, brokers can also provide valuable risk management advice. They may offer suggestions for mitigating risks and implementing loss prevention strategies. This proactive approach can help minimize the likelihood of claims and reduce your overall insurance costs in the long run.

Benefits of Choosing a Local Insurance Broker

Opting for a local insurance broker comes with numerous advantages. Here’s why you should consider working with a nearby broker:

Personalized Service and Attention

Local insurance brokers pride themselves on providing personalized service. They take the time to get to know you, understand your specific circumstances, and tailor their advice accordingly. This level of attention ensures that you receive tailored solutions that address your unique needs, rather than a one-size-fits-all approach.

Expertise and Industry Knowledge

Brokers are highly knowledgeable about the insurance industry and its complexities. They stay up-to-date with the latest trends, regulations, and coverage options, allowing them to provide expert guidance. Their extensive experience and network of connections within the insurance sector enable them to offer valuable insights and access to specialized coverage if needed.

Time and Cost Savings

By working with a local insurance broker, you save valuable time and effort. Instead of researching and comparing numerous insurance providers and policies on your own, brokers do the legwork for you. They present you with a curated selection of options, saving you hours of research and ensuring you receive competitive rates. Additionally, brokers can negotiate on your behalf, potentially securing better terms and premiums, ultimately saving you money.

Access to a Wide Range of Carriers

One of the significant advantages of using a broker is their access to multiple insurance carriers. Brokers have established relationships with various providers, giving them the ability to shop around for the best coverage and pricing. This ensures that you have access to a wide range of options, increasing your chances of finding the ideal policy for your needs.

Advocacy and Support

Local insurance brokers act as your advocate throughout the entire insurance process. They’re on your side, ensuring that your best interests are prioritized. Whether it’s negotiating with insurance companies, assisting with claims, or providing ongoing support and advice, brokers are dedicated to helping you navigate the complexities of insurance with ease and confidence.

Finding a Reputable Local Insurance Broker

When searching for a local insurance broker, it’s essential to choose one with a strong reputation and a track record of success. Here are some tips to help you find the right broker for your needs:

Seek Recommendations

Start by asking friends, family, or colleagues for recommendations. Personal referrals can provide valuable insights into a broker’s reputation and level of service. Additionally, consider checking online reviews and testimonials to gather further information about their expertise and client satisfaction.

Verify Licensing and Credentials

Ensure that the broker you choose is properly licensed and holds the necessary credentials to operate in your state or region. This is crucial to guarantee that they are legally authorized to provide insurance brokerage services and have the required expertise.

Evaluate Experience and Specialization

Consider the broker’s experience and specialization in the insurance field. Look for brokers who have a proven track record in handling cases similar to yours. Whether it’s auto, home, business, or health insurance, choosing a broker with relevant experience can ensure they have the knowledge and skills to address your specific needs effectively.

Assess Communication and Transparency

Effective communication and transparency are vital in the insurance brokerage relationship. During your initial interactions, pay attention to how the broker communicates with you. Do they explain complex insurance concepts in a clear and understandable manner? Are they responsive and accessible when you have questions or concerns? Choosing a broker who prioritizes open and honest communication can make the insurance process much smoother and more transparent.

Consider Additional Services and Resources

Some insurance brokers offer additional services beyond traditional brokerage. These may include risk management consulting, employee benefits administration, or access to specialized insurance products. Evaluating the range of services provided can help you determine if a particular broker aligns with your comprehensive insurance needs.

Review Fees and Payment Structures

Understand the broker’s fee structure and how they are compensated. Brokers may charge a flat fee, a percentage of the policy premium, or a combination of both. It’s essential to discuss and agree upon the fee structure upfront to ensure there are no surprises. Additionally, inquire about any potential conflicts of interest to ensure the broker’s recommendations are solely based on your best interests.

Case Study: How Local Insurance Brokers Make a Difference

To illustrate the impact of working with a local insurance broker, let’s consider a hypothetical case study:

Imagine a small business owner, Sarah, who recently started her own bakery. As her business grew, she realized the importance of having adequate insurance coverage to protect her investment. Sarah approached a local insurance broker, John, who conducted a thorough risk assessment of her business.

John identified several potential risks, including property damage, liability claims, and business interruption. He explained the different coverage options available, such as commercial property insurance, general liability insurance, and business income protection. With John's guidance, Sarah was able to select a comprehensive policy that provided adequate coverage for her bakery.

A few months later, an unexpected fire broke out in Sarah's bakery, causing significant damage. John was there to support Sarah throughout the claims process. He assisted with filing the claim, ensuring all necessary documentation was submitted, and advocated for Sarah to receive a fair settlement. Thanks to John's expertise and advocacy, Sarah was able to quickly recover from the incident and get her bakery back up and running.

This case study highlights the invaluable role of local insurance brokers. By providing personalized advice, guiding clients through the insurance process, and offering ongoing support, brokers like John make a significant difference in helping individuals and businesses secure their financial futures.

Conclusion

In today’s complex insurance landscape, having a trusted advisor by your side is invaluable. Local insurance brokers serve as your trusted guides, offering personalized attention, expert knowledge, and advocacy. By working with a local broker, you can access a wide range of insurance options, save time and money, and receive the support you need to navigate the insurance process with confidence. Whether you’re seeking coverage for your home, auto, business, or health, a local insurance broker can provide the guidance and protection you deserve.

How do I find a reputable local insurance broker?

+To find a reputable local insurance broker, start by seeking recommendations from trusted sources such as friends, family, or colleagues. Online reviews and testimonials can also provide valuable insights into a broker’s reputation. Verify their licensing and credentials to ensure they are legally authorized to provide brokerage services. Evaluate their experience and specialization to ensure they have the expertise to handle your specific insurance needs. Assess their communication and transparency to ensure a smooth and transparent relationship. Consider additional services and resources they offer to align with your comprehensive insurance requirements. Lastly, review their fee structure and payment terms to ensure clarity and agreement.

What services do local insurance brokers typically provide?

+Local insurance brokers offer a range of services, including risk assessment and coverage analysis, policy comparison and selection, claims support and advocacy, policy reviews and updates, and risk management and loss prevention. They provide personalized advice, guide you through the insurance process, and offer ongoing support to ensure you have the right coverage for your needs.

How can a local insurance broker save me time and money?

+By working with a local insurance broker, you save time and effort that would otherwise be spent researching and comparing insurance providers and policies. Brokers do the legwork for you, presenting a curated selection of options tailored to your needs. They can also negotiate on your behalf, potentially securing better terms and premiums, ultimately saving you money.

What should I consider when reviewing an insurance broker’s fee structure?

+When reviewing an insurance broker’s fee structure, it’s essential to understand how they are compensated. Brokers may charge a flat fee, a percentage of the policy premium, or a combination of both. Discuss and agree upon the fee structure upfront to avoid any surprises. Additionally, inquire about potential conflicts of interest to ensure the broker’s recommendations are solely based on your best interests.