Lowest Cost Insurance

In today's economic climate, finding the lowest cost insurance is a top priority for many individuals and businesses alike. The insurance market is vast and diverse, offering a range of options that can be overwhelming for those seeking the most cost-effective coverage. This comprehensive guide aims to shed light on the factors influencing insurance costs and provide strategies to secure the best value without compromising on essential coverage.

Understanding the Factors That Affect Insurance Costs

The cost of insurance is determined by a multitude of factors, each playing a unique role in shaping the final premium. By understanding these elements, individuals can make informed decisions to lower their insurance expenses.

Risk Assessment

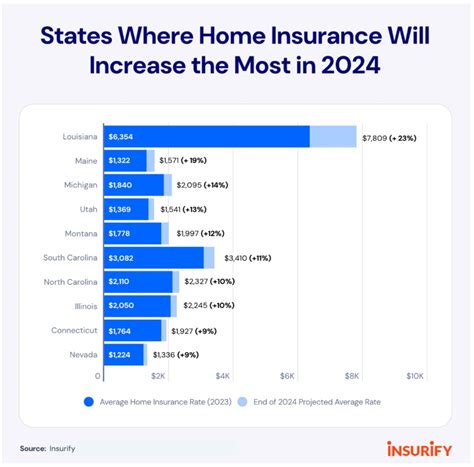

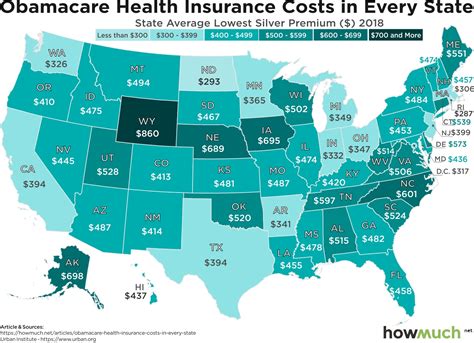

At the heart of insurance pricing lies risk assessment. Insurance companies evaluate potential risks associated with insuring an individual or entity. Factors such as age, health status, occupation, and location play a pivotal role in this assessment. For instance, a young, healthy individual is likely to be offered more affordable health insurance rates compared to an older person with pre-existing conditions.

Similarly, the risk of insuring a property in a high-crime or natural disaster-prone area is higher, leading to increased insurance premiums. Risk assessment is a complex process that involves statistical analysis and actuarial science, ensuring that insurance companies can accurately predict and manage potential risks.

Policy Coverage and Deductibles

The scope of coverage and the associated deductibles are key factors in determining insurance costs. Comprehensive policies that offer extensive coverage tend to be more expensive than basic plans. For example, a car insurance policy with collision and comprehensive coverage will typically cost more than a policy that only covers liability.

Deductibles, the amount an insured individual pays out of pocket before the insurance coverage kicks in, also influence premium costs. Higher deductibles often result in lower premiums, as the insured assumes a larger share of the financial risk. However, it's important to strike a balance, as higher deductibles can make it more challenging to cover unexpected expenses.

Claims History

Insurance companies closely monitor an individual’s or entity’s claims history. A history of frequent claims can signal higher risk and lead to increased premiums. On the other hand, a clean claims record can result in loyalty discounts and more favorable insurance rates.

For instance, a homeowner who has consistently maintained their property and has never filed an insurance claim may be rewarded with lower premiums. Conversely, a driver with multiple at-fault accidents on their record is likely to face higher car insurance costs.

Insurance Provider and Competition

The insurance market is competitive, with numerous providers offering a variety of policies. The competition drives prices down, providing consumers with more affordable options. Shopping around and comparing quotes from different insurance companies can lead to significant savings.

Additionally, insurance providers often have unique specialties and target specific demographics. Some may offer more competitive rates for certain types of coverage, such as travel insurance for frequent travelers or pet insurance for pet owners. Understanding the market and the strengths of different providers can help individuals identify the most cost-effective options.

Regulatory and Legal Factors

Insurance costs are also influenced by regulatory and legal frameworks. Government regulations and laws can impact the insurance industry’s operations, affecting the cost of doing business and, subsequently, the premiums charged to consumers.

For example, in regions with strict environmental regulations, insurance companies may face higher costs associated with environmental liability coverage, which can be passed on to policyholders in the form of higher premiums. Similarly, changes in healthcare legislation can impact the cost of health insurance policies.

Strategies to Secure the Lowest Cost Insurance

With a solid understanding of the factors influencing insurance costs, individuals can employ effective strategies to secure the lowest cost insurance without compromising on essential coverage.

Shop Around and Compare

One of the most effective ways to find the lowest cost insurance is to shop around and compare quotes from multiple providers. Online insurance marketplaces and comparison websites can make this process more efficient, providing a platform to compare policies and premiums side by side.

When comparing quotes, pay attention to the coverage details and exclusions. Ensure that the policies being compared offer similar levels of coverage to make an accurate assessment of value. Additionally, consider the reputation and financial stability of the insurance providers to ensure a reliable and trustworthy service.

Bundle Policies and Leverage Discounts

Bundling multiple insurance policies with the same provider can often lead to significant savings. Insurance companies offer multi-policy discounts to encourage customers to consolidate their insurance needs. For instance, bundling home and auto insurance policies can result in discounts of up to 25% on both policies.

Apart from bundling, insurance providers offer a variety of discounts to attract and retain customers. These may include loyalty discounts for long-term customers, good student discounts for young drivers with good grades, or safety discounts for installing home security systems or anti-theft devices in vehicles.

Raise Deductibles Strategically

As mentioned earlier, increasing deductibles can lower insurance premiums. However, it’s important to strike a balance, as higher deductibles can make it more challenging to cover unexpected expenses. Consider your financial situation and risk tolerance when deciding on deductibles.

For those with sufficient savings or emergency funds, higher deductibles can be a viable option to lower insurance costs. On the other hand, individuals with limited financial flexibility may prefer lower deductibles to ensure they can afford the out-of-pocket expenses associated with claims.

Improve Risk Profile

Taking steps to improve your risk profile can lead to lower insurance costs over time. For instance, maintaining a clean driving record can result in more favorable car insurance rates. Similarly, investing in home safety measures, such as smoke detectors, fire sprinklers, or burglar alarms, can lower the risk of accidents or theft, leading to reduced home insurance premiums.

In the case of health insurance, maintaining a healthy lifestyle and managing pre-existing conditions can lead to lower premiums. Many insurance providers offer wellness programs or incentives for policyholders who engage in healthy activities or achieve specific health goals.

Seek Professional Advice

Insurance can be complex, and it’s not always easy to identify the most cost-effective options. Seeking advice from insurance professionals or brokers can provide valuable insights and ensure you’re making informed decisions. These experts can help assess your specific needs and circumstances, offering personalized recommendations to secure the lowest cost insurance.

Insurance brokers, in particular, have access to a wide range of insurance providers and policies, allowing them to shop the market on your behalf. They can negotiate with insurance companies to secure the best rates and terms, ensuring you receive the coverage you need at the most competitive price.

Case Study: Lowering Insurance Costs for Small Businesses

Small businesses often face unique challenges when it comes to insurance, as they may have limited resources and a higher perceived risk. However, by implementing strategic insurance practices, small businesses can significantly lower their insurance costs.

One successful example is a small retail store that implemented a comprehensive risk management program. The store owners invested in security cameras, upgraded their fire suppression systems, and implemented rigorous employee training on safety protocols. These measures not only improved the safety of the workplace but also reduced the risk of accidents and theft.

As a result, when it came time to renew their insurance policies, the store owners were able to negotiate lower premiums with their insurance provider. The insurance company recognized the reduced risk associated with the business and offered more favorable rates. Additionally, the store owners were able to bundle their property, liability, and business interruption insurance policies, further reducing their overall insurance costs.

This case study demonstrates how proactive risk management and a strategic approach to insurance can lead to significant savings for small businesses. By taking steps to mitigate risks and improving their risk profile, businesses can not only protect themselves but also lower their insurance expenses.

Future Implications and Innovations in Insurance

The insurance industry is evolving rapidly, driven by technological advancements and changing consumer expectations. These innovations have the potential to revolutionize the way insurance is priced and delivered, offering new opportunities for cost-effective coverage.

Telematics and Usage-Based Insurance

Telematics technology, which uses sensors and GPS to track driving behavior, is gaining traction in the insurance industry. Usage-based insurance, also known as pay-as-you-drive insurance, leverages telematics data to offer more personalized and dynamic insurance rates.

For instance, a driver with a history of safe driving and minimal usage may be offered lower premiums, as the insurance company can accurately assess their individual risk. This approach rewards responsible driving behavior and provides consumers with more control over their insurance costs.

Blockchain and Smart Contracts

Blockchain technology is revolutionizing various industries, and insurance is no exception. Smart contracts, self-executing contracts with the terms directly written into code, have the potential to streamline insurance processes and reduce costs.

By using smart contracts, insurance companies can automate various tasks, such as policy issuance, claims processing, and premium calculations. This automation can lead to increased efficiency, reduced administrative costs, and more accurate and timely insurance services.

Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are transforming the way insurance companies assess risk and price policies. These technologies can analyze vast amounts of data, including historical claims data, demographic information, and environmental factors, to make more accurate predictions about potential risks.

For example, AI-powered systems can analyze weather patterns and historical data to predict the likelihood of natural disasters, allowing insurance companies to more accurately price policies in high-risk areas. Additionally, AI can personalize insurance recommendations based on an individual's unique circumstances, ensuring they receive the most cost-effective coverage tailored to their needs.

| Insurance Type | Average Premium |

|---|---|

| Homeowners Insurance | $1,200 annually |

| Auto Insurance | $1,500 annually |

| Health Insurance (Individual) | $6,500 annually |

| Life Insurance (Term) | $500 annually |

Frequently Asked Questions

How can I lower my car insurance costs?

+

To lower car insurance costs, consider raising your deductibles, maintaining a clean driving record, and bundling your car insurance with other policies. Additionally, explore usage-based insurance options that reward safe driving habits.

What factors determine health insurance costs?

+

Health insurance costs are influenced by factors such as age, location, health status, and the scope of coverage. Shopping around, comparing plans, and considering high-deductible health plans (HDHPs) with Health Savings Accounts (HSAs) can help lower costs.

Are there ways to reduce life insurance premiums?

+

Yes, you can reduce life insurance premiums by opting for term life insurance instead of whole life, increasing your policy term, and maintaining a healthy lifestyle. Some insurers also offer discounts for non-smokers and policy bundling.