Health Insurance Premium Tax Credit

The Health Insurance Premium Tax Credit, often referred to as the Premium Tax Credit (PTC), is a crucial component of the Affordable Care Act (ACA) in the United States. It plays a vital role in making health insurance more affordable and accessible for millions of Americans. In this comprehensive guide, we will delve into the intricacies of the Premium Tax Credit, exploring its purpose, eligibility criteria, application process, and the impact it has on individuals and families.

Understanding the Premium Tax Credit

The Premium Tax Credit is a tax credit designed to assist individuals and families with low to moderate incomes in covering the cost of their health insurance premiums. It aims to ensure that those who need health coverage can obtain it without facing unaffordable financial burdens. The credit is provided as a direct reduction in the amount of taxes owed, making it a valuable incentive for enrolling in health insurance plans.

How Does the Premium Tax Credit Work?

The Premium Tax Credit is calculated based on a few key factors, including an individual’s or family’s income, the cost of the health insurance plan they select, and the geographic area they reside in. The credit is intended to make insurance premiums more affordable by reducing the cost to a level that is considered affordable based on the individual’s income.

Here's a simplified breakdown of the process:

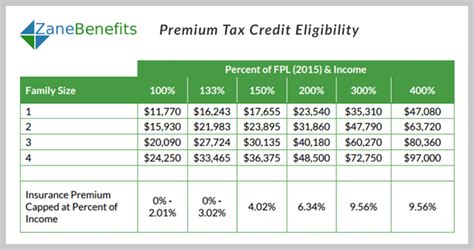

- Income Assessment: The first step is to determine the household income. The PTC is primarily aimed at those with incomes between 100% and 400% of the Federal Poverty Level (FPL). For instance, in 2023, this range is approximately $12,970 to $51,900 for an individual and $26,770 to $107,100 for a family of four.

- Plan Selection: Individuals then choose a health insurance plan that suits their needs from the Health Insurance Marketplace (also known as the Exchange). The Marketplace offers a range of plans with different coverage levels and costs.

- Premium Calculation: The cost of the selected plan is then assessed. The Premium Tax Credit is designed to cover a portion of this cost, ensuring that the premium is affordable relative to the individual's income.

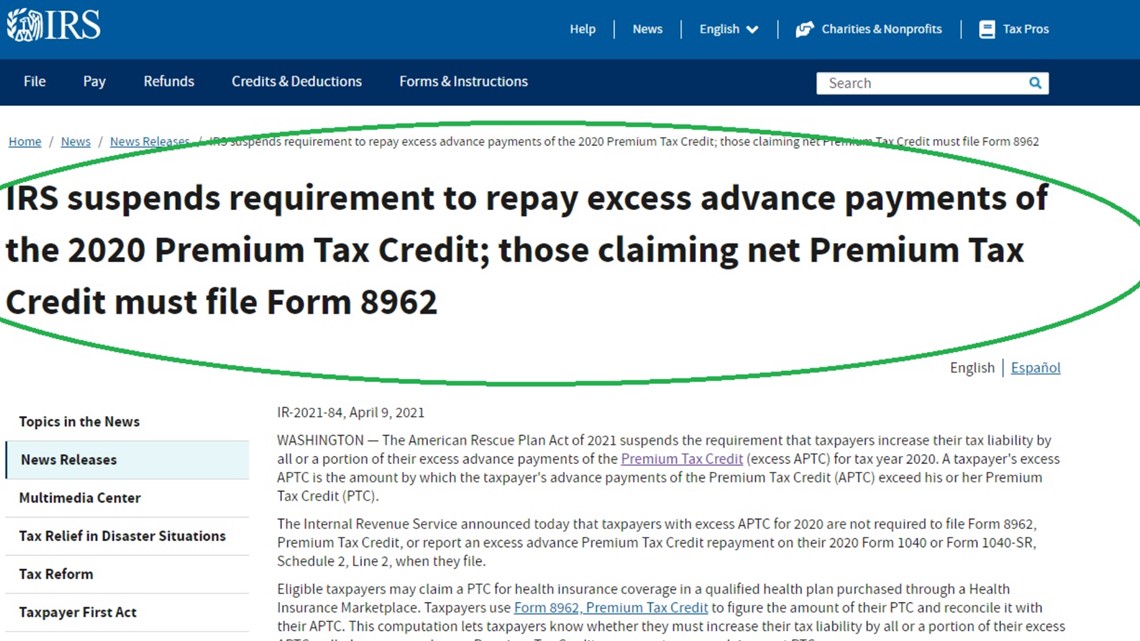

- Credit Application: The credit can be applied in two ways: Advance Credit or Reconciliation Credit. With Advance Credit, individuals receive the credit in advance as a reduction in their monthly premium payments. Reconciliation Credit, on the other hand, is claimed when filing taxes, and the amount is based on the difference between the Advance Credit received and the actual credit amount.

Eligibility Criteria

To be eligible for the Premium Tax Credit, individuals must meet several criteria:

- Income: As mentioned earlier, the income range is typically between 100% and 400% of the FPL. However, there are certain exceptions and adjustments for specific circumstances, such as individuals with no income or those experiencing financial hardship.

- Health Insurance Marketplace: The credit is only available for plans purchased through the Health Insurance Marketplace. It does not apply to employer-sponsored plans or plans purchased outside the Marketplace.

- Citizenship or Immigration Status: Eligible individuals must be U.S. citizens, nationals, or lawful residents. Non-citizens may also qualify if they meet certain residency and immigration status requirements.

- No Access to Affordable Employer-Sponsored Insurance: Individuals are not eligible if they have access to affordable employer-sponsored insurance. The IRS defines affordable as coverage that costs less than 9.61% of an individual's income for 2023.

| Income Range | Percentage of FPL |

|---|---|

| Individual | 100% - 400% |

| Family of Four | 100% - 400% |

Application and Enrollment Process

Applying for the Premium Tax Credit involves a few key steps, which we’ll outline here:

Step 1: Determining Eligibility

The first step is to assess whether you meet the eligibility criteria. This involves estimating your household income for the year and determining if it falls within the specified range. You can use online calculators or consult with tax professionals to get an accurate estimate.

Step 2: Choosing a Health Insurance Plan

Once you’ve confirmed your eligibility, the next step is to select a health insurance plan from the Health Insurance Marketplace. The Marketplace offers a range of plans with varying levels of coverage and costs. It’s essential to choose a plan that best suits your healthcare needs and financial situation.

Step 3: Applying for the Premium Tax Credit

When enrolling in a health insurance plan through the Marketplace, you’ll have the option to apply for the Premium Tax Credit. You can choose to receive the credit in advance as a reduction in your monthly premium payments (Advance Credit) or claim it when filing your taxes (Reconciliation Credit). It’s crucial to provide accurate income and household information to ensure you receive the correct amount of credit.

Step 4: Premium Payment and Credit Application

After selecting your plan and applying for the Premium Tax Credit, you’ll receive confirmation of your enrollment and credit amount. You’ll then need to pay your monthly premiums, which will be reduced by the amount of the Advance Credit. It’s essential to keep records of your payments and any correspondence regarding the credit.

Impact and Benefits of the Premium Tax Credit

The Premium Tax Credit has had a significant impact on improving health insurance accessibility and financial stability for many Americans. Here are some key benefits and impacts:

Increased Health Insurance Coverage

The Premium Tax Credit has encouraged more individuals and families to enroll in health insurance plans. By making premiums more affordable, the credit has helped reduce the number of uninsured individuals, especially among those with low to moderate incomes. This has led to improved access to healthcare services and better overall health outcomes.

Financial Relief for Low-Income Households

For households struggling to make ends meet, the Premium Tax Credit provides much-needed financial relief. By reducing the cost of health insurance premiums, it ensures that individuals and families can afford essential healthcare coverage without compromising other basic needs. This stability is particularly crucial for those facing economic challenges.

Encouraging Healthy Behaviors

The availability of affordable health insurance through the Premium Tax Credit encourages individuals to seek preventive care and manage chronic conditions. With reduced financial barriers, people are more likely to visit healthcare providers regularly, leading to early detection and management of health issues. This proactive approach to healthcare can help prevent more severe and costly health problems down the line.

Real-Life Examples and Success Stories

Let’s explore a couple of real-life scenarios to better understand the impact of the Premium Tax Credit:

Single Parent Household

Sarah, a single mother with two children, was struggling to make ends meet on her modest income. She knew the importance of health insurance but couldn’t afford the premiums without assistance. After learning about the Premium Tax Credit, she applied through the Health Insurance Marketplace. With the credit, she was able to secure a plan that covered her family’s healthcare needs, providing peace of mind and access to essential medical services.

Self-Employed Individual

John, a self-employed graphic designer, had been paying for his own health insurance but found the premiums to be increasingly burdensome. When he discovered the Premium Tax Credit, he realized he qualified based on his income. By applying for the credit, John was able to reduce his monthly premiums significantly, allowing him to continue his entrepreneurial journey without worrying about the financial strain of health insurance.

Future Implications and Considerations

The Premium Tax Credit has proven to be a successful tool in expanding health insurance coverage and improving financial stability. As we look to the future, there are several considerations and potential changes to keep in mind:

Policy Updates and Extensions

The Affordable Care Act and the Premium Tax Credit have been subject to ongoing policy discussions and potential legislative changes. Keeping up with these updates is crucial to understand any modifications to eligibility criteria, income thresholds, or the application process. It’s essential to stay informed to ensure continued access to the credit and its benefits.

Advancements in Healthcare Technology

The healthcare industry is constantly evolving, with advancements in technology and digital health solutions. As these innovations continue to shape the healthcare landscape, it’s important to consider their impact on health insurance plans and premiums. The Premium Tax Credit may need to adapt to ensure it remains effective in covering the cost of these evolving healthcare services.

Economic Fluctuations and Income Variability

Economic conditions and income levels can vary significantly over time, impacting eligibility for the Premium Tax Credit. During economic downturns or personal financial challenges, the credit becomes even more crucial in providing stability and access to healthcare. Ensuring that the credit remains flexible and responsive to changing income situations is essential to its effectiveness.

Can I qualify for the Premium Tax Credit if I’m self-employed?

+Yes, self-employed individuals can qualify for the Premium Tax Credit if their income falls within the specified range and they meet the other eligibility criteria. It’s important to accurately estimate your income and apply through the Health Insurance Marketplace to receive the credit.

How is the Premium Tax Credit calculated for a family of four?

+The Premium Tax Credit is calculated based on a family’s income and the cost of the selected health insurance plan. For a family of four, the credit is designed to make premiums more affordable relative to the family’s income. The credit amount may vary depending on the plan chosen and the family’s specific circumstances.

What happens if my income changes during the year?

+If your income changes during the year, it’s important to notify the Health Insurance Marketplace and adjust your Advance Credit payments accordingly. This ensures that you receive the correct amount of credit based on your updated income. Failure to do so may result in overpayment or underpayment of the credit.