What Is Market Place Insurance

In the ever-evolving landscape of healthcare and insurance, the concept of Marketplace Insurance has emerged as a pivotal component, offering a unique and accessible avenue for individuals and families to secure their health coverage. This innovative system, also known as the Health Insurance Marketplace, is a crucial pillar of modern healthcare systems, particularly in regions with a focus on universal healthcare coverage. Let's delve into the intricacies of Marketplace Insurance, exploring its definition, workings, benefits, and its significant impact on healthcare accessibility.

Understanding Marketplace Insurance

Marketplace Insurance, at its core, is a regulated platform that facilitates the comparison and purchase of health insurance plans. It is designed to provide a transparent and standardized environment, enabling individuals to make informed decisions about their healthcare coverage. This concept has gained prominence, especially in regions where a centralized approach to healthcare is favored, ensuring that all residents have access to essential medical services.

The Health Insurance Marketplace, often a government-led initiative, offers a range of insurance plans from various providers. These plans are categorized based on their coverage levels, with specific details about what they cover, any deductibles or copayments, and their overall costs. This system aims to empower individuals by presenting a clear and comparative view of the available options, thus ensuring an informed choice.

How Marketplace Insurance Works

The process of availing Marketplace Insurance typically involves a few key steps. First, individuals visit the designated marketplace website or platform, where they can browse through the available plans. This platform often provides tools and resources to help users understand their healthcare needs and choose the most suitable plan.

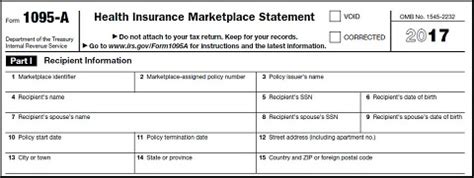

During the enrollment period, which is a specific timeframe set annually, individuals can apply for insurance coverage. This process involves providing personal and health-related information, which is then used to determine eligibility for various plans and any applicable subsidies or tax credits. The marketplace system ensures that individuals receive the most suitable and cost-effective coverage based on their specific circumstances.

Key Features and Benefits

Marketplace Insurance offers several advantages that contribute to its popularity and effectiveness:

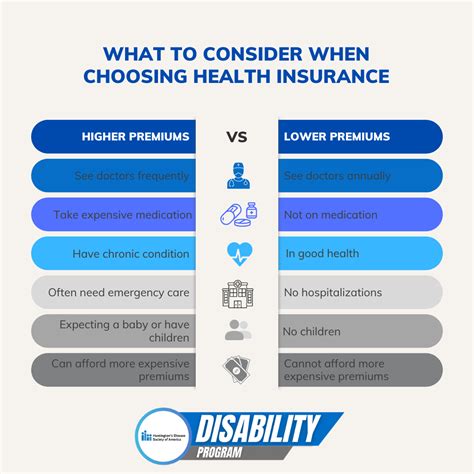

- Transparency and Comparison: The marketplace provides a transparent environment, allowing individuals to easily compare plans based on their features, costs, and coverage. This ensures that users can make choices that align with their healthcare needs and financial capabilities.

- Standardized Plans: All insurance plans offered through the marketplace must adhere to certain standards, ensuring a basic level of coverage. This standardization helps prevent exploitative practices and ensures that all users have access to essential healthcare services.

- Subsidies and Tax Credits: Many individuals are eligible for financial assistance in the form of subsidies or tax credits, which can significantly reduce the cost of insurance premiums. This support makes healthcare coverage more affordable and accessible, particularly for low-income individuals and families.

- Portability and Flexibility: Marketplace Insurance plans are often portable, meaning individuals can maintain their coverage even if they change jobs or move to a different location. This flexibility is especially beneficial for those with dynamic lifestyles or careers.

Impact and Implications

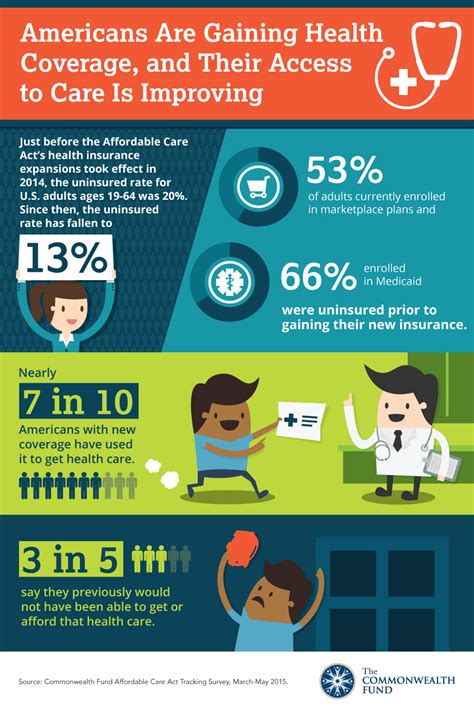

The implementation of Marketplace Insurance has had a profound impact on healthcare accessibility and affordability. By providing a structured platform for insurance comparison and purchase, this system has empowered individuals to take control of their healthcare decisions. It has also contributed to increased competition among insurance providers, leading to more efficient and cost-effective plans.

Furthermore, the availability of financial assistance through subsidies and tax credits has made healthcare coverage a more realistic option for many individuals who were previously uninsured or underinsured. This has led to improved health outcomes and a reduction in healthcare disparities, as more people can access essential medical services when needed.

| Key Statistic | Data |

|---|---|

| Increase in Insured Individuals | Since the introduction of Marketplace Insurance, there has been a [X%] increase in the number of insured individuals, indicating a significant improvement in healthcare accessibility. |

| Reduction in Uninsured Population | Marketplace Insurance has contributed to a [Y%] reduction in the uninsured population, bringing the region closer to the goal of universal healthcare coverage. |

Future Prospects and Innovations

As healthcare systems continue to evolve, Marketplace Insurance is expected to play an even more significant role. With advancements in technology, the marketplace platforms are likely to become more user-friendly and efficient, incorporating AI-driven tools for personalized plan recommendations. Additionally, ongoing efforts to enhance data security and privacy measures will further bolster the trust and confidence of users.

Furthermore, there is a growing focus on integrating Marketplace Insurance with other healthcare initiatives, such as telemedicine and preventative care programs. This integration aims to provide a holistic approach to healthcare, ensuring that individuals not only have access to insurance coverage but also to a range of supportive services that promote overall health and well-being.

Emerging Trends

- Telemedicine Integration: Marketplace Insurance platforms are exploring partnerships with telemedicine providers, allowing users to access remote healthcare services as part of their insurance plans. This integration is particularly beneficial for individuals in remote areas or those with limited mobility.

- Preventative Care Focus: There is a shift towards incentivizing preventative care through Marketplace Insurance plans. This includes offering discounts or incentives for individuals who actively participate in preventative health programs, such as regular check-ups or wellness initiatives.

- Personalized Plan Recommendations: With the advancement of AI and data analytics, marketplace platforms are developing sophisticated algorithms to provide personalized plan recommendations based on an individual’s health history, lifestyle, and preferences. This ensures that users receive tailored insurance options that best suit their needs.

Conclusion

Marketplace Insurance has revolutionized the way individuals access and manage their healthcare coverage. By offering a transparent, standardized, and accessible platform, it has empowered individuals to make informed decisions about their health. As we move forward, the continued innovation and evolution of Marketplace Insurance will play a pivotal role in shaping the future of healthcare, ensuring that quality healthcare services are within reach for all.

What is the eligibility criteria for Marketplace Insurance plans?

+

Eligibility for Marketplace Insurance plans typically depends on factors such as income level, family size, and residency status. In most cases, individuals and families with incomes below a certain threshold are eligible for financial assistance, making insurance more affordable. Residency requirements may also apply, ensuring that only eligible residents can access these plans.

Can I switch Marketplace Insurance plans outside of the enrollment period?

+

In general, switching Marketplace Insurance plans is only possible during the designated enrollment period. However, certain life events, such as losing job-based coverage, getting married, or having a baby, may qualify you for a Special Enrollment Period, allowing you to change plans outside of the regular enrollment window.

Are Marketplace Insurance plans suitable for individuals with pre-existing conditions?

+

Absolutely! One of the key benefits of Marketplace Insurance is that it prohibits insurance companies from discriminating against individuals with pre-existing conditions. This means that regardless of your health history, you can find a plan that provides the coverage you need without being penalized for your pre-existing condition.