Florida Department Of Insurance License Lookup

The Florida Department of Insurance is a crucial regulatory body overseeing the insurance industry within the state. One of its key functions is the licensing and regulation of insurance professionals, ensuring they meet the necessary standards and providing a means for consumers to verify the credentials of those they entrust with their insurance needs.

This article delves into the process of conducting a Florida Department of Insurance license lookup, offering an in-depth guide for individuals seeking to verify the credentials of insurance professionals operating within the state.

Understanding the Florida Department of Insurance License Lookup

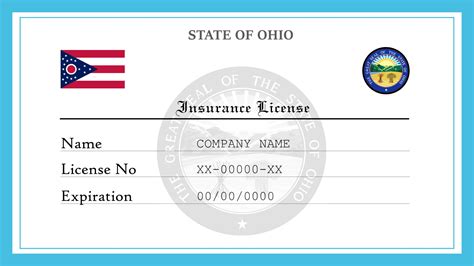

The Florida Department of Insurance maintains a comprehensive database of licensed insurance professionals, including agents, brokers, and adjusters. This database serves as a public record, allowing anyone to conduct a license lookup to verify the legitimacy and status of an insurance professional’s license.

The license lookup process is straightforward and accessible, enabling consumers to make informed decisions when choosing insurance services. By utilizing the department's online resources, individuals can quickly obtain essential information about an insurance professional's license, ensuring transparency and accountability in the industry.

The Importance of License Verification

License verification plays a critical role in protecting consumers from potential fraud and ensuring they receive services from qualified and licensed professionals. It provides a layer of assurance, confirming that the insurance professional has met the necessary educational, ethical, and competency standards set by the state.

Additionally, license verification allows consumers to access important details such as an agent's license type, expiration date, and any disciplinary actions or complaints associated with their license. This transparency empowers consumers to make well-informed choices and report any suspicious activities or unlicensed individuals to the appropriate authorities.

License Lookup Process

Conducting a Florida Department of Insurance license lookup is a simple process, accessible through the department’s official website. Here’s a step-by-step guide to help you navigate the procedure:

- Visit the Florida Department of Insurance website: Begin by accessing the official website of the Florida Department of Insurance. This is the primary source for accurate and up-to-date information regarding insurance-related matters in the state.

- Locate the License Lookup Tool: On the homepage or in the navigation menu, look for a section dedicated to license lookups or verification. This tool is designed to provide easy access to the database of licensed insurance professionals.

- Select the License Type: Choose the appropriate license type from the options provided. Common license types include insurance agents, brokers, adjusters, or other specialized licenses. This step ensures you are searching the correct category.

- Enter the Insurance Professional's Information: Input the relevant details of the insurance professional you wish to verify. This may include their name, license number, or other unique identifiers. Accurate information is crucial for precise results.

- Submit the Search: Once you have entered the necessary details, click the "Search" or "Submit" button to initiate the license lookup process. The system will then search the database based on your input.

- Review the Search Results: After submitting the search, the system will display the results, providing detailed information about the insurance professional's license. This may include their name, license status, expiration date, and any disciplinary actions or complaints.

- Assess the License Status: Evaluate the license status as indicated in the search results. A current and active license status signifies that the insurance professional is authorized to provide insurance services within the state. Other status indicators, such as "expired" or "suspended," may warrant further investigation or action.

- Contact the Department for Further Information: If you have any concerns or require additional information, the Florida Department of Insurance provides contact details on their website. You can reach out to their customer service or regulatory teams to address specific queries or report any suspicious activities.

Tips for Effective License Lookup

To ensure a smooth and accurate license lookup process, consider the following tips:

- Verify the Insurance Professional's Name: Double-check the spelling and accuracy of the insurance professional's name to avoid any potential mismatches in the search results.

- Cross-Reference with Other Sources: In addition to the official license lookup tool, cross-reference the information with other reliable sources, such as the National Association of Insurance Commissioners (NAIC) database, to ensure consistency.

- Regularly Check License Status: It is advisable to regularly verify the license status of insurance professionals, especially if you are maintaining an ongoing relationship with them. This helps ensure they remain in good standing with the regulatory authorities.

- Report Suspected Unlicensed Activity: If you encounter an insurance professional who is operating without a valid license, report the activity to the Florida Department of Insurance. This helps maintain the integrity of the industry and protects consumers from potential scams or fraudulent practices.

Advanced License Lookup Options

For more advanced users or those requiring bulk license verification, the Florida Department of Insurance offers additional tools and resources. These include:

- Bulk License Verification: This feature allows users to upload a list of license numbers or names for batch verification. It is particularly useful for businesses or organizations that regularly work with multiple insurance professionals.

- API Integration: The department provides an Application Programming Interface (API) that enables developers to integrate license verification functionality into their own applications or systems. This allows for automated and efficient license checks.

- Data Downloads: The Florida Department of Insurance makes certain datasets available for download, including lists of licensed professionals. These datasets can be used for research, analysis, or integration into internal systems.

License Renewal and Continuing Education

Maintaining a valid insurance license in Florida requires periodic renewal and compliance with continuing education requirements. These measures ensure that insurance professionals stay up-to-date with industry changes and maintain their competency.

License Renewal Process

License renewal in Florida typically occurs on a biennial basis, although the exact timing may vary depending on the license type. The Florida Department of Insurance sends renewal notices to license holders, providing instructions and deadlines for the renewal process.

To renew a license, professionals must complete the required continuing education hours and pay the associated fees. The department's website provides detailed guidelines and resources for license renewal, including step-by-step instructions and a list of approved continuing education providers.

Continuing Education Requirements

Continuing education is a vital component of license maintenance, ensuring that insurance professionals stay informed about industry developments, regulations, and best practices. The specific requirements for continuing education vary based on license type and duration since the last renewal.

Common continuing education topics include insurance law updates, ethical practices, consumer protection, and specialized courses related to specific insurance fields. The Florida Department of Insurance maintains a list of approved continuing education providers, ensuring that professionals can access high-quality educational resources.

License Reinstatement and Disciplinary Actions

In cases where a license has lapsed or been suspended, the Florida Department of Insurance provides guidance on the reinstatement process. This process typically involves fulfilling specific requirements, such as completing additional education courses or providing documentation to address disciplinary issues.

Additionally, the department maintains a record of disciplinary actions taken against licensed professionals. These actions may include license suspensions, revocations, or other sanctions imposed due to violations of insurance regulations or unethical practices. Consumers can access this information through the license lookup tool, allowing them to make informed decisions about the integrity of insurance professionals.

Conclusion

The Florida Department of Insurance’s license lookup tool is a powerful resource for consumers, businesses, and the general public. By providing transparent access to license information, the department empowers individuals to make informed choices and protect themselves from unlicensed or unethical insurance practices.

Through this comprehensive guide, individuals can navigate the license lookup process with ease, ensuring they are working with licensed and reputable insurance professionals. Additionally, the advanced tools and resources offered by the department further enhance the efficiency and accuracy of license verification, contributing to a well-regulated and trustworthy insurance industry in Florida.

How often should I verify an insurance professional’s license status?

+It is recommended to verify an insurance professional’s license status at least once a year, especially if you maintain an ongoing relationship with them. This ensures that they are still in good standing and authorized to provide insurance services.

What should I do if I find that an insurance professional’s license is expired or suspended?

+If you discover that an insurance professional’s license is expired or suspended, it is advisable to cease any business transactions with them until the issue is resolved. You can contact the Florida Department of Insurance to report the matter and seek guidance on next steps.

Are there any specific license requirements for different types of insurance, such as auto, health, or life insurance?

+Yes, different types of insurance may require specific licenses. For instance, an insurance professional specializing in auto insurance may need a different license than someone focusing on health or life insurance. The Florida Department of Insurance provides detailed information on the various license types and their requirements.