Cheapest Car Auto Insurance

When it comes to car insurance, finding the cheapest option is a priority for many drivers. With the cost of insurance policies varying significantly, it's essential to understand the factors that influence these prices and explore ways to secure the most affordable coverage. In this comprehensive guide, we delve into the world of car auto insurance, offering expert insights and practical tips to help you secure the best value for your money.

Understanding the Cost of Car Insurance

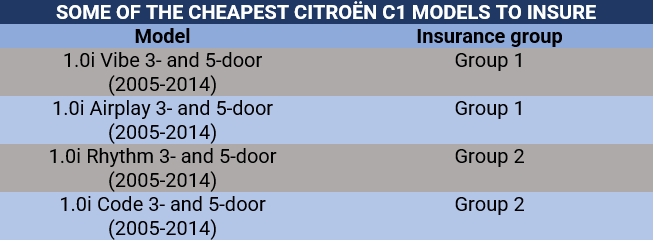

The price of car insurance is influenced by a multitude of factors, each playing a role in determining the final cost of your policy. These factors include, but are not limited to, your age, gender, driving record, location, and the make and model of your vehicle. Additionally, insurance companies consider the level of coverage you require, including liability, collision, comprehensive, and any optional add-ons.

One of the primary considerations for insurance providers is the statistical risk associated with insuring a particular driver. Younger, less experienced drivers, for instance, are often charged higher premiums due to their increased likelihood of being involved in accidents. Similarly, drivers with a history of accidents or traffic violations may face higher insurance costs. The type of vehicle you drive also matters; sports cars and luxury vehicles typically attract higher insurance premiums due to their higher repair costs and greater likelihood of theft.

Tips for Finding the Cheapest Car Insurance

Securing the cheapest car insurance requires a strategic approach and a thorough understanding of the market. Here are some expert tips to help you find the most affordable coverage:

Shop Around for Quotes

Don’t settle for the first insurance quote you receive. It’s essential to shop around and compare prices from multiple providers. Different insurance companies have varying pricing structures and policies, so obtaining multiple quotes can help you identify the most competitive rates.

Utilize online comparison tools and websites that allow you to input your details once and receive multiple quotes. This not only saves time but also ensures you're getting a comprehensive view of the market. Remember, insurance quotes can vary significantly, so it's worth the effort to compare.

Understand Your Coverage Needs

Before you start shopping for insurance, it’s crucial to understand the level of coverage you require. Assess your specific needs and budget to determine the right balance between cost and coverage. Consider factors such as your vehicle’s age, its value, and your personal financial situation.

For instance, if you own an older vehicle that's paid off, you might opt for liability-only coverage, which is typically more affordable than comprehensive coverage. However, if you have a newer, high-value car, comprehensive coverage might be a better choice to protect your investment.

Explore Discounts and Savings

Insurance companies offer a range of discounts and savings opportunities to attract and retain customers. These discounts can significantly reduce your insurance premiums, so it’s worth exploring your options.

Common discounts include safe driver discounts, multi-policy discounts (bundling your car insurance with home or renters insurance), and loyalty discounts for long-term customers. Additionally, some providers offer discounts for drivers who maintain a clean driving record, take defensive driving courses, or install certain safety features in their vehicles.

Consider Higher Deductibles

One way to lower your insurance premiums is by opting for a higher deductible. A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. By choosing a higher deductible, you reduce the financial risk for the insurance company, which often translates to lower premiums.

However, it's important to choose a deductible amount that you can comfortably afford in the event of an accident or claim. While a higher deductible can save you money on your premiums, it's essential to ensure you have the financial means to cover the deductible should the need arise.

Maintain a Good Driving Record

Insurance companies closely scrutinize your driving history when determining your insurance premiums. A clean driving record can significantly reduce your insurance costs. Conversely, a history of accidents, traffic violations, or DUI convictions can lead to higher premiums or even policy cancellations.

To keep your insurance costs down, it's crucial to maintain a safe driving record. This includes obeying traffic laws, avoiding aggressive driving behaviors, and regularly maintaining your vehicle to prevent mechanical failures that could lead to accidents.

Explore Group Insurance Options

If you’re part of certain organizations or groups, you may be eligible for group insurance discounts. Many insurance companies offer special rates to members of professional associations, alumni groups, or employee groups. These group insurance plans often provide significant savings, so it’s worth checking if you’re eligible.

Additionally, if you're a student or a recent graduate, you may be able to access student discounts or alumni discounts on your car insurance. These discounts can provide a substantial reduction in your insurance costs, so it's a good idea to explore these options.

Review and Adjust Your Coverage Annually

Insurance needs can change over time, so it’s important to review your coverage annually to ensure you’re still getting the best value. Your circumstances, such as your driving record, vehicle ownership, or personal financial situation, may have changed, which could impact the most suitable coverage and pricing.

During your annual review, compare your current policy with other available options to ensure you're not overpaying. You may also identify opportunities to adjust your coverage, such as increasing your deductible or removing unnecessary add-ons, to further reduce your insurance costs.

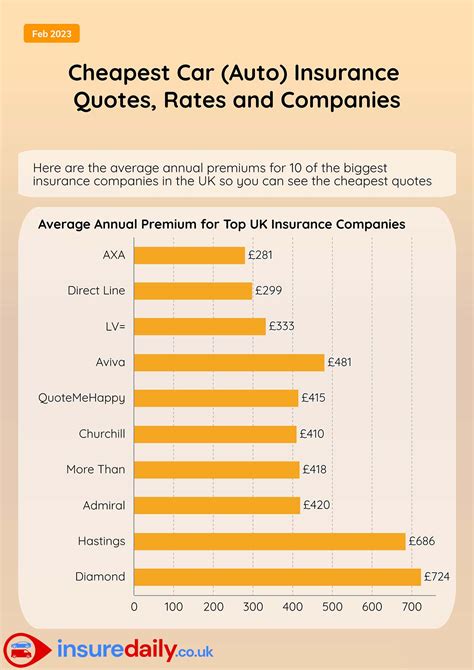

Performance Analysis: Top Affordable Car Insurance Providers

To help you in your search for the cheapest car insurance, we’ve analyzed and compared several top insurance providers based on their affordability, coverage options, and customer satisfaction. Here’s a glimpse at some of the most affordable car insurance providers in the market today:

| Insurance Provider | Average Annual Premium |

|---|---|

| State Farm | $1,195 |

| Geico | $1,220 |

| Progressive | $1,275 |

| Allstate | $1,320 |

| Esurance | $1,350 |

Please note that these average annual premiums are based on a standard coverage package and may vary depending on your individual circumstances and location. It's always recommended to obtain personalized quotes from these providers to get an accurate assessment of your insurance costs.

Future Implications: The Evolution of Affordable Car Insurance

The landscape of car insurance is constantly evolving, and technological advancements are playing a significant role in shaping the future of affordable coverage. Here are some key trends and innovations that are likely to impact the affordability of car insurance in the coming years:

Telematics and Usage-Based Insurance

Telematics technology, which tracks driving behavior and habits, is gaining traction in the insurance industry. Usage-based insurance (UBI) policies use telematics data to offer personalized premiums based on how, when, and where a driver uses their vehicle. This data-driven approach rewards safe driving behaviors and can lead to significant savings for drivers with good habits.

Artificial Intelligence and Machine Learning

AI and machine learning technologies are being employed by insurance companies to enhance risk assessment and pricing accuracy. These advanced tools can analyze vast amounts of data, including driving behavior, weather patterns, and accident statistics, to predict risks more precisely. This level of accuracy can lead to more tailored and affordable insurance policies for drivers.

Digital Transformation and Direct-to-Consumer Models

The digital transformation of the insurance industry is making it easier for consumers to access and compare insurance policies online. Direct-to-consumer models, where insurance companies sell policies directly to customers without the need for intermediaries, can result in lower overhead costs and more competitive pricing. This shift towards digital insurance is likely to continue, offering consumers greater convenience and more affordable options.

Pay-As-You-Drive and Mileage-Based Insurance

Pay-as-you-drive (PAYD) and mileage-based insurance policies are gaining popularity, particularly among low-mileage drivers. These policies charge premiums based on the number of miles driven, providing an affordable option for those who don’t drive frequently. As more drivers adopt these flexible insurance models, we can expect to see a wider range of options and more competitive pricing.

Sustainable and Green Driving Initiatives

The rise of eco-friendly driving initiatives and the adoption of electric vehicles (EVs) are influencing the insurance market. Many insurance companies are offering discounts and incentives for drivers who adopt sustainable practices, such as using EVs or carpooling. As the shift towards sustainable transportation continues, we can expect to see more insurance providers offering green driving initiatives and competitive rates for eco-conscious drivers.

Conclusion

Finding the cheapest car insurance requires a combination of thorough research, understanding your coverage needs, and exploring the various discounts and savings opportunities available. By following the expert tips outlined in this guide and keeping an eye on the evolving trends in the insurance industry, you can secure affordable coverage that meets your requirements without breaking the bank.

Remember, it's important to regularly review and adjust your insurance coverage to ensure you're getting the best value for your money. With the right approach and a proactive mindset, you can navigate the world of car insurance with confidence and secure the most affordable protection for your vehicle.

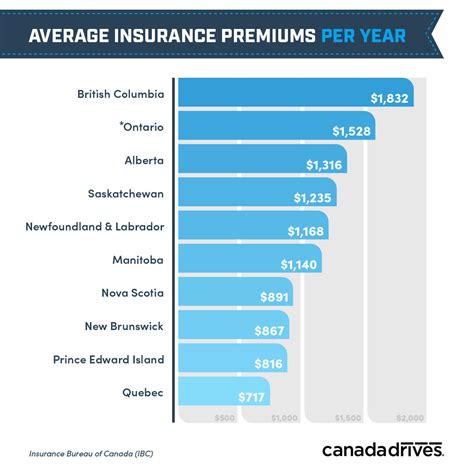

What is the average cost of car insurance in the United States?

+The average cost of car insurance in the United States varies depending on several factors, including your location, driving record, and the type of coverage you choose. According to recent data, the average annual premium for car insurance in the U.S. is approximately $1,592. However, this figure can range significantly, with some states having much higher or lower averages.

Can I get car insurance without a license or a vehicle?

+Obtaining car insurance without a valid driver’s license or a vehicle can be challenging. Most insurance providers require you to have a valid license and own or lease a vehicle to purchase a policy. However, some companies offer specialized insurance products for unique situations, so it’s worth exploring your options with different providers.

How can I save money on my car insurance as a young driver?

+As a young driver, you can explore various options to save on car insurance. Consider adding yourself to your parent’s policy as a named driver, which often results in lower premiums. You can also maintain a clean driving record, take defensive driving courses, and explore student discounts or good-grade discounts offered by some insurance companies. Additionally, opting for a higher deductible can reduce your premiums, but be sure you can afford the increased out-of-pocket expense.

What factors influence the cost of car insurance for senior drivers?

+For senior drivers, the cost of car insurance can be influenced by various factors. These include your age, driving record, and the type of vehicle you drive. Some insurance companies offer discounts for senior citizens, so it’s worth shopping around to find the most competitive rates. Additionally, maintaining a good driving record and exploring safe driver discounts can help reduce your insurance costs.