Health Insurance For Low Income

Navigating the complex world of health insurance can be especially daunting for individuals with low incomes. With limited financial resources, it's crucial to make informed choices to ensure access to essential healthcare services without incurring overwhelming costs. This comprehensive guide aims to demystify the process of obtaining health insurance for low-income individuals, providing valuable insights and practical strategies.

Understanding the Landscape of Health Insurance for Low-Income Individuals

Health insurance is a fundamental aspect of personal well-being, yet it often presents significant financial challenges for those with limited means. The good news is that various options and support systems are available to help low-income individuals secure adequate healthcare coverage. Understanding these options and knowing where to access them is the first step towards achieving better health outcomes.

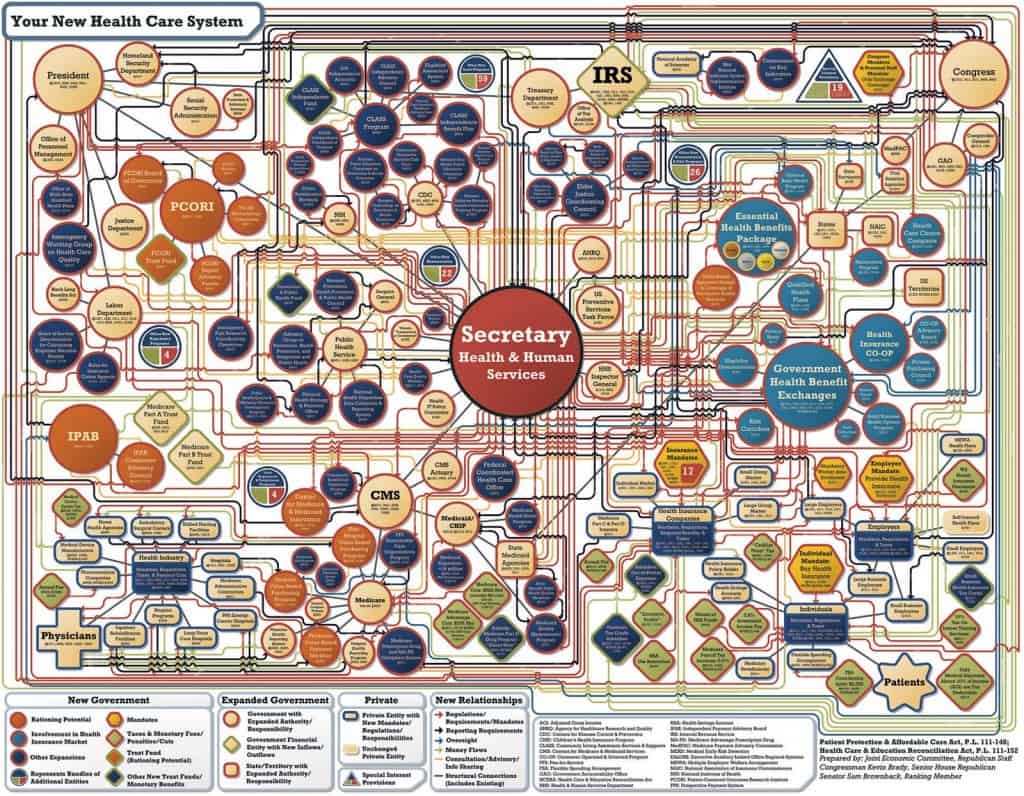

The U.S. healthcare system offers a range of insurance plans, from employer-sponsored group plans to individual market policies and government-funded programs. Each type of insurance has its own set of rules, benefits, and potential drawbacks. For low-income individuals, the most accessible and affordable options often lie within the government-funded programs, such as Medicaid and the Children's Health Insurance Program (CHIP), as well as the Affordable Care Act (ACA) marketplace plans with premium subsidies.

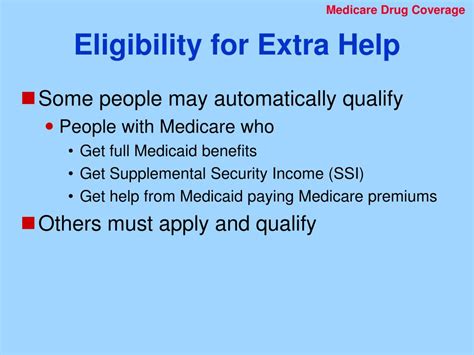

Medicaid, a joint federal and state program, provides health coverage to millions of Americans, including eligible low-income adults, children, pregnant women, elderly adults, and people with disabilities. The program's eligibility criteria and covered services can vary from state to state, offering a safety net for those who might otherwise struggle to afford healthcare.

The Children's Health Insurance Program (CHIP) is another vital resource, specifically designed to provide low-cost health coverage to children in families who earn too much to qualify for Medicaid but cannot afford private insurance. CHIP covers a comprehensive range of services, including regular check-ups, immunizations, doctor visits, dental and vision care, and more.

The Affordable Care Act (ACA) marketplace, often referred to as the Health Insurance Marketplace, offers a platform for individuals and families to shop for and enroll in health insurance plans. Low-income individuals can often qualify for premium tax credits that lower their monthly insurance premiums, making high-quality health plans more affordable. The marketplace also offers cost-sharing reductions, which further reduce out-of-pocket costs for eligible individuals.

In addition to these government-funded programs, some states offer additional health insurance programs tailored to the needs of their residents. For example, some states provide programs for specific populations, such as low-income adults without dependent children, or those who are ineligible for Medicaid but still need financial assistance for health insurance.

Exploring Affordable Health Insurance Options

When it comes to finding affordable health insurance, low-income individuals have a range of options to consider, each with its own set of benefits and potential challenges. Here’s a closer look at some of the most viable paths to securing essential healthcare coverage without breaking the bank.

Medicaid and CHIP

Medicaid and the Children’s Health Insurance Program (CHIP) are invaluable resources for low-income individuals and families. These government-funded programs offer comprehensive healthcare coverage at little to no cost, ensuring access to vital medical services without the financial strain.

Medicaid eligibility is determined by a combination of factors, including income, family size, disability status, and age. While income is a significant criterion, other factors can also play a role in qualifying for coverage. For instance, pregnant women and children may have higher income thresholds to qualify for Medicaid, ensuring that they receive the healthcare they need.

CHIP, on the other hand, is specifically designed to provide health coverage for children in families who earn too much to qualify for Medicaid but still struggle to afford private insurance. CHIP offers a wide range of benefits, including regular check-ups, immunizations, dental and vision care, and more, ensuring that children receive the medical attention they need to grow and thrive.

To apply for Medicaid or CHIP, individuals can visit their state's Medicaid website or use the Health Insurance Marketplace. The application process typically involves providing detailed information about income, family size, and other relevant factors. It's important to note that eligibility for these programs can change based on life events, such as a change in income or family status, so regular updates and reviews of coverage are essential.

| Program | Eligibility Criteria | Benefits |

|---|---|---|

| Medicaid | Low income, family size, disability status, age | Comprehensive healthcare coverage |

| CHIP | Children in families with income too high for Medicaid, but unable to afford private insurance | Regular check-ups, immunizations, dental and vision care |

Affordable Care Act (ACA) Marketplace Plans

The Affordable Care Act (ACA) marketplace, often referred to as the Health Insurance Marketplace, offers a wide range of health insurance plans tailored to meet the diverse needs of individuals and families. For low-income individuals, the marketplace can be a valuable resource, providing access to high-quality healthcare coverage with the added benefit of premium tax credits and cost-sharing reductions.

Premium tax credits, available to individuals and families with incomes between 100% and 400% of the federal poverty level, can significantly reduce the cost of monthly insurance premiums. These credits are designed to make health insurance more affordable, ensuring that low-income individuals can access the coverage they need without financial strain.

Cost-sharing reductions, another valuable feature of the ACA marketplace, further reduce out-of-pocket costs for eligible individuals. These reductions can lower deductibles, copayments, and coinsurance, making healthcare more accessible and affordable for those who need it most.

To enroll in an ACA marketplace plan, individuals can visit the official Health Insurance Marketplace website or use the services of a certified application counselor or navigator. The enrollment process typically involves providing detailed information about income, family size, and other relevant factors. It's important to note that the open enrollment period for the marketplace plans usually runs from November to December each year, with a special enrollment period for those who qualify due to certain life events.

The ACA marketplace offers a variety of plan types, including Bronze, Silver, Gold, and Platinum plans, each with different levels of coverage and cost. It's essential to carefully review the benefits and costs of each plan to choose the one that best suits your healthcare needs and budget.

| Feature | Description |

|---|---|

| Premium Tax Credits | Reduces the cost of monthly insurance premiums for eligible individuals |

| Cost-Sharing Reductions | Lowers out-of-pocket costs, such as deductibles and copayments |

| Plan Types | Bronze, Silver, Gold, and Platinum plans with varying levels of coverage and cost |

State-Specific Health Insurance Programs

In addition to federal programs like Medicaid and the ACA marketplace, many states offer their own health insurance programs tailored to the unique needs of their residents. These state-specific programs can provide valuable coverage options for low-income individuals, often with more flexible eligibility criteria and tailored benefits.

For instance, some states provide health insurance programs specifically for low-income adults without dependent children, a population that often falls into a coverage gap. These programs aim to bridge this gap, ensuring that individuals who are ineligible for Medicaid but still need financial assistance for health insurance can access the coverage they require.

Other states may offer programs focused on specific populations, such as those with disabilities or certain chronic health conditions. These programs can provide specialized coverage and support, ensuring that individuals with unique healthcare needs receive the care they require.

To explore state-specific health insurance programs, individuals can visit their state's health department website or contact their local health department. It's important to note that eligibility criteria and covered services can vary significantly from state to state, so it's crucial to research and understand the options available in your specific location.

By leveraging the resources provided by federal and state governments, low-income individuals can access essential healthcare services, improve their overall health and well-being, and take control of their financial future.

Maximizing Benefits and Cost Savings

Securing affordable health insurance is just the first step towards achieving better health outcomes and financial stability. To truly maximize the benefits of your health insurance coverage and minimize costs, it’s essential to understand how to navigate the healthcare system effectively.

Understanding Your Coverage and Benefits

The first step in maximizing your health insurance benefits is understanding what your plan covers. Each health insurance plan has a unique set of benefits and limitations, and being aware of these can help you make informed decisions about your healthcare.

Your insurance plan's summary of benefits and coverage document outlines the specific services and treatments covered by your plan, as well as any associated costs, such as deductibles, copayments, and coinsurance. It's crucial to review this document carefully to understand your coverage and identify any potential gaps or limitations.

In addition to the summary of benefits, it's also beneficial to understand the specifics of your plan's network. Knowing which healthcare providers are in-network and out-of-network can help you make cost-effective choices when seeking medical care. In-network providers have negotiated rates with your insurance company, which typically means lower costs for you.

If you're unsure about your coverage or have specific questions, don't hesitate to reach out to your insurance provider's customer service team. They can provide detailed information about your plan's benefits, help you understand any confusing terms or policies, and guide you in making the most of your coverage.

Utilizing Preventive Care Services

Preventive care services are a crucial component of any health insurance plan, as they focus on keeping you healthy and catching potential health issues early on. Many health insurance plans, especially those offered through the ACA marketplace, cover a wide range of preventive services at no cost to you.

These services can include regular check-ups, immunizations, screenings for various health conditions, and counseling for topics like nutrition, weight management, and mental health. By taking advantage of these preventive services, you can identify potential health issues early, when they're often more treatable and less costly to manage.

For example, routine screenings can detect conditions like high blood pressure or high cholesterol, which, if left untreated, can lead to more serious health issues. Similarly, immunizations can protect you from a range of diseases, ensuring you stay healthy and avoid costly medical treatments.

To make the most of your preventive care benefits, schedule regular check-ups with your primary care provider and ask about the specific preventive services covered by your plan. Many preventive services, such as annual wellness visits, are often fully covered by insurance, making them an excellent way to stay on top of your health without incurring additional costs.

Managing Out-of-Pocket Costs

While health insurance helps to cover a significant portion of your healthcare costs, there are still out-of-pocket expenses to consider, such as deductibles, copayments, and coinsurance. These costs can vary depending on your insurance plan and the specific services you receive.

To effectively manage your out-of-pocket costs, it's essential to understand how your insurance plan works and what services are covered. For instance, some plans may have different deductibles and copayments for in-network and out-of-network providers, so it's crucial to be aware of these differences and plan accordingly.

One effective strategy for managing out-of-pocket costs is to take advantage of generic medications, which are often significantly less expensive than brand-name drugs. Additionally, many insurance plans offer discounts or incentives for using in-network pharmacies, so be sure to ask your provider about these options.

If you're facing high out-of-pocket costs, don't hesitate to reach out to your insurance provider's financial assistance team. Many providers offer programs to help reduce costs for those who qualify, such as payment plans or waivers for certain fees. These programs can provide much-needed relief and ensure you receive the healthcare you need without financial hardship.

Navigating the Healthcare System

Understanding the healthcare system and knowing how to navigate it effectively is crucial for anyone, but especially for those with limited financial resources. By familiarizing yourself with the ins and outs of the healthcare system, you can make informed decisions, access the right services, and avoid unnecessary costs.

Choosing the Right Healthcare Providers

When it comes to selecting healthcare providers, it’s essential to choose those who are in-network with your insurance plan. In-network providers have negotiated rates with your insurance company, which typically means lower costs for you. You can often find a list of in-network providers on your insurance company’s website or by contacting their customer service team.

It's also important to consider the reputation and expertise of your healthcare providers. Look for providers who specialize in the specific areas of healthcare that you need, whether it's primary care, specialty care, or mental health services. Reading reviews and checking ratings can help you make informed decisions about which providers to choose.

If you're not sure where to start, your insurance company may offer a provider directory or referral service. These resources can help you find providers who meet your specific needs and are covered by your insurance plan.

Understanding and Comparing Healthcare Costs

Healthcare costs can vary significantly depending on the provider, the service, and your insurance plan. To make informed decisions about your healthcare and manage your costs effectively, it’s crucial to understand and compare these costs.

Your insurance company's website or customer service team can provide information about the costs of various healthcare services, including deductibles, copayments, and coinsurance. This information can help you estimate your out-of-pocket costs and make more cost-effective choices when seeking medical care.

Additionally, many healthcare providers offer cost estimates for their services. These estimates can give you a clearer picture of what you might expect to pay, helping you plan and budget accordingly. If you're unsure about the costs of a particular service, don't hesitate to ask your provider for an estimate.

Comparing costs between different providers can also help you find the most cost-effective option. While it's important to consider more than just price when choosing a provider, understanding the financial implications can help you make more informed decisions about your healthcare.

Seeking Financial Assistance and Support

Healthcare costs can be a significant financial burden, especially for those with limited income. Fortunately, there are various resources and support systems available to help individuals manage these costs and access the healthcare they need.

Many healthcare providers offer financial assistance programs, such as payment plans or discounts for uninsured or underinsured patients. These programs can provide much-needed relief, making healthcare more affordable and accessible. To find out if your provider offers such programs, don't hesitate to ask their billing or financial services department.

In addition to provider-specific programs, there are also national and state-level financial assistance programs available. For instance, the Hill-Burton program provides free or low-cost healthcare services to those who can't afford to pay. To find out if you're eligible for this program or others like it, contact your state's health department or visit their website.

Community health centers are another valuable resource, offering a range of healthcare services at reduced costs or on a sliding fee scale based on income. These centers can provide essential primary care, dental care, mental health services, and more, ensuring that individuals with limited financial means can access the healthcare they need.

By exploring these resources and seeking financial assistance when needed, individuals can navigate the healthcare system more effectively, reduce their financial burden, and improve their overall health and well-being.

Conclusion: Empowering Low-Income Individuals to Access Healthcare

Securing affordable health insurance and navigating the healthcare system can be challenging, especially for individuals with limited financial resources. However, with the right knowledge and resources, it’s possible to overcome these challenges and access the healthcare services necessary for a healthy and fulfilling life.

This comprehensive guide has outlined the various health insurance options available to low-income individuals, from government-funded programs like Medicaid and CHIP to ACA marketplace plans and state-specific health insurance programs. By understanding these options and taking advantage of the available resources, individuals can secure essential healthcare coverage and manage their costs effectively.

Additionally, this guide has provided insights into maximizing health insurance benefits, utilizing preventive care services, and navigating the healthcare system. By following these strategies and seeking support when needed, individuals can take control of their healthcare and financial future, ensuring they receive the care they need without financial strain.

As we move forward, it’s important to continue advocating for affordable healthcare and supporting those who need it most. By working together and leveraging the resources available, we can ensure that everyone has access to the healthcare they deserve, regardless of their