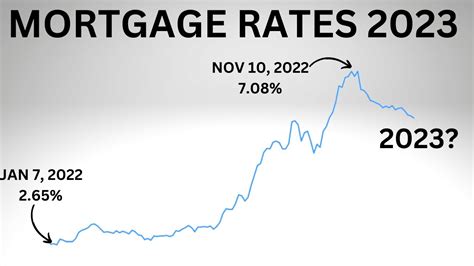

Home Mortgage Insurance Rates

In the dynamic landscape of the housing market, understanding the intricacies of home mortgage insurance rates is paramount. These rates, often overlooked, play a pivotal role in the overall cost of homeownership. This article aims to delve deep into the world of mortgage insurance, shedding light on its mechanisms, factors influencing rates, and its significance in the real estate sphere.

The Fundamentals of Mortgage Insurance

Mortgage insurance, a critical component of many home loan agreements, serves as a safeguard for lenders in the event of borrower default. It’s a mandatory requirement for borrowers who put down less than a 20% down payment on their home purchase. This insurance provides a financial cushion, ensuring that lenders can recover their losses if borrowers fail to meet their mortgage obligations.

The premise of mortgage insurance is straightforward: it protects lenders from the risk associated with high loan-to-value ratios. When borrowers have a lower down payment, the lender assumes more risk, as there's a greater chance they might not be able to recoup their entire investment if the borrower defaults. Mortgage insurance steps in to mitigate this risk, making it possible for individuals with less cash on hand to purchase a home.

Factors Influencing Mortgage Insurance Rates

Mortgage insurance rates are not a one-size-fits-all proposition. They vary based on a myriad of factors, each contributing to the overall cost of insurance. Understanding these factors is crucial for borrowers, as it helps them make informed decisions about their home purchase and financing.

Loan-to-Value Ratio (LTV)

The LTV ratio, which compares the loan amount to the home’s purchase price or appraised value, is a key determinant of mortgage insurance rates. Lenders typically require a higher insurance premium when the LTV is higher, reflecting the increased risk they assume. For instance, a loan with an LTV of 90% may carry a higher insurance premium compared to one with an LTV of 80%.

| LTV Ratio | Mortgage Insurance Rate |

|---|---|

| 80% | 0.50% to 1.00% of the loan amount |

| 90% | 0.75% to 1.25% of the loan amount |

| 95% | 1.25% to 1.75% of the loan amount |

Credit Score and History

Your credit score is a critical factor in determining mortgage insurance rates. Lenders use credit scores to assess the risk of lending to borrowers. Generally, borrowers with higher credit scores can expect to pay lower insurance premiums, as they are considered less risky. Conversely, borrowers with lower credit scores may face higher insurance rates to compensate for the increased risk.

Loan Term and Type

The term and type of your loan can also impact insurance rates. For instance, loans with shorter terms, such as 15-year fixed-rate mortgages, may offer lower insurance rates compared to 30-year fixed-rate mortgages. Additionally, the type of loan, whether it’s a conventional, FHA, or VA loan, can influence insurance rates due to the different risk profiles associated with each loan type.

Occupancy Status

Whether the property is for primary residence, second home, or investment property can affect insurance rates. Lenders typically view primary residences as less risky, as borrowers are more likely to maintain their payments on a home they live in. As a result, insurance rates for primary residences may be lower compared to other occupancy types.

The Impact of Mortgage Insurance on Borrowers

Mortgage insurance has a direct and significant impact on borrowers, affecting both their monthly payments and overall homeownership costs. Let’s explore how mortgage insurance rates influence borrowers’ financial obligations.

Monthly Payment Increases

Mortgage insurance premiums are typically included in the monthly mortgage payment, adding to the overall cost of borrowing. For borrowers with a lower down payment, the insurance premium can be a substantial portion of their monthly payment. As a result, the total monthly outlay for a home loan with mortgage insurance can be significantly higher compared to a loan without insurance.

For instance, consider a borrower who takes out a $200,000 mortgage with a 4% interest rate and a 30-year term. With a 20% down payment, the monthly payment, including principal, interest, and insurance, would be approximately $950. However, if the borrower puts down only 5%, the insurance premium increases, resulting in a monthly payment of around $1,100, a substantial 16% increase.

Total Cost of Homeownership

Over the life of a mortgage, the accumulated insurance premiums can add up to a significant sum. This is particularly true for borrowers with longer loan terms or those who refinance frequently. For instance, a borrower with a 30-year fixed-rate mortgage might pay tens of thousands of dollars in insurance premiums over the loan’s lifetime.

Private Mortgage Insurance (PMI) Cancellation

For borrowers with private mortgage insurance (PMI), there’s a possibility of cancellation once they reach a certain level of equity in their home. Typically, PMI can be canceled when the loan-to-value ratio drops to 80% or lower. This cancellation can significantly reduce the borrower’s monthly payment, as the insurance premium is no longer required. However, the process and criteria for cancellation can vary based on the lender and loan type.

Strategies for Managing Mortgage Insurance Costs

While mortgage insurance is a necessary expense for many borrowers, there are strategies to manage and potentially reduce these costs. These strategies can help borrowers save money and optimize their homeownership experience.

Increasing Down Payment

One of the most effective ways to reduce mortgage insurance costs is by increasing the down payment. A higher down payment reduces the loan-to-value ratio, which in turn can lead to lower insurance premiums or even eliminate the need for mortgage insurance altogether. For instance, a 20% down payment is a common threshold at which mortgage insurance is no longer required for conventional loans.

Improving Credit Score

A higher credit score can also lead to lower insurance rates. Borrowers can work on improving their credit score by paying bills on time, reducing debt, and correcting errors on their credit report. A higher credit score not only reduces insurance costs but also improves the chances of obtaining a lower interest rate on the mortgage.

Refinancing

For borrowers who have built equity in their home, refinancing can be an option to eliminate mortgage insurance. If the loan-to-value ratio has dropped to 80% or lower, the borrower may be eligible to refinance their loan without mortgage insurance. However, refinancing does come with costs, so it’s important to weigh the benefits against the expenses.

Utilizing Alternative Loan Programs

Some loan programs, such as VA loans and USDA loans, offer mortgage insurance at a lower rate or even eliminate it altogether. These programs often have specific eligibility criteria, such as military service or rural residency, but they can provide significant savings for qualified borrowers.

The Future of Mortgage Insurance

The landscape of mortgage insurance is evolving, driven by changes in the housing market and regulatory environment. While the fundamental purpose of mortgage insurance remains the same, its implementation and availability are subject to continuous review and adjustment.

Policy Changes and Reforms

In recent years, there have been policy reforms aimed at making mortgage insurance more accessible and affordable. These reforms often focus on streamlining the process, reducing premiums, and expanding eligibility criteria. For instance, the FHA mortgage insurance reforms in 2020 aimed to provide more flexibility and affordability for borrowers.

Technological Innovations

The digital revolution is also making its mark on the mortgage insurance industry. Digital platforms and automated underwriting systems are enhancing the efficiency and accuracy of mortgage insurance evaluations. These innovations can lead to faster processing times and potentially lower costs for borrowers.

Market Competition

The mortgage insurance market is competitive, with various providers offering different products and rates. This competition can drive down insurance rates and provide borrowers with more options. Additionally, as the market matures, we can expect to see more specialized insurance products tailored to different borrower profiles and risk levels.

Potential Regulatory Changes

Regulatory bodies, such as the Federal Housing Finance Agency (FHFA) and the Department of Housing and Urban Development (HUD), play a significant role in shaping the mortgage insurance landscape. Changes in regulations can impact the availability and cost of mortgage insurance, so borrowers and industry professionals should stay informed about potential policy shifts.

Conclusion: Navigating the World of Mortgage Insurance

Mortgage insurance is an essential component of the home buying process for many individuals. While it adds to the overall cost of homeownership, it also opens the door to homeownership for those who may not have the means to make a large down payment. By understanding the factors that influence mortgage insurance rates and employing strategic approaches, borrowers can navigate the mortgage insurance landscape effectively.

As the housing market continues to evolve, so too will the mortgage insurance industry. Staying informed about policy changes, technological advancements, and market trends will empower borrowers to make informed decisions about their home financing. Whether it's increasing the down payment, improving credit score, or exploring alternative loan programs, there are numerous strategies to optimize the mortgage insurance experience.

Can I avoid mortgage insurance altogether?

+Yes, you can avoid mortgage insurance by making a down payment of at least 20% of the home’s purchase price. This reduces the loan-to-value ratio to a level where mortgage insurance is typically not required for conventional loans.

How long do I have to pay mortgage insurance?

+The duration of mortgage insurance payments depends on the loan type and the lender’s policies. For conventional loans, you may be able to cancel mortgage insurance once you reach 20% equity in your home. However, for other loan types like FHA loans, mortgage insurance may be required for the life of the loan.

Are there any tax benefits associated with mortgage insurance?

+Yes, mortgage insurance premiums are typically tax-deductible, which can provide some relief to borrowers. However, it’s important to consult with a tax professional to understand the specific deductions available in your situation.