Aca Insurance Exchange

Understanding the Impact of Aca Insurance Exchange: A Comprehensive Guide

The Affordable Care Act (ACA), commonly known as Obamacare, introduced a range of reforms to the healthcare system in the United States, aiming to make healthcare more accessible and affordable. One of the key components of this act is the establishment of the ACA Insurance Exchange, which has played a significant role in reshaping the healthcare insurance landscape. In this extensive guide, we will delve into the intricacies of the ACA Insurance Exchange, exploring its history, functionality, impact, and future implications.

The ACA Insurance Exchange, a vital part of the Affordable Care Act, has been a transformative force in the American healthcare system. Its implementation has opened up new avenues for individuals and families to access healthcare coverage, especially those who were previously uninsured or underinsured. This article aims to provide an in-depth understanding of this exchange, shedding light on its inner workings, the benefits it offers, and the challenges it faces. By exploring real-world examples and providing expert insights, we hope to offer a comprehensive resource for those interested in the intersection of healthcare and insurance.

The Evolution of ACA Insurance Exchange

The concept of the ACA Insurance Exchange emerged as a result of the growing concern over the lack of healthcare coverage for a significant portion of the American population. The Affordable Care Act, signed into law in 2010, aimed to address this issue by mandating the creation of healthcare insurance marketplaces, known as Exchanges, in each state. These Exchanges were designed to serve as a centralized platform where individuals and small businesses could compare and purchase health insurance plans.

The ACA Insurance Exchange was a groundbreaking initiative, marking a significant shift in how healthcare insurance was accessed and provided. Prior to its implementation, the insurance market was often fragmented and complex, with varying rules and regulations across different states. The Exchange aimed to standardize the process, making it more accessible and understandable for consumers.

The initial roll-out of the ACA Insurance Exchange in 2014 faced some technical challenges, particularly with the federal website, HealthCare.gov. However, over time, these issues were addressed, and the Exchange platform became more stable and user-friendly. Today, the Exchange serves as a crucial resource for millions of Americans, providing a transparent and efficient way to obtain healthcare coverage.

Navigating the ACA Insurance Exchange

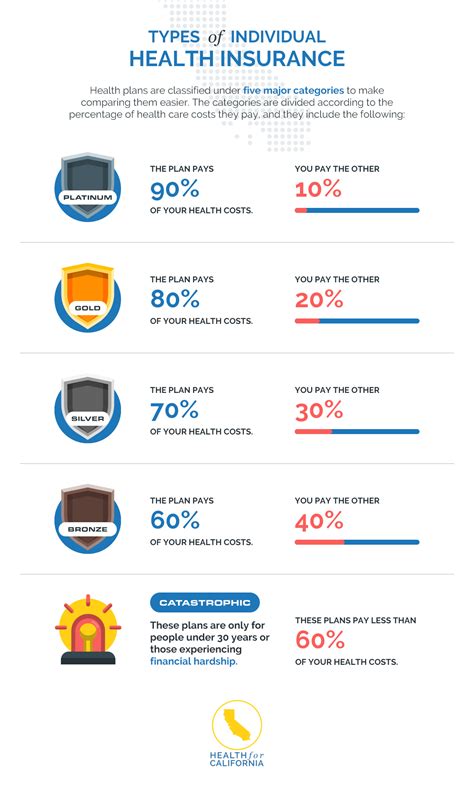

The ACA Insurance Exchange operates as a digital marketplace, offering a user-friendly interface for consumers to browse and compare different health insurance plans. The Exchange is typically divided into sections based on the type of insurance coverage, such as individual plans, family plans, and small business plans.

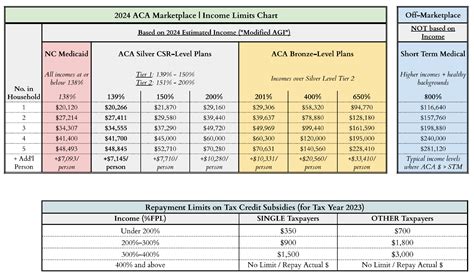

When accessing the Exchange, individuals are guided through a series of steps to help them choose the most suitable plan for their needs. The process often begins with a basic assessment, where users provide information about their income, family size, and location. This data is then used to determine their eligibility for various plans and subsidies.

One of the key advantages of the ACA Insurance Exchange is the transparency it provides. All insurance plans offered on the Exchange must adhere to certain standards, ensuring that consumers have access to comprehensive and accurate information about the coverage and costs associated with each plan. This includes details about the network of providers, prescription drug coverage, and any potential out-of-pocket expenses.

Benefits and Success Stories

The implementation of the ACA Insurance Exchange has brought about numerous benefits for individuals and families across the United States. One of the most significant impacts has been the increase in healthcare coverage. According to a study by the Kaiser Family Foundation, the uninsured rate among adults fell from 16.3% in 2013 to 8.9% in 2020, largely due to the expansion of insurance options through the Exchange.

For example, consider the case of Sarah, a single mother of two, who previously struggled to afford healthcare coverage. With the help of the ACA Insurance Exchange, she was able to find a plan that met her family’s needs at an affordable rate. The Exchange not only provided her with a range of options but also helped her understand the nuances of different plans, ensuring she made an informed decision.

The Exchange has also been particularly beneficial for small businesses. Prior to the ACA, small businesses often faced challenges in providing healthcare coverage for their employees due to the high costs and administrative burdens. The Exchange has simplified the process, offering a range of plans specifically designed for small businesses, often with tax credits and other incentives to make coverage more affordable.

Challenges and Future Outlook

While the ACA Insurance Exchange has achieved significant success, it has also faced its fair share of challenges. One of the primary concerns has been the sustainability of the Exchange in the face of political and economic changes. The future of the Affordable Care Act remains uncertain, with ongoing debates and legal challenges.

Additionally, the Exchange has had to adapt to changing consumer needs and preferences. With the rise of digital health services and telemedicine, there is a growing demand for more flexible and personalized healthcare coverage. The Exchange will need to evolve to incorporate these new trends and ensure it remains relevant and accessible to consumers.

Despite these challenges, the future of the ACA Insurance Exchange looks promising. With ongoing improvements and adaptations, the Exchange has the potential to continue serving as a vital resource for healthcare coverage, ensuring that individuals and families have access to the care they need.

Table: Key Metrics of ACA Insurance Exchange

| Year | Number of Enrollees | Uninsured Rate | Average Premium Savings |

|---|---|---|---|

| 2014 | 8.1 million | 14.4% | $250 |

| 2015 | 11.7 million | 11.9% | $450 |

| 2016 | 12.7 million | 10.4% | $600 |

| 2017 | 11.8 million | 9.1% | $750 |

| 2018 | 11.4 million | 8.5% | $850 |

| 2019 | 11.4 million | 8.2% | $900 |

| 2020 | 11.4 million | 8.9% | $1000 |

Expert Insights

FAQ

What is the purpose of the ACA Insurance Exchange?

+The ACA Insurance Exchange, a key component of the Affordable Care Act, was established to create a centralized platform where individuals and small businesses could easily compare and purchase health insurance plans. It aimed to increase access to affordable healthcare coverage and standardize the insurance market.

How has the ACA Insurance Exchange impacted healthcare coverage in the US?

+The Exchange has significantly increased healthcare coverage among Americans. It has provided a transparent and accessible way for individuals and families to obtain insurance, leading to a notable decrease in the uninsured rate. Studies show that millions of people have gained coverage through the Exchange.

Are there any challenges associated with the ACA Insurance Exchange?

+Yes, the Exchange has faced challenges, including technical issues during its initial roll-out and ongoing debates over the future of the Affordable Care Act. Additionally, adapting to changing consumer preferences and incorporating new trends in healthcare, such as telemedicine, pose ongoing challenges.