Geico Automotive Insurance

In the world of automotive insurance, Geico stands as a prominent player, offering a comprehensive range of services to its customers. With a rich history dating back to the mid-20th century, Geico has evolved into a trusted name in the insurance industry, providing coverage and peace of mind to millions of drivers across the United States.

A Brief History of Geico

Geico, an acronym for Government Employees Insurance Company, was founded in 1936 by Leo and Lillian Goodwin. The initial focus was on providing insurance to government employees, a niche market that the Goodwins recognized as underserved. Over the years, Geico expanded its reach, catering to a broader audience, including private individuals and businesses.

One of the key milestones in Geico's history was its transition from a small, regional insurer to a national powerhouse. This transformation was fueled by innovative marketing strategies, including the iconic "15-minute policy" campaign, which promised customers a quick and efficient insurance experience.

Today, Geico is a subsidiary of Berkshire Hathaway and is known for its competitive rates, efficient claims process, and a wide array of insurance products. Let's delve deeper into what makes Geico a preferred choice for automotive insurance.

Automotive Insurance Coverage

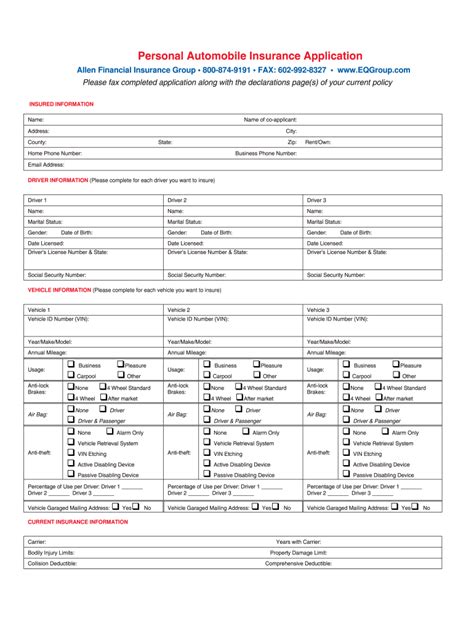

Geico offers a comprehensive suite of automotive insurance coverages to meet the diverse needs of its customers. These include:

- Liability Coverage: This coverage protects policyholders against bodily injury and property damage claims made by others in an accident where the insured is at fault.

- Collision Coverage: Covers the cost of repairing or replacing a vehicle after an accident, regardless of fault.

- Comprehensive Coverage: Provides protection against damages caused by events other than collisions, such as theft, vandalism, natural disasters, and animal collisions.

- Medical Payments Coverage: Helps cover the medical expenses of the insured and their passengers in an accident, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Protects policyholders in case of an accident with a driver who either does not have insurance or has insufficient coverage.

Geico's coverage options are highly customizable, allowing customers to tailor their policies to their specific needs and budget. The company also offers additional coverages, such as Rental Car Reimbursement, Emergency Roadside Assistance, and Personal Injury Protection (PIP), depending on the state and the policy chosen.

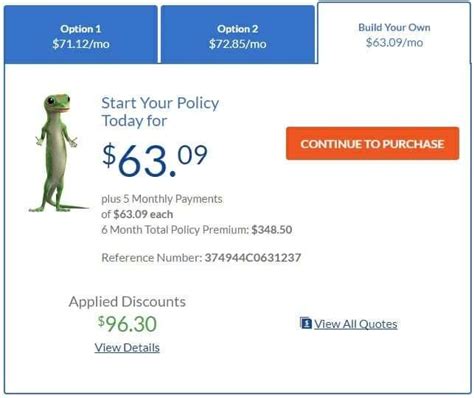

Discounts and Savings

One of the significant advantages of choosing Geico for automotive insurance is the range of discounts available. These discounts can significantly reduce the cost of insurance premiums, making Geico a cost-effective choice for many drivers.

- Multi-Policy Discount: Policyholders can save by bundling their automotive insurance with other Geico policies, such as homeowners or renters insurance.

- Military Discount: Geico offers special rates and discounts for active-duty military personnel, veterans, and their families.

- Good Student Discount: Students who maintain a certain GPA or are enrolled in certain academic programs may be eligible for this discount.

- Safe Driver Discount: Drivers with a clean driving record can benefit from reduced premiums.

- Emergency Deployment Discount: A unique discount for military personnel who are deployed for active duty.

Geico also provides discounts for vehicles equipped with certain safety features, such as anti-lock brakes and air bags, and for policyholders who take defensive driving courses.

Claim Process and Customer Service

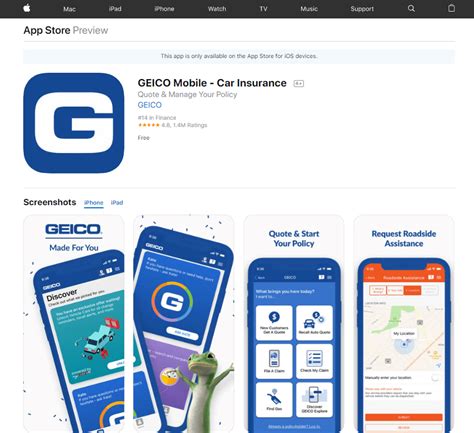

In the event of an accident or claim, Geico aims to provide a seamless and efficient process. Policyholders can report claims online, via phone, or through the Geico mobile app. Geico’s claim specialists are available 24⁄7 to guide customers through the process, offering assistance and support.

Geico's claim process is designed to be straightforward and transparent. Policyholders can track the progress of their claim online and receive regular updates. The company also offers direct repair options, where customers can choose to have their vehicle repaired at a preferred shop, with Geico directly paying the shop for the repairs.

Digital Tools and Resources

Geico has embraced digital technology to enhance the customer experience. The Geico mobile app allows policyholders to manage their insurance policies, report claims, and access their insurance cards from their smartphones. The app also provides helpful tools like a car accident guide and a roadside assistance feature.

Additionally, Geico's website offers a wealth of resources, including educational articles, calculators to estimate insurance costs, and tools to compare coverage options. These digital resources empower customers to make informed decisions about their insurance needs.

Automotive Insurance Performance and Reputation

Geico’s performance and reputation in the automotive insurance sector are exceptional. The company consistently ranks highly in customer satisfaction surveys, with J.D. Power recognizing Geico for its excellent claims service and overall customer satisfaction.

Geico's financial stability is another testament to its reliability. The company holds an A++ rating from A.M. Best, one of the highest ratings an insurance company can achieve. This rating reflects Geico's strong financial position and ability to meet its obligations to policyholders.

Community Engagement and Giving Back

Beyond its insurance offerings, Geico actively contributes to the communities it serves. The company supports various charitable initiatives and causes, including education, military support, and environmental sustainability. Geico’s commitment to giving back enhances its reputation as a socially responsible business.

Future Outlook and Innovations

As the insurance industry continues to evolve, Geico remains at the forefront of innovation. The company is investing in technology to enhance its digital offerings, improve the customer experience, and streamline its processes. Geico’s focus on data analytics and machine learning will enable it to offer even more personalized and efficient services in the future.

Furthermore, Geico is exploring new insurance products and services to meet the changing needs of its customers. With the rise of electric and autonomous vehicles, Geico is adapting its offerings to provide comprehensive coverage for these emerging technologies.

In conclusion, Geico's comprehensive automotive insurance coverage, competitive rates, and focus on customer service make it a top choice for many drivers. The company's rich history, coupled with its innovative spirit, positions it well for continued success in the dynamic insurance landscape.

Frequently Asked Questions

How can I get a quote from Geico for automotive insurance?

+You can request a quote from Geico by visiting their website, using their mobile app, or by calling their customer service hotline. The quote process typically involves providing details about your vehicle, driving history, and desired coverage options.

What factors influence Geico’s automotive insurance rates?

+Geico’s rates are influenced by various factors, including the make and model of your vehicle, your driving record, the number of miles driven annually, and the level of coverage you choose. Additionally, your age, gender, and marital status can also impact your premium.

Does Geico offer discounts for multiple vehicles on one policy?

+Yes, Geico offers a multi-vehicle discount when you insure more than one vehicle on the same policy. This can lead to significant savings on your insurance premiums.

How does Geico handle claims for accidents involving uninsured/underinsured drivers?

+If you have uninsured/underinsured motorist coverage, Geico will handle the claim process on your behalf. They will investigate the accident, assess the damages, and work to ensure you receive the compensation you’re entitled to under your policy.

Can I bundle my automotive insurance with other Geico policies to save money?

+Absolutely! Geico offers a multi-policy discount when you bundle your automotive insurance with other policies, such as homeowners or renters insurance. This can result in substantial savings on your overall insurance premiums.