Car Insurances Florida

When it comes to car insurance in Florida, understanding the unique laws and regulations of the state is crucial for residents and visitors alike. Florida's insurance landscape is distinct, offering both challenges and opportunities for policyholders. In this comprehensive guide, we'll delve into the specifics of car insurance in Florida, exploring the coverage options, requirements, and factors that influence premiums, ensuring you have the knowledge to make informed decisions about your auto insurance.

Navigating the Florida Insurance Market

Florida is known for its vibrant culture, stunning beaches, and, unfortunately, its susceptibility to natural disasters. These factors, coupled with a unique no-fault insurance system, create a complex insurance environment. Understanding the Florida car insurance market is essential for obtaining adequate coverage at a reasonable cost.

Florida’s No-Fault Insurance System

One of the most significant aspects of car insurance in Florida is its no-fault insurance system. This means that, in the event of an accident, your own insurance policy typically covers your injuries and damages, regardless of who caused the accident. This system aims to streamline the claims process and reduce litigation.

Under Florida’s no-fault law, Personal Injury Protection (PIP) coverage is mandatory. PIP covers medical expenses and lost wages for the policyholder and their passengers, up to the policy limit. It’s crucial to understand that while PIP provides some coverage, it may not be sufficient for severe accidents or extensive medical treatment.

| PIP Coverage | Description |

|---|---|

| Minimum Required | $10,000 |

| Recommended | $100,000 or more |

While PIP is mandatory, additional coverage options are available to enhance your protection. These include:

- Bodily Injury Liability (BIL): Covers injuries you cause to others.

- Property Damage Liability (PDL): Covers damage to others' property.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): Protects you if an at-fault driver has insufficient insurance.

- Collision Coverage: Pays for repairs to your vehicle after an accident, regardless of fault.

- Comprehensive Coverage: Covers damages from non-collision incidents like theft, vandalism, or natural disasters.

Factors Influencing Florida Car Insurance Rates

Like any state, Florida car insurance rates are influenced by a variety of factors. Understanding these factors can help you anticipate and manage your insurance costs.

Traffic Density and Accident Rates

Florida’s high population and tourist influx contribute to heavy traffic, increasing the likelihood of accidents. Areas with higher accident rates often experience higher insurance premiums.

Natural Disasters and Weather Events

Florida’s susceptibility to hurricanes, tropical storms, and flooding makes comprehensive coverage a critical component of car insurance policies. These events can lead to substantial property damage, impacting insurance rates.

Population Density and Crime Rates

Cities with higher population density and crime rates may experience higher insurance costs due to increased risks of car theft and vandalism.

Driver Demographics and History

Insurance rates are also influenced by personal factors such as age, gender, driving history, and credit score. Younger drivers and those with a history of accidents or traffic violations may face higher premiums.

Vehicle Type and Usage

The type of vehicle you drive and how you use it can impact your insurance rates. Sports cars and luxury vehicles often have higher premiums due to their cost and performance. Additionally, vehicles used for business purposes may require commercial insurance.

Tips for Finding Affordable Car Insurance in Florida

Navigating the Florida insurance market can be challenging, but there are strategies to find affordable coverage that meets your needs.

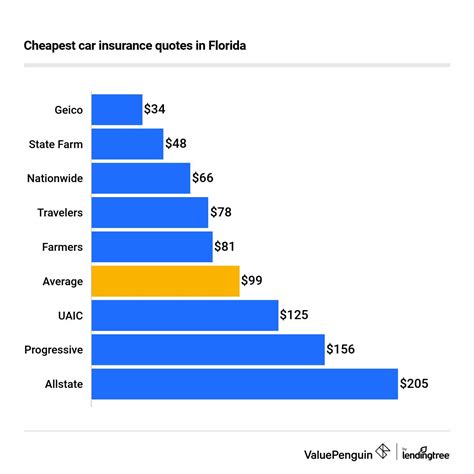

Shop Around and Compare Quotes

Insurance rates can vary significantly between providers. Take the time to compare quotes from multiple insurers to find the best combination of coverage and price.

Bundle Your Policies

Many insurance companies offer discounts when you bundle multiple policies, such as auto and home insurance. This can be a cost-effective way to save on your overall insurance expenses.

Consider Higher Deductibles

Opting for a higher deductible can lower your premium, but it’s essential to ensure you can afford the deductible in the event of a claim.

Maintain a Clean Driving Record

A clean driving record is one of the best ways to keep your insurance premiums low. Avoid traffic violations and accidents to maintain a positive driving history.

Explore Discounts

Insurance companies offer various discounts, including safe driver discounts, good student discounts, and loyalty discounts. Ask your insurer about the discounts you may be eligible for.

Choosing the Right Coverage

Determining the right coverage for your needs involves assessing your personal circumstances and financial situation. Here are some considerations:

Minimum Required Coverage

Florida law requires a minimum level of coverage. Ensure your policy meets or exceeds these requirements to avoid legal issues.

Additional Coverage Options

Consider your personal circumstances and the risks you face. If you frequently drive long distances, adding comprehensive coverage for natural disasters may be wise. For those with valuable assets, higher liability limits can provide added protection.

Understanding Policy Exclusions

Review your policy carefully to understand what is and isn’t covered. Some policies may have exclusions for specific types of damage or situations.

The Future of Florida Car Insurance

The car insurance landscape in Florida is continually evolving. As technology advances, we can expect to see changes in how insurance is priced and delivered. Here are some potential future developments:

Usage-Based Insurance (UBI)

UBI programs, which use telematics devices to monitor driving behavior, are gaining traction. These programs offer customized premiums based on individual driving habits, rewarding safe drivers with lower rates.

Autonomous Vehicle Insurance

As self-driving cars become a reality, the insurance industry will need to adapt. New coverage types may emerge to address the unique risks and liabilities associated with autonomous vehicles.

Data-Driven Pricing

Insurance companies are increasingly using data analytics to price policies. This could lead to more accurate and personalized pricing, but it also raises privacy concerns.

Digital Transformation

The insurance industry is embracing digital technologies, offering online quotes, policy management, and claims processing. This shift towards digital services can improve efficiency and customer experience.

Conclusion

Understanding the intricacies of car insurance in Florida is crucial for residents and visitors. From the unique no-fault system to the factors influencing rates, this guide has provided a comprehensive overview. By staying informed and shopping around, you can find the right coverage at a competitive price. Remember, your car insurance is a vital part of your financial plan, offering protection in the event of an accident or other unexpected events.

What is the average cost of car insurance in Florida?

+The average cost of car insurance in Florida varies depending on several factors, including your age, driving history, and the type of coverage you choose. As of 2023, the average cost of car insurance in Florida is approximately 1,800 per year. However, this can range significantly, with some drivers paying as little as 1,000 per year while others pay over $3,000.

Are there any discounts available for Florida car insurance policies?

+Yes, there are several discounts available that can help reduce your car insurance premiums in Florida. These include safe driver discounts, good student discounts, multi-policy discounts (when you bundle car insurance with other policies like homeowners or renters insurance), and loyalty discounts for long-term customers. Additionally, some companies offer discounts for vehicles equipped with safety features or for those who complete defensive driving courses.

How can I save money on my Florida car insurance premiums?

+To save money on your Florida car insurance premiums, you can consider increasing your deductible, maintaining a clean driving record, and exploring discounts. Additionally, shopping around and comparing quotes from multiple insurers can help you find the most competitive rates. Bundling your car insurance with other policies, such as homeowners or renters insurance, can also lead to significant savings.