Best Rated Health Insurance Companies

In the vast landscape of healthcare, choosing the right health insurance company is a critical decision that can significantly impact your well-being and financial security. With numerous options available, it can be daunting to navigate the market and identify the best providers. This comprehensive guide aims to shed light on the top-rated health insurance companies, offering insights into their services, reputation, and key features to help you make an informed choice.

Understanding the Top-Rated Health Insurance Companies

The health insurance industry is a complex web of providers, each offering unique plans and benefits. When evaluating the best-rated companies, several factors come into play, including financial stability, customer satisfaction, coverage options, and network of healthcare providers.

Financial stability is a critical aspect, as it ensures the company's ability to pay claims promptly and maintain long-term viability. Customer satisfaction ratings provide an insight into the company's performance, service quality, and overall customer experience. Coverage options play a pivotal role, as they determine the scope and flexibility of your healthcare choices.

Additionally, the network of healthcare providers associated with an insurance company is a key consideration. A robust network ensures access to a wide range of medical professionals and facilities, enhancing your healthcare options and convenience.

Top-Rated Health Insurance Companies: An In-Depth Look

Let’s delve into some of the leading health insurance companies that consistently rank highly in industry assessments and customer satisfaction surveys.

1. UnitedHealthcare

UnitedHealthcare is a prominent player in the health insurance market, known for its extensive network of providers and comprehensive coverage options. The company offers a wide range of plans, including individual, family, and employer-sponsored options, catering to diverse healthcare needs.

Key Features:

- Diverse Plan Options: UnitedHealthcare provides an array of plans, from HMO and PPO to EPO and POS, ensuring flexibility and choice.

- Large Provider Network: With a vast network of healthcare professionals and facilities, UnitedHealthcare offers convenient access to care.

- Innovative Technologies: The company leverages digital tools and platforms to enhance the customer experience, including mobile apps for easy claim submission and provider search.

2. Blue Cross Blue Shield

Blue Cross Blue Shield (BCBS) is a renowned health insurance provider with a rich history spanning over a century. BCBS offers a nationwide network of healthcare providers, making it a popular choice for individuals seeking comprehensive coverage.

Key Features:

- National Coverage: BCBS provides coverage across the United States, ensuring access to care regardless of location.

- Individualized Plans: The company offers tailored plans to meet the unique needs of individuals and families, including maternity care and prescription drug coverage.

- Wellness Programs: BCBS promotes preventive care through various wellness initiatives, encouraging healthy lifestyles and early detection of potential health issues.

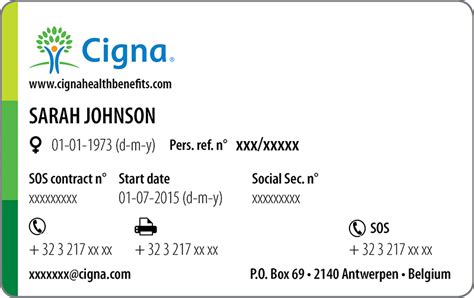

3. Cigna

Cigna is a leading global health service company, offering a wide range of insurance and healthcare services. The company's focus on personalized care and innovative technologies has garnered recognition in the industry.

Key Features:

- Personalized Care: Cigna emphasizes a holistic approach to healthcare, offering personalized plans and support to manage chronic conditions and overall well-being.

- Digital Health Tools: The company leverages digital platforms and wearable technologies to enhance patient engagement and provide convenient access to healthcare services.

- Global Reach: With a presence in over 30 countries, Cigna offers international coverage, making it an ideal choice for individuals with global healthcare needs.

4. Aetna

Aetna is a well-established health insurance provider, known for its comprehensive coverage and customer-centric approach. The company offers a wide range of plans, including Medicare and Medicaid options, catering to diverse populations.

Key Features:

- Flexible Plans: Aetna provides a variety of plan options, allowing individuals to choose coverage that aligns with their specific healthcare needs and budget.

- Medicare Advantage: The company offers a range of Medicare Advantage plans, providing additional benefits beyond original Medicare coverage.

- Member Resources: Aetna provides extensive resources and support to members, including health and wellness programs, disease management tools, and educational materials.

5. Humana

Humana is a leading health and well-being company, offering a holistic approach to healthcare. The company focuses on personalized care, wellness, and disease prevention, aiming to improve overall health outcomes.

Key Features:

- Wellness-Focused: Humana emphasizes preventive care and healthy lifestyle choices, offering various wellness programs and incentives to promote overall well-being.

- Senior-Centric Plans: The company specializes in Medicare and Medicaid plans, providing comprehensive coverage for seniors and individuals with disabilities.

- Innovative Care Models: Humana explores innovative care models, such as value-based care and telemedicine, to enhance access and improve patient outcomes.

Evaluating Health Insurance Companies: A Comprehensive Guide

When assessing health insurance companies, it's essential to consider a range of factors to ensure you choose the best provider for your needs. Here's a comprehensive guide to help you make an informed decision:

Financial Stability

Financial stability is a critical aspect when evaluating health insurance companies. A financially stable company is more likely to honor its commitments and pay claims promptly. Look for companies with strong financial ratings from reputable agencies such as AM Best, Moody’s, or Standard & Poor’s.

Customer Satisfaction

Customer satisfaction is a key indicator of a company’s performance and service quality. Research customer reviews and ratings on trusted platforms to gain insights into the company’s reputation and customer experience. Consider factors such as claim processing, customer service responsiveness, and overall satisfaction levels.

Coverage Options

The range and flexibility of coverage options are essential considerations. Evaluate the types of plans offered, including HMO, PPO, EPO, and POS, to ensure they align with your healthcare needs. Consider factors such as prescription drug coverage, maternity benefits, and mental health services.

Provider Network

A robust provider network is crucial for convenient access to healthcare services. Assess the company’s network of healthcare professionals and facilities, ensuring it includes your preferred doctors and hospitals. Consider the network’s geographical coverage to ensure availability in your area.

Additional Benefits and Programs

Look for companies that offer additional benefits and programs beyond basic coverage. This may include wellness initiatives, disease management support, and educational resources. Such programs can enhance your overall healthcare experience and promote a healthier lifestyle.

Comparative Analysis: Top-Rated Health Insurance Companies

To provide a comprehensive comparison, let’s examine some key features of the top-rated health insurance companies side by side.

| Company | Financial Stability | Customer Satisfaction | Coverage Options | Provider Network |

|---|---|---|---|---|

| UnitedHealthcare | Strong financial ratings, consistent performance | High customer satisfaction, prompt claim processing | Diverse plan options, including HMO, PPO, EPO, and POS | Extensive network of providers, convenient access |

| Blue Cross Blue Shield | Stable finances, reliable claim payments | Positive customer reviews, responsive service | Individualized plans, national coverage | Broad network, including rural and urban areas |

| Cigna | Financial strength, global reach | Excellent customer support, personalized care | Flexible plans, international coverage | Wide network, including specialty care providers |

| Aetna | Strong financial position, stable performance | High satisfaction, member resources | Diverse plans, including Medicare Advantage | Extensive network, including rural and urban areas |

| Humana | Stable finances, focused on value-based care | Positive reviews, senior-centric plans | Wellness-focused, Medicare and Medicaid plans | Robust network, including telemedicine options |

The Future of Health Insurance: Emerging Trends

The health insurance industry is constantly evolving, with emerging trends shaping the future of healthcare. Here are some key trends to watch out for:

Value-Based Care

Value-based care models are gaining traction, focusing on outcomes and patient satisfaction rather than volume of services. This approach aims to improve quality and efficiency while reducing costs.

Telemedicine and Digital Health

The rise of telemedicine and digital health technologies is transforming the way healthcare is delivered. These innovations enhance access to care, especially in rural areas, and provide convenient options for routine consultations and follow-ups.

Consumer-Driven Health Plans

Consumer-driven health plans empower individuals to take control of their healthcare choices and expenses. These plans, such as Health Savings Accounts (HSAs) and Health Reimbursement Arrangements (HRAs), offer tax advantages and encourage proactive health management.

Wellness and Prevention

There is a growing emphasis on wellness and preventive care, with health insurance companies offering incentives and programs to promote healthy lifestyles and early detection of health issues. This shift aims to reduce the burden of chronic diseases and improve overall population health.

FAQs

How do I choose the right health insurance plan for my needs?

+Choosing the right health insurance plan involves assessing your specific healthcare needs, budget, and preferences. Consider factors such as coverage options, provider network, and additional benefits. Research and compare plans from top-rated companies to find the best fit.

What should I look for in a health insurance company’s financial stability?

+Financial stability is crucial. Look for companies with strong financial ratings and a history of consistent performance. Check ratings from reputable agencies to ensure the company can honor its commitments and pay claims promptly.

How important is customer satisfaction when choosing a health insurance company?

+Customer satisfaction is a key indicator of a company’s performance and service quality. Positive customer reviews and high satisfaction ratings suggest prompt claim processing, responsive customer service, and overall positive experiences.

What are the benefits of value-based care models in health insurance?

+Value-based care models focus on outcomes and patient satisfaction, aiming to improve quality and efficiency while reducing costs. These models encourage providers to deliver coordinated, patient-centered care, leading to better health outcomes and a more positive patient experience.

As you navigate the complex world of health insurance, remember that choosing the right provider is a critical decision that can impact your well-being and financial security. By understanding the top-rated health insurance companies and their key features, you can make an informed choice that aligns with your healthcare needs and preferences.