Compare Insurance Quotes Auto

In today's fast-paced world, where time is of the essence, getting multiple insurance quotes for your automobile can be a tedious and time-consuming task. However, it is a necessary step to ensure you find the best coverage at the most competitive rates. This comprehensive guide will delve into the intricacies of comparing auto insurance quotes, providing you with the knowledge and tools to make an informed decision.

The Importance of Comparison Shopping

When it comes to auto insurance, one size does not fit all. Insurance companies use various factors to calculate premiums, and these can vary significantly between providers. By comparing quotes, you unlock the power to choose the coverage that best suits your needs and budget.

Factors Influencing Premiums

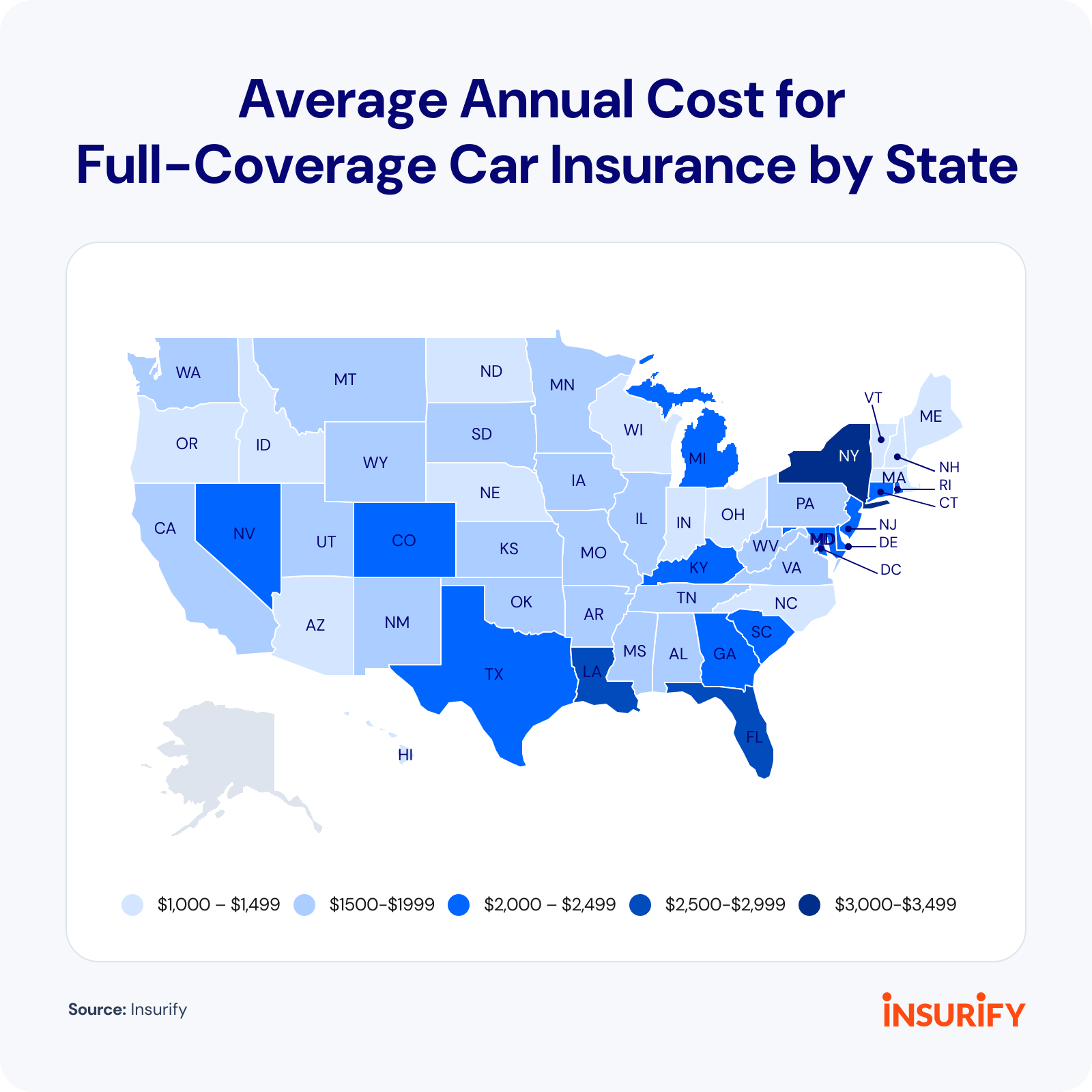

Numerous elements contribute to the calculation of your auto insurance premium. These include your driving history, vehicle make and model, age and gender, location, and even credit score in some states. Understanding how these factors impact your quote is crucial for an effective comparison.

| Factor | Description |

|---|---|

| Driving History | Your record of accidents, violations, and claims plays a significant role in determining your premium. |

| Vehicle | The type of car you drive, its safety features, and repair costs can affect your insurance rates. |

| Demographics | Age, gender, and marital status are considered, with younger drivers and males typically facing higher premiums. |

| Location | The area you live in and its crime rate, traffic density, and weather conditions influence your quote. |

| Credit Score | In many states, a good credit score can lead to lower insurance rates. |

The Comparison Process

Comparing insurance quotes involves a systematic approach. Here’s a step-by-step guide to help you navigate the process:

- Gather Information: Start by collecting the necessary details about your vehicle, driving history, and personal information. This will ensure a smooth and accurate quote process.

- Choose Reputable Insurers: Select a range of well-known and trusted insurance companies to request quotes from. A mix of traditional and online providers can offer a comprehensive view of the market.

- Use Online Tools: Many insurance companies provide online quote tools. These can be a quick and convenient way to get an initial estimate, but remember to follow up with a detailed quote for accuracy.

- Request Detailed Quotes: Contact the insurers directly to request comprehensive quotes. This allows you to discuss your specific needs and understand the coverage offered.

- Compare Apples to Apples: Ensure you're comparing similar coverage levels and deductibles. Different insurers may use different terminology, so clarify any uncertainties to make an accurate comparison.

- Consider Additional Benefits: Look beyond the premium. Some insurers offer unique benefits like roadside assistance or accident forgiveness, which could be valuable additions to your coverage.

- Check for Discounts: Inquire about discounts for good driving records, multiple policy bundles, or safety features in your vehicle. These can significantly reduce your overall premium.

- Read the Fine Print: Don't rush into a decision. Take the time to review the policy documents thoroughly, understanding the coverage limits, exclusions, and any potential gaps in coverage.

- Seek Expert Advice: If you're unsure, consult an insurance broker or agent. They can provide valuable insights and guidance based on your specific circumstances.

The Impact of Deductibles

One crucial aspect to consider when comparing quotes is the deductible. This is the amount you agree to pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lead to lower premiums, but it’s essential to strike a balance that you’re comfortable with. Consider your financial situation and the potential risks to find the right deductible for your needs.

Online vs. Traditional Insurance Providers

The rise of online insurance providers has revolutionized the comparison process. These digital platforms offer convenience and often provide instant quotes. However, traditional insurance agents still have their place, offering personalized advice and guidance. Consider a hybrid approach, leveraging online tools for initial comparisons and then consulting with an agent to fine-tune your coverage.

Maximizing Your Savings

Beyond comparing quotes, there are strategies to further reduce your auto insurance costs. Here are some tips to consider:

- Improve Your Driving Record: A clean driving history can lead to significant savings. Practice safe driving and avoid violations to keep your record spotless.

- Bundle Policies: Insuring multiple vehicles or combining auto insurance with other policies, like homeowners or renters insurance, can result in substantial discounts.

- Explore Telematics Insurance: Some insurers offer usage-based insurance, where your driving behavior is monitored and used to calculate premiums. This can benefit safe drivers and provide an accurate reflection of your risk profile.

- Maintain a Good Credit Score: As mentioned earlier, a good credit score can impact your insurance rates. Work on improving your credit to unlock potential savings.

- Review Your Coverage Regularly: Insurance needs can change over time. Regularly review your policy to ensure it aligns with your current situation and make adjustments as necessary.

The Role of Technology

Advancements in technology have transformed the insurance industry. Insurers now utilize data analytics and machine learning to assess risk and calculate premiums more accurately. This has led to more personalized and competitive quotes. Embrace these technological advancements to access the best deals and ensure your coverage remains up-to-date.

Conclusion: Empowering Your Decision

Comparing auto insurance quotes is a powerful tool to ensure you receive the best value for your insurance needs. By understanding the factors that influence premiums, following a systematic comparison process, and leveraging technology, you can make an informed decision. Remember, insurance is a long-term investment, and taking the time to compare quotes can pay off significantly in the long run.

FAQs

How often should I compare insurance quotes?

+It’s a good practice to compare quotes annually or whenever you experience a significant life change, such as buying a new car, moving to a different location, or getting married.

Can I negotiate my insurance premium?

+While insurance premiums are typically non-negotiable, you can discuss your options with an agent to explore potential discounts or alternative coverage options.

What happens if I provide incorrect information when requesting a quote?

+Providing inaccurate information can lead to an invalid quote. Insurance companies verify the details you provide, and any discrepancies could result in higher premiums or policy cancellation.

Are online insurance quotes accurate?

+Online quotes are often initial estimates and may not reflect the final premium. It’s essential to follow up with a detailed quote to ensure accuracy.

Can I switch insurance providers mid-policy term?

+Yes, you can switch providers at any time, but you may incur a fee for canceling your existing policy early. It’s advisable to time your switch to coincide with your renewal date to avoid additional costs.