Ways To Make Insurance Cheaper

The cost of insurance can often be a significant expense for individuals and businesses alike. Whether it's health, auto, home, or business insurance, finding ways to reduce premiums is a common goal. Fortunately, there are several strategies and considerations that can help make insurance more affordable. In this comprehensive guide, we will delve into various aspects that influence insurance costs and explore practical ways to lower your insurance expenses.

Understanding the Factors That Impact Insurance Costs

Insurance premiums are calculated based on a multitude of factors, each contributing to the overall cost. By understanding these influences, you can make informed decisions to potentially reduce your insurance expenses. Here are some key factors to consider:

Risk Assessment

Insurance companies assess the risk associated with insuring an individual or entity. Higher risk typically leads to higher premiums. For example, in auto insurance, factors such as age, driving history, and the type of vehicle can influence the risk assessment. Similarly, in health insurance, pre-existing conditions and age play a significant role.

Coverage and Policy Terms

The level of coverage you choose directly impacts your insurance costs. Comprehensive policies with higher coverage limits generally cost more. Additionally, the policy terms, including deductibles, co-payments, and exclusions, can affect the overall expense. Understanding these terms and customizing your coverage to your specific needs can help strike a balance between affordability and adequate protection.

Location and Demographics

Your geographical location and demographic factors can influence insurance rates. For instance, areas with higher crime rates or natural disaster risks may have higher insurance premiums. Demographic factors such as age, gender, and marital status can also be considered in certain types of insurance.

Credit History and Claims Record

Insurers often use credit scores as an indicator of financial responsibility. A good credit history can lead to lower insurance rates, as it suggests a lower risk of non-payment. Additionally, a clean claims record, where you haven’t made frequent or costly claims, can work in your favor and result in more affordable premiums.

Competition and Market Dynamics

The insurance market is highly competitive, and this competition can drive prices down. Shopping around and comparing quotes from multiple insurers can help you find the most competitive rates. Understanding market trends and keeping up with industry news can also provide insights into potential savings opportunities.

Strategies to Make Insurance More Affordable

Now that we’ve explored the factors influencing insurance costs, let’s delve into practical strategies to make insurance more affordable. These strategies can be applied across various types of insurance, helping you save money while maintaining adequate coverage.

Shop Around and Compare Quotes

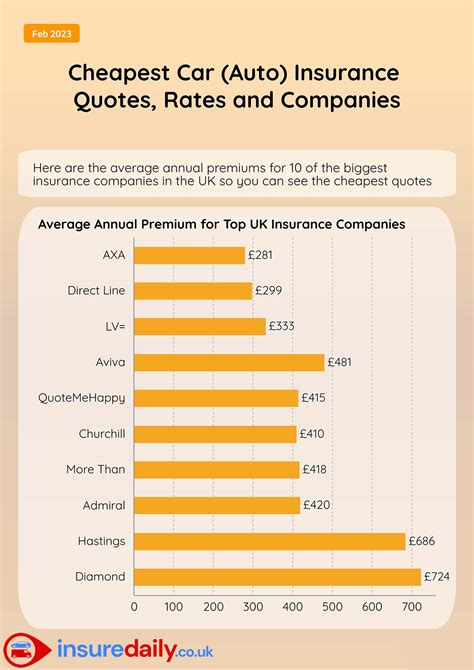

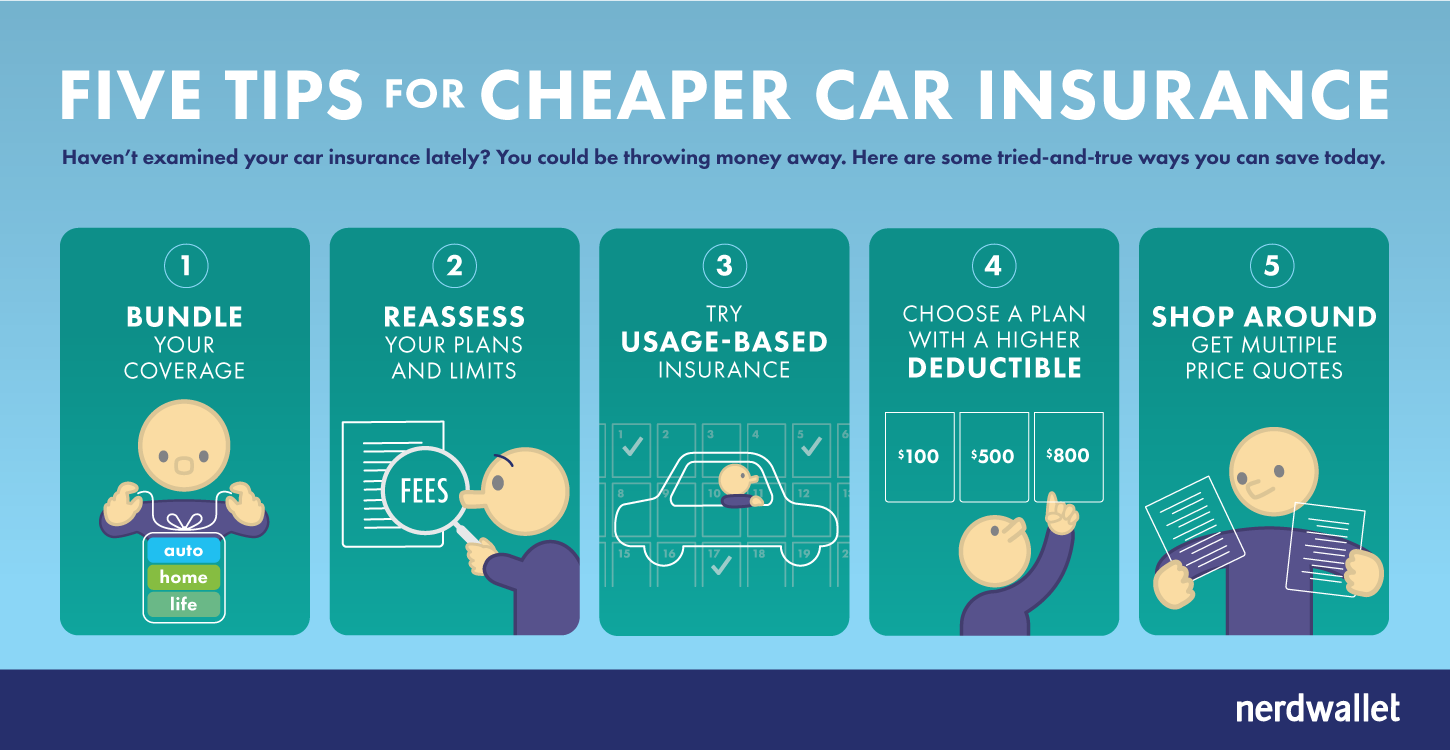

One of the simplest yet most effective ways to reduce insurance costs is to shop around and compare quotes from different insurers. Each company uses its own proprietary algorithms to calculate premiums, so rates can vary significantly. By obtaining multiple quotes, you can identify the most competitive options and potentially negotiate better rates.

Online comparison tools and insurance brokers can streamline the process, allowing you to quickly gather quotes from various providers. Ensure you're comparing policies with similar coverage levels and terms to make an accurate assessment.

Bundle Policies for Discounts

Bundling multiple insurance policies with the same insurer can often lead to substantial discounts. For instance, if you have auto and home insurance, consider combining them with a single provider. Many insurers offer multi-policy discounts, reducing the overall cost of your insurance portfolio.

Additionally, bundling different types of insurance, such as auto and life insurance, or home and renters insurance, can provide additional savings. By combining policies, you not only save money but also simplify your insurance management, making it more convenient.

Review and Optimize Coverage

Regularly reviewing your insurance coverage and making necessary adjustments can help reduce costs without compromising protection. Assess your current needs and evaluate whether your existing policies provide adequate coverage. If you find yourself overinsured, consider reducing coverage limits or increasing deductibles to lower premiums.

On the other hand, if you've made significant life changes, such as buying a new home or starting a family, ensure your insurance coverage reflects these changes. Gaps in coverage can leave you vulnerable, so it's essential to strike a balance between affordability and adequate protection.

Improve Risk Profile

Insurance companies assess risk based on various factors, and improving your risk profile can lead to lower premiums. For example, in auto insurance, maintaining a clean driving record by avoiding accidents and traffic violations can positively impact your risk assessment. Similarly, in health insurance, adopting a healthy lifestyle and managing pre-existing conditions can reduce your perceived risk.

Additionally, consider taking safety measures to reduce the likelihood of claims. For instance, installing security systems in your home or using defensive driving techniques can lower the risk of theft or accidents, respectively. By demonstrating responsible behavior and reducing potential claims, you can negotiate better insurance rates.

Utilize Discounts and Rewards

Insurance companies often offer a range of discounts and rewards to attract and retain customers. These discounts can be based on various factors, such as age, occupation, loyalty, or even payment methods. By understanding the discounts available, you can strategically choose policies that provide the best value.

For instance, some insurers offer discounts for early policy renewals or for paying premiums annually instead of monthly. Others may provide rewards for referring new customers or for maintaining a long-term relationship. Exploring these options and taking advantage of available discounts can significantly reduce your insurance expenses.

Explore Alternative Insurance Options

Traditional insurance providers aren’t the only option for obtaining coverage. Alternative insurance models, such as mutual insurance companies or captive agents, can offer competitive rates and unique benefits. Mutual insurance companies are owned by policyholders, and profits are distributed as dividends, potentially resulting in lower premiums.

Captive agents, on the other hand, represent a single insurance company and can provide personalized service and tailored coverage. Exploring these alternative options can open up new possibilities for affordable insurance.

Advanced Strategies for Lowering Insurance Costs

While the strategies mentioned above can help reduce insurance costs for most individuals and businesses, there are additional advanced techniques that can provide even greater savings. These strategies require a deeper understanding of insurance dynamics and may involve more complex decision-making processes.

Understand and Optimize Deductibles

Deductibles are the amount you pay out of pocket before your insurance coverage kicks in. Choosing higher deductibles can significantly reduce your insurance premiums. However, it’s essential to carefully consider your financial situation and risk tolerance before opting for higher deductibles.

By increasing your deductible, you're essentially agreeing to pay more in the event of a claim. This can be a cost-effective strategy if you have a good claims record and are confident you won't need to make frequent or costly claims. It's a balance between reducing premiums and ensuring you can afford the increased out-of-pocket expenses.

Consider Self-Insuring for Low-Risk Exposures

Self-insuring involves setting aside funds to cover potential losses instead of purchasing insurance. This strategy is suitable for low-risk exposures, such as certain types of business liabilities or minor property damage. By self-insuring, you can avoid the cost of insurance premiums and retain control over your finances.

However, self-insuring requires a thorough understanding of your risk profile and the ability to accurately assess potential losses. It's crucial to have a robust financial plan in place to ensure you can cover unexpected expenses. This strategy may not be suitable for everyone and should be carefully considered with the guidance of financial and insurance professionals.

Negotiate with Your Insurer

Insurance companies are often willing to negotiate rates, especially if you have a strong claims record and a long-term relationship with the insurer. By demonstrating your loyalty and providing evidence of responsible behavior, you can potentially secure better rates. Negotiating can be a powerful tool to lower your insurance costs.

During negotiations, highlight your clean claims history, any safety measures you've implemented, and your overall risk profile. Insurers value long-term customers and may be open to providing discounts or tailored coverage options to retain your business. Don't be afraid to advocate for yourself and explore the possibilities of negotiating more affordable rates.

Explore Group Insurance Plans

Group insurance plans, often offered through employers or professional associations, can provide substantial discounts due to the collective bargaining power of the group. These plans typically offer competitive rates and a range of coverage options, making them an attractive choice for individuals and businesses.

If you're eligible for a group insurance plan, consider joining to take advantage of the reduced premiums. Group plans can provide peace of mind and ensure you have adequate coverage at an affordable price. Additionally, group plans often come with additional benefits and support services, further enhancing their value.

Use Technology to Optimize Insurance Costs

Advancements in technology have revolutionized the insurance industry, providing tools and platforms to help consumers optimize their insurance costs. Online comparison websites, mobile apps, and digital insurance brokers offer convenient ways to compare quotes, manage policies, and access real-time information.

Utilizing these digital tools can streamline the insurance shopping process and provide valuable insights into the market. Additionally, insurers are increasingly using technology to assess risk and offer personalized coverage options. By embracing these technological advancements, you can stay informed and make more informed decisions about your insurance needs.

Conclusion: Making Insurance Affordable for All

Making insurance more affordable is a multifaceted process that requires a combination of strategies and a deep understanding of the insurance landscape. By exploring the factors that influence insurance costs and implementing practical techniques, individuals and businesses can reduce their insurance expenses without compromising protection.

From shopping around and comparing quotes to optimizing coverage and improving risk profiles, there are numerous ways to make insurance more accessible. Advanced strategies, such as understanding deductibles, self-insuring, negotiating with insurers, and exploring group plans, can provide even greater savings for those willing to delve deeper into the world of insurance.

Remember, insurance is a crucial aspect of financial planning, and finding the right balance between coverage and affordability is essential. By staying informed, leveraging technology, and taking a proactive approach to insurance management, you can make insurance a more manageable expense, ensuring you have the protection you need without straining your budget.

What are some common misconceptions about insurance costs?

+There are several misconceptions about insurance costs. One common myth is that insurance is always expensive and unaffordable. While insurance can be a significant expense, there are numerous strategies to reduce costs, as outlined in this article. Additionally, the belief that all insurance companies offer the same rates is another misconception. Shopping around and comparing quotes is essential to finding the most competitive prices.

How often should I review and adjust my insurance coverage?

+It’s recommended to review your insurance coverage annually or whenever you experience significant life changes. Regular reviews ensure your coverage remains up-to-date and reflects your current needs. Life events such as buying a new home, starting a family, or changing jobs can impact your insurance requirements, so it’s crucial to assess and adjust your policies accordingly.

Can I negotiate insurance rates with my insurer?

+Yes, negotiating insurance rates is possible and can lead to significant savings. Insurers are often open to discussions, especially if you have a strong claims record and a long-term relationship with the company. By highlighting your loyalty, clean claims history, and responsible behavior, you can potentially secure better rates and customized coverage options.