How Much Does Renters Insurance Cost

Renters insurance, also known as tenant insurance, is a vital protection for individuals living in rented accommodations. It provides financial coverage for various scenarios that could affect renters, ensuring peace of mind and safeguarding personal belongings and liability. The cost of renters insurance is a common concern, and understanding the factors influencing its price can help individuals make informed decisions about their coverage.

The Average Cost of Renters Insurance

The average cost of renters insurance varies depending on several factors, including the location of the rental property, the amount of coverage required, and the insurer providing the policy. According to industry data, the average annual premium for renters insurance in the United States is approximately $187 as of 2023. However, this average can vary significantly based on individual circumstances.

Regional Variations

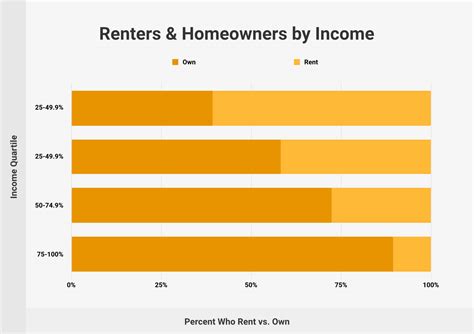

Renters insurance premiums can differ greatly across regions. For instance, states like New York and Florida often have higher average rates due to the increased risk of natural disasters and higher living costs. In contrast, states like Idaho and North Dakota typically have lower average rates.

| State | Average Annual Premium |

|---|---|

| New York | $275 |

| Florida | $250 |

| Idaho | $150 |

| North Dakota | $140 |

Coverage Amounts and Limits

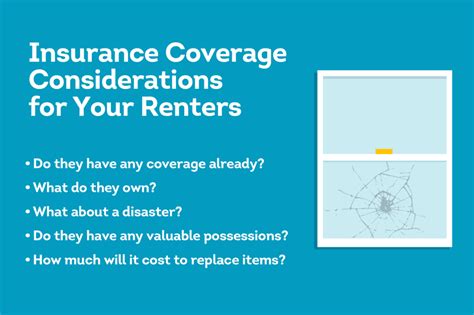

The amount of coverage you select is a significant factor in determining the cost of your renters insurance. Policies typically offer coverage limits for personal property, liability, and additional living expenses. The higher the coverage limits you choose, the more expensive your premium is likely to be. It’s essential to strike a balance between the coverage you need and the cost of the policy.

| Coverage Type | Average Coverage Limit |

|---|---|

| Personal Property | $30,000 - $50,000 |

| Liability | $100,000 - $300,000 |

| Additional Living Expenses | Varies (usually covers up to 20% of personal property limit) |

Factors Affecting Renters Insurance Cost

Several other factors can influence the cost of renters insurance, including:

- Credit Score: Insurers often consider credit history when calculating premiums. A higher credit score may result in a lower premium.

- Deductibles: Choosing a higher deductible can lower your premium, but it means you’ll pay more out of pocket if you need to make a claim.

- Discounts: Many insurers offer discounts for things like bundling renters insurance with other policies, installing security devices, or being claims-free for a certain period.

- Type of Building: Renting in a high-rise apartment building may cost more than renting a single-family home due to increased risk.

- Security Features: Having advanced security features like a monitored alarm system or reinforced doors can lower your premium.

Shopping for Renters Insurance

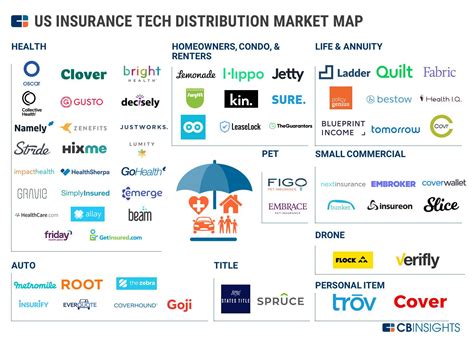

When shopping for renters insurance, it’s essential to compare quotes from multiple insurers to find the best coverage at the most affordable price. Online quote tools and insurance comparison websites can be valuable resources for this process.

Additionally, consider seeking advice from an insurance agent or broker who can guide you through the process and help you understand the coverage options available. They can also assist in identifying potential discounts and ensure you're getting the best value for your insurance dollar.

Future Trends in Renters Insurance Costs

Looking ahead, several factors may influence the cost of renters insurance in the coming years. Increasing frequency and severity of natural disasters, driven by climate change, could lead to higher premiums in high-risk areas. Additionally, as more people embrace the sharing economy and rent out their properties through platforms like Airbnb, insurers may adjust their policies and pricing to account for the increased risk of short-term rentals.

On the other hand, advancements in technology and the use of data analytics may also benefit renters. Insurers are increasingly using telemetrics and smart home devices to monitor and reward safe behaviors, which could lead to more personalized and affordable insurance options.

What is the cheapest renters insurance option?

+The cheapest option will depend on your specific circumstances, but some insurers known for their competitive rates include Lemonade, MetLife, and State Farm.

How can I save money on renters insurance?

+You can save money by increasing your deductible, bundling your policies, maintaining a good credit score, and installing security devices. Additionally, some insurers offer discounts for certain professions or memberships.

Do I need renters insurance if my landlord has a policy?

+Yes, your landlord’s insurance typically covers the building itself but not your personal belongings or liability. Renters insurance is essential to protect your possessions and legal liabilities.

What is the difference between renters insurance and homeowners insurance?

+Renters insurance covers personal belongings and liability for renters, while homeowners insurance provides coverage for the structure of the home and the personal belongings of the owner.