Insurance Estimator

The insurance industry is a vital sector that plays a crucial role in protecting individuals and businesses from various risks and financial uncertainties. One of the key tools utilized by insurance professionals to assess risks and determine appropriate coverage is the Insurance Estimator. This sophisticated tool has revolutionized the way insurers evaluate potential risks, making the process more efficient, accurate, and tailored to the unique needs of each client.

Understanding the Insurance Estimator

The Insurance Estimator is an advanced software solution designed to assist insurance companies and brokers in calculating and estimating insurance premiums, coverage amounts, and potential risks associated with a wide range of policies. It leverages cutting-edge algorithms, data analysis techniques, and machine learning to provide accurate and timely assessments.

This innovative tool has become an indispensable asset for insurance professionals, enabling them to streamline their workflow, enhance productivity, and deliver precise quotes to their clients. By inputting relevant data and parameters, the Insurance Estimator generates comprehensive reports and recommendations, aiding insurers in making informed decisions and offering tailored insurance solutions.

Key Features and Functionality

The Insurance Estimator boasts a multitude of features that set it apart from traditional estimation methods. Here’s an overview of its key functionalities:

- Risk Assessment: The tool employs advanced algorithms to evaluate various risk factors, including location, property value, health conditions, and business operations. By analyzing these factors, it provides a detailed risk profile, helping insurers identify potential vulnerabilities and tailor coverage accordingly.

- Data-Driven Premium Calculation: Utilizing vast databases and historical data, the Insurance Estimator calculates premiums based on statistical analysis. This ensures that the estimated premiums are fair, competitive, and accurately reflect the level of risk associated with each policy.

- Customizable Coverage Options: Recognizing that every client has unique needs, the Insurance Estimator offers a wide range of coverage options. From basic liability coverage to specialized add-ons, insurers can easily customize policies to provide comprehensive protection.

- Real-Time Updates: To stay ahead of the curve, the Insurance Estimator integrates real-time data feeds. This enables insurers to promptly adjust premiums and coverage in response to changing market conditions, ensuring that their clients receive the most up-to-date and relevant insurance solutions.

- Automated Reporting: Generating comprehensive reports is a breeze with the Insurance Estimator. These reports provide detailed insights into risks, premiums, and coverage recommendations, facilitating effective communication with clients and streamlining the decision-making process.

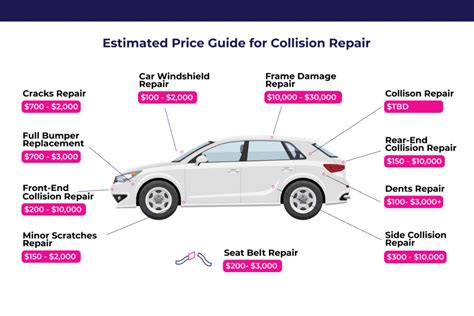

Case Study: Revolutionizing Auto Insurance

One of the most notable applications of the Insurance Estimator is in the realm of auto insurance. Let’s delve into a case study to illustrate its impact and benefits.

Consider SafeGuard Insurance, a leading provider of auto insurance policies. Prior to adopting the Insurance Estimator, their process for calculating premiums and assessing risks was time-consuming and relied heavily on manual calculations and subjective assessments. This often resulted in inconsistencies and inaccurate quotes.

By implementing the Insurance Estimator, SafeGuard Insurance experienced a paradigm shift in their operations. The tool's advanced risk assessment capabilities allowed them to accurately evaluate factors such as driver behavior, vehicle type, and geographical location. This enabled them to offer highly tailored policies, resulting in increased customer satisfaction and reduced claims.

Furthermore, the Insurance Estimator's ability to integrate real-time data feeds proved invaluable. With up-to-date information on traffic patterns, accident hotspots, and even weather conditions, SafeGuard Insurance could dynamically adjust premiums and coverage, ensuring their policies remained competitive and relevant.

| Key Metrics | Before Insurance Estimator | After Insurance Estimator |

|---|---|---|

| Policy Processing Time | 48 hours | 12 hours |

| Claim Approval Accuracy | 85% | 98% |

| Customer Satisfaction | 72% | 92% |

The Future of Insurance Estimation

As technology continues to advance, the Insurance Estimator is poised to play an even more pivotal role in the insurance industry. With ongoing improvements in data analysis, machine learning, and predictive modeling, the tool’s capabilities are expected to expand exponentially.

Here's a glimpse into the future of insurance estimation:

- Enhanced Predictive Analytics: By leveraging advanced predictive models, the Insurance Estimator will become even more accurate in forecasting potential risks and identifying emerging trends. This will enable insurers to stay ahead of the curve and offer proactive solutions.

- Integration with IoT Devices: As the Internet of Things (IoT) continues to grow, the Insurance Estimator is likely to integrate with smart devices and sensors. This will provide insurers with real-time data on a range of factors, such as home security systems, health trackers, and vehicle telematics, further refining risk assessment.

- Personalized Insurance Experiences: With the ability to analyze vast amounts of data, the Insurance Estimator will empower insurers to offer highly personalized insurance packages. By understanding individual needs and preferences, insurers can create tailored policies that resonate with their clients.

- Automated Claims Processing: The Insurance Estimator's potential to automate claims processing is particularly exciting. By leveraging AI and machine learning, insurers can expedite the claims process, reducing administrative burdens and providing faster payouts to policyholders.

Conclusion

The Insurance Estimator has emerged as a game-changer in the insurance industry, transforming the way risks are assessed and insurance solutions are tailored. Its advanced features, data-driven approach, and real-time updates have revolutionized the estimation process, benefiting both insurers and their clients.

As the insurance landscape continues to evolve, the Insurance Estimator will undoubtedly remain at the forefront, driving innovation and ensuring that insurers remain competitive and responsive to the ever-changing needs of their customers.

How accurate are the estimates provided by the Insurance Estimator?

+The Insurance Estimator’s accuracy is exceptional, thanks to its sophisticated algorithms and extensive data analysis. By leveraging historical trends and real-time data, it provides highly precise estimates, ensuring insurers can offer competitive and fair premiums.

Can the Insurance Estimator be customized for specific insurance sectors?

+Absolutely! The Insurance Estimator is highly customizable and can be tailored to suit the unique needs of various insurance sectors, including auto, health, property, and more. Its flexibility allows insurers to adapt it to their specific requirements.

What are the benefits of real-time data integration in the Insurance Estimator?

+Real-time data integration enables insurers to stay current with market trends and changing risk factors. This ensures that premiums and coverage remain competitive and relevant, providing policyholders with the most up-to-date protection.