State Farm Insurance Get A Quote

Welcome to a comprehensive guide exploring the world of State Farm Insurance and its quote process. In this article, we delve into the intricacies of obtaining a quote from State Farm, a leading insurance provider, to help you navigate the path to securing the right coverage for your needs. With a rich history spanning over a century, State Farm has established itself as a trusted name in the insurance industry, offering a wide range of coverage options to protect individuals and businesses alike.

Understanding State Farm Insurance

State Farm Insurance, founded in 1922, has evolved into a comprehensive insurance provider with a strong focus on customer satisfaction and tailored coverage. Over the years, they have expanded their services to cater to a diverse range of clients, including individuals, families, and small businesses. The company’s mission is to help people manage the risks of everyday life, recover from the unexpected, and realize their dreams.

State Farm offers a vast array of insurance products, including auto, home, life, health, and business insurance. Their approach to insurance is characterized by a deep understanding of the unique needs of their clients, ensuring that each policy is tailored to provide the right level of protection.

The Benefits of State Farm Insurance

Choosing State Farm as your insurance provider comes with numerous advantages. Firstly, their extensive network of local agents provides personalized service, ensuring that you receive expert guidance tailored to your specific situation. This level of personalized attention is a key differentiator for State Farm, setting them apart from many other insurance providers.

Additionally, State Farm is renowned for its financial stability and strong reputation. With a long history of delivering on its promises, the company has built a solid foundation of trust with its customers. This stability is particularly important when considering long-term insurance needs, as it ensures the company will be there to provide support and coverage when you need it most.

State Farm also prides itself on its innovative approach to insurance. They continuously adapt to the changing needs of their customers, introducing new products and services to stay ahead of the curve. This commitment to innovation ensures that State Farm remains a relevant and reliable partner in the dynamic world of insurance.

The Quote Process: A Step-by-Step Guide

Obtaining a quote from State Farm is a straightforward process designed to be as convenient as possible for potential customers. Here’s a step-by-step breakdown of how to get a quote:

- Visit the State Farm Website: Begin by navigating to the official State Farm website. Here, you'll find a user-friendly interface that guides you through the quote process.

- Select Your Insurance Type: The website offers a range of insurance options, including auto, home, life, and health insurance. Choose the type of insurance you're interested in to start the quote process.

- Provide Basic Information: You'll be prompted to enter some basic details, such as your name, contact information, and the type of coverage you're seeking. This information helps State Farm provide an accurate quote.

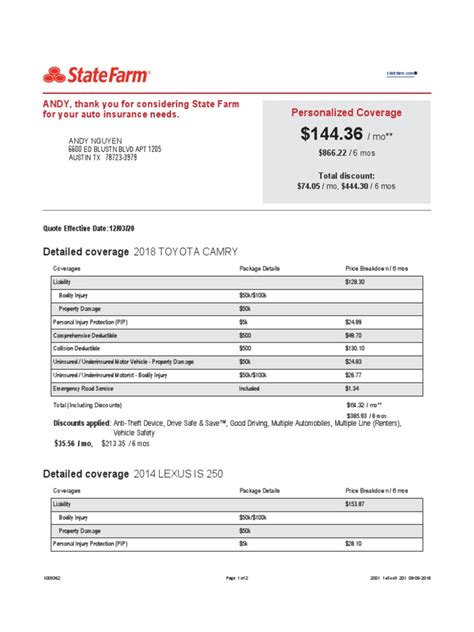

- Choose Your Coverage Options: State Farm offers a variety of coverage options for each type of insurance. Take the time to explore these options and select the ones that best fit your needs. This step ensures that your quote is tailored to your specific requirements.

- Review and Compare: Once you've provided all the necessary information, State Farm will generate a quote based on your selections. Review the quote carefully, ensuring that it aligns with your expectations and budget. If needed, you can adjust your coverage choices and obtain a new quote.

- Contact a Local Agent: While the online quote process is convenient, it's always beneficial to connect with a local State Farm agent. They can provide expert advice, answer any questions you may have, and guide you through the finer details of your policy.

By following these steps, you can efficiently obtain a quote from State Farm, bringing you one step closer to securing the insurance coverage you need.

Comparative Analysis: State Farm vs. Competitors

To further illustrate the value of State Farm Insurance, let’s compare it to some of its key competitors in the insurance market.

| Insurance Provider | Coverage Options | Customer Satisfaction | Financial Stability |

|---|---|---|---|

| State Farm | Comprehensive range of insurance products including auto, home, life, health, and business insurance. | High customer satisfaction ratings, known for personalized service and tailored coverage. | Exceptional financial stability with a long history of strong performance. |

| Allstate | Similar range of insurance products, offering auto, home, life, and business insurance. | Competitive customer satisfaction, with a focus on digital tools and resources. | Strong financial position, though not as established as State Farm. |

| Progressive | Specializes in auto insurance, with additional offerings in home and business insurance. | High customer satisfaction, particularly for its online resources and quote process. | Solid financial standing, but less established than State Farm. |

| Geico | Primarily known for auto insurance, with some home and life insurance options. | Excellent customer satisfaction, especially for its convenient online services. | Strong financial stability, backed by a well-established parent company. |

As the table illustrates, State Farm stands out for its comprehensive coverage options, high customer satisfaction, and exceptional financial stability. While each competitor has its strengths, State Farm's well-rounded approach and long-standing reputation make it a top choice for many insurance seekers.

Real-World Success Stories: State Farm in Action

To truly understand the value of State Farm Insurance, let’s explore some real-world success stories where State Farm played a pivotal role.

Case Study 1: Auto Insurance Claim

John, a loyal State Farm customer, was involved in a minor car accident. Thanks to his comprehensive auto insurance policy, he was able to quickly file a claim and receive prompt assistance. State Farm's local agent guided him through the process, ensuring that his vehicle was repaired efficiently and that he received fair compensation for any additional damages. John's positive experience underscores the importance of having reliable insurance coverage.

Case Study 2: Homeowner's Insurance

Sarah, a recent homeowner, chose State Farm for her homeowner's insurance needs. When a severe storm caused damage to her roof, she was relieved to have State Farm by her side. The insurance provider's quick response and efficient claim process allowed Sarah to repair her home without financial strain. This real-life scenario highlights the peace of mind that State Farm provides to its customers.

Case Study 3: Business Insurance

For small business owners like Mike, State Farm's business insurance offerings were a lifesaver. When his business suffered a theft, State Farm's comprehensive coverage stepped in to replace the stolen equipment and cover the costs of repairs. This allowed Mike to get his business back on track quickly, demonstrating the crucial role that State Farm plays in supporting small businesses.

Future Implications and Industry Insights

As we look to the future, State Farm continues to innovate and adapt to meet the evolving needs of its customers. The company’s commitment to technological advancements and digital services ensures that the quote process and overall customer experience remain seamless and efficient.

Additionally, State Farm's focus on sustainability and social responsibility positions it as a forward-thinking insurance provider. By embracing environmentally conscious practices and supporting community initiatives, State Farm aligns itself with the values of its customers and society as a whole.

In conclusion, State Farm Insurance stands as a pillar of stability and reliability in the insurance industry. With its extensive coverage options, personalized service, and financial strength, State Farm is well-equipped to meet the diverse insurance needs of individuals and businesses alike. By choosing State Farm, you can rest assured that you're in good hands, protected from life's unexpected twists and turns.

How can I contact a State Farm agent near me?

+To find a State Farm agent near you, visit the official State Farm website and use the “Find an Agent” tool. This tool allows you to search for agents based on your location, ensuring you connect with a local professional who can provide personalized guidance.

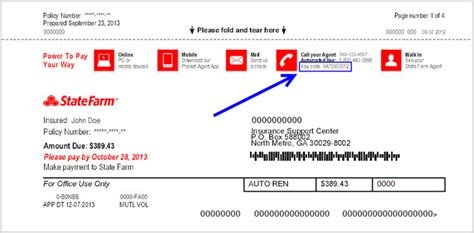

What are the payment options for State Farm insurance policies?

+State Farm offers a range of payment options to cater to different preferences and needs. You can choose to pay your insurance premiums monthly, semi-annually, or annually. Additionally, State Farm accepts payments through various methods, including online transfers, credit/debit cards, and even mobile payment apps.

Can I customize my insurance policy with State Farm?

+Absolutely! State Farm understands that everyone’s insurance needs are unique. When obtaining a quote, you have the flexibility to choose the coverage options that best fit your situation. This allows you to tailor your policy to your specific requirements, ensuring you get the right level of protection.