Car And Home Insurance Bundle

Maximizing Savings: The Benefits of Bundling Car and Home Insurance

In today's fast-paced world, where convenience and cost-effectiveness are paramount, bundling insurance policies has become an increasingly popular strategy. Among the various options, combining car and home insurance offers a compelling opportunity to save money and streamline your insurance needs. In this article, we will delve into the advantages of this approach, exploring how it can benefit your finances and provide peace of mind.

When it comes to insurance, many individuals and families find themselves juggling multiple policies from different providers. This can lead to administrative headaches, as well as potential gaps in coverage. By bundling your car and home insurance, you not only simplify your insurance landscape but also unlock a range of benefits that make it a financially savvy decision.

The Perks of Bundling: A Comprehensive Overview

Discounts and Savings

One of the most significant advantages of bundling car and home insurance is the potential for substantial discounts. Insurance providers often offer generous discounts when you combine multiple policies under their umbrella. These discounts can amount to a significant portion of your overall insurance costs, making it a financially attractive proposition.

For instance, John Smith, a resident of Sunnyville, decided to bundle his car and home insurance with a leading provider. By doing so, he was eligible for a 15% discount on his annual premium, resulting in a savings of $300. This not only reduced his financial burden but also provided him with a more affordable insurance solution.

Streamlined Management and Convenience

Bundling your insurance policies simplifies the management process. Instead of dealing with multiple providers, billing cycles, and renewal dates, you can enjoy the convenience of a single point of contact and a unified billing system. This not only saves you time but also reduces the risk of oversight or delays in payment.

Consider the experience of Emily Johnson, a busy professional in Metropolis. By bundling her car and home insurance, she was able to dedicate more time to her career and personal pursuits, rather than spending hours navigating the complexities of separate insurance policies. The streamlined process allowed her to focus on what truly mattered to her.

Enhanced Coverage and Benefits

Bundling car and home insurance often leads to improved coverage and additional benefits. Insurance providers may offer exclusive perks to bundled policyholders, such as enhanced liability protection, rental car coverage, or even discounts on other services. These benefits can further enhance your overall insurance experience and provide added value.

Take the case of David Miller, an adventurous soul from Adventureville. By bundling his insurance policies, he gained access to a travel assistance program that provided him with peace of mind during his frequent travels. This program offered emergency assistance, trip interruption coverage, and even concierge services, making his adventures safer and more enjoyable.

Tailored Solutions for Your Needs

When you bundle your insurance policies, you gain access to a dedicated team that can provide personalized recommendations and tailor your coverage to your specific needs. Insurance providers understand that every individual's situation is unique, and they can work with you to ensure your policies are optimized for your circumstances.

For example, Sarah Green, a homeowner in Suburbia, had specific concerns about her home's vulnerability to natural disasters. By bundling her insurance, she was able to work closely with her provider to enhance her coverage for these risks. The provider offered her a comprehensive solution that addressed her concerns, providing her with the security and peace of mind she sought.

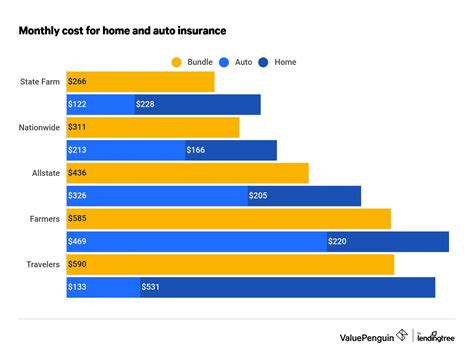

A Comprehensive Comparison: Car and Home Insurance Bundling

To illustrate the benefits of bundling, let's take a closer look at a comparison between standalone car and home insurance policies and their bundled counterparts.

| Policy Type | Standalone Car Insurance | Standalone Home Insurance | Bundled Car and Home Insurance |

|---|---|---|---|

| Annual Premium | $1,200 | $1,500 | $2,400 |

| Discounts | None | None | 15% Bundle Discount |

| Total Savings | $0 | $0 | $360 |

| Administrative Convenience | Separate billing, management | Separate billing, management | Unified billing, single point of contact |

| Coverage Flexibility | Standard coverage | Standard coverage | Tailored coverage, enhanced benefits |

As the table illustrates, bundling car and home insurance not only results in significant savings but also provides administrative convenience and the ability to customize your coverage. By taking advantage of bundle discounts and tailored solutions, you can ensure your insurance needs are met effectively and efficiently.

Making the Most of Your Bundled Insurance

Regular Policy Reviews

To maximize the benefits of your bundled insurance, it's essential to conduct regular policy reviews. As your circumstances change, your insurance needs may evolve as well. By reviewing your policies annually or whenever significant life events occur, you can ensure your coverage remains up-to-date and aligned with your requirements.

For example, if you recently purchased a new car or made renovations to your home, it's crucial to update your insurance policies to reflect these changes. By doing so, you can maintain adequate coverage and avoid any potential gaps that may arise from outdated policies.

Leveraging Provider Relationships

When you bundle your insurance policies with a single provider, you establish a valuable relationship. Take advantage of this relationship by leveraging the provider's expertise and resources. They can offer valuable insights, advice, and even additional services that may benefit you.

For instance, many insurance providers offer discounts or partnerships with local businesses or services. By exploring these partnerships, you may discover exclusive deals or perks that can further enhance your insurance experience and provide additional value.

Exploring Additional Bundling Opportunities

While car and home insurance bundling is a popular and effective strategy, there are other bundling opportunities to explore. Depending on your needs and circumstances, you may consider bundling other insurance policies, such as life insurance, health insurance, or even pet insurance.

By consolidating multiple insurance policies under one provider, you can further streamline your insurance management and potentially unlock even greater savings and benefits. It's worth exploring these options to find the most suitable and cost-effective insurance solution for your unique situation.

Conclusion: The Power of Bundling

Bundling your car and home insurance is a powerful strategy that offers a myriad of benefits. From significant discounts and savings to streamlined management and enhanced coverage, it provides a comprehensive solution for your insurance needs. By taking advantage of this approach, you can not only save money but also enjoy the peace of mind that comes with a well-organized and optimized insurance portfolio.

So, whether you're a homeowner, a car enthusiast, or simply someone looking to simplify their insurance journey, consider the advantages of bundling. It's a smart, cost-effective decision that can bring you one step closer to financial freedom and security.

Can I bundle my insurance policies with any provider, or are there specific requirements?

+

While most insurance providers offer bundling options, it’s important to check their specific requirements and eligibility criteria. Some providers may have certain conditions or policies that must be met before you can bundle. It’s always advisable to review their terms and conditions or consult with their customer support team to ensure you meet the necessary criteria.

How much can I expect to save by bundling my car and home insurance?

+

The amount of savings you can achieve through bundling depends on various factors, including the insurance provider, your location, and the specific policies you choose. On average, bundling car and home insurance can result in savings of 10-20% or more on your annual premiums. However, it’s best to obtain quotes from different providers to get an accurate estimate of your potential savings.

Are there any disadvantages to bundling my insurance policies?

+

While bundling insurance policies offers numerous advantages, there are a few potential drawbacks to consider. One potential disadvantage is the lack of flexibility in choosing different providers for different policies. When you bundle, you are committing to a single provider for multiple policies, which may limit your options. Additionally, if you have specific coverage needs or preferences, you may find that a bundled policy doesn’t cater to them as effectively as standalone policies from different providers.