Best Car Insurance Cheap

Finding the best car insurance that offers both quality coverage and affordability is a priority for many vehicle owners. With numerous insurance providers and policies available, navigating the market can be daunting. This article aims to guide you through the process, providing insights and tips to secure the best car insurance at a reasonable cost.

Understanding Car Insurance: A Comprehensive Guide

Car insurance is a legal requirement for vehicle owners in most countries, serving as a financial safety net in the event of accidents, theft, or other vehicle-related incidents. It provides coverage for damages to your vehicle, as well as any liability claims resulting from accidents you may cause. Understanding the different types of car insurance and their coverage is crucial for making an informed decision.

Types of Car Insurance

There are primarily three types of car insurance: liability, collision, and comprehensive. Liability insurance covers damages you cause to others’ property or injuries you inflict in an accident. Collision insurance covers damage to your own vehicle, regardless of fault. Comprehensive insurance covers a wide range of incidents, including theft, vandalism, and natural disasters.

| Insurance Type | Coverage |

|---|---|

| Liability | Property damage and bodily injury to others |

| Collision | Damage to your vehicle, regardless of fault |

| Comprehensive | Theft, vandalism, natural disasters, and other non-collision incidents |

Factors Affecting Car Insurance Costs

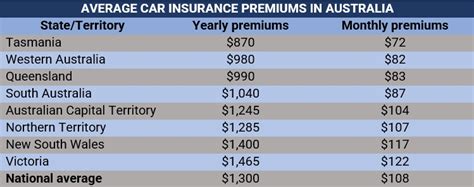

The cost of car insurance can vary significantly depending on several factors. These include your age, gender, driving history, the make and model of your vehicle, and the location where you reside. Insurance providers use these factors to assess the level of risk associated with insuring you and set their premiums accordingly.

For instance, younger drivers are often considered higher-risk due to their lack of experience, leading to higher insurance premiums. Similarly, certain vehicle makes and models may be more expensive to insure due to their higher repair costs or higher likelihood of theft.

Tips for Finding Cheap Car Insurance

Securing affordable car insurance requires a strategic approach. Here are some tips to help you find the best deals:

Shop Around and Compare Quotes

Don’t settle for the first insurance quote you receive. Take the time to compare quotes from multiple providers. Online comparison tools can be a great starting point, allowing you to quickly get estimates from various insurers. However, remember that these tools provide only a snapshot of the market, and it’s important to delve deeper to find the best value.

Understand Your Coverage Needs

Assess your specific coverage needs. Do you need comprehensive coverage, or can you manage with liability and collision insurance? Consider your vehicle’s age, its value, and your personal financial situation. If your car is older and less valuable, comprehensive insurance might not be necessary, and you could save money by opting for a more basic plan.

Utilize Discounts and Bundles

Insurance providers often offer discounts for various reasons. These can include safe driving records, loyalty discounts for long-term customers, or discounts for installing safety features in your vehicle. Additionally, consider bundling your car insurance with other policies, such as home or life insurance. Many insurers offer multi-policy discounts, which can significantly reduce your overall insurance costs.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, is an innovative approach that calculates your insurance premium based on your actual driving habits. This can be an excellent option for safe, low-mileage drivers. By installing a tracking device or using a smartphone app, the insurance provider monitors your driving behavior, including mileage, speed, and braking habits. If you drive safely and infrequently, you may qualify for significant discounts.

Improve Your Driving Record

Your driving record is a significant factor in determining your insurance premium. A clean driving record, free of accidents and traffic violations, can lead to lower insurance costs. If you have a less-than-perfect record, consider taking a defensive driving course. Many insurance providers offer discounts for completing such courses, and it can also help improve your driving skills and safety awareness.

Raise Your Deductible

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. By raising your deductible, you can often lower your insurance premiums. However, it’s important to choose a deductible amount that you can afford in the event of an accident. This strategy works best for responsible drivers who are confident they won’t need to make frequent insurance claims.

Maintain a Good Credit Score

Surprisingly, your credit score can impact your insurance premiums. Many insurance providers use credit-based insurance scores to assess your risk level. Maintaining a good credit score can lead to lower insurance costs. If you’re looking to improve your credit score, consider strategies such as paying your bills on time, reducing your credit card balances, and regularly checking your credit report for errors.

The Importance of Quality Coverage

While finding cheap car insurance is important, it’s equally crucial to ensure you’re getting adequate coverage. Insufficient coverage can leave you vulnerable to significant financial risks in the event of an accident. Here’s a breakdown of why quality coverage matters:

Peace of Mind

Having comprehensive insurance provides peace of mind. You know that, should an accident occur, you’re protected financially. This is especially important for newer vehicles, as repair or replacement costs can be substantial. With adequate coverage, you can rest easy knowing that your insurer will cover these expenses, allowing you to focus on your recovery and getting back on the road.

Legal Requirements

In many regions, having a minimum level of car insurance is a legal requirement. This typically includes liability insurance to cover any damage or injuries you cause to others. Failing to meet these requirements can result in legal penalties, including fines and even the suspension of your driver’s license.

Protection Against Financial Loss

Car accidents can result in significant financial losses. Even a minor fender bender can lead to costly repairs or replacement of parts. With comprehensive insurance, you’re protected against these expenses, ensuring that you don’t have to bear the full financial burden of an accident.

Making an Informed Decision

When choosing car insurance, it’s essential to strike a balance between affordability and adequate coverage. Here are some key considerations to help you make an informed decision:

Research Insurance Providers

Take the time to research different insurance providers. Look beyond just the cost of their policies. Consider factors such as their financial stability, customer service reputation, and claims handling process. You want an insurer who is financially sound and has a good track record of paying out claims promptly and fairly.

Understand Policy Terms and Conditions

Before committing to a policy, carefully read the terms and conditions. Understand what is and isn’t covered, and be aware of any exclusions or limitations. Pay attention to the fine print, as this is where crucial details are often found. If you have any questions or concerns, don’t hesitate to reach out to the insurance provider for clarification.

Seek Expert Advice

If you’re unsure about which insurance policy to choose, consider seeking advice from an insurance broker or financial advisor. These professionals can provide valuable insights based on your specific circumstances and needs. They can help you navigate the complex world of insurance, ensuring you make a decision that’s right for you.

Regularly Review and Update Your Policy

Your insurance needs may change over time. Regularly review your policy to ensure it still meets your requirements. Consider updating your coverage if your circumstances change, such as purchasing a new vehicle or moving to a different location. By staying vigilant and proactive, you can ensure you always have the best car insurance for your needs.

How much does car insurance typically cost?

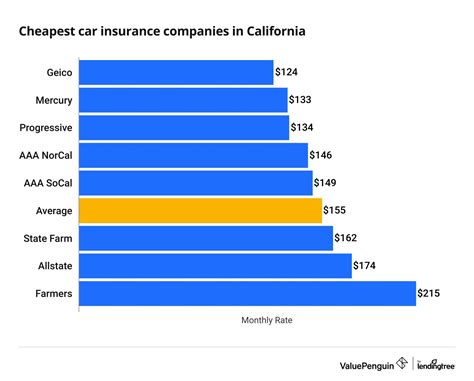

+The cost of car insurance can vary widely depending on factors such as your location, driving history, and the make and model of your vehicle. On average, drivers in the United States pay around 1,674 per year for car insurance, but this can range from as low as a few hundred dollars to over 3,000 per year.

What factors can influence my car insurance premium?

+Several factors can influence your car insurance premium, including your age, gender, driving record, the make and model of your vehicle, and your location. Other factors, such as your credit score and the number of miles you drive annually, can also impact your insurance costs.

Are there any ways to lower my car insurance costs?

+Yes, there are several strategies to lower your car insurance costs. These include shopping around for quotes, maintaining a clean driving record, increasing your deductible, and taking advantage of discounts offered by insurers. Additionally, consider bundling your car insurance with other policies, such as home or life insurance, to potentially save money.