Renters Insurance Progressive Phone Number

Renters insurance is an essential aspect of financial protection for individuals who rent their living spaces. It provides coverage for personal belongings, liability, and additional living expenses in the event of unforeseen circumstances. One of the prominent providers in the industry is Progressive, a well-known insurance company that offers comprehensive renters insurance policies. This article aims to delve into the specifics of renters insurance, its importance, and provide an in-depth analysis of Progressive's coverage and services, including their dedicated phone number for renters insurance inquiries.

Understanding Renters Insurance: A Comprehensive Guide

Renters insurance is a type of property insurance that specifically caters to the needs of tenants. Unlike homeowners insurance, which covers the structure and its contents, renters insurance primarily focuses on the personal belongings and liability of the insured individual. Here’s a detailed breakdown of what renters insurance typically covers:

Personal Property Coverage

This is the core aspect of renters insurance. It provides financial protection for the policyholder’s personal belongings, including furniture, electronics, clothing, and other valuables. In the event of a covered loss, such as theft, fire, or natural disasters like floods or hurricanes, renters insurance can reimburse the insured for the replacement or repair costs of their damaged or stolen items.

For instance, imagine a scenario where a renter's apartment is burglarized, resulting in the theft of their laptop, television, and other valuable items. With renters insurance, the policyholder can file a claim and receive compensation to replace these stolen belongings, ensuring they aren't left with a significant financial burden.

Liability Protection

Renters insurance also includes liability coverage, which safeguards the policyholder against legal and financial responsibilities arising from accidents or injuries that occur on the rented premises. This coverage can be crucial in situations where a guest is injured in the insured’s home and decides to file a lawsuit.

Consider a hypothetical case where a renter's guest slips and falls in their apartment, resulting in a severe injury. In such a scenario, liability coverage from renters insurance can provide legal defense and cover any settlement or judgment costs, protecting the policyholder from potentially devastating financial consequences.

Additional Living Expenses

In the unfortunate event that the insured’s rental property becomes uninhabitable due to a covered loss, renters insurance often includes additional living expenses coverage. This coverage reimburses the policyholder for temporary living arrangements, such as hotel stays or rental of alternative accommodation, until their primary residence is suitable for habitation again.

For example, if a renter's apartment becomes unlivable due to a fire, additional living expenses coverage can cover the cost of staying in a nearby hotel until repairs are completed and the apartment is once again safe and habitable.

Progressive Renters Insurance: A Trusted Provider

Progressive is a prominent name in the insurance industry, known for its innovative approaches and comprehensive coverage options. When it comes to renters insurance, Progressive offers a range of customizable policies to cater to the diverse needs of its customers.

Coverage Options and Benefits

Progressive renters insurance provides several coverage options, allowing policyholders to tailor their plans according to their specific requirements. These options typically include:

- Personal Property Coverage: Progressive offers flexible limits for personal property coverage, ensuring that policyholders can protect their belongings to the fullest extent. The company provides coverage for a wide range of items, including jewelry, electronics, and even bicycles.

- Liability Coverage: Progressive's liability coverage protects renters from lawsuits and legal expenses resulting from accidents or injuries that occur on their rented premises. The company offers generous liability limits to provide adequate protection.

- Additional Living Expenses: In the event of a covered loss that renders the rental property uninhabitable, Progressive's additional living expenses coverage steps in. This coverage ensures that policyholders can maintain their normal living standards by covering temporary housing and related expenses.

- Loss Assessment Coverage: Progressive also provides loss assessment coverage, which can be particularly beneficial for renters in condominiums or co-ops. This coverage helps cover the insured's share of expenses when the association's property sustains damage and requires repairs.

Furthermore, Progressive renters insurance offers additional benefits and discounts, making their policies even more attractive. These include:

- Discounts: Progressive offers various discounts to policyholders, such as multi-policy discounts (for bundling renters insurance with other Progressive policies), loyalty discounts, and discounts for specific safety features in the rental property.

- 24/7 Claims Support: Progressive understands the importance of prompt and efficient claims handling. Their dedicated claims team is available around the clock to assist policyholders with their claims, ensuring a smooth and stress-free process.

- Online and Mobile Access: Progressive renters insurance policyholders can easily manage their policies and access important information through the company's online platform and mobile app. This convenience allows renters to stay informed and make necessary updates to their coverage.

Progressive Renters Insurance Phone Number

For those seeking assistance or information regarding Progressive’s renters insurance policies, the company provides a dedicated phone number for renters insurance inquiries. Policyholders and prospective customers can reach out to Progressive’s customer service team by calling 1-800-776-4737. This number is a direct line for renters insurance, ensuring that callers receive prompt and specialized assistance.

By contacting Progressive's renters insurance phone number, individuals can inquire about policy options, receive quotes, and discuss their specific coverage needs with knowledgeable representatives. The customer service team is trained to provide detailed information and guidance, ensuring that renters make informed decisions about their insurance coverage.

Why Choose Progressive Renters Insurance

Progressive renters insurance stands out for several reasons, making it an attractive choice for individuals seeking comprehensive and reliable coverage. Here are some key advantages of choosing Progressive for renters insurance:

- Customization: Progressive understands that every renter's needs are unique. Their renters insurance policies are highly customizable, allowing policyholders to select coverage limits and options that align with their specific circumstances and valuables.

- Competitive Pricing: Progressive is known for offering competitive rates for renters insurance. By providing customizable coverage options, policyholders can find the right balance between their coverage needs and their budget, ensuring they receive the best value for their insurance premium.

- Innovative Technology: Progressive utilizes advanced technology to enhance the insurance experience. Their online and mobile platforms provide convenient access to policy information, allowing renters to make quick updates, pay premiums, and file claims with ease. This technological integration streamlines the insurance process and adds a layer of convenience.

- Excellent Customer Service: Progressive prides itself on its dedicated and knowledgeable customer service team. The company's focus on providing exceptional service ensures that policyholders receive timely assistance and personalized guidance throughout their insurance journey. Whether it's answering queries, helping with claims, or providing general insurance advice, Progressive's customer service team is readily available to assist.

Conclusion: Empowering Renters with Progressive Renters Insurance

Renters insurance is an essential safeguard for individuals who rent their living spaces. It provides peace of mind and financial protection in the face of unforeseen circumstances. Progressive renters insurance offers a comprehensive and customizable approach to renters insurance, ensuring that policyholders can tailor their coverage to their unique needs. With competitive pricing, innovative technology, and excellent customer service, Progressive stands out as a trusted provider in the industry.

By understanding the importance of renters insurance and exploring the benefits offered by Progressive, individuals can make informed decisions about their financial protection. Progressive's dedicated phone number for renters insurance inquiries further enhances the accessibility and convenience of their services, making it easier for policyholders and prospective customers to connect with knowledgeable representatives.

Empowering renters with the right insurance coverage is a crucial step towards financial security and peace of mind. With Progressive renters insurance, individuals can enjoy the confidence that comes with knowing their personal belongings, liability, and additional living expenses are protected, allowing them to focus on what truly matters – their daily lives and well-being.

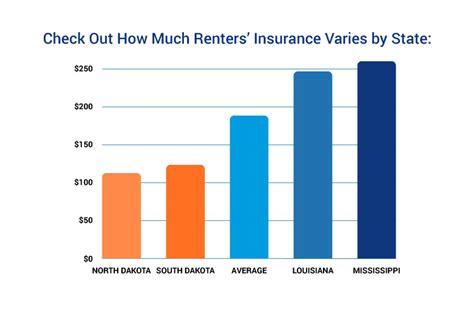

What is the typical cost of renters insurance with Progressive?

+The cost of renters insurance with Progressive can vary depending on several factors, including the coverage limits, the location of the rental property, and any additional endorsements or discounts applied. On average, renters insurance policies with Progressive can range from 15 to 30 per month. However, it’s important to note that the exact cost will be unique to each policyholder’s situation.

Can I bundle my renters insurance with other Progressive policies to save money?

+Absolutely! Progressive offers a multi-policy discount when you bundle your renters insurance with other Progressive policies, such as auto insurance or homeowners insurance. By bundling your policies, you can often save a significant amount on your overall insurance premiums. It’s a great way to streamline your insurance needs and take advantage of cost-saving opportunities.

How do I file a claim with Progressive renters insurance?

+Filing a claim with Progressive renters insurance is straightforward. You can start the process by contacting Progressive’s 24⁄7 claims team at 1-800-776-4737. They will guide you through the steps and provide the necessary information to initiate your claim. You can also initiate a claim online through Progressive’s website or mobile app, making the process even more convenient.