Insurance By The Mile

The Evolution of Insurance by the Mile: A Comprehensive Guide to Usage-Based Insurance

In the rapidly evolving landscape of the insurance industry, a paradigm shift is taking place, one that is revolutionizing how we perceive and purchase insurance policies. Among these innovations, "Insurance by the Mile," also known as Usage-Based Insurance (UBI), stands out as a game-changer, offering a more tailored and dynamic approach to automotive coverage.

This cutting-edge concept is no longer a futuristic idea but a present-day reality, shaping the way drivers assess and acquire insurance. With UBI, the traditional one-size-fits-all insurance model is transformed, providing a personalized experience that reflects an individual's actual driving behavior and needs. This article delves deep into the world of Insurance by the Mile, exploring its mechanisms, benefits, and the transformative impact it is having on the insurance sector.

Understanding Insurance by the Mile

Insurance by the Mile, or UBI, is an innovative pricing model that calculates insurance premiums based on an individual's actual vehicle usage. This contrasts sharply with the traditional method, which typically assesses risk based on demographic factors, vehicle type, and historical driving records.

With UBI, insurers utilize advanced telematics technology to monitor and record various aspects of a driver's behavior, such as the number of miles driven, the time of day, and even the driver's habits and road conditions. This data-driven approach allows insurers to offer highly customized policies, ensuring that premiums accurately reflect an individual's risk profile and driving patterns.

The core principle behind UBI is simple: drivers who use their vehicles less, or who exhibit safer driving habits, should be rewarded with lower insurance premiums. This incentivizes responsible driving and reduces the financial burden on those who are careful on the road.

The Technology Behind UBI

At the heart of UBI's success is the utilization of advanced telematics technology. Telematics devices, which can be installed in vehicles or integrated into existing systems, are designed to collect and transmit data about a vehicle's usage and performance.

These devices can monitor a wide range of factors, including speed, acceleration, braking, and even the driver's adherence to traffic laws. The data is then transmitted to the insurer, where it is analyzed to assess the driver's risk profile and determine the appropriate insurance premium.

Some UBI programs also offer real-time feedback to drivers, providing insights into their driving behavior and suggesting ways to improve safety and reduce costs. This two-way communication fosters a more engaged and responsible driving culture.

The Benefits of Insurance by the Mile

The implementation of Insurance by the Mile brings about a myriad of advantages for both insurers and policyholders, fostering a more equitable and efficient insurance landscape.

Fairer Pricing for Drivers

One of the most significant benefits of UBI is its ability to provide fairer and more accurate pricing for drivers. Traditional insurance models often result in individuals being overcharged or undercharged based on broad demographic factors that may not accurately reflect their actual driving habits.

With UBI, the risk assessment is tailored to the individual, ensuring that those who drive less or more carefully pay premiums that truly reflect their level of risk. This means that low-mileage drivers, who are typically penalized in traditional models, can benefit from significant savings.

Furthermore, UBI encourages safer driving habits. By monitoring and rewarding drivers for safe practices, UBI promotes a culture of responsible driving, leading to reduced accidents and a safer road environment for all.

Improved Risk Assessment for Insurers

For insurers, UBI offers a more accurate and comprehensive view of their policyholders' risk profiles. By analyzing real-time driving data, insurers can identify high-risk drivers and price their policies accordingly, reducing the likelihood of financial losses.

Additionally, UBI allows insurers to better segment their customer base, offering customized products and services to meet the diverse needs of their policyholders. This level of personalization can enhance customer satisfaction and loyalty, fostering long-term relationships.

Data-Driven Insights for Enhanced Safety

The data collected through UBI programs provides valuable insights into driving behavior and road safety. Insurers can use this data to identify trends, hotspots for accidents, and areas where driver education or infrastructure improvements are needed.

By leveraging this data, insurers can collaborate with local authorities and road safety organizations to implement targeted interventions, leading to safer roads and reduced accident rates. This data-driven approach has the potential to save lives and reduce the societal costs associated with road accidents.

The Impact of Insurance by the Mile

The introduction of Insurance by the Mile has had a profound impact on the insurance industry, reshaping the way policies are priced, sold, and perceived.

Transforming the Insurance Landscape

UBI has forced the insurance industry to adapt and innovate, moving away from the traditional model that has dominated for decades. This shift has encouraged insurers to invest in technology, data analytics, and customer engagement, leading to a more dynamic and responsive industry.

The success of UBI has also paved the way for other innovative insurance models, such as pay-as-you-go policies and mileage-based coverage, which further enhance the flexibility and personalization of insurance products.

Enhancing Customer Engagement and Satisfaction

With UBI, insurers are no longer just providers of a necessary service but partners in their policyholders' driving journey. The real-time feedback and personalized premiums foster a deeper connection between insurers and drivers, enhancing trust and loyalty.

Policyholders have a more active role in their insurance experience, with the ability to influence their premiums through their driving behavior. This level of engagement can lead to increased customer satisfaction and a more positive perception of the insurance industry as a whole.

Promoting Sustainable Transportation

UBI also aligns with broader societal goals, particularly in the context of sustainable transportation and reducing carbon emissions. By incentivizing low-mileage driving, UBI encourages drivers to consider alternative transportation methods or reduce their overall vehicle usage.

This reduction in vehicle miles traveled can have a significant positive impact on the environment, reducing fuel consumption and associated greenhouse gas emissions. UBI, therefore, has the potential to contribute to a greener, more sustainable future.

Real-World Examples and Case Studies

To illustrate the impact and effectiveness of Insurance by the Mile, let's explore some real-world examples and case studies.

Case Study: Progressive Snapshot

Progressive's Snapshot program is one of the most well-known UBI offerings in the United States. Snapshot uses a small device that plugs into a vehicle's onboard diagnostics port, tracking the driver's miles driven, time of day, and harsh braking incidents.

Based on this data, Progressive offers policyholders a discount on their insurance premiums, with some drivers saving up to 30% on their policies. This incentive has led to a significant increase in safer driving habits among Snapshot participants, resulting in reduced accident rates and a more efficient insurance model.

Case Study: Pay-as-You-Drive Insurance in Europe

In Europe, several insurers have implemented pay-as-you-drive (PAYD) insurance models, which are similar to UBI. These programs use GPS tracking or mileage-based systems to monitor vehicle usage and calculate premiums accordingly.

One notable example is the PAYD insurance offered by the UK-based insurer, Ingenie. Ingenie targets young drivers, who are often penalized with high premiums due to their perceived risk. By offering PAYD policies, Ingenie provides an affordable alternative, rewarding young drivers for safe and responsible behavior.

UBI's Impact on Fleet Management

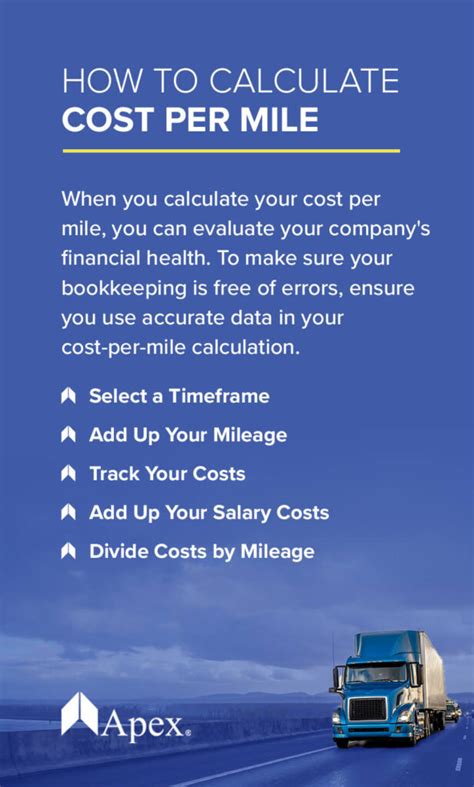

UBI has also found significant applications in the realm of fleet management. For businesses with large vehicle fleets, UBI offers a more cost-effective and efficient way to insure their assets. By monitoring driving behavior and vehicle usage, fleet managers can identify areas for improvement and reduce their overall insurance costs.

Additionally, UBI data can provide valuable insights into fleet performance, helping businesses optimize their operations, reduce fuel consumption, and improve overall efficiency.

| UBI Program | Insurers | Savings Potential |

|---|---|---|

| Progressive Snapshot | Progressive Insurance | Up to 30% on premiums |

| PAYD Insurance | Ingenie (UK) | Varies based on driving behavior |

| Fleet UBI | Various Fleet Insurers | Reduced insurance costs, improved fleet efficiency |

The Future of Insurance by the Mile

As technology continues to advance and consumer expectations evolve, the future of Insurance by the Mile looks promising and full of potential.

Expanding Coverage Options

While UBI has primarily focused on automotive insurance, its principles can be applied to a wide range of coverage types. In the future, we can expect to see UBI-like models in home insurance, where premiums are based on factors like occupancy rates and energy usage, or even in health insurance, where policies could be tailored to an individual's lifestyle and health habits.

Integrating Artificial Intelligence and Machine Learning

The integration of AI and machine learning technologies will further enhance the capabilities of UBI. These technologies can analyze vast amounts of data in real-time, identifying patterns and making predictions with greater accuracy. This will enable insurers to offer even more precise and personalized pricing, further incentivizing safe and responsible behavior.

Addressing Privacy Concerns

As UBI relies on the collection and analysis of personal data, ensuring consumer privacy and data security is of paramount importance. Insurers will need to invest in robust data protection measures and transparent data handling practices to maintain public trust.

Additionally, regulatory frameworks will likely evolve to address the unique privacy considerations associated with UBI, providing clear guidelines for insurers and protecting consumer rights.

Collaborative Industry Initiatives

The success of UBI is not solely dependent on individual insurers but also on collaborative industry initiatives. Insurers, technology providers, and regulatory bodies can work together to develop industry-wide standards, best practices, and innovative solutions that benefit consumers and the industry as a whole.

Conclusion

Insurance by the Mile represents a significant step forward in the insurance industry's evolution, offering a more dynamic, fair, and personalized approach to coverage. With its ability to reward responsible behavior, enhance safety, and provide tailored pricing, UBI is shaping a brighter future for both insurers and policyholders.

As we look ahead, the continued innovation and expansion of UBI will undoubtedly play a pivotal role in the insurance landscape, driving progress and ensuring a more sustainable, efficient, and customer-centric industry.

How does Insurance by the Mile benefit low-mileage drivers?

+

Low-mileage drivers, who often pay disproportionately high premiums in traditional insurance models, stand to benefit significantly from UBI. By tracking actual vehicle usage, UBI providers can offer more accurate and often lower premiums for those who drive less frequently.

Are there any privacy concerns associated with UBI?

+

Yes, UBI involves the collection of personal data, which raises privacy concerns. Insurers must ensure they have robust data protection measures in place and provide transparent data handling practices to maintain public trust.

Can UBI help reduce accidents and improve road safety?

+

Absolutely! UBI incentivizes safer driving habits by offering rewards for responsible behavior. By encouraging drivers to adopt safer practices, UBI can contribute to a significant reduction in accidents and improve overall road safety.

What are some of the challenges insurers face with UBI implementation?

+

Insurers must invest in advanced telematics technology, data analytics, and customer engagement platforms to successfully implement UBI. Additionally, they must navigate regulatory frameworks and ensure compliance with data privacy laws.