Sr22 Insurance What Is

SR22 insurance is a specialized form of liability coverage that is often required for drivers who have had their driver's license suspended or revoked due to certain traffic violations. It is a legal requirement in many states across the United States and serves as proof of financial responsibility for high-risk drivers.

Understanding SR22 Insurance

An SR22 is not an insurance policy in itself but rather a certificate of insurance that demonstrates to the state's Department of Motor Vehicles (DMV) that the driver has obtained the required level of liability coverage. This certificate is typically filed by the insurance provider with the DMV on behalf of the policyholder.

The specific requirements for SR22 insurance can vary by state, but generally, it includes bodily injury and property damage liability coverage. Some states may also require additional coverage, such as uninsured motorist protection or personal injury protection.

Who Needs SR22 Insurance?

Drivers may be mandated to carry SR22 insurance if they have been involved in serious traffic violations, including:

- Driving under the influence (DUI) or driving while intoxicated (DWI)

- Reckless driving

- Hit-and-run incidents

- Multiple traffic violations or serious moving violations

- Driving without insurance

The exact reasons for requiring an SR22 can differ by state and the individual's driving record. In some cases, the court or the DMV may order the driver to obtain SR22 insurance as a condition for reinstating their driving privileges.

The Process of Obtaining SR22 Insurance

To obtain SR22 insurance, drivers typically need to follow these steps:

- Check State Requirements: Research the specific SR22 requirements for your state. These can be found on your state's DMV website or through a licensed insurance agent.

- Find an Insurer: Not all insurance companies offer SR22 insurance. You may need to shop around and compare providers to find one that offers this type of coverage.

- Purchase a Policy: Once you've found an insurer, purchase a policy that meets your state's SR22 requirements. The insurer will then file the SR22 certificate with the DMV on your behalf.

- Maintain Coverage: It's crucial to keep your SR22 insurance in force for the required period, typically for 3 years. If you let your policy lapse, your SR22 status will be canceled, and you may face further penalties.

| State | SR22 Requirements |

|---|---|

| California | 15/30/5 (bodily injury/property damage) |

| Texas | 30/60/25 (bodily injury/property damage) |

| Florida | 10/20/10 (bodily injury/property damage) |

The Benefits of SR22 Insurance

While SR22 insurance is often seen as a consequence of past driving violations, it offers several benefits to drivers:

- Reinstatement of Driving Privileges: The primary benefit of SR22 insurance is that it allows drivers to regain their ability to drive legally. Without this certificate, many drivers would be unable to operate a vehicle on public roads.

- Improved Driving Record: By maintaining SR22 insurance and avoiding further violations, drivers can gradually improve their driving record. This can lead to reduced insurance premiums and a lower risk profile over time.

- Protection for Others: SR22 insurance ensures that the driver has the necessary liability coverage to protect others in the event of an accident they cause. This provides a safety net for other drivers, passengers, and pedestrians.

Challenges and Considerations

Obtaining SR22 insurance can present several challenges, including:

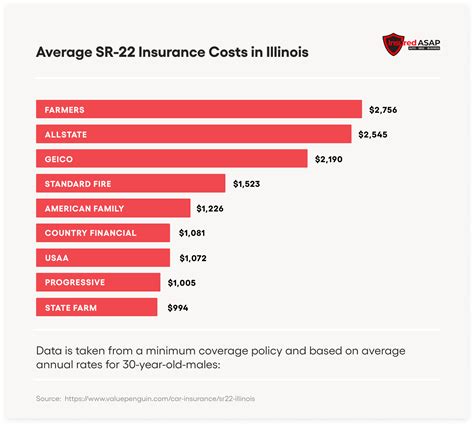

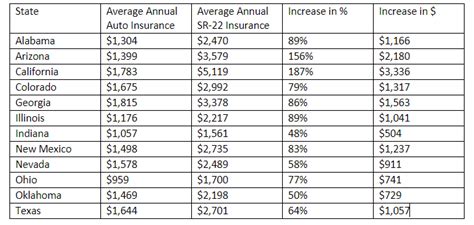

- Cost: As mentioned, SR22 insurance can be significantly more expensive than standard auto insurance. This is due to the higher risk associated with the driver's profile. It's important to shop around and compare quotes to find the most affordable option.

- Limited Options: Not all insurance companies offer SR22 insurance, and those that do may have stricter eligibility criteria. This can make it challenging to find a suitable policy, especially for drivers with multiple violations or a history of lapsed coverage.

- Maintaining Coverage: SR22 insurance requires drivers to maintain continuous coverage for the specified period. Any lapse in coverage can result in the cancellation of the SR22 status and additional penalties. It's crucial to stay informed about your policy's renewal dates and keep your payments up to date.

Frequently Asked Questions

Can I get SR22 insurance if I’ve never had auto insurance before?

+Yes, even if you’ve never had auto insurance, you can still obtain SR22 insurance. However, it may be more challenging and costly due to your lack of insurance history. It’s best to consult with an insurance agent who specializes in high-risk policies.

How long do I need to maintain SR22 insurance?

+The duration of SR22 insurance requirements varies by state but is typically for a period of 3 years. During this time, you must maintain continuous coverage to avoid further penalties.

Will SR22 insurance cover my vehicle if it’s damaged in an accident?

+SR22 insurance is primarily a liability coverage, meaning it protects others in the event of an accident you cause. To cover your own vehicle, you may need to purchase additional coverage, such as collision or comprehensive insurance.