Calculating Insurance

Insurance is a complex financial mechanism that provides protection against various risks and uncertainties, offering peace of mind to individuals, businesses, and organizations. The process of calculating insurance involves determining the appropriate premiums and coverage amounts to ensure adequate financial security while also considering the specific needs and risks associated with each insured entity.

Understanding the intricacies of insurance calculations is essential for both policyholders and insurance providers. It involves a careful analysis of potential risks, the likelihood of losses, and the associated costs, all while balancing the need for adequate coverage with the affordability of premiums.

In this comprehensive guide, we delve into the world of insurance calculations, exploring the key factors, methods, and considerations that influence the process. Whether you're an individual seeking personal insurance, a business owner requiring comprehensive coverage, or an insurance professional, this article aims to provide an in-depth understanding of the art and science behind insurance calculations.

The Fundamentals of Insurance Calculations

At its core, insurance calculation is about assessing risks and determining the financial implications of those risks. This involves a series of steps, each critical to the accuracy and fairness of the insurance contract.

Step 1: Identifying the Risks

The first step in insurance calculation is identifying the risks that the insured entity faces. Risks can vary widely, from natural disasters like floods and hurricanes to human-induced risks such as theft, accidents, or business-specific hazards.

For individuals, risks might include health issues, accidents, or property damage. Businesses, on the other hand, may face risks related to their operations, such as product liability, cyber attacks, or economic downturns.

Insurance professionals use their expertise and tools like risk assessment surveys and industry data to identify and categorize these risks.

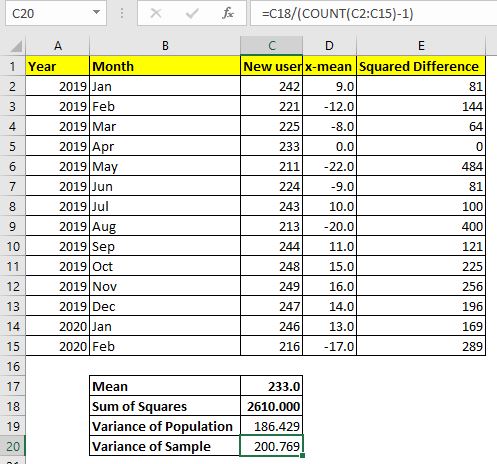

Step 2: Estimating the Probability of Loss

Once the risks are identified, the next step is to estimate the probability of loss. This involves analyzing historical data, industry trends, and statistical models to determine the likelihood of the identified risks materializing.

For instance, if an insurance company is calculating the premium for a homeowner's insurance policy, they would consider the historical data on home fires, floods, or other relevant risks in the area. This data helps them estimate the chances of the insured homeowner experiencing such losses.

Step 3: Determining the Potential Loss Amount

After assessing the probability of loss, the next step is to determine the potential financial impact of that loss. This involves considering the costs associated with the risk, including repair or replacement costs, medical expenses, legal fees, or business interruption losses.

For a business, this might involve estimating the costs of a cyber attack, which could include not only the direct costs of repairing the system but also the indirect costs of lost business, data recovery, and legal fees.

Step 4: Calculating the Premium

With the probability of loss and the potential loss amount established, the insurance company can then calculate the premium. The premium is the amount the insured entity pays to the insurer to transfer the risk.

The premium calculation takes into account not only the risk and potential loss but also the insurer's operational costs, profit margin, and other factors like competition and market conditions.

Mathematically, the premium can be calculated using the formula:

Premium = [Expected Loss] + [Administrative Costs] + [Profit Margin]

Where:

- Expected Loss is the product of the probability of loss and the potential loss amount.

- Administrative Costs include the insurer's operational expenses, such as salaries, marketing, and overhead.

- Profit Margin is the return the insurer expects to make on the policy.

It's important to note that this is a simplified formula, and in reality, insurance companies use more complex models and algorithms to calculate premiums, often considering numerous factors and variables.

Step 5: Setting the Coverage Amount

The coverage amount, also known as the sum insured, is the maximum amount the insurance company will pay out in the event of a loss. It’s crucial to set the coverage amount appropriately to ensure the insured entity has adequate protection without paying excessive premiums.

The coverage amount should consider the insured entity's financial needs and the potential losses they could face. For example, a business might need to set a higher coverage amount to ensure they can recover from a major disaster, while an individual might set a lower amount for their personal insurance needs.

Factors Influencing Insurance Calculations

Several factors come into play when calculating insurance, each influencing the final premium and coverage amount. Understanding these factors is essential for both insurers and policyholders to make informed decisions.

Risk Profile

The risk profile of the insured entity is a significant factor. This includes the individual or business’s history of claims, the nature of their operations, and any specific risks they face. For example, a business operating in a high-risk industry like construction will likely have higher premiums than a low-risk business like a software development company.

Historical Data and Claims Experience

Insurance companies heavily rely on historical data and claims experience to estimate future losses. If an insured entity has a history of frequent claims, it may indicate a higher risk, leading to increased premiums. Conversely, a long period without claims may result in lower premiums.

Age and Health

For personal insurance, factors like age and health play a crucial role. Younger individuals are generally considered lower risk for health and life insurance, while older individuals may face higher premiums due to increased health risks.

Location and Environment

The geographical location of the insured entity is a critical factor. Areas prone to natural disasters like hurricanes, earthquakes, or floods may result in higher premiums. Similarly, environmental factors like crime rates or traffic density can influence insurance calculations.

Policy Type and Coverage Level

The type of insurance policy and the level of coverage desired also impact the calculation. Comprehensive policies with higher coverage limits will generally cost more than basic policies with lower limits.

Regulatory and Legal Requirements

Insurance calculations must also consider the legal and regulatory environment. Certain types of insurance, like auto insurance, are mandated by law, and the premiums must comply with these regulations.

Competition and Market Dynamics

The insurance market is competitive, and insurers must consider market dynamics when setting premiums. Factors like market share, brand reputation, and the pricing strategies of competitors all play a role in insurance calculations.

Methods and Tools for Insurance Calculations

Insurance companies employ various methods and tools to calculate insurance premiums and coverage amounts. These tools help streamline the process, ensure accuracy, and allow for the efficient management of large datasets.

Actuarial Science

Actuarial science is a field that uses mathematical and statistical methods to assess risk in insurance, finance, and other industries. Actuaries play a crucial role in insurance calculations, using their expertise to analyze and model risk, estimate probabilities, and calculate premiums.

Statistical Models and Predictive Analytics

Insurance companies use advanced statistical models and predictive analytics to forecast losses and set premiums. These models consider historical data, industry trends, and external factors to make accurate predictions.

Risk Assessment Surveys and Questionnaires

Insurance companies often use risk assessment surveys and questionnaires to gather information about the insured entity. These tools help insurers understand the risks and potential losses associated with the insured entity, allowing for a more accurate calculation of premiums and coverage.

Technology and Data Analytics

The insurance industry heavily relies on technology and data analytics to process vast amounts of data and make informed decisions. Advanced software and analytics tools help insurers analyze risk, estimate losses, and set premiums efficiently and accurately.

Industry Benchmarks and Peer Comparison

Insurance companies often use industry benchmarks and peer comparison to ensure their premiums and coverage amounts are competitive and fair. This involves analyzing the pricing and coverage strategies of other insurers in the market.

Challenges and Considerations in Insurance Calculations

While insurance calculations are a well-established practice, they come with their own set of challenges and considerations. These factors can influence the accuracy and fairness of insurance contracts.

Uncertainty and Variability

One of the biggest challenges in insurance calculations is dealing with uncertainty and variability. Predicting future losses is an inexact science, and unexpected events can significantly impact the accuracy of calculations.

Moral Hazard and Adverse Selection

Moral hazard refers to the tendency of individuals or entities to take more risks once they are insured, knowing that the insurer will bear the cost of the loss. Adverse selection occurs when high-risk individuals or entities are more likely to purchase insurance, leading to an increase in overall claims.

Changing Risk Factors

Risk factors can change over time due to various reasons, including technological advancements, environmental changes, or societal shifts. Insurance companies must continuously monitor and adjust their calculations to account for these changes.

Regulatory Compliance

Insurance calculations must comply with various regulatory requirements and guidelines. Insurers must ensure their calculations meet legal standards and ethical practices to avoid legal and reputational risks.

Balancing Coverage and Affordability

A key consideration in insurance calculations is balancing the need for adequate coverage with the affordability of premiums. Insurers must set premiums that are fair and competitive while also ensuring they can meet their obligations to policyholders.

The Future of Insurance Calculations

The insurance industry is evolving, and with it, the methods and tools used for insurance calculations. Technological advancements, data analytics, and changing consumer expectations are shaping the future of insurance calculations.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are transforming the insurance industry. These technologies are being used to analyze vast amounts of data, identify patterns, and make accurate predictions, helping insurers calculate premiums and coverage more efficiently and accurately.

Telematics and IoT

Telematics and the Internet of Things (IoT) are providing insurers with real-time data and insights. For example, telematics devices in vehicles can provide data on driving behavior, helping insurers calculate more accurate auto insurance premiums.

Blockchain Technology

Blockchain technology is being explored in the insurance industry for its potential to enhance security, transparency, and efficiency. It can be used to verify and record insurance transactions, reducing fraud and streamlining processes.

Digital Transformation

The insurance industry is undergoing a digital transformation, with insurers investing in digital tools and platforms to enhance their operations. This includes digital underwriting, claims processing, and policy management, all of which can improve the accuracy and efficiency of insurance calculations.

Changing Consumer Expectations

Consumers are increasingly expecting personalized and tailored insurance products. Insurers are responding by offering more flexible and customized policies, which requires more complex and dynamic insurance calculations.

Conclusion

Insurance calculations are a complex but essential process in the insurance industry. They involve a careful analysis of risks, probabilities, and potential losses to determine appropriate premiums and coverage amounts. Understanding the fundamentals, factors, methods, and considerations in insurance calculations is crucial for both insurers and policyholders to make informed decisions.

As the insurance industry continues to evolve, technological advancements and changing consumer expectations are shaping the future of insurance calculations. With the right tools, expertise, and ethical practices, insurers can continue to provide fair and affordable coverage to protect individuals and businesses from financial losses.

How do insurance companies set premiums for individual policies?

+Insurance companies set premiums for individual policies based on a variety of factors, including the insured’s age, health status, occupation, location, and the type and level of coverage desired. They use actuarial science and statistical models to estimate the probability of loss and the potential loss amount, which helps determine the appropriate premium.

What is the role of actuaries in insurance calculations?

+Actuaries play a crucial role in insurance calculations. They use their expertise in mathematics, statistics, and risk analysis to assess and model the financial impact of risk. Actuaries help insurance companies set premiums, determine coverage amounts, and ensure the financial solvency of the insurer.

How do insurers account for changing risk factors over time?

+Insurers continuously monitor and adjust their calculations to account for changing risk factors. They use historical data, industry trends, and predictive analytics to forecast losses and set premiums. Regular reviews and updates to insurance policies ensure that the coverage and premiums remain aligned with the current risk landscape.