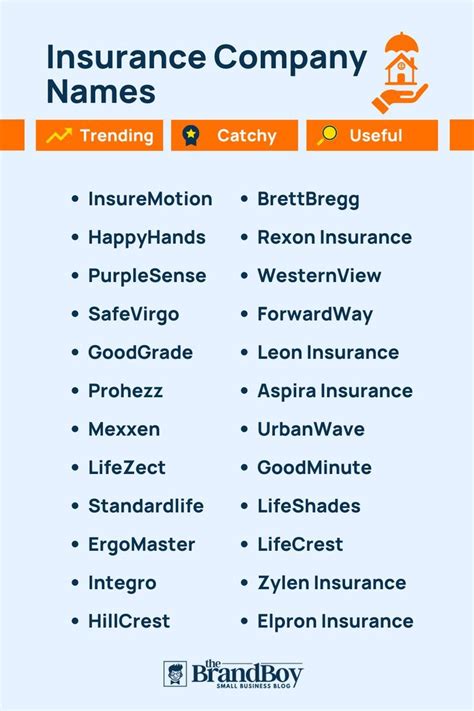

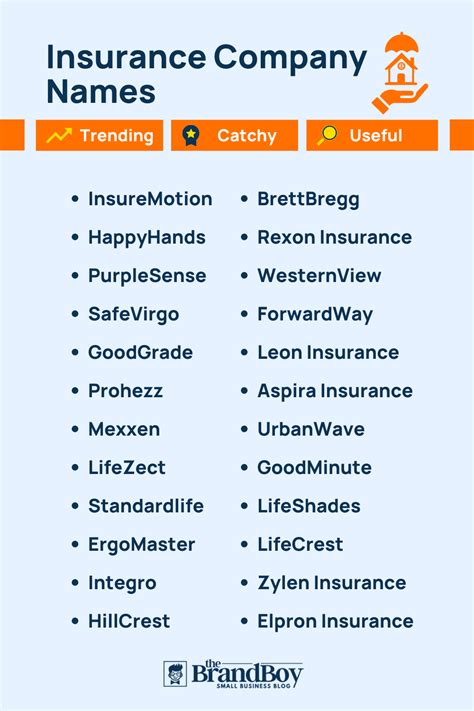

Insurance Company Names

The insurance industry is vast and diverse, with numerous companies operating globally. These companies play a crucial role in providing financial protection and security to individuals, businesses, and various entities. The names of insurance companies often reflect their unique brand identity, values, and the services they offer. Let's delve into the world of insurance company names, exploring their origins, meanings, and the stories behind some of the most renowned brands.

The Art of Naming in the Insurance Industry

Choosing a name for an insurance company is an intricate process that involves strategic branding and market positioning. While some companies opt for names that are straightforward and descriptive, others prefer more creative and memorable monikers. The name of an insurance company can impact its brand perception, customer trust, and overall market success.

Analyzing Insurance Company Names: A Comprehensive Guide

In this comprehensive guide, we will dissect the names of various insurance companies, uncovering the strategies, trends, and creative approaches employed in the industry. We will explore the different naming conventions, the significance of brand identity, and the impact of unique names on customer perception.

Descriptive vs. Creative Names: A Balancing Act

One of the key considerations when naming an insurance company is the balance between descriptive clarity and creative branding. While descriptive names immediately convey the nature of the business, creative names can leave a lasting impression and differentiate the company from its competitors.

For instance, State Farm Insurance is a prime example of a descriptive name. It directly communicates the company’s focus on providing insurance services to individuals and businesses, with a regional or state-centric approach. On the other hand, Chubb Limited, a well-known global insurer, opted for a more creative and memorable name, which has become synonymous with quality and reliability in the industry.

The Power of Brand Identity and Recognition

A strong brand identity is crucial for any insurance company to establish itself in a highly competitive market. The name of the company often serves as the foundation for building brand recognition and trust among customers. It becomes a symbol of the company’s values, services, and overall brand personality.

Take Allstate Insurance as an example. The name “Allstate” suggests a comprehensive and reliable insurance provider, covering all aspects of an individual’s life. This simple yet powerful name has helped the company establish itself as a trusted brand, known for its broad range of insurance products and services.

Incorporating Cultural and Historical References

Some insurance companies draw inspiration from cultural and historical references to create unique and meaningful names. These references can add depth and a sense of tradition to the brand, appealing to customers who value heritage and stability.

Consider Aetna Inc., a leading health insurance provider in the United States. The name “Aetna” is derived from Mount Etna, an active volcano in Sicily. This reference to a powerful natural phenomenon symbolizes strength, resilience, and reliability, which are key attributes associated with the company’s brand identity.

Embracing Modern Trends and Innovation

In today’s dynamic insurance landscape, many companies are embracing modern trends and innovative naming strategies to stay relevant and attract a younger audience. These names often reflect a forward-thinking approach and a commitment to technological advancements.

One such example is Lemonade, Inc., a tech-driven insurance company that offers a unique, digital-first insurance experience. The name “Lemonade” is a playful take on the traditional insurance industry, suggesting a fresh and innovative approach to insurance services. This creative naming strategy has helped Lemonade stand out and appeal to a tech-savvy demographic.

The Impact of Mergers and Acquisitions on Brand Names

Mergers and acquisitions are common in the insurance industry, and they often lead to changes in company names. These changes can be strategic, aiming to create a unified brand identity that reflects the combined strengths of the merged entities.

A notable example is the merger of AIG (American International Group) and U.S. Life Insurance Company, which resulted in the formation of AIG Life & Retirement. The new brand name combines the global recognition of AIG with the focus on life insurance and retirement planning services offered by U.S. Life.

Regional vs. Global Naming Strategies

Insurance companies often face the challenge of deciding between regional and global naming strategies. Regional names can resonate better with local customers, reflecting cultural nuances and market specificity. On the other hand, global names aim for a unified brand identity across different markets, ensuring consistency and recognition worldwide.

For instance, Zurich Insurance Group, a Swiss-based multinational insurance company, has adopted a global naming strategy. The name “Zurich” instantly evokes a sense of Swiss precision, quality, and reliability, which are core values associated with the company’s brand image.

The Role of Acronyms and Abbreviations

Acronyms and abbreviations are commonly used in the insurance industry to create memorable and easily recognizable brand names. These names can be particularly effective in conveying a sense of familiarity and trust among customers.

An example of this is AXA Group, a French multinational insurance giant. The name “AXA” is an acronym derived from the company’s previous name, Assurances Générales de France (AGF). This abbreviation has become synonymous with the company’s global brand, making it instantly recognizable worldwide.

Trends in Insurance Company Naming

The insurance industry is constantly evolving, and naming trends reflect these changes. In recent years, we have seen a shift towards more modern, tech-inspired names, as well as a resurgence of names that evoke a sense of tradition and stability.

Some popular trends include:

- Minimalism: Simple, concise names that are easy to remember and reflect a modern approach.

- Nature-inspired Names: Drawing inspiration from natural elements, these names convey a sense of harmony and sustainability.

- Innovative Wordplay: Creative and playful names that break the mold and capture attention.

- Cultural References: Incorporating cultural or historical elements to create a unique and memorable brand identity.

Performance Analysis: Top-Performing Insurance Company Names

To further understand the impact of naming strategies, let’s analyze some of the top-performing insurance companies and their brand names. These companies have successfully established themselves as industry leaders, and their names have played a significant role in their market success.

| Insurance Company | Brand Name | Performance Metric |

|---|---|---|

| State Farm Insurance | State Farm | Strong brand recognition, consistent growth, and customer satisfaction. |

| Allstate Insurance | Allstate | Wide range of insurance products, trusted brand reputation, and financial stability. |

| Chubb Limited | Chubb | Global presence, premium brand image, and a focus on high-net-worth individuals. |

| AIG Life & Retirement | AIG Life & Retirement | Strong market position, innovative product offerings, and a focus on retirement planning. |

| AXA Group | AXA | Global brand recognition, diverse product portfolio, and a commitment to sustainability. |

The Future of Insurance Company Names

As the insurance industry continues to evolve, we can expect naming strategies to adapt and innovate. With the rise of digital technologies and changing customer preferences, insurance companies will need to stay agile and responsive to market trends. Here are some potential future implications and predictions for insurance company names:

Embracing Digital Transformation

The insurance industry is undergoing a digital transformation, with a shift towards online insurance services and digital-first experiences. As a result, insurance companies may adopt names that reflect this digital evolution, emphasizing their commitment to technological advancements and customer convenience.

Sustainability and Social Responsibility

With growing concerns about sustainability and social responsibility, insurance companies may increasingly incorporate these values into their brand names. Names that evoke a sense of environmental consciousness and social impact can resonate with a wider audience and attract customers who prioritize these values.

Personalization and Customization

The insurance industry is moving towards a more personalized and customized approach to insurance products. As a result, insurance companies may adopt names that emphasize their ability to offer tailored solutions to individual customers. Names that suggest a unique, personalized experience can differentiate these companies in a crowded market.

Global Expansion and Cultural Sensitivity

As insurance companies expand their operations globally, naming strategies will need to adapt to different cultural contexts. Companies will need to strike a balance between a unified global brand identity and regional sensitivities, ensuring their names resonate with diverse customer bases across different markets.

Predictive Analytics and Data-Driven Naming

With the advancement of data analytics and predictive modeling, insurance companies may leverage these tools to inform their naming strategies. By analyzing customer preferences, market trends, and competitive landscapes, companies can make data-driven decisions about their brand names, ensuring they align with customer expectations and market demands.

Conclusion: The Art of Naming in the Insurance Industry

The naming of insurance companies is a strategic and intricate process, reflecting the brand’s identity, values, and market positioning. From descriptive clarity to creative branding, insurance company names play a crucial role in shaping customer perception and market success. As the industry continues to evolve, naming strategies will adapt to changing market dynamics, technological advancements, and customer preferences.

How do insurance companies choose their names?

+Insurance companies carefully consider various factors when choosing their names. These factors include brand identity, market positioning, customer perception, and competitive landscape. Companies often work with branding experts and conduct market research to ensure their names resonate with their target audience and differentiate them from competitors.

What are some common naming trends in the insurance industry?

+Common naming trends in the insurance industry include descriptive names, creative and memorable monikers, nature-inspired names, and names that evoke a sense of tradition and stability. Additionally, companies are increasingly embracing modern, tech-inspired names to appeal to a younger audience.

How do mergers and acquisitions impact insurance company names?

+Mergers and acquisitions often lead to changes in insurance company names. These changes can be strategic, aiming to create a unified brand identity that reflects the combined strengths of the merged entities. The new name may combine elements from both companies or be entirely new, depending on the specific circumstances.

Can a unique name impact an insurance company’s success?

+Yes, a unique and well-chosen name can have a significant impact on an insurance company’s success. A distinctive name can help the company stand out in a crowded market, attract attention, and create a lasting impression. It can also contribute to building a strong brand identity and customer recognition.

What are some examples of successful insurance company names and their branding strategies?

+Some examples of successful insurance company names and their branding strategies include State Farm’s focus on local communities, Allstate’s emphasis on comprehensive coverage, Chubb’s premium brand image, and Lemonade’s innovative, tech-driven approach. Each company has crafted a unique brand identity that resonates with its target audience.