Best Cheap Homeowners Insurance

Homeownership is a significant milestone, and one of the essential aspects of protecting your investment is securing reliable homeowners insurance. While finding affordable coverage is a priority, it's crucial to strike a balance between cost and the level of protection offered. This article aims to guide you through the process of identifying the best cheap homeowners insurance options, ensuring you get the coverage you need without breaking the bank.

Understanding Homeowners Insurance

Homeowners insurance is a contract between you and an insurance company, providing financial protection for your home and its contents. It covers a range of potential risks, including damage to your property, theft, and liability for accidents that occur on your property. The cost of this insurance varies based on several factors, such as the location, age, and type of your home, as well as the level of coverage you require.

Understanding the basics of homeowners insurance is key to making informed decisions. Here's a breakdown of the fundamental components:

Coverage Types

- Dwelling Coverage: This covers the structure of your home, including walls, roofs, and permanent fixtures.

- Personal Property Coverage: It protects your personal belongings, such as furniture, clothing, and electronics.

- Liability Coverage: Provides protection if someone is injured on your property or if you damage someone else's property.

- Additional Living Expenses: Covers temporary living expenses if your home becomes uninhabitable due to a covered event.

Policy Limitations

While homeowners insurance offers comprehensive protection, there are certain limitations and exclusions. For instance, most policies do not cover damage caused by floods, earthquakes, or poor maintenance. It's essential to review the policy's fine print to understand what's covered and what's not.

Deductibles and Premiums

The cost of homeowners insurance is influenced by the deductible you choose. A higher deductible typically results in a lower premium, but it means you'll have to pay more out of pocket if you need to file a claim. It's a delicate balance between affordability and financial preparedness.

Finding the Best Cheap Homeowners Insurance

Identifying the best cheap homeowners insurance involves a careful evaluation of your needs and a thorough market research. Here's a step-by-step guide to help you in your search:

Assess Your Needs

Before diving into the market, take the time to understand your specific needs. Consider the following factors:

- The value of your home and its contents.

- The level of liability coverage you require.

- Any specific risks or hazards in your area (e.g., natural disasters, crime rates).

- Additional coverages you may need, such as flood or earthquake insurance.

Compare Quotes

The next step is to compare quotes from multiple insurance providers. Online quote comparison tools can be incredibly useful for this task. These tools allow you to input your information once and receive multiple quotes, making the process more efficient.

Check for Discounts

Insurance companies often offer discounts to attract new customers. Some common discounts include:

- Multi-Policy Discounts: Bundling your homeowners insurance with other policies, like auto insurance, can lead to significant savings.

- Safety Features Discounts: Features like smoke detectors, fire extinguishers, and security systems may qualify you for discounts.

- Loyalty Discounts: Staying with the same insurer for an extended period may result in loyalty rewards.

Read Reviews and Ratings

Researching insurance companies' reputations is crucial. Look for reviews and ratings from independent sources to get an unbiased perspective. Pay attention to customer satisfaction levels and the company's financial stability.

Consider Local Insurers

While national insurance providers offer convenience, local insurers may provide more tailored coverage options and better understand the unique risks in your area. Consider reaching out to local insurance agents for personalized advice.

Review Policy Details

When comparing policies, it's essential to look beyond the price tag. Review the policy's coverage limits, deductibles, and exclusions. Ensure the policy provides the right balance of coverage and affordability for your needs.

Utilize Technology

In today's digital age, there are numerous tools and resources available to simplify the insurance shopping process. Mobile apps and online platforms can help you manage your policies, track claims, and stay informed about your coverage.

Top Cheap Homeowners Insurance Providers

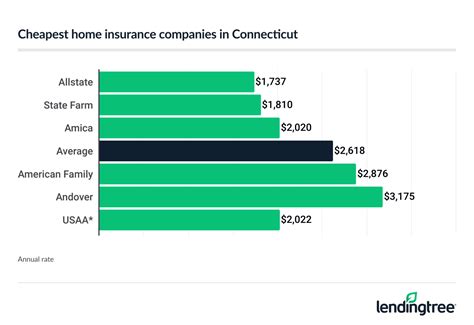

While the market is vast, some insurance providers consistently offer competitive rates and comprehensive coverage. Here are a few top contenders to consider:

State Farm

State Farm is one of the largest insurance providers in the United States. They offer a range of homeowners insurance policies with customizable coverage options. State Farm is known for its excellent customer service and claims handling.

Allstate

Allstate provides a wide array of insurance products, including homeowners insurance. They offer flexible coverage options and innovative features like the Allstate Digital Locker, which helps you inventory and protect your personal belongings.

Farmers Insurance

Farmers Insurance is a trusted name in the insurance industry, offering comprehensive homeowners insurance policies. They provide coverage for various dwelling types and offer discounts for bundling policies.

Progressive

Progressive is a well-known insurance provider that offers competitive rates for homeowners insurance. They provide customizable coverage options and innovative tools to help you manage your policy.

Erie Insurance

Erie Insurance is a regional insurance provider known for its exceptional customer service and affordable rates. They offer a range of homeowners insurance policies with optional add-ons to tailor coverage to your needs.

Performance Analysis and Customer Satisfaction

When evaluating insurance providers, it's crucial to consider their performance and customer satisfaction ratings. Independent rating agencies like J.D. Power and A.M. Best provide valuable insights into insurers' financial strength and customer satisfaction levels.

| Insurance Provider | J.D. Power Rating | A.M. Best Rating |

|---|---|---|

| State Farm | 4 out of 5 | A++ (Superior) |

| Allstate | 3.5 out of 5 | A+ (Superior) |

| Farmers Insurance | 3 out of 5 | A (Excellent) |

| Progressive | 3.5 out of 5 | A- (Excellent) |

| Erie Insurance | 4 out of 5 | A+ (Superior) |

These ratings provide a snapshot of the insurance providers' performance and financial stability, offering valuable information to guide your decision-making process.

Future Implications and Industry Trends

The insurance industry is evolving, and several trends are shaping the future of homeowners insurance. Here's a glimpse into what the future may hold:

Digital Transformation

Insurance companies are increasingly embracing digital technologies to enhance customer experiences. Expect to see more mobile apps, online platforms, and digital tools to manage policies and track claims.

Data-Driven Personalization

Advanced analytics and data-driven insights will allow insurers to offer more personalized coverage options. This could mean tailored policies based on your unique needs and risks.

Sustainability and Green Initiatives

With growing environmental concerns, insurance providers are expected to offer incentives and discounts for sustainable homes and green initiatives. This could include coverage for eco-friendly upgrades and renewable energy systems.

Enhanced Risk Management

Advanced risk assessment tools and technologies will enable insurers to better understand and manage risks. This could lead to more accurate pricing and coverage options tailored to specific risks.

Conclusion

Finding the best cheap homeowners insurance is a process that requires careful consideration and research. By understanding your needs, comparing quotes, and exploring the market, you can secure comprehensive coverage at an affordable price. Remember, the right insurance policy is one that provides peace of mind and financial protection without straining your budget.

Frequently Asked Questions

How much does homeowners insurance typically cost?

+

The cost of homeowners insurance varies widely based on factors like location, home value, and coverage limits. On average, homeowners can expect to pay between 1,000 and 2,000 annually for basic coverage.

What factors influence the cost of homeowners insurance?

+

Several factors influence insurance costs, including the location and age of your home, the coverage limits you choose, and any discounts you qualify for. Higher-risk areas, such as those prone to natural disasters, may have higher premiums.

Are there any ways to lower my homeowners insurance premiums?

+

Yes, there are several strategies to reduce your premiums. These include increasing your deductible, bundling policies with the same insurer, and making home improvements to enhance safety and security.

What should I look for when comparing homeowners insurance policies?

+

When comparing policies, pay attention to coverage limits, deductibles, and exclusions. Ensure the policy provides adequate coverage for your home and its contents, and consider additional coverage for specific risks like floods or earthquakes if necessary.

Is it possible to get homeowners insurance with a poor credit score?

+

Yes, it is possible to obtain homeowners insurance with a poor credit score. However, insurers may charge higher premiums or offer limited coverage options. It’s essential to shop around and compare quotes to find the best deal.