State Farm Insurence

Welcome to an in-depth exploration of State Farm, one of the largest insurance companies in the United States. This comprehensive article aims to delve into the history, services, and impact of State Farm on the insurance industry. With a rich legacy spanning over a century, State Farm has solidified its position as a trusted provider of insurance solutions. From its humble beginnings to its current status as a major player in the industry, State Farm's journey is a fascinating tale of innovation and customer-centricity. Join us as we uncover the secrets behind State Farm's success and its role in shaping the future of insurance.

A Legacy of Trust: The Story of State Farm

State Farm Insurance, with its headquarters in Bloomington, Illinois, boasts a history that stretches back to 1922. Founded by a visionary named George J. Mecherle, a former farmer and insurance salesman, State Farm began as a small auto insurance agency with a big mission: to provide affordable and reliable insurance coverage to the hardworking farmers and motorists of the Midwest.

Mecherle's unique understanding of the needs of farmers and his belief in the power of mutual insurance companies led to the creation of a business model that prioritized customer satisfaction and financial stability. This model, combined with a focus on innovation and a deep-rooted commitment to community, has propelled State Farm to become one of the largest insurance providers in the nation.

Over the decades, State Farm has expanded its reach and diversified its offerings. What started as a simple auto insurance agency has grown into a comprehensive insurance provider, offering a wide range of products and services, including home, life, health, and business insurance, as well as banking and investment solutions. State Farm's commitment to its customers and its ability to adapt to changing market trends have been key drivers of its success.

One of the most notable aspects of State Farm's history is its unwavering dedication to community involvement. State Farm has a long-standing tradition of giving back to the communities it serves, sponsoring numerous educational, safety, and environmental initiatives. This commitment to social responsibility has not only strengthened its bond with its customers but has also positioned State Farm as a leader in corporate citizenship.

Services and Offerings: A Comprehensive Insurance Portfolio

State Farm’s service portfolio is as diverse as it is extensive, catering to the varied needs of its customers. Here’s a closer look at some of the key insurance products and services State Farm provides:

Auto Insurance

State Farm’s auto insurance offerings are tailored to meet the unique needs of different driver profiles. Whether you’re a new driver, a student, or a seasoned motorist, State Farm has a plan that suits your circumstances. Their policies offer comprehensive coverage, including liability, collision, and comprehensive protection, as well as additional options like rental car reimbursement and roadside assistance.

State Farm's Drive Safe & Save program is a notable feature, rewarding safe driving behavior with discounts on premiums. Additionally, their Steer Clear program encourages young drivers to adopt safe driving habits, offering discounts for completing approved driver education courses.

Home Insurance

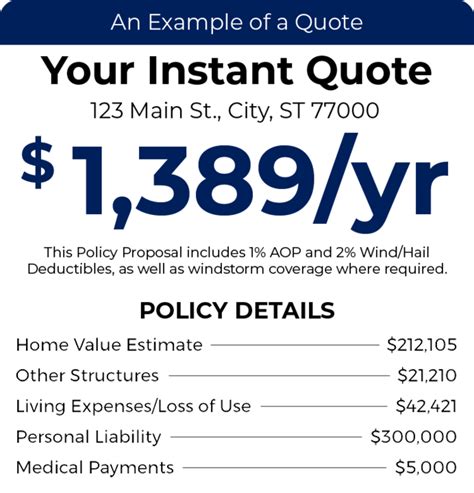

State Farm’s home insurance policies provide comprehensive protection for homeowners and renters alike. Their plans cover a range of potential risks, including fire, theft, and natural disasters. State Farm’s home insurance offerings also extend to condominiums and mobile homes, ensuring that a variety of living situations are covered.

For homeowners, State Farm offers replacement cost coverage, ensuring that policyholders can rebuild their homes to their original condition in the event of a total loss. Additionally, their personal liability coverage provides protection against lawsuits resulting from accidents on the insured property.

Life Insurance

State Farm’s life insurance offerings provide financial protection for policyholders and their families. Their term life insurance policies offer coverage for a specified period, while their permanent life insurance plans, including whole and universal life insurance, provide lifelong coverage with the added benefit of cash value accumulation.

State Farm also offers accidental death and dismemberment insurance, providing additional financial support in the event of an accident. Their life insurance policies can be customized to meet specific needs, offering flexibility and peace of mind.

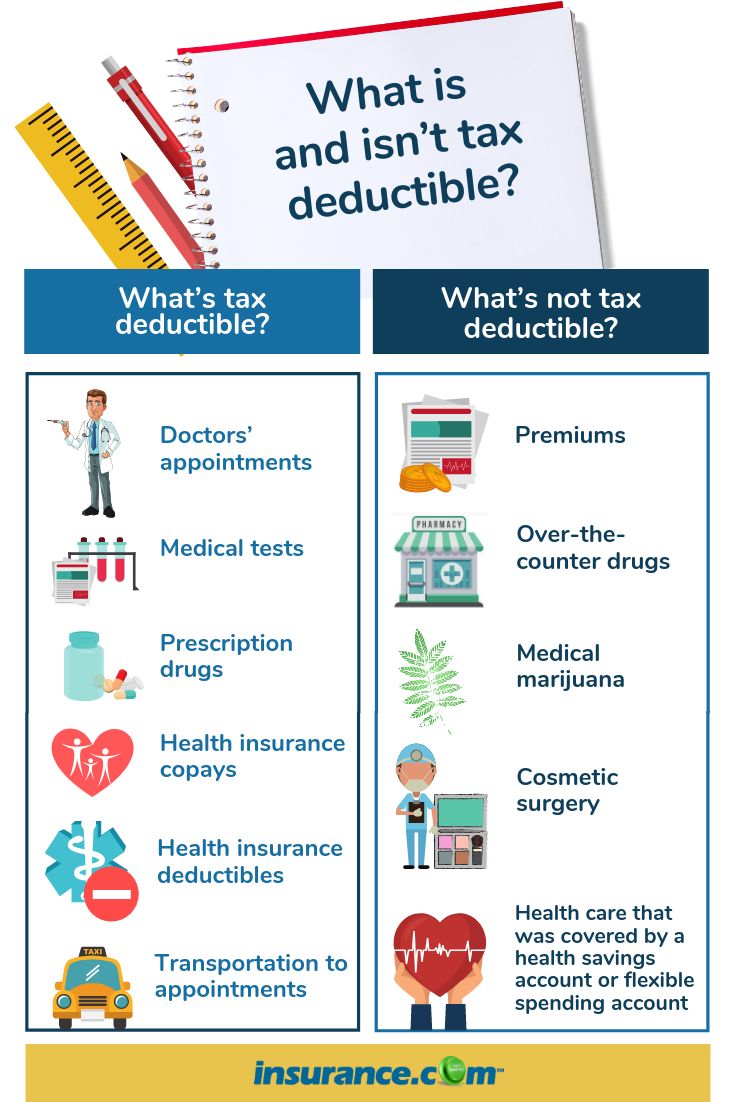

Health Insurance

State Farm’s health insurance plans are designed to provide comprehensive coverage for medical expenses. Their policies cover a range of services, including doctor visits, hospital stays, prescription drugs, and preventive care. State Farm’s health insurance offerings also include dental and vision coverage, ensuring that policyholders can maintain their overall health.

For those with specific health needs, State Farm offers supplemental health insurance plans, such as critical illness and accident insurance, providing additional financial support in the event of a covered illness or accident.

Business Insurance

State Farm’s business insurance offerings are tailored to meet the unique needs of small businesses and entrepreneurs. Their policies cover a range of risks, including property damage, liability, and business interruption. State Farm also offers specialized coverage for professionals, such as doctors, lawyers, and accountants.

For businesses with specific needs, State Farm's business insurance plans can be customized to include coverage for cyber risks, employee benefits, and business auto insurance. Their flexible approach ensures that businesses can protect their assets and operations effectively.

Innovation and Technology: State Farm’s Digital Transformation

State Farm has embraced digital innovation to enhance its services and improve the customer experience. With a focus on technology, State Farm has developed a range of digital tools and platforms to streamline insurance processes and make insurance more accessible and convenient.

Digital Claims Processing

State Farm’s digital claims processing system allows policyholders to file claims online or through their mobile app. This system provides a seamless and efficient claims experience, with real-time updates and the ability to track the progress of a claim. Policyholders can upload supporting documents, such as photos of damage, directly through the app, simplifying the claims process.

Telematics and Usage-Based Insurance

State Farm has introduced telematics technology, which uses sensors and GPS to monitor driving behavior. This data is used to provide personalized insurance rates based on an individual’s driving habits. State Farm’s usage-based insurance program, Drive Safe & Save, rewards safe driving with discounts, encouraging safer roads and lower insurance costs.

Mobile Apps and Online Portals

State Farm’s mobile apps and online portals provide policyholders with 24⁄7 access to their insurance information. These platforms allow customers to manage their policies, pay bills, and access digital ID cards. Policyholders can also use the apps to find nearby repair shops, check claim status, and receive real-time updates on their coverage.

Artificial Intelligence and Chatbots

State Farm has implemented artificial intelligence and chatbots to enhance customer service. These technologies provide instant responses to common inquiries, reducing response times and improving customer satisfaction. Policyholders can ask questions about their coverage, check policy details, and receive assistance with claims through these interactive platforms.

Community Engagement and Social Responsibility

State Farm’s commitment to community engagement and social responsibility is a cornerstone of its corporate philosophy. Through various initiatives, State Farm has made a positive impact on the communities it serves, fostering education, promoting safety, and supporting environmental sustainability.

Education and Youth Programs

State Farm has a long history of supporting education and youth development. They sponsor numerous educational programs and initiatives, including scholarships, grants, and financial literacy programs. State Farm’s commitment to education extends beyond financial support, as they also provide resources and mentorship to help students succeed.

One notable program is the State Farm Youth Advisory Board, which engages young people in community leadership and service. This program empowers youth to identify and address community needs, fostering a sense of responsibility and leadership.

Safety and Disaster Relief

State Farm is dedicated to promoting safety and providing support during times of disaster. They sponsor a range of safety initiatives, including driver education programs, home safety resources, and disaster preparedness workshops. State Farm also partners with organizations like the Red Cross to provide relief and recovery support to communities affected by natural disasters.

Environmental Sustainability

State Farm recognizes the importance of environmental sustainability and has implemented various initiatives to reduce its environmental impact. They have committed to reducing their carbon footprint through energy-efficient practices and the use of renewable energy sources. State Farm also promotes sustainable practices among its employees and customers, encouraging environmentally conscious behaviors.

Future Outlook: State Farm’s Continuing Journey

As the insurance landscape continues to evolve, State Farm remains committed to its core values of customer service, innovation, and community involvement. With a strong foundation built on over a century of experience, State Farm is well-positioned to adapt to changing market dynamics and meet the evolving needs of its customers.

State Farm's digital transformation efforts will continue to enhance the customer experience, making insurance more accessible and efficient. Their focus on technology and innovation will drive new product developments and service improvements, ensuring that State Farm remains at the forefront of the insurance industry.

Additionally, State Farm's commitment to community engagement and social responsibility will continue to strengthen its bond with the communities it serves. Through ongoing support for education, safety initiatives, and environmental sustainability, State Farm will maintain its position as a trusted partner and leader in corporate citizenship.

As State Farm looks to the future, its legacy of trust and customer-centricity will continue to guide its growth and development. With a rich history and a forward-thinking approach, State Farm is poised to thrive in an ever-changing insurance landscape, providing its customers with the protection and peace of mind they deserve.

What types of insurance does State Farm offer?

+State Farm offers a wide range of insurance products, including auto, home, life, health, and business insurance. They also provide banking and investment solutions.

How does State Farm’s Drive Safe & Save program work?

+The Drive Safe & Save program rewards safe driving behavior with discounts on auto insurance premiums. Policyholders can earn discounts by maintaining a safe driving record and using State Farm’s telematics technology to monitor their driving habits.

What is State Farm’s commitment to community engagement?

+State Farm has a strong commitment to community engagement and social responsibility. They sponsor educational programs, safety initiatives, and environmental sustainability efforts, actively supporting the communities they serve.

How does State Farm use technology to enhance customer experience?

+State Farm utilizes technology to streamline insurance processes and improve customer service. This includes digital claims processing, telematics for usage-based insurance, mobile apps and online portals for policy management, and AI chatbots for instant customer support.